The Best Commercial Truck Insurance Companies for 2023

Commercial truck insurance is coverage that protects trucking businesses, businesses that use trucks, or independent truck drivers. This guide will cover all of the information business owners and contractors should know when buying commercial truck insurance. More specifically, this guide will review how commercial truck insurance works, how much it costs, different coverage options, requirements for businesses, how to get a truck insurance quote, and the top insurance providers.

Before diving into the details, here is a preview of our top picks. Instead of providing a list of the top 10 commercial truck insurance companies, we’ve boiled our research down to the three best providers to choose from:

Progressive |

State Farm |

The Hartford |

|

| Best For | Best Overall | Runner-Up | High-Risk Drivers |

| Financial Strength | Strong | Excellent | Strong |

| Customer Reputation | A | A+ | A |

| Our Rating | 10/10 | 9.5/10 | 9.0/10 |

| Learn More | Get Quote | Get Quote | Get Quote |

*These links will take you to one of our insurance partners. The companies listed here may or may not be available at this time.

Understanding Commercial Truck Insurance

Commercial truck insurance is a significant investment for business owners. Before signing up for a policy, it is important to understand the coverage that your business needs and to adhere to federal and state law. This guide will first provide an overview of commercial truck insurance, including the types of coverage, costs, and legal requirements. Then we’ll review how to evaluate different providers and share some recommendations for top insurance companies that cover commercial trucks.

What Is Commercial Truck Insurance?

Commercial truck insurance refers to a series of auto insurance policies used by trucking businesses, companies that use trucks, or independent truck drivers. The purpose of this insurance is to provide financial and legal protection from bodily injury and property damage, as well as to provide coverage for specialized cargo and trucking equipment.

Unlike commercial auto insurance, which covers a wider range of vehicles used for business purposes, commercial trucking insurance applies to large vehicles (such as semi-trucks) often used for construction, transport of goods, or agriculture. Commercial truck insurance takes into account the types of cargo or materials being transported, as well as the size and type of vehicle. Policies are available for the many types of commercial trucks, including tow trucks, cement mixers, pickups, and tractors.

How Does Commercial Truck Insurance Work?

Commercial truck insurance falls under the broader category of commercial auto insurance. However, commercial trucking insurance is specifically used by truck drivers and businesses that use trucks.

Truck insurance is purchased to cover specific vehicles, and it is most often purchased by the owner of those vehicles. The insurance also only applies when individuals who are listed on the insurance policy are using the vehicle for business purposes. The individuals listed on the policy will also determine the cost of the policy, as their driving record is an important factor for determining monthly premiums.

The types of businesses and individuals that buy usually fall into the following categories:

- Motor Carriers – This refers to for-hire trucking companies that own a fleet of vehicles. They are responsible for insuring their fleet.

- Owner-operators – These are individuals who own and operate their own trucking business. This phrase most often refers to individuals, and they most often own their vehicles. Sometimes the “owner” is leasing their vehicle from a motor carrier who owns it, and in these cases, the vehicle is usually insured by its owner.

- Private Carriers – These are individuals who use their personal vehicles to transport goods on behalf of their employer. People who frequently transport goods for their company using their personal vehicle may be asked to buy their own insurance or may be compensated by their employer for insurance costs.

Any of these businesses can purchase commercial truck insurance. Coverage is available for a single box truck or for an entire fleet of semi-trucks. When choosing a policy, the owner must work with an insurance company to define these factors:

- Coverage – defines which damage, incidents, and expenses will be covered

- Monthly Premium – the amount of money that the policyholder must pay to retain the policy

- Deductible – the amount of money a covered company must pay toward their claim before coverage kicks in

- Policy Limit – the defined maximum that the insurer is required to pay toward claims filed on the policy

The policyholder pays a monthly premium for the coverage specified in the policy agreement. Under the terms of the agreement, the insurance company will pay for damages, repairs, and medical or legal expenses associated with a covered incident. Usually, an incident is only covered when the vehicle is listed on the policy, the driver is listed on the policy, and the incident occurs during business operation.

In the event of an incident, such as a collision, the policyholder must contact the insurance company to “file a claim,” usually within a few days. If the incident is covered under the policy, the policyholder will be responsible for all expenses incurred up to the deductible. The insurer will pay for any remaining expenses beyond the deductible and up to the policy limit.

Insurance companies differ in how they handle expenses after an accident. Many have a network of pre-approved repair shops that policyholders must use to assess damages and fix the truck. From there, the insurance company would pay the shop in full and bill you for your portion based on the deductible. Other insurance companies might ask you to shop around for price estimates from different auto repair shops, or even send their own representative to estimate the cost of repair. Keep in mind that some insurers might work on a reimbursement model, in which the policyholder will need to pay all expenses for repair up front and then be reimbursed by the insurance company for costs that exceed the deductible.

The best policy for you will depend on the level of risk of an incident, the type of policy limit you will need, and your business’ cash flow.

Requirements for Business Owners and Contractors

Businesses that operate commercial trucks between states are subject to federal laws regarding insurance. The Federal Motor Carrier Safety Administration (FMCSA) requires that commercial truck drivers are covered by a minimum amount of insurance in the event of an accident. More specifically, Title 49, Section 387 of the United States Code of Federal Regulations lists the amount of coverage required for a commercial truck driver based on the truck’s weight and cargo. In general, the heavier the truck and more dangerous the cargo, the higher the insurance requirements. This table summarizes the federal minimum liability requirement for trucks based on the different types of cargo being transported:

Commercial Truck Insurance Requirements

| Type of Freight | Minimum Liability Coverage |

|---|---|

| Non-hazardous freight (in vehicles under 10,001 lbs.) | $300,000 |

| Non-hazardous freight (in vehicles over 10,001 lbs.) | $750,000 |

| Oil (transported by for-hire and private carriers) | $1,000,000 |

| Hazardous material or explosives (transported by for-hire and private carriers) | $5,000,000 |

Motor carriers transporting household goods must also maintain cargo insurance of $5,000 per vehicle and $10,000 per occurrence. Furthermore, business owners must send proof of insurance to the FMCSA in order to receive a motor carrier (MC) number, which permits them to transport cargo between states.

Commercial trucks, such as semi-trucks, that transport cargo between states are subject to coverage minimums under federal law, while those that remain within state lines are subject to coverage minimums under state law. As with federal laws, the amount of liability coverage that states require will usually depend on the size of the vehicle and the type of cargo it is transporting.

In New York and California, the liability coverage minimums for intrastate commercial trucks are the same as in the federal guidelines based on the type of cargo (general freight, household goods, or hazardous material) and a vehicle weight greater than 10,000 pounds. However, household goods carriers in California require greater cargo insurance, at $20,000 per vehicle and $20,000 per incident. Some states, like Texas, also have a lower coverage minimum for intrastate general freight ($500,000 rather than $750,000).

Many states have their own insurance filings, as well. For example, in California, commercial trucks usually require a Motor Carrier Permit and must submit an MCP-65 filing to confirm that they have the required liability insurance. Household goods movers must also submit a TL676 filing to guarantee sufficient liability insurance and cargo insurance.

Similarly, business owners who operate tow trucks in Texas must submit a Form T to prove sufficient liability insurance. Florida requires that commercial truck drivers convicted of a DUI submit an FR 44 filing, which must be maintained for at least three years, confirming higher insurance limits.

RELATED GUIDES

What Does Commercial Truck Insurance Cover?

This guide references the term “covered incident.” So what constitutes a “covered incident” under commercial truck insurance? That typically depends on the people covered under the policy, the people involved in an incident, the type of truck, and the nature of the incident.

Who Is Covered Under a Policy?

