U.S. Cities Where Construction Workers Would Have to Work the Longest Hours to Afford a Home in 2022

After slowing down at the beginning of the pandemic, the construction industry has bounced back, spurred on by the housing market boom.

Construction employment reached 7.7 million in August, surpassing pre-COVID levels, and nearly matching peak construction employment in 2006. With the signing of the Infrastructure Investment and Jobs Act into law, the long-term outlook for the construction industry is looking upbeat as well. This legislation provides billions of dollars in funding for infrastructure projects and creates millions of jobs over the next decade, many in construction.

However, as the construction sector rapidly recovered from its pandemic-induced decline, supply chain disruptions proved persistent and inflation tightly squeezed household budgets. Although average hourly earnings for all private-sector workers have increased by 5.2% from 2021, inflation hit a 40-year high in June with prices up 9.1% over the past 12 months. Inflation has moderated slightly since, but is still at elevated levels.

FOR CONSTRUCTION WORKERS

With rising costs, many businesses are doing everything they can to cut costs. However, construction professionals should be careful not to cut back on their insurance policies, especially truck insurance and contractor liability insurance.

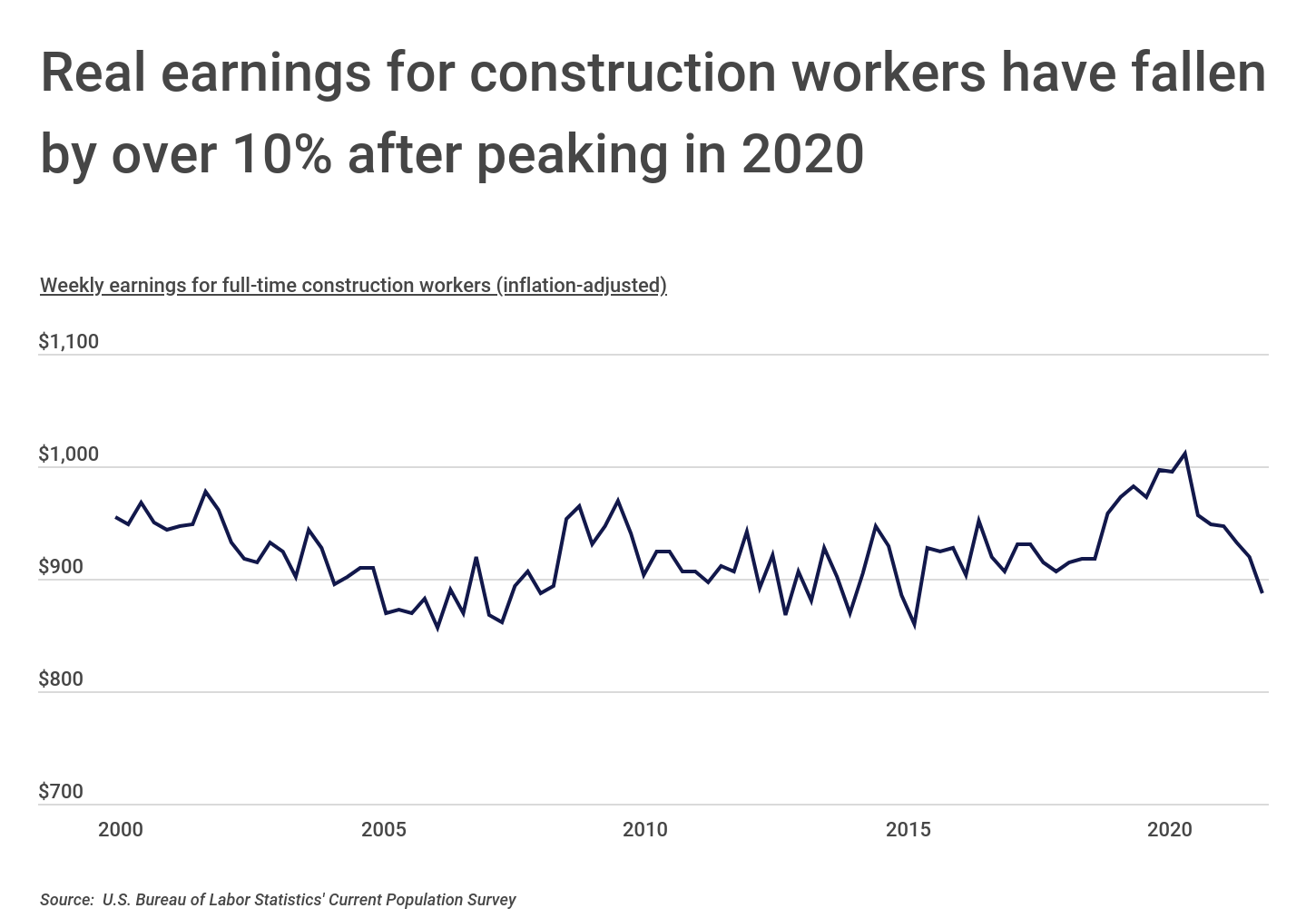

Even with the strong job market, construction wages have failed to keep pace with inflation. The average weekly wage for full-time construction workers was $887 in April, after adjusting for inflation. This represents a 12% drop from October 2020 when real wages peaked at $1,012.

