The Best Construction Accounting Software for 2023

Construction accounting software allows contractors and other construction professionals to accurately track money coming into and out of their businesses. Unlike general accounting software, accounting software for construction is designed to handle the unique aspects of the construction industry, such as job costing and retainage. In this guide, we explain which software products work best for different types of construction businesses—from small contractors to commercial developers. We start with reviews of the best construction accounting software, followed by an in-depth discussion of how construction accounting differs from general accounting, key features to look for, pricing, and other frequently asked questions.

Best Construction Accounting Software

- The top pick by our users

- #1 best construction accounting software overall

- Offered as a cloud-based or on-premise solution

- Highly customizable for businesses of any size

Try CMiC

- Our runner-up best accounting software for construction

- Top selection for customer service

- Offers additional functionality for project management

- Optional equipment and inventory management modules available

Try FOUNDATION

- Best for firms that need construction accounting and project management software

- Excellent choice for larger firms with complex businesses

- Provides a comprehensive suite of features for construction firms

Try Sage

- The #1 top pick for enterprise customers

- Offered as a cloud-based or on-premise solution

- Additional modules for field service management, project management, and operations

- 24/7 customer support via phone or email

Try Jonas

- QuickBooks for Construction – the best choice for small contractors

- The least expensive option for businesses looking to save money

- Exceptional product support and training documentation

- QuickBooks Advanced offers batch invoices and automated workflows

Try QuickBooks

Construction Accounting Software Reviews

CMiC (Best Overall)

CMiC is an excellent all-around software for construction accounting and financial management. With functionality for accounting, project management, human capital, and the field, CMiC covers most of the essential needs for any construction business. CMiC combines all of the business’s data into a single database that allows users to generate a variety of sophisticated reports that help shed light on project costs and minimize potential risks.

Pros

- Can be scaled to meet the needs of different-sized businesses

- Available as either a cloud-based or on-premise solution

- Quality customer support and training materials

Cons

- Users report that the product can be slow at times

- Setup and initial training can be time-consuming

CMiC’s construction-specific accounting systems include core functionality around budgeting, corporate and project forecasting, general ledger, accounts payable, and accounts receivable. The accounting features of CMiC include automated controls and risk management features that help companies minimize risks and errors and maximize financial performance. CMiC creates a single centralized record of past and present financial transactions, which saves time, improves data integrity, and allows for accurate documentation, forecasting, and reporting on financial health.

Beyond its strong accounting and financial management tools, CMiC includes robust tools for project management, human capital management, and asset management. This makes CMiC a strong enterprise offering that allows for alignment and visibility across projects. Additionally, CMiC’s FIELD product includes a mobile app that allows managers and workers in the field to share project information, documents, and status updates with staff in the home office.

CMiC is offered as both a cloud-based and on-premise solution. Users report that CMiC can take a while to set up and learn, but CMiC is able to provide in-depth training to help facilitate the transition to the new system. CMiC also has a strong customer support operation and an extensive library of on-demand reference materials for users to answer questions or troubleshoot themselves.

CMiC also has the benefit of being a scalable solution, just as useful for small construction businesses as it is for larger organizations. While potential customers need to contact CMiC for pricing information, CMiC is a highly customizable solution and its different options for features and deployment help ensure that you can scale it to your business’s needs.

CMiC’s impressive collection of features, flexibility, and suitability for companies of all sizes make it our overall Best Accounting Software for Construction pick.