Even though commercial truck insurance is purchased by the business owner, it covers expenses for drivers who are named in the policy, their passengers, and individuals who were harmed in a trucking accident. Here’s a look at who is protected under the different types of coverage that typically comprise commercial truck insurance.

Types of Trucks Covered

Almost any truck can be covered under a commercial truck insurance policy, but different insurance providers may only cover certain types of trucks. In addition, some “trucks” may actually be covered under a standard commercial auto insurance policy if they are not used “as a truck” or in ways that this type of coverage is intended. Here is an overview of the different types of trucks that tend to be covered under commercial truck insurance.

Pickup Trucks

Depending on its use, pickup trucks might be insured under a personal auto policy or a commercial truck policy. Construction contractors, landscapers, or any other worker who uses a pickup truck for business purposes will likely need commercial truck insurance that includes liability coverage, physical damage coverage, and uninsured or underinsured motorist coverage. For individuals who use a pickup truck as a primary personal vehicle without a business, then a personal auto policy is sufficient.

Cement Mixers

Cement mixers are vehicles that transport concrete to and from construction sites. These trucks are known for their constantly revolving drum, which holds the concrete and keeps it in liquid form. Cement mixers tend to be at a high risk for incidents because they have a high center of gravity, making them more likely to tip over. The increased risk is reflected in higher costs of coverage. Cement mixers should have coverage for liability, physical damage, medical payments, and uninsured or underinsured motorists.

Tow Trucks

Tow trucks are vehicles that transport other vehicles or watercraft from one place to another. Tow trucks should have liability and physical damage coverage. Tow trucks would also benefit from on-hook towing insurance, which covers expenses for repairs for the vehicles that are being towed. Some insurance providers will offer specific policies for towing companies. See this complete tow truck insurance guide for more information.

Box Trucks

Box trucks, or straight trucks, are used to transport large items such as furniture. These vehicles are easily identified by their rectangular (“boxlike”) cargo hold. These vehicles are 10-26 feet long and weigh between 12,500 and 33,000 pounds. Different types of box trucks include cargo cutaways, ice box trucks, moving trucks, reefer/refrigerator trucks, and sleeper box trucks.

In addition to primary liability and physical damage coverage, box trucks should also have motor truck cargo coverage to protect the goods themselves and non-trucking liability coverage, which covers the truck when it is not on the road.

Dump Trucks

Dump trucks are vehicles that transport loose material such as sand and gravel to construction sites. In addition to primary liability and physical damage coverage, dump trucks should also consider policies for non-trucking liability, motor truck cargo, and rental reimbursement/downtime.

Tractors & Semi-trucks

While most of the other types of trucks on this list are used for transporting items between two places, tractors are traditionally used in agriculture for tasks such as plowing and planting. Tractors will typically stay on a farm rather than travel on a road. However, since a tractor is one of the most vital pieces of equipment for a farmer, it’s important to insure these vehicles, too. Sometimes insurers have coverage specifically for agriculture, which may also cover tractors. This depends on the insurer, so it is best to speak to an agent.

Another common type of tractor is a semi-truck (also known as a tractor-trailer or 18-wheeler). Semis are composed of a tractor unit that connects to a semi-trailer in order to haul freight. Aside from primary liability and physical damage coverage, business owners who handle semi-trucks should also consider coverage for motor truck cargo and trailer interchange.

Other Trucks

In addition to the previously mentioned vehicles, there are several other types of commercial trucks that should be insured. These include:

- Agricultural truck

- Bucket truck

- Car carrier or Rollback

- Catering truck

- Delivery Van

- Flatbed truck

- Front Loader

- Garbage truck

- Pump truck

- Refrigerated truck

- Roll-on Vehicle

- Stake body truck

- Step Van

- Street Sweeper

- Tank truck

Types of Coverage

The different types of trucks and their applications require different types of coverage. For this reason, policies are typically structured using a variety of different coverage options combined into one single policy that provides all the protection the business or individual needs. Below is a list of the different coverage options.

Primary Liability

Primary liability policies are often provided as a combined single limit (CSL), which includes both bodily injury and property damages. Suppose a driver covered under the policy causes an accident. If the driver damages another person’s car or causes an injury during the incident, the insurance will cover the cost of the injured party’s repairs, in addition to their medical expenses. However, the driver and the truck who caused the accident are not covered. This is why motor carriers also opt for medical payments coverage and physical damage coverage.

Physical Damage

While primary liability covers the cost of injury or damages to other parties, physical damage coverage pays for the costs of damage to the policyholder’s own vehicles involved in an accident. Physical damage coverage encompasses both collision coverage (damage from a crash) and comprehensive coverage (non-collision losses or damage, such as theft or vandalism).

Uninsured/Underinsured Motorists

Commercial trucks are often the largest vehicles on the road. If one of your trucks gets into an accident caused by another driver, there’s a possibility that the at-fault driver does not have sufficient coverage to pay for your injuries and property damage. Uninsured/underinsured motorists coverage will cover the costs instead.

Medical Payments

Since private liability insurance only covers bodily injuries for other individuals involved in an accident in which your truck is at fault, it’s useful to obtain medical payments coverage, which covers medical bills for you and your passengers who may have also been injured.

Motor Truck Cargo Coverage

Motor truck cargo coverage insures the freight that a for-hire trucker transports from one place to another, in the event of an incident such as a fire or collision. Truckers are legally responsible for insuring their cargo while it is in transit, until it is signed for at its destination.

Only for-hire truckers who drive semis, dump trucks, tractors, trailers, box trucks, cement mixers, cargo vans, dually pick-ups, flatbeds, and car haulers are eligible for motor truck cargo coverage. Other trucking vehicles that are not eligible include garbage trucks, passenger trucks, and ice cream trucks. In addition, not all types of cargo are eligible for insurance. These include art, jewelry, pharmaceuticals, tobacco, alcohol, live animals, and explosives, which would require separate coverage.

General Liability

While primary liability coverage covers injuries or damages that occur while driving the truck, motor truck general liability coverage covers injuries or property damage that a for-hire trucker or motor carrier causes that are not directly related to driving the truck. Specifically, motor truck general liability covers the following:

- Bodily Injury and Property Damage Liability – provides liability protection when a covered incident causes physical injuries to an individual or property, such as if a customer is injured in a slip-and-fall at the truck depot

- Personal Injury and Advertising Injury Liability – covers non-physical injury to a person or entity that resulted from the motor carrier’s negligence

- Medical Payments – provides payments for medical costs associated with a covered incident that physical injuries or death to an individual

- Products / Completed Operations – covers bodily injury or property damage that results from erroneously delivering another person’s goods

- Damage to Premises Rented to You – temporarily covers damage to premises that the motor carrier rents for seven or fewer consecutive days

Drivers under this coverage are limited to a 500-mile radius. It can only be purchased in conjunction with primary liability coverage. Notably, motor truck general liability is not available for individuals who operate a business in addition to for-hire trucking. The following vehicles are also not eligible for motor truck general liability:

- Garbage trucks

- Cement trucks

- Limos

- Hearses

- Buses

- Passenger vans

- Ice cream trucks

Non-Trucking Liability

Owner-operators with a permanent lease to a motor carrier should consider purchasing non-trucking liability (NTL) coverage in order to be insured if using the truck for a non-business purpose. For example, NTL coverage would cover medical expenses and property damage expenses that occur when driving the truck for personal reasons, such as grocery shopping.

NTL does not cover any activities that might fall under “business use,” such as hauling cargo, filling the gas tank, driving for maintenance, and washing the truck. These activities would be covered by the motor carrier’s primary liability coverage.