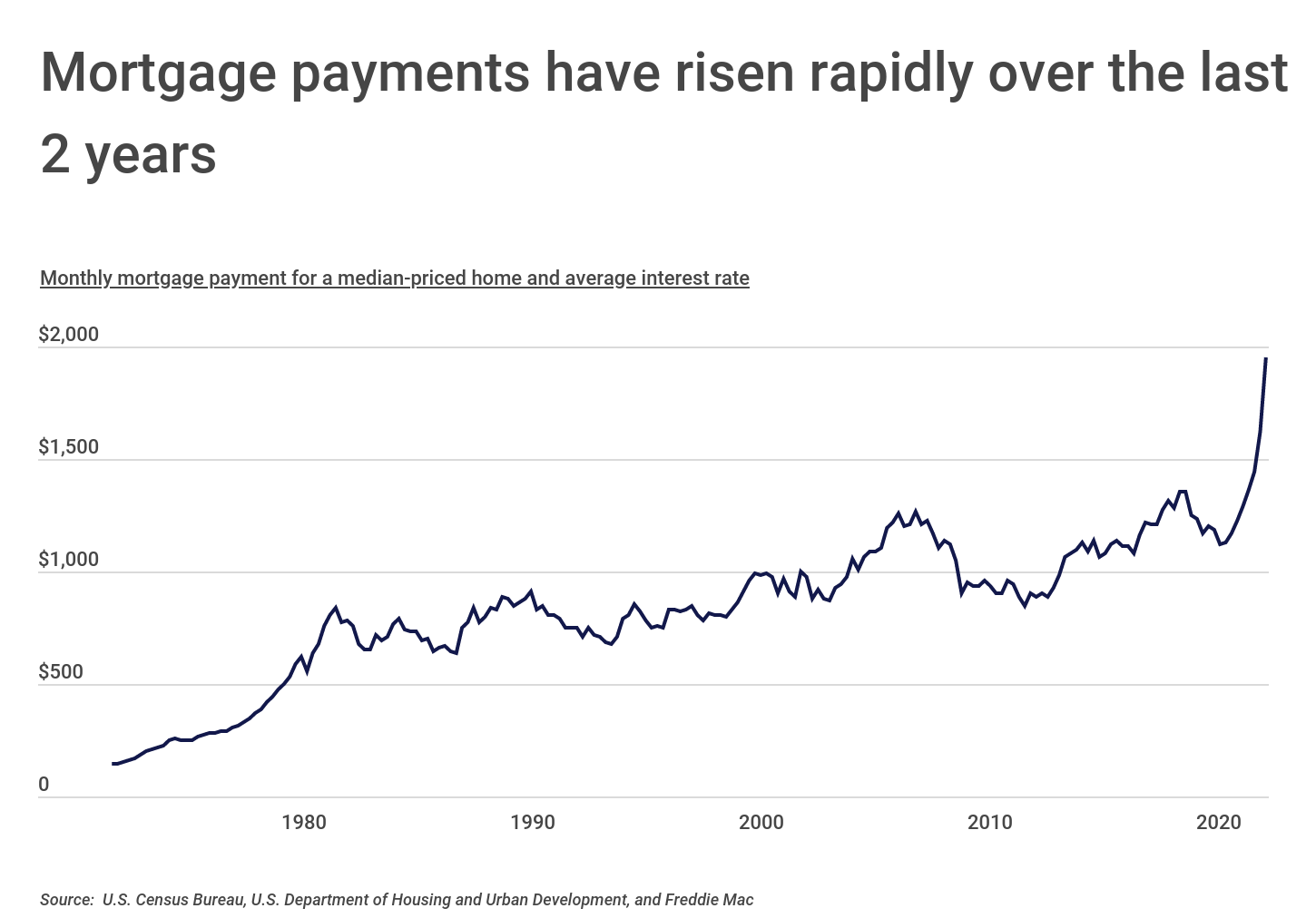

To make things worse, the housing market has been red-hot for the past two-plus years. Increased demand for homes due to record-low mortgage rates, remote work, and stimulus payments coupled with low inventory have caused home prices to skyrocket. The median home sales price was over $440,000 in the second quarter of 2022, up 36% from 2020. Due to actions by the Federal Reserve to combat inflation, mortgage interest rates have risen substantially in recent months from the lows seen in the earlier days of the pandemic. Higher interest rates have caused monthly mortgage payments to climb, and now the monthly mortgage payment for a median-priced home is nearly $2,000, an amount difficult for many Americans to afford.

FOR CONSTRUCTION BUSINESSES

New technology has helped construction businesses save money by decreasing operating costs. For example, the construction takeoff and construction estimating processes have been significantly sped up by new software products.