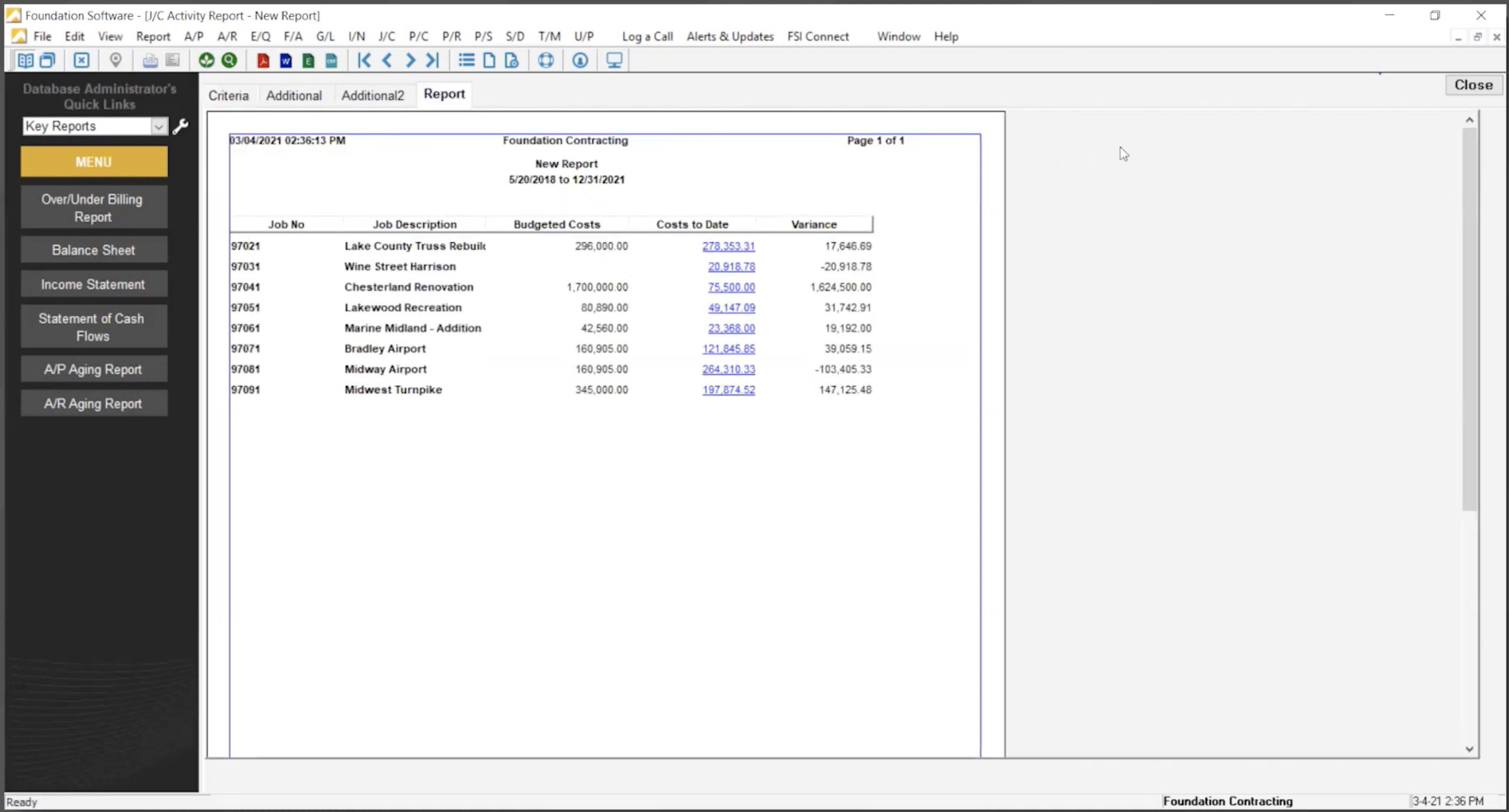

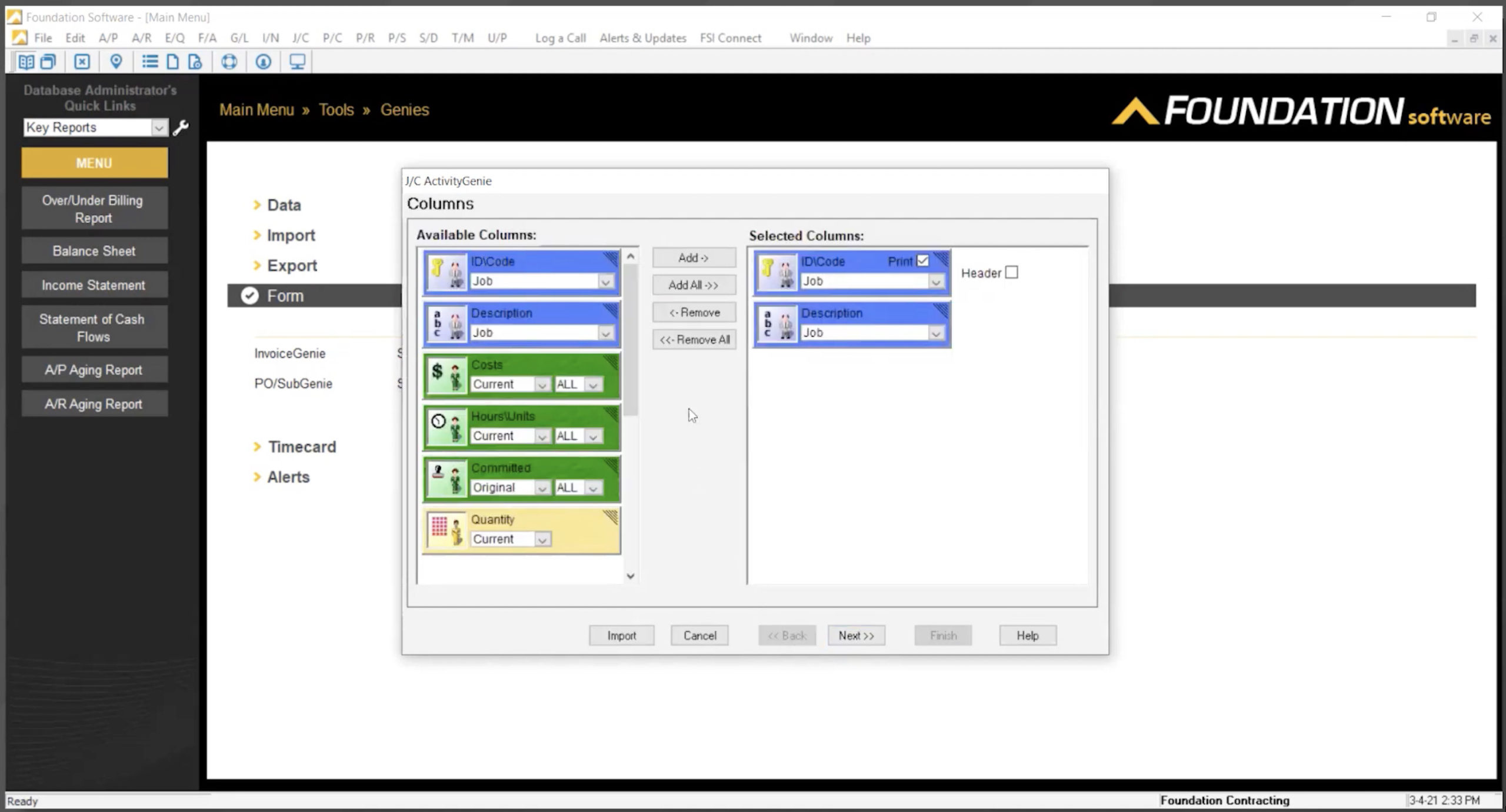

FOUNDATION (Runner-Up)

Started in 1985, FOUNDATION is one of the best construction accounting software vendors available. FOUNDATION offers robust features with a wide range of modules for businesses of all sizes, making it a comprehensive and customizable option that can serve a wide variety of construction operations.

Pros

- Easier to learn and use than many other leading options

- Mobile app and cloud-based installation available

- Exceptionally helpful and responsive customer service

Cons

- Reporting capabilities are not as strong as some competitors

- Users sometimes encounter glitches, freezing, crashes, etc.

Like many other construction accounting software options, FOUNDATION’s base modules include job costing, payroll, general ledger, accounts payable, accounts receivable, and purchase order/subcontractor management. FOUNDATION goes further with the comprehensiveness of additional modules for project management, scheduling, inventory and equipment tracking, document imaging, and many other aspects of construction financial management.

Users have mixed feelings about the reporting capabilities of FOUNDATION, with some users feeling that the prebuilt reports do not meet their needs. However, FOUNDATION recently added integration with DataGenie, which strengthens FOUNDATION’s functionality around reporting. FOUNDATION offers a number of predefined reports, but DataGenie offers users the ability to customize and design their own reports.

Users find that FOUNDATION is easy to learn and use, especially compared to other sophisticated construction accounting and management software. Modules are simple to understand and laid out logically. However, some users report that the software sometimes freezes, crashes, or has glitches, and many of the software updates are just to address bugs rather than add or improve features.

When users run into issues, FOUNDATION is also extremely well-regarded for its customer service, with industry expertise, quick response times, and helpfulness in resolving problems. With so many different features and modules available, this customer support can help customers make sure that they are maximizing the software’s features and functionality.

FOUNDATION is available as both an on-premise and a cloud-based solution, which allows businesses to choose their preferred installation. In addition to offering a cloud-based product, FOUNDATION has a strong mobile app that makes it possible to share real-time information from the job site. The mobile app is also helpful for managing employee time and payroll and handling service dispatch.