Rental Reimbursement with Downtime

Business owners who purchase rental reimbursement with downtime coverage are eligible to use a rental truck or receive financial compensation if their commercial truck cannot be used for business purposes after an accident. This is especially important to ensure that the trucking business still receives a steady income if a truck is temporarily out of commission.

When selecting rental reimbursement with downtime coverage, the policy limit you choose determines how much money the insurer will pay per day in the event that the truck is damaged. The insured will receive reimbursement for a maximum of 30 days to cover the cost of a rental truck. Some insurers like Progressive will also assist in finding an adequate rental truck as a temporary replacement.

While many insurance companies offer rental reimbursement with downtime insurance as one coverage option, other insurers offer these as two separate components. When offered separately, rental reimbursement pays for the cost of a rental truck, while downtime coverage pays for lost income if a rental truck is unavailable.

Not all commercial trucks are eligible for rental reimbursement with downtime coverage. Only the following vehicle types are covered:

- Dually Pickups

- Flatbed Trucks weighing more than 16,000 pounds

- Refrigerated Trucks weighing more than 16,000 pounds

- Stake Trucks weighing more than 16,000 pounds

- Tank Trucks carrying more than 1,400 gallons

- Dump Trucks weighing more than 16,000 pounds

- Front Loaders weighing more than 45,000 pounds

- Roll On Vehicles weighing more than 45,000 pounds

- Straight Trucks weighing more than 16,000 pounds

- Tractors

Trailer Interchange

Sometimes motor carriers haul trailers that belong to other companies, under “a trailer interchange agreement.” A trailer interchange agreement is a contract that arranges to transfer a trailer from one trucker to another in order to complete a shipment. Typically, the trucker in possession of the trailer is responsible for paying any damages that are incurred while they have the trailer. Since borrowed trailers are not covered under the motor carrier’s own physical damage insurance, they therefore require supplemental trailer interchange coverage to cover any physical damage due to incidents like collision, fire, theft, explosion, or vandalism.

Only tractors/semi-trucks and pickups are eligible for this coverage, and all motor carriers must also purchase primary liability coverage. Note that trailer interchange is not available in Virginia.

What Doesn’t Commercial Truck Insurance Cover?

In addition to listing what’s covered, commercial truck insurance policies will also list exclusions. Exclusions might refer to certain types of incidents or certain types of cargo. Many exclusions for commercial truck insurance are similar to what is excluded in commercial auto policies. These include:

Intentional Damages

Insurance companies will not cover damages or injuries that result from intentional harm to another person or property. Causing intentional harm with the goal of deceiving the insurance company into paying for damages constitutes insurance fraud, which can lead to financial and criminal penalties.

Property of Others

Many commercial truck insurance policies will not cover damages to property, personal items, or automobiles belonging to others, even if the person in care of the property or automobile is covered under the policy. If your company regularly transports property or automobiles belonging to others, there are additional coverage options you can explore.

Damages Exceeding Policy Limits

Every policy will have a maximum limit that the insurance company will pay toward claims. Any additional damages beyond the coverage limit will not be covered. Business owners may wish to add an excess liability (or umbrella) policy in order to extend coverage limits.

Certain Types of Cargo

Furthermore, certain types of cargo are excluded from commercial truck insurance policies. These include valuables such as money and jewelry; drugs such as alcohol, tobacco, and pharmaceuticals; contraband; live animals; property in another carrier’s possession; and explosive materials. In some cases, additional coverage options, such as Hazmat Insurance and Livestock Cargo Insurance, are available to insure these types of cargo.

Sample Policy

To get a better idea of what is included and excluded from a commercial truck insurance policy, request a sample policy from the insurance company. To see what a policy form might look like, here’s a Sample Motor Truck Cargo Coverage Form from National General. You may wish to request several samples for different types of coverage (such as primary liability and motor truck cargo coverage) to ensure that all your bases are covered.

Commercial Truck Insurance Costs

The “cost” of an insurance policy typically refers to how much a business owner must pay in monthly premiums. Higher policy limits correlate with more expensive monthly premiums. Costs for commercial truck insurance vary significantly, depending on factors such as the type of truck (e.g. semi-truck, box truck, cement mixer, etc.), truck size, deductible, type of cargo, and location.

How Much Does Commercial Truck Insurance Cost?

Commercial truck insurance costs between $2,000 to $18,000 per vehicle per year, depending on the type of truck and if owner-operators are under a lease or their own authority.

Progressive estimates the average commercial truck insurance policy is between $703 per month for specialty truckers and up to $1,118 per month for transport truckers (an average of approximately $8,400-$13,500 a year). But for owner-operators with a permanent lease to a motor carrier, the motor carrier usually covers the primary insurance, meaning that the owner-operator will have to pay less out of pocket. However, owner-operators under their own authority are responsible for all of their insurance for their trucks and their drivers, which increases costs. Depending on how much or how little additional coverage is needed, the range can be as significant as $2,000 to $18,000 or more.

Factors That Affect the Cost of Commercial Truck Insurance Policies

There are several factors that determine how much commercial truck insurance will cost. Some can be adjusted by the business owner to reduce the amount of coverage required, while others are an integral part of conducting business and cannot be changed. Below are some of the most influential factors affecting coverage:

Types of Vehicles Covered

Heavier vehicles generally incur higher insurance costs because of their increased risk of causing significant damage in an accident. In addition, newer vehicles are usually more expensive to insure because they would be more expensive to repair or replace in the event of an accident. The greater the number of vehicles in the fleet, the more the policy will cost.

Location and Operating Radius

If drivers are traveling long distances (such as throughout a region or between states, rather than locally), the insurance cost is likely to be higher. Truckers with a larger operating radius often have higher risks of getting into an accident because there may be fewer stops during a route, or a route could be less familiar. In addition, individual states have different commercial truck insurance rates, so drivers in certain states are likely to pay more.

Vehicle Storage

Where you park your trucks when they are not in use can affect insurance premiums. The more secure the area, the lower the insurance cost. For example, commercial trucks that are parked in a garage or closed yard will incur lower rates than trucks parked in public areas or open lots.

Cargo

Different types of cargo carry different levels of risk. Heavier or more dangerous cargo would likely cause more damage in an accident than lighter cargo, so the price of the insurance policy will reflect that risk. Note that some types of cargo, such as explosives, pharmaceuticals, and livestock, are not covered at all under most types of commercial truck insurance policies and would therefore require additional coverage.

Driving History

As with personal auto insurance, driving history has a significant impact on how much a business owner pays in commercial truck insurance premiums. However, because the stakes are higher with larger vehicles, a driver with a history of violations or accidents will have an even more dramatic increase in insurance costs. One of the best ways to save money on insurance is to keep driving records free of accidents and violations. Business owners managing a fleet with multiple drivers will want to look closely at driving records during the hiring process, and may also wish to invest in additional training for driver safety.

Amount of Coverage and Deductible

Not surprisingly, the more coverage required, the higher the monthly cost will be. Choosing a higher deductible is one way to lower the cost of monthly premiums. However, this option is not without its financial risks. Having a high deductible on your plan means that in the event of an incident, the company is on the hook for paying more money out of pocket before the insurance policy kicks in.

How to Find Cheap Commercial Truck Insurance

Commercial truck insurance is extremely important and should not be skimped. However, there are still ways to save on insurance and find cost-effective coverage that works. In fact, saving a few hundred or a few thousand dollars a month in insurance means that money can be used on other parts of the business. The main ways to save on commercial truck insurance are to find discounts or choose a policy with less coverage.