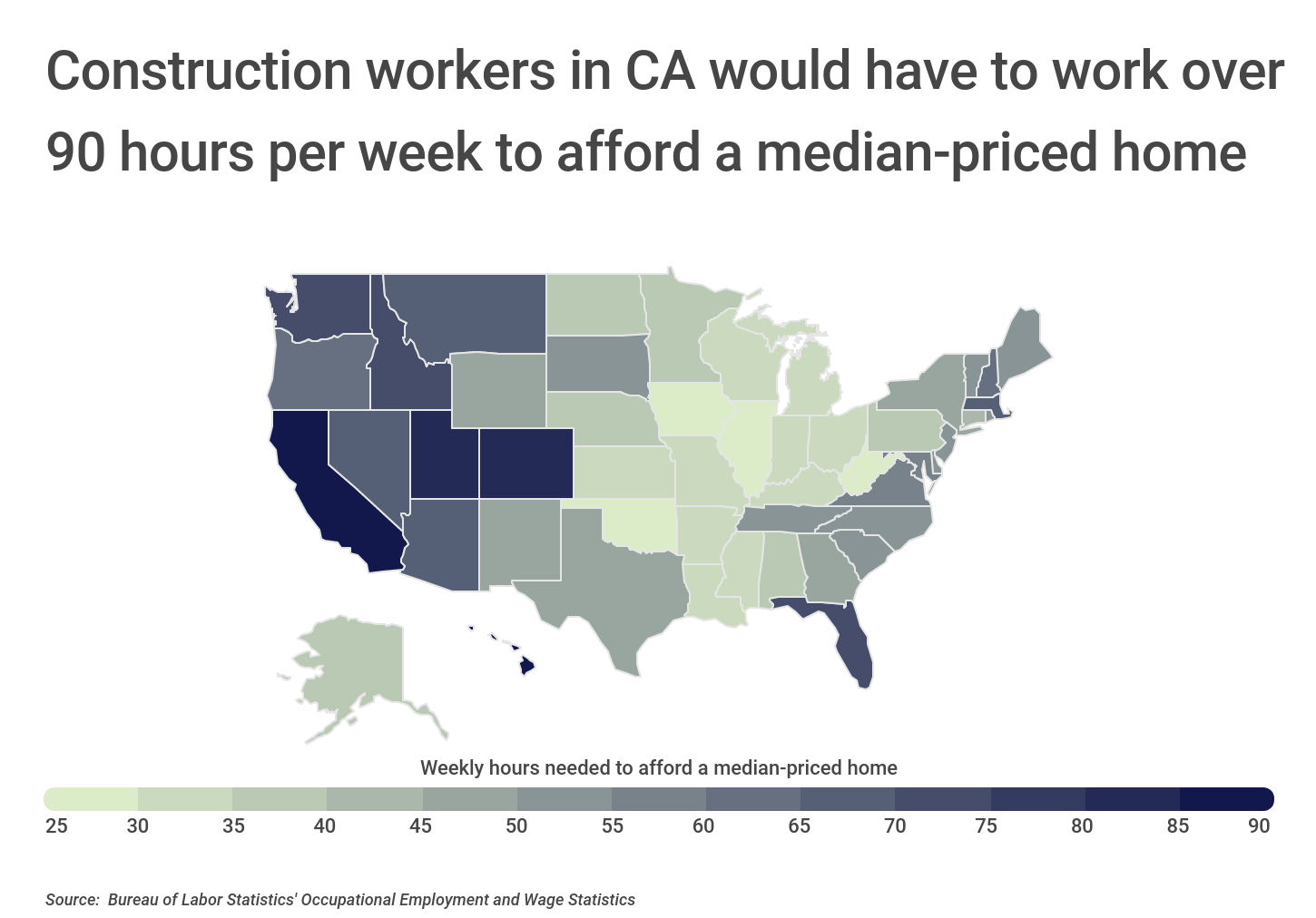

Rising home prices in many cities mean that the workers who build homes often cannot afford to buy them. Indeed, California construction workers would have to work 91 hours per week to afford a median-priced home, more than twice a typical 40-hour work week. This calculation assumes that a worker would spend no more than 30% of their income on housing, a common home affordability rule. Construction workers in Hawaii (85 hours), Colorado (84 hours), and Utah (84 hours) would also have to work over double the standard work week to manage the monthly mortgage payments for a median-priced home. At the other end of the spectrum, in West Virginia home prices are affordable enough—and construction median wages are high enough—that a construction worker would only have to work 21 weekly hours to be able to afford a median-priced home.