FOUNDATION’s customizability means that its pricing will vary according to each business’s specific needs. Interested businesses should contact a FOUNDATION sales representative to help determine which modules are right for you and get a quote for a customized package.

FOUNDATION’s strong features and customer service make it one of our leading picks for construction accounting software and our overall Runner-Up Best Accounting Software for Construction.

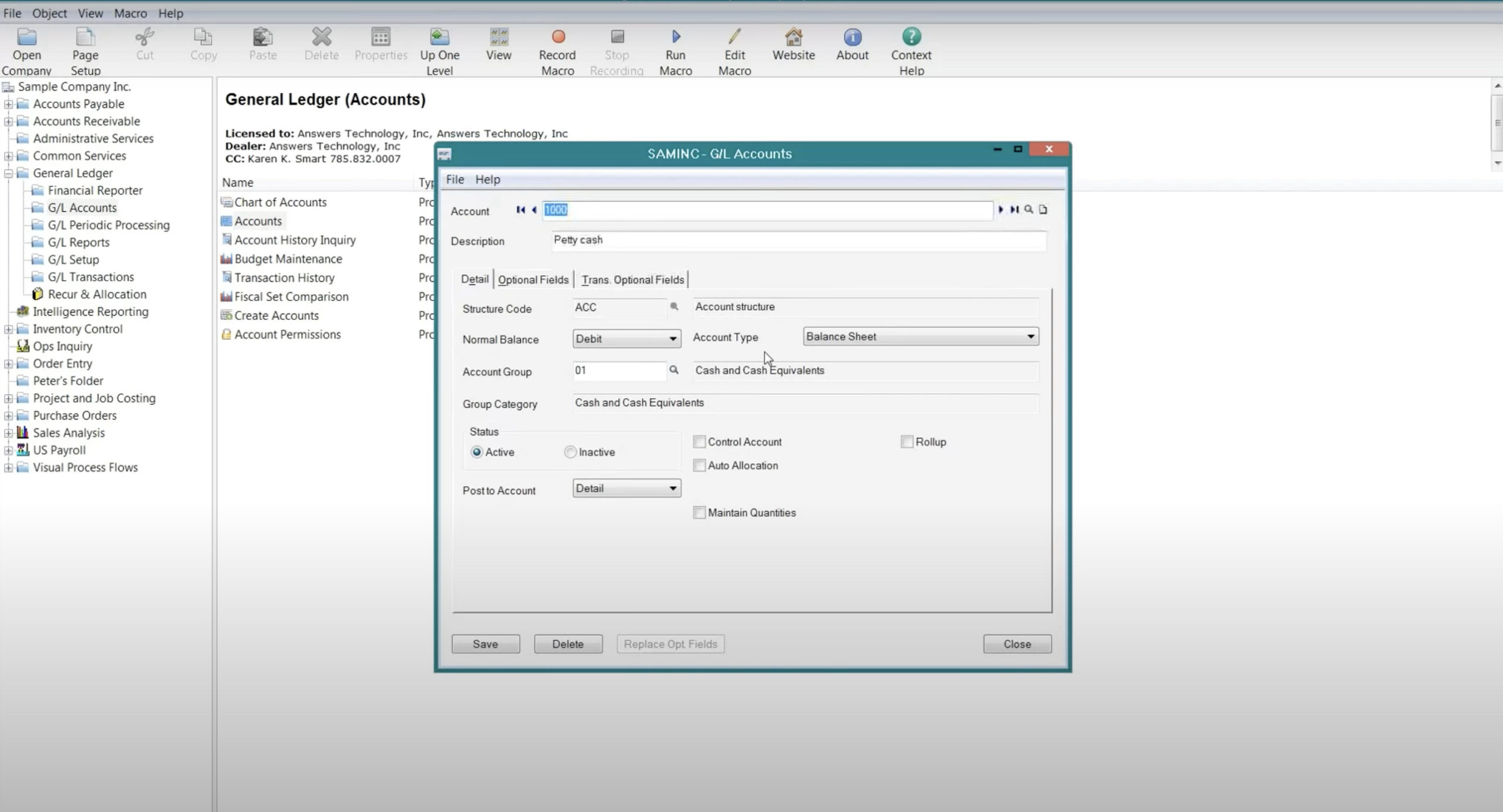