Multiple Price Quotes

Usually a business can find similar coverage from different providers, which makes getting quotes from multiple truck insurance providers a worthwhile exercise. If your business needs only basic protection, it’s likely that most commercial truck insurance companies can provide the coverage you need. While some make it easier than others, all insurance companies will provide a quote to potential customers. Shop around, and request price quotes from multiple companies if price is a key consideration.

Discounts

Commercial Driver’s License (CDL) Discount

For-hire truck drivers who have had a Commercial Driver’s License (CDL) for at least two years can receive a discount on their liability coverage.

Business Experience Discount

Owner-operators who have been in business for more than three years can receive a business experience discount.

Prior Insurance Savings

With some insurance companies, policyholders who have maintained continuous insurance coverage for the last 12 months can receive a discount on the next year’s insurance.

Paid in Full Discount

Some insurance companies will offer a discount for policyholders who pay their premium in a lump sum at the beginning of coverage. For example, Progressive customers can save up to 15 percent with this discount.

Higher Deductibles

A high deductible policy will result in lower monthly premiums, but also carries a higher risk of paying a lot of money out of pocket in the event of an accident. Business owners may wish to consider a policy with a higher deductible if the drivers have a clean driving record, the cargo transported is relatively low-risk, and the business would be able to cover the full amount of the deductible in the event of an accident.

Lower Coverage Limits

The policy limit is a factor in how much commercial truck insurance costs. Policies with lower coverage limits will incur lower monthly premiums. Business owners should consider how much coverage they will actually need, rather than automatically choosing the high policy limit offered.

Less Coverage

More coverage results in higher monthly costs, and less coverage results in lower monthly costs. For example, business owners may not need specialized insurance for cargo, or may not need rental reimbursement because there are many trucks in the fleet. Sticking with the bare bones of state or federal requirements without any add-ons can save money, too.

The Cheapest States for Commercial Truck Insurance

Though you probably won’t relocate in search of a low commercial truck insurance premium, it is interesting to note which states have the lowest commercial truck insurance rates. Quotes from different insurance companies may vary, but based on average pricing data from Progressive, the top 10 states with the lowest commercial truck insurance rates for interstate motor truck cargo coverage are:

- Mississippi

- Wyoming

- Nebraska

- Iowa

- Idaho

- South Dakota

- North Dakota

- Wisconsin

- Alaska

- Montana

For trucks only being used locally (within state borders), the top 10 states with the lowest commercial truck insurance premiums are:

- Mississippi

- Wyoming

- Massachusetts

- Iowa

- Arizona

- Nebraska

- North Dakota

- Montana

- Kansas

- South Dakota

Finding the Best Commercial Truck Insurance Company

There are many companies that offer coverage for commercial trucks, but it can be tricky to make an apples-to-apples comparison. That is why it can be helpful to enlist the help of a broker or agent. You can also do your own research online to find which provider would be best for you.

Where to Get a Quote: Broker vs. Agent vs. Online

Insurance brokers are individuals or companies that help clients to find the best insurance policy for their situation because they are well-versed in the specifics of different companies’ policies for commercial truck insurance. It is worth noting that the price of the insurance might ultimately be higher with a broker because of the added broker fees. However, using a broker can save business owners a lot of time in the research process and result in the best coverage for the budget, which many clients believe is well worth the investment.

Insurance agents are representatives of one insurance company. They help clients understand different insurance options offered by that one insurer. Agents are the way to go if you have narrowed down your choice to a specific insurance provider, but need more information about different policies and coverage options before making a decision.

Individuals can also forgo the help of a broker or agent and purchase a policy online. In general, this option is best for those who are already familiar with insurance policies or who have conducted extensive research to determine the coverage that their trucking business requires. Business owners can usually sign up directly on an insurance company’s website, although some insurers will also confirm the purchase over the phone.

Comparing Commercial Truck Insurance Providers

Coverage Options

When choosing an insurance provider, the coverage options are one of the main factors to consider. While most insurance companies will likely offer the basic general liability and property damage insurance, your business needs might also require additional coverage such as trailer interchange or non-trucking liability. In those cases, it is important to make sure you choose a provider who offers all the types of coverage you need. In addition, it helps to understand the policy limits and terms of coverage for each company so you can choose the plan that is best for you. Also keep in mind that not all insurance companies operate in every state, so business owners with interstate trucking need to ensure they would be covered in each state where they conduct business.

To conduct independent research on different insurance coverage options, the best way to go is to read guides like this one to narrow down a list of your top options. Next, speak with a representative from each company.

Company Reputation

Once you’ve figured out which insurance companies offer your desired coverage, another thing to keep in mind is the company’s reputation. A few trustworthy sources to consult for insurance companies’ reputations include J.D. Power and the Better Business Bureau (BBB).

Every year, J.D. Power compiles ratings from customers of major insurance companies to give an overview of the company’s products, business practices, and customer satisfaction. Similarly, the Better Business Bureau provides customers with a public platform to share their complaints about companies, while also giving those companies a chance to resolve customer issues. Taken together, both J.D. Power and the BBB offer a holistic overview of the company’s reputation among its customers, as well as how the company handles complaints. Our recommended insurance providers have received high ratings from both the BBB and J.D. Power.

Financial Strength

Commercial truck insurance is designed to cover incidents that would otherwise result in high out-of-pocket costs. With larger and heavier vehicles, the economic damage from trucking incidents is more significant than with a personal vehicle or smaller commercial automobile. As a result, business owners should always evaluate the financial strength of an insurer, since that will determine the insurer’s ability to pay expensive claims. If you want to conduct the research on your own, public insurance companies are required to make their financial documents publicly accessible. However, to make a direct comparison of different insurance companies (including those that are not public), it helps to reference ratings from the major credit rating agencies: AM Best, Moody’s, and S&P. Ratings from these agencies provide a snapshot of a company’s financial health. The insurance providers that we recommend are well-regarded by all three major rating agencies.

Cost

As previously discussed, price quotes vary a lot based on factors such as driving history, location, and the types of trucks. J.D. Power’s insurance industry studies offer some perspective on customer satisfaction with pricing policies, but these studies are somewhat limited because they do not break down customer satisfaction based on specific types of coverage. Because there is so much variation, you will usually need to request a quote from each company in order to compare costs effectively.

Commercial Truck Insurance for New Drivers & Companies

It can be difficult for first-time truck insurance buyers to get a good rate because insurers have no track record of safe driving to reference. Especially if the individual is young, the premiums can be much higher than for experienced drivers. New businesses may face similar challenges finding affordable truck insurance.

For this reason, new drivers and companies should look for commercial truck insurance providers with already affordable rates, as well as numerous discounts that can lower the cost of the policy. Based on our research, the company with the best commercial truck insurance company for new drivers is Nationwide, followed by Progressive. Read detailed reviews of each company below.

Commercial Truck Insurance for High-Risk Drivers

Drivers with accidents or moving violations on their record may be deemed “high-risk” by insurance companies, and, thus, find it challenging to find a fair affordable rate for commercial truck insurance. Insurance companies can be especially discriminatory to drivers who have hit-and-run or driving under the influence citations in their past. Even if the history of “high-risk” driving track record is from years ago, it can still affect insurance rates today.

Drivers who might be considered high-risk should look for companies who have generally low premiums. Furthermore, companies that offer discounts for things unrelated to driving history can help high-risk drivers save: multi-policy, up-front payment, and multi-car discounts are all commonly available and great ways to save on premiums regardless of driving history. Some companies will also give additional price breaks as the policyholder’s driving record improves over time, or as they implement safety measures on their vehicle or in their processes.