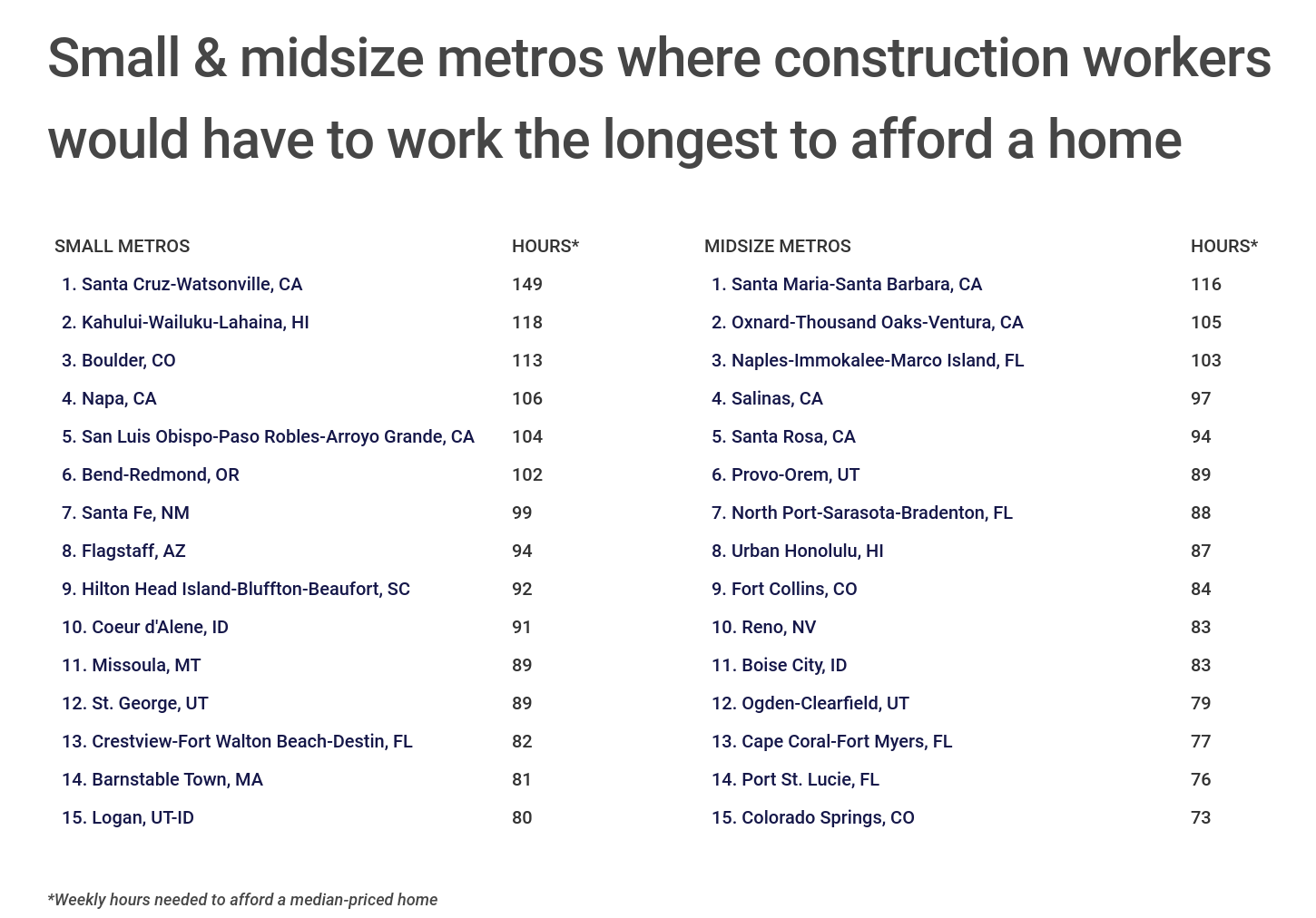

Similar trends hold at the metro level, where perhaps not surprisingly, metros in California stand out as being some of the most unaffordable in the country. Even though locations like San Francisco and San Jose offer above-average wages, homes there are so much more expensive than average that the typical construction worker would need to work the equivalent of at least three full-time jobs to afford one. At the opposite end of the spectrum, locations in the Midwest like St. Louis and Chicago offer well-paying construction jobs and below-average home prices, making these locations highly affordable for a person in the trades.

To find the metropolitan areas where construction workers would have to work the longest hours to afford a home, researchers at Construction Coverage analyzed the latest data from the U.S. Bureau of Labor Statistics, the U.S. Census Bureau, and Zillow. The researchers ranked metro areas according to the weekly hours needed to afford a median-priced home. Researchers also calculated the median hourly wage for construction workers, median home price, the monthly mortgage payment for a median-priced home, and the overall homeownership rate.

Here are the U.S. metropolitan areas where construction workers would have to work the longest hours to afford a home.

Large Metros Where Construction Workers Would Have to Work the Longest Hours to Afford a Home