With all of this in mind, we believe The Hartford is the best commercial truck insurance company for high-risk drivers. Their discounts and focus on safety helps high-risk drivers save and avoid future incidents. Additionally, Progressive is another great option for riskier drivers. Progressive actually began as a company focused on insuring high-risk drivers who had difficulty getting policies with other providers. That along with their great pricing, discount options, and strong reputation makes them a great choice for high-risk drivers as well. Read complete reviews of both The Hartford and Progressive below.

Best Commercial Truck Insurance Companies

Progressive Commercial Truck Insurance (Best Overall)

Progressive was founded in 1937 and is headquartered in Mayfield, Ohio. According to data from S&P, Progressive is consistently the largest commercial vehicle insurer in the U.S. With such a prominent presence in the commercial truck insurance market, it should be no surprise that Progressive is one of the best-regarded providers out there.

Pros

- As the biggest commercial vehicle insurer in the country, Progressive offers one of the largest selections of truck policies

- Progressive’s Smart Haul® Program provides discounts when using an electronic logging device

- Has one of the best online price quote tools of any commercial insurer

Cons

- Received slightly lower customer satisfaction scores in a recent J.D. Power survey than competing companies

Coverage Options

Progressive is well-regarded for commercial trucking insurance due to its breadth and depth of policy options. The company insures owner-operators, motor carriers, and private carriers in all 50 states. Progressive offers not only the primary liability insurance required by federal law, but also trucking-specific coverage options such as motor truck cargo, motor truck general liability, non-trucking liability, rental reimbursement with downtime, on-hook towing, and trailer interchange. All of this makes it easier for Progressive to be a one-stop shop for all commercial trucking insurance needs, regardless of your company’s size, location, or specialty.

Company Reputation

As one of the largest auto insurers in the U.S., Progressive enjoys a strong national reputation. In J.D. Power’s 2022 U.S. Insurance Shopping Study, Progressive scored 859 out of 1,000 when it comes to customer satisfaction, which was 4th among large insurers. Progressive also has an A+ rating with the Better Business Bureau.

Financial Strength

Progressive has received high marks across the board for financial strength. AM Best has given Progressive an A+ (Superior) rating, the highest in its scale. Similarly, Moody’s has rated Progressive with an Aa and S&P gave Progressive an AA, both of which indicate that the company has a very low credit risk and a strong capacity to meet financial requirements.

Cost

According to Progressive’s website, the national average monthly cost for a new commercial for-hire truck insurance policy (primary liability and physical damage) ranges from $703 for specialty truckers to $1,118 for other transportation truckers. For more specific information for your needs, Progressive makes it easy for businesses and drivers to get price quotes over the phone or online.

Progressive also offers a variety of discount programs, including a Business Experience Discount for businesses that have been around for more than three years, a Commercial Driver’s License (CDL) Discount, and the Smart Haul® Program for drivers who use an electronic logging device (ELD) and grant access to the truck’s driving data.

Recommendation

We highly recommend Progressive due to its combination of financial strength, variety of insurance options, and strong reputation. The discounts available also make Progressive a cost-effective choice for many business owners. Overall, these qualities make Progressive our top pick as the Best Commercial Truck Insurance Company.

State Farm Commercial Truck Insurance (Runner-Up)

State Farm is a reputable Fortune 500 company that is the largest provider of both auto and home insurance policies in the United States. The Illinois-based company offers a comprehensive truck insurance program, including coverage for employees, the goods involved, and commercial automobiles.

Pros

- Offers a wide range of policy options to fit most truck drivers’ needs

- Achieved the highest level of customer satisfaction among major commercial insurers

- Provides several discount options to help lower the cost of policies

Cons

- Unlike other insurers, State Farm does not offer an online quote tool

- Potential customers must speak to a local representative to get a quote

Coverage Options

State Farm offers all of the standard commercial trucking coverage options one would expect, including bodily injury, property damage liability, personal injury, comprehensive, collision, and uninsured/underinsured motorist coverage. They also offer motor truck cargo and transportation coverage through their inland marine policies, as well as less common coverage options like rideshare insurance.

Vehicles covered under State Farm’s commercial truck policies include everything from pickup trucks to equipment like dump trucks and bucket trucks, which means that your business’s fleet is likely to find the type of coverage needed with State Farm.

Company Reputation

State Farm has one of the best reputations of any major commercial truck insurance provider. In J.D. Power’s 2022 study of auto insurance providers, State Farm tied for the highest customer satisfaction rating of all large insurers with a score of 885 out of 1,000.

Financial Strength

State Farm boasts impressive financial stability, carrying the highest possible rating of an A++ on AM Best’s Financial Strength Rating. State Farm also enjoys high ratings from Standard & Poor’s, which gives an AA financial rating. These stellar ratings suggest that State Farm is a reliable insurance provider when it comes to paying out its claims.

Cost

State Farm offers several discounts so that you can save money on your commercial truck insurance plan such as Multiple Auto discount for two or more vehicles insured by the company. They also offer an Accident-Free discount, but you have to remain accident-free for at least three years to qualify. For vehicles equipped with advanced safety or anti-theft features, State Farm also charges reduced rates.

One minor downside of State Farm is that they do not offer online quotes, and instead require potential customers to contact a local State Farm agent for additional information about cost. However, State Farm’s website makes it easy to identify and contact agents in your area to get started on a quote. Further, State Farm’s approach ensures that your quote will be better tailored to reflect the number of vehicles you use, how much you drive them, and your industry.

Additionally, State Farm also provides many other forms of business coverage which can be packaged or bundled together with a commercial truck policy for savings and convenience.

Recommendation

State Farm offers a mix of quality coverage, strong customer reputation, and financial strength that few other insurers can match. With all of these positive qualities, State Farm is our Runner-Up pick for the Best Commercial Truck Insurance Company.

The Hartford Commercial Truck Insurance (Best for High-Risk Drivers)

Founded in 1810 as a fire insurance company, The Hartford has since expanded its portfolio to include business, home, and auto insurance policies. Today, The Hartford is a Fortune 500 company with particularly strong offerings in commercial insurance, providing coverage to more than one million small businesses, including commercial truck and auto policies.

Pros

- Received stronger customer satisfaction ratings than other truck insurers

- Its FleetAhead Program provides real-time data for fleet managers, which can be used to improve safety and achieve greater discounts

Cons

- Unlike some of the other companies included in this guide, The Hartford does not offer online quotes

Coverage Options

The Hartford has a strong selection of coverage options for commercial truck policies. In addition to typical coverages like liability, property, and uninsured and underinsured motorist coverage, The Hartford has a number of other coverages useful to commercial trucks. These include coverages for motor truck cargo, on-hook towing, trailer interchange, property in transit, livestock transit, and more. This means that The Hartford’s coverages can be customized to particular features of your business or industry that might require specialized insurance coverage for your vehicles.

Company Reputation

With more than 200 years in business, The Hartford has an exceptional and longstanding reputation as an insurance provider. The Better Business Bureau currently gives The Hartford an A+ rating. And The Hartford is one of the top performers of all midsized insurers on J.D. Power’s surveys of customer satisfaction. A recent J.D. Power study gave The Hartford a rating of 889 out of 1,000, which exceeded the segment average of 855. Together these factors indicate that The Hartford does well in serving its customers.

Financial Strength

The Hartford performs well on measures of financial strength. The company has earned an A+ rating from both AM Best and Standard & Poor’s, along with an A1 rating from Moodys. The Hartford’s customers can be assured that their insurance provider will meet its financial obligations when paying out claims.

Cost

The Hartford does not offer online quotes, so to find information about cost, you will need to contact The Hartford directly. The Hartford’s website includes contact information for you to get started. Once you reach out, you can work with an agent to identify the right coverages for your business and the vehicles you use and get a quote on cost.

One noteworthy feature of The Hartford’s coverage is its FleetAhead program, which uses devices installed in vehicles to report real-time data on driver safety and performance. This is beneficial both because it can help fleet managers improve the efficiency of their drivers and because The Hartford can use that data to more accurately gauge risk and potentially save policyholders money when they have safe drivers.

Recommendation

More so than some of its competitors, The Hartford offers an impressive variety of coverages that are specifically tailored to different types of businesses that might require commercial truck insurance. The customizability of its policies combined with an emphasis on improving safety make The Hartford our choice as Best Truck Insurance for High-Risk Drivers.

Nationwide Commercial Truck Insurance (Best for New Drivers & Companies)

Nationwide was founded in 1926, making it one of the oldest auto insurance companies in the U.S. And with more than 32,000 employees in offices around the country, Nationwide lives up to its name, making it easy for customers to find local offices, request quotes, and find coverage that works for them no matter where their business is located.

Pros

- Scores above-average in customer satisfaction for its auto-specific policies

- Offers competitive discounts and affordable rates for new drivers when compared to other companies

Cons

- Does not offer coverage for semi-trucks or tractor trailers

- Received lower customer satisfaction ratings than competing truck insurers for its overall commercial insurance offering

Coverage Options

Nationwide’s coverages are comprehensive, including auto liability, medical payments, collision and comprehensive insurance, and uninsured and underinsured motorist insurance. Furthermore, business owners can purchase additional coverage options for their trucking company, including motor truck cargo liability insurance. Covered vehicles include box trucks, pickup trucks, and utility trucks, and Nationwide offers an additional specific coverage for farm truck insurance. However, semi-trucks and tractor trailers are not covered by Nationwide’s commercial vehicle policies. For semi-truck insurance, you will need to go with a different provider.

Company Reputation

One drawback for Nationwide is its reputation with consumers compared to competing insurers. In J.D. Power’s 2022 U.S. Insurance Shopping Study, Nationwide was rated an 858 out of 1,000 for customer satisfaction, which was lower than some of the other insurers evaluated. In last year’s Auto Claims Satisfaction Study—one specific to vehicle insurance—Nationwide scored slightly below average but higher than some competitors. Additionally, Nationwide has received an A+ rating from the Better Business Bureau and has been BBB accredited since 1955. This means that the BBB has judged Nationwide to meet its highest standards for fair and ethical business practices.

Financial Strength

Nationwide has a longstanding history of financial strength and carries excellent ratings with the major credit rating agencies. Nationwide enjoys an A+ rating from both AM Best and S&P, along with an A1 rating from Moody’s. Together, this means that Nationwide customers can be assured of the company’s ability to pay claims in the event of an incident.

Cost

Nationwide has a convenient online quote system that allows you to enter information about your business and receive an estimate for the cost of a policy. Nationwide’s quote form also allows you to select additional coverages that your business may need to address all your insurance needs in one process. This is also helpful because Nationwide offers discounts for customers who bundle or purchase multiple policies with Nationwide. Nationwide also provides discounts for customers who pay their annual balance in full or install anti-theft devices on their vehicles, and offers some of the best rates for newer drivers and companies.

Recommendation

Nationwide offers a variety of benefits that make it a good choice for commercial truck insurance. While its customer satisfaction ratings are occasionally low, Nationwide has solid discounts and lower costs for newer drivers, which make it our recommendation for The Best Commercial Truck Insurance Company for New Drivers and Companies.

Acuity (Best for Custom Trucking Insurance Policies)

Acuity has been providing a variety of insurance products since 1925, including both personal and commercial lines. Today, the company insures over 100,000 business clients.

Pros

- Acuity offers a variety of coverage options and enhancements to suit a wide range of trucking businesses

- Acuity has a 0.08 NAIC complaint index, which is well below the national complaint index

- BBB accredited with an A+ rating and 4.56 out of 5-star customer reviews

Cons

- S&P financial rating indicates strong, but not superior, financial strength

Coverage Options

Acuity offers trucking insurance suitable for a range of business sizes, from small owner-operators to large trucking companies. Its policy offerings include standard commercial auto insurance coverage, general liability coverage, and cargo insurance. They also offer the following additional specialized coverage options:

- Deadhead or bobtail coverage: Protects owner-operators who operate their tractor with an empty trailer, or without a trailer at all

- Trailer interchange: Protects against losses when you are pulling a trailer that isn’t your property, but you are responsible by contract for any incidents that may occur

- Combined truck/trailer/cargo deductible: Enhances coverage by not requiring a separate deductible to be met for each component of your truck affected by an incident

- Loan/lease gap coverage: Provides coverage when the amount owed on a loan for your vehicle is greater than the actual cash value (ACV) received in the event of a total loss

- Rental reimbursement: Covers transportation costs (such as a rental car) while your vehicle is being repaired

- Tow coverage following a loss: Provides coverage for the cost of a tow truck often up to a certain mileage limit

In addition to providing coverage, Acuity will complete required state and federal motor carrier filings for your business.

Company Reputation

Acuity has 45 years of experience in the trucking insurance industry, with 10,000 trucking insurance customers. They also report 96% claims satisfaction from their customers, providing a single point of contact throughout the entire claims handling process.

According to the NAIC, Acuity only incurred five complaints for any policy type last year and only one commercial auto complaint. These impressive stats earned a 0.08 complaint index, which is well below the national complaint index, and a 0.11 complaint index for commercial auto policies specifically. In addition to its outstanding complaint record with NAIC, Acuity is BBB accredited with an A+ rating. Its customer reviews have also earned the company 4.56 out of 5 stars on its BBB profile.

Financial Strength

In 2020, Acuity earned A+ financial strength ratings with a stable outlook from Standard & Poor’s (S&P) and AM Best. S&P’s rating indicates a “strong capacity to meet financial commitments, but somewhat susceptible to economic conditions and changes in circumstances.” A.M Best’s rating indicates a “superior ability to meet ongoing insurance obligations.” Both of these ratings can give clients a good level of confidence in Acuity’s claims-paying abilities.

Cost

The cost of trucking insurance through Acuity varies depending on business size and industry, as well as the additional optional coverages included. However, some online reviewers have noted that Acuity auto insurance policies are more expensive when compared to similar providers. You can get a quote directly on the Acuity website, or work with a local agent who will be able to help you determine exactly what coverage options are right for you.

Recommendation

Acuity has a positive company reputation and strong financial health, and they provide a variety of options and enhancements so that you can create a policy that best suits your business’s industry and size. So, we recommend Acuity as the best for custom truck insurance policies.

National Independent Truckers Insurance Company (Best for Settling Claims; Best Customer Service)

NITIC has been providing trucking insurance for over 30 years. It is counted among the big giants in the insurance industry, renowned for its fast claims settlement process. NITIC offers coverage for all types of trucks at reasonable prices, including customized options and a variety of discounted rates.

Pros

- Several insurance options to fit most truckers’ needs

- Excellent customer satisfaction regarding policy administration and handling claims

- One of the most affordable options on the market

Cons

- NITIC doesn’t offer online quotes like other insurers on the list; customers need to contact agents directly for pricing

Coverage Options

NITIC offers one of the broadest sets of coverage options for trucks in the industry. From primary liability and non-trucking insurance to refrigeration breakdown and trailer interchange, NITIC offers all types of commercial truck insurance options under one roof. They provide coverage for a number of vehicles including dump trucks, hotshot trucks, box trucks, tow trucks, and many more. Customers can easily modify their vehicle coverage according to their business needs.