Photo Credit: Mihai Andritoiu / Shutterstock

15. Nashville-Davidson–Murfreesboro–Franklin, TN

- Weekly hours needed to afford a median-priced home: 70

- Median hourly wage: $22.01

- Median home price: $457,360

- Monthly mortgage payment for a median-priced home: $1,993

- Overall homeownership rate: 65.6%

Photo Credit: Sean Pavone / Shutterstock

14. Phoenix-Mesa-Scottsdale, AZ

- Weekly hours needed to afford a median-priced home: 70

- Median hourly wage: $23.02

- Median home price: $478,985

- Monthly mortgage payment for a median-priced home: $2,088

- Overall homeownership rate: 64.4%

Photo Credit: Songquan Deng / Shutterstock

13. Orlando-Kissimmee-Sanford, FL

- Weekly hours needed to afford a median-priced home: 71

- Median hourly wage: $18.82

- Median home price: $399,709

- Monthly mortgage payment for a median-priced home: $1,742

- Overall homeownership rate: 61.9%

Photo Credit: Steve Minkler / Shutterstock

12. Riverside-San Bernardino-Ontario, CA

- Weekly hours needed to afford a median-priced home: 71

- Median hourly wage: $27.82

- Median home price: $585,817

- Monthly mortgage payment for a median-priced home: $2,553

- Overall homeownership rate: 64.1%

Photo Credit: Andriy Blokhin / Shutterstock

11. Sacramento–Roseville–Arden-Arcade, CA

- Weekly hours needed to afford a median-priced home: 71

- Median hourly wage: $29.23

- Median home price: $615,712

- Monthly mortgage payment for a median-priced home: $2,683

- Overall homeownership rate: 61.2%

Photo Credit: ESB Professional / Shutterstock

10. Boston-Cambridge-Nashua, MA-NH

- Weekly hours needed to afford a median-priced home: 73

- Median hourly wage: $30.22

- Median home price: $661,141

- Monthly mortgage payment for a median-priced home: $2,881

- Overall homeownership rate: 61.7%

Photo Credit: A G Baxter / Shutterstock

9. Washington-Arlington-Alexandria, DC-VA-MD-WV

- Weekly hours needed to afford a median-priced home: 76

- Median hourly wage: $24.63

- Median home price: $555,266

- Monthly mortgage payment for a median-priced home: $2,420

- Overall homeownership rate: 63.9%

Photo Credit: Jeremy Janus / Shutterstock

8. Seattle-Tacoma-Bellevue, WA

- Weekly hours needed to afford a median-priced home: 79

- Median hourly wage: $33.18

- Median home price: $781,617

- Monthly mortgage payment for a median-priced home: $3,407

- Overall homeownership rate: 60.2%

Photo Credit: photo.ua / Shutterstock

7. Salt Lake City, UT

- Weekly hours needed to afford a median-priced home: 87

- Median hourly wage: $23.29

- Median home price: $606,689

- Monthly mortgage payment for a median-priced home: $2,644

- Overall homeownership rate: 68.2%

Photo Credit: Roschetzky Photography / Shutterstock

6. Austin-Round Rock, TX

- Weekly hours needed to afford a median-priced home: 88

- Median hourly wage: $22.20

- Median home price: $582,073

- Monthly mortgage payment for a median-priced home: $2,537