Company Reputation

NITIC is considered one of the most reliable truck insurance providers in the U.S. They have a team of experienced professionals that help customers navigate the whole process—from setting up policies to handling claims—and customers are generally highly satisfied with the services they receive. Having over three decades of experience in providing insurance solutions, NITIC has gained a large and supportive client base. Their excellent online reviews across Google, Facebook, Yelp, and other platforms speak to their high level of customer service.

Financial Strength

NITIC enjoys good ratings from AM Best. This indicates that the insurance provider has the ability to settle claims reliably. NITIC is also renowned for its fast claims processing.

Cost

NITIC offers a variety of discount options on various trucking coverages. Customers can see big savings if they insure multiple fleets or bundle together multiple policies. The only downside of NITIC is they don’t provide online quotes. However, customers can easily get in touch with an agent to obtain a custom price quote, which will be based on operating radius, driving records, and coverage level.

Recommendation

While not as big as some of the other insurers on this list, NITIC has carved out its place in the commercial trucking insurance space. The insurer has strong financials, excellent customer service and claims handling, and receives some of the best reviews of any company in the industry. For these reasons, we recommend NITIC as the Commercial Trucking Insurance Company With the Best Customer Service.

Sentry (Best Personalized Customer Experience)

Sentry is a mutual insurance company founded in 1904. They offer specific and specialized insurance products for individuals and businesses. This includes commercial trucking insurance with a variety of coverage options for trucking businesses of all sizes.

Pros

- Specialized insurance products allow Sentry to offer expert and personalized service

- A+ Financial Strength Rating from A.M Best for 30 years in a row

- NAIC Complaint Index score of 0.68 indicates fewer complaints than average

- You must contact an agent to purchase a policy, who can provide guidance throughout the process

Cons

- Not currently BBB Accredited

- No online quotes offered

Coverage Options

Sentry’s coverage options for trucking insurance include standard options such as commercial auto, general liability, physical damage, and motor truck cargo insurance. They also offer more specialized coverage options, including:

- Non-trucking liability insurance: Provides coverage for owner-operators driving their trucks for non-business-related purposes

- Cyber liability insurance: This coverage protects your business from losses in the event of a cyber security breach that compromises customer data

In addition to the coverage that Sentry provides, they also offer safety resources that can help you learn how to manage your risk and decrease the likelihood that you’ll need to file a claim for your business.

Company Reputation

Sentry offers trucking insurance only through agents who are specialized and experienced in the trucking industry. They also provide clients with claims adjusters that specialize in trucking risks and will have the knowledge to assist you well during the claims handling process. Sentry currently insures over 50,000 truck drivers.

According to the NAIC Complaint Index, Sentry has no reported commercial auto complaints. Their overall complaint index for all policy types is 0.68, which indicates fewer complaints than the national index of insurance companies. In addition to its positive NAIC Complaint Index report, Sentry also has an A+ rating with the Better Business Bureau (BBB); however, they are not currently accredited by the BBB.

Financial Strength

Sentry has earned an A+ rating from AM Best for 30 years in a row. This rating denotes superior financial stability, as well as superior ability to meet claims-paying obligations. This consistent rating can give customers confidence that approved claims will be paid in full without difficulty.

Cost

Because you must find an independent agent or broker to purchase insurance, the cost of insuring your business may vary. Other factors that may influence the cost of trucking insurance through Sentry are the size of your business, your industry, and your business’s risk of an incident. Online reviews indicate that their pricing is similar to other providers on the market.

One perk of being insured through Sentry are discounts with partnering vendors on products such as safety training, criminal background checks, drug and alcohol testing, and cargo theft prevention. To get a quote from Sentry, you can search for agents or submit a contact form.

Recommendation

Sentry has a variety of coverage options, strong financial ratings, and a positive company reputation. Sentry only offers policies through local Sentry agents, who can help you make an informed decision. Additionally, the expertise of their trained in-house claims team can take some of the stress out of the claims-handling process. So, we recommend them as the best trucking insurance provider for a personalized customer experience.

OOIDA (Best Truck Insurance for Small Businesses/Owner-Operators)

Owner-Operator Independent Drivers Association (OOIDA) is an international trade association for professional truck drivers and independent owner-operators. This organization advocates for a fair business climate and highway safety for the trucking industry, and they also offer trucking insurance to members.

Pros

- Variety of coverage options for owner-operators and leased owner-operators

- NAIC Complaint Index of 0.58 indicates a fewer-than-average number of complaints

Cons

- OOIDA membership is required to purchase trucking insurance

Coverage Options

Coverage included in OOIDA’s trucking insurance for owner-operators with authority includes primary liability, general liability, physical damage, motor truck cargo, and passenger accident. For leased owner-operators, OOIDA offers non-trucking liability, unladen liability, bobtail liability, physical damage coverage, and passenger accident coverage.

While you must be a member to purchase trucking insurance with OOIDA, a one-year membership is just $45. This additional cost may be worth it to be insured by an organization like OOIDA.

Company Reputation

OOIDA has an NAIC complaint index of 0.58, which is below the national complaint index. They only have 1 complaint recorded by the NAIC, and they have no commercial auto complaints reported. They also have an A+ rating with the Better Business Bureau, but they are not currently BBB accredited. These factors indicate a positive reputation among OOIDA customers.

Cost

The cost of insurance through OOIDA will vary depending on your insurance needs. To get a quote you must first become an OOIDA member, which costs $45 annually. For more information on membership and insurance pricing, you can contact the organization online or by phone.

Recommendation

OOIDA trucking insurance is designed with its members in mind: independent owner-operators. They also provide services and benefits for their members, including life and health benefits, discounts and rebates, and business services. As such, we recommend them as the Best Trucking Insurance for Small Businesses.

biBERK (Best Online Experience)

biBERK, an insurance company within Berkshire Hathaway Insurance Group, specializes in small business insurance. They offer a variety of transportation insurance coverage options ideal for trucking businesses and more.

Pros

- Policies are underwritten by companies with an A++ financial strength rating

- biBERK allows you to get a quote and manage policies online

Cons

- Newer insurance company founded in 2015

Coverage Options

biBERK, a small business insurance company founded in 2015, offers transportation coverage including worker’s compensation, general liability, cyber insurance, business owner’s policies (BOP), and commercial auto insurance. These coverage options can be tailored for trucking businesses, as well as other sectors of the transportation industry, such as delivery, towing, and logistics services.

Company Reputation

Berkshire Hathaway’s companies are generally known for excellent customer service, and biBERK is not an exception. Despite being a relatively young company, biBERK is a BBB-accredited business with an A+ rating. Its customers give it a 4.28 out of 5-star rating based on their experience. When compared to other insurers, biBERK scores particularly well in this regard.

Financial Strength

Most biBERK policies are underwritten by Wellfleet Insurance Company, Berkshire Hathaway Direct Insurance Company, National Liability & Fire Insurance Company, or New York Insurance Company. This means that one of these companies will accept claims-paying responsibility for most biBERK policies. All of these companies have earned an A++ rating from AM Best, indicating a superior ability to meet financial obligations.

Cost

The cost of transportation/trucking insurance through biBERK will vary depending on the size and industry of your business, as well as the type of policies that your business will need. Some transportation businesses may only require commercial auto and worker’s compensation insurance, while others may require additional and more specific types of coverage. biBERK allows you to get a quote online, and they claim to help you save up to 20% on your insurance policies compared to other companies.

Recommendation

biBERK has strong financial backing, a positive company reputation, and specialized experience in small business insurance. Because they are a modern insurance company, biBERK’s online services allow you to get a quote, submit claims and manage your policy entirely online. We recommend biBERK for the best online experience, ideal for business owners looking for simplified insurance that they can manage digitally.

Trucking Industry Statistics

The statistics presented below are from the most recent Commodity Flow Survey, produced by the U.S. Census Bureau and Bureau of Transportation Statistics. The data is used by trucking and transportation professionals as well as public policy makers who need to better understand facts about the shipping industry.

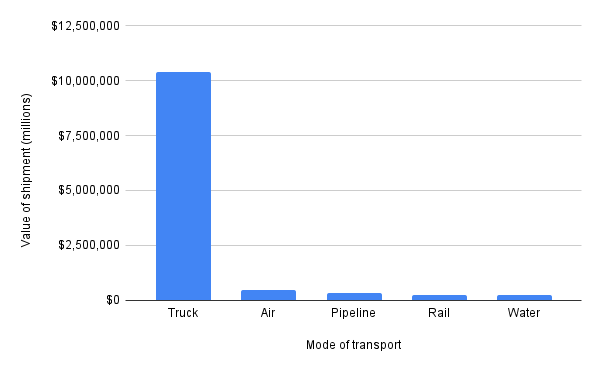

Shipments by Mode of Transport

Trucks are responsible for the lionshare of goods shipped in the U.S. each year. Based on the most recent available data, trucks account for an astonishing 89% of total shipment value (among shipments with a single mode of transport). This figure represents $10.4 trillion in value annually.

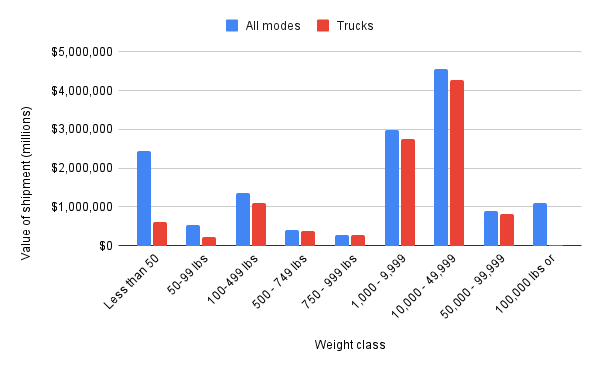

Truck Shipments by Weight

Shipments between 10,000 and 49,999 pounds are the most common size shipments in the U.S. when looking at all modes of transport as well as for trucks specifically. This size shipment accounts for 31% of the total shipment value across all modes of transport and 41% of total shipment value for goods transported by truck. Shipments weighing between 1,000 and 9,999 pounds are the next most common weight class.

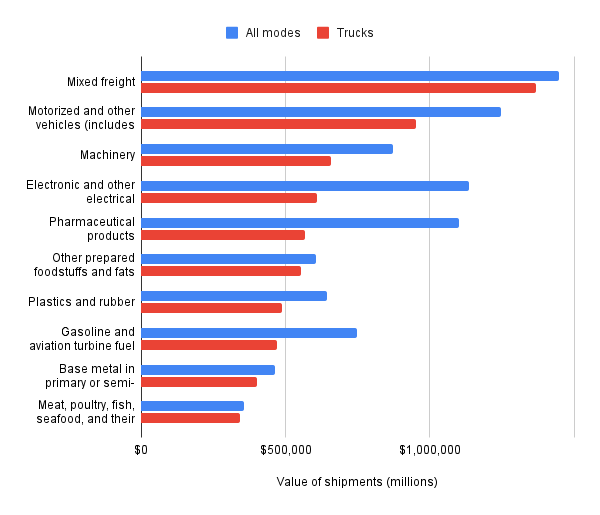

Truck Shipments by Commodity

Mixed freight shipments account for the largest share of total value when considering all modes of transport as well as trucks only. There are $1.4 trillion in mixed freight shipments transported by truck annually, which is about 13% of total truck shipments. Motorized vehicles take the second spot for both modes of transport. The total value of motorized vehicles shipped by truck each year is $950 billion, or roughly 9% of total.

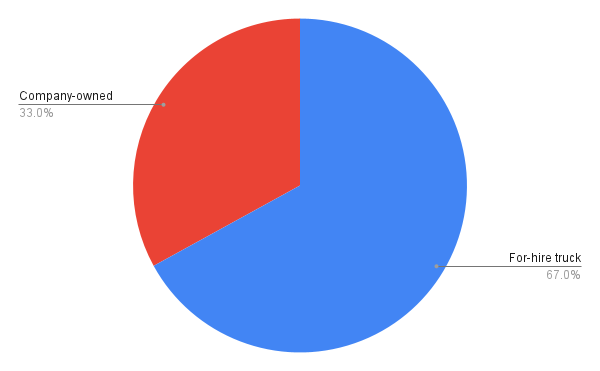

Truck Shipments by Owner Type

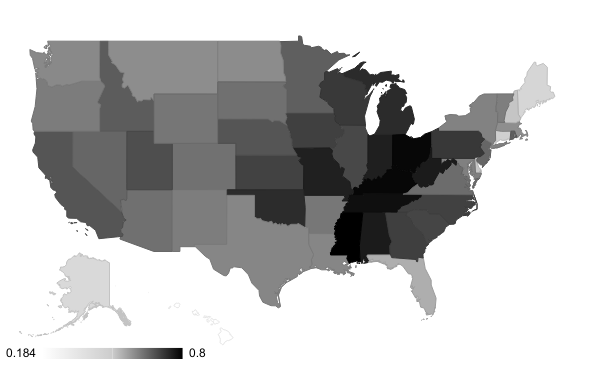

The Census Bureau data also highlights how important small businesses are to the U.S. trucking and transportation industry. Nationally, only about one-third of total shipments (by value) are transported in company-owned trucks. The remaining two-thirds are transported by for-hire trucking companies, many of which are small businesses.

These values vary widely by state though, as shown in the map below. Overall, states in the Appalachian Region of the U.S. tend to have more for-hire trucking activity. For example, roughly 80% of all trucking activity in Mississippi, Ohio, Kentucky, and Tennessee is done by for-hire trucking companies. On the other hand, a majority of trucking activity is carried out by company-owned trucks in Hawaii, Alaska, Maine, and Connecticut.

The states that report the most for-hire trucking activity overall are California, Texas, Illinois, Ohio, Pennsylvania, and Michigan.

Frequently Asked Questions

Trucking insurance (formally known as commercial truck insurance) refers to a series of commercial auto policies used by trucking businesses, independent drivers, or companies that use trucks. It provides financial and legal protection from bodily injury and property damage in the event of an accident. It also provides coverage for specialized cargo and trucking equipment from damage and theft.

By law, commercial trucks are required to hold a minimum amount of liability coverage based on the type and weight of freight being transported. This primary liability insurance covers bodily injury and property damage done to others as a result of an accident. Additionally, motor carriers transporting certain types of goods are required to hold cargo insurance, which insures the freight that a trucker transports from one place to another. In addition to the insurance that is legally required, truck businesses also benefit from having physical damage, medical payments, general liability, non-trucking liability, and trailer interchange coverage.

As a result of the size of the vehicles being driven and the value of the cargo being transported, truck insurance tends to be expensive. Fortunately, there are a few things you can do to lower the cost of your insurance. The single best strategy for keeping your insurance costs low is to maintain a safe driving history, avoiding accidents and moving violations. The next best option is to shop around and take advantage of all available discounts offered by the insurance carriers. For example, some insurers provide steep multi-line discounts for customers that maintain multiple policies with them. Additionally, insurers like Progressive offer “paid-in-full” discounts of up to 15% for customers that pay their premium in full each coverage period, rather than paying in monthly installments. The last thing you can do to lower your premiums is to adjust your coverage limits and deductibles. Lower coverage limits and higher deductibles will lower the total cost of your insurance, but you might end up paying more out of pocket in the event of a claim.

Reference

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.