- Overall homeownership rate: 58.6%

Photo Credit: Nicholas Courtney / Shutterstock

5. Denver-Aurora-Lakewood, CO

- Weekly hours needed to afford a median-priced home: 89

- Median hourly wage: $24.00

- Median home price: $638,061

- Monthly mortgage payment for a median-priced home: $2,781

- Overall homeownership rate: 64.8%

Photo Credit: Dancestrokes / Shutterstock

4. San Diego-Carlsbad, CA

- Weekly hours needed to afford a median-priced home: 105

- Median hourly wage: $29.02

- Median home price: $907,871

- Monthly mortgage payment for a median-priced home: $3,957

- Overall homeownership rate: 53.9%

Photo Credit: Chones / Shutterstock

3. Los Angeles-Long Beach-Anaheim, CA

- Weekly hours needed to afford a median-priced home: 108

- Median hourly wage: $29.08

- Median home price: $933,282

- Monthly mortgage payment for a median-priced home: $4,068

- Overall homeownership rate: 48.7%

Photo Credit: yhelfman / Shutterstock

2. San Francisco-Oakland-Hayward, CA

- Weekly hours needed to afford a median-priced home: 139

- Median hourly wage: $35.14

- Median home price: $1,458,909

- Monthly mortgage payment for a median-priced home: $6,358

- Overall homeownership rate: 55.0%

Photo Credit: Uladzik Kryhin / Shutterstock

1. San Jose-Sunnyvale-Santa Clara, CA

- Weekly hours needed to afford a median-priced home: 152

- Median hourly wage: $35.70

- Median home price: $1,619,785

- Monthly mortgage payment for a median-priced home: $7,060

- Overall homeownership rate: 56.6%

Detailed Findings & Methodology

To find the metropolitan areas where construction workers would have to work the longest hours to afford a home in their city, researchers at Construction Coverage analyzed the latest data from the U.S. Bureau of Labor Statistics’s 2021 Occupational Employment and Wage Statistics data, the U.S. Census Bureau’s 2020 American Community Survey, and Zillow’s most recent Zillow Home Value Index (ZHVI), a measure of typical home value. The researchers ranked metro areas according to the weekly hours needed to afford a median-priced home, the median hourly wage for construction workers, median home price, the monthly mortgage payment for a median-priced home, and the overall homeownership rate. Weekly hours needed to afford a median-priced home were calculated by assuming that construction workers do not spend more than 30% of their wages on their monthly mortgage payment. Median home price was calculated from Zillow’s ZHVI, and the monthly mortgage payment for a median-priced home was calculated by assuming a 30-year fixed rate mortgage with a 20% down payment.

To improve relevance, only metropolitan areas with at least 100,000 people were included in the analysis. Additionally, metro areas were grouped into the following cohorts based on population size:

- Small metros: 100,000-349,999

- Midsize metros: 350,000-999,999

- Large metros: more than 1,000,000

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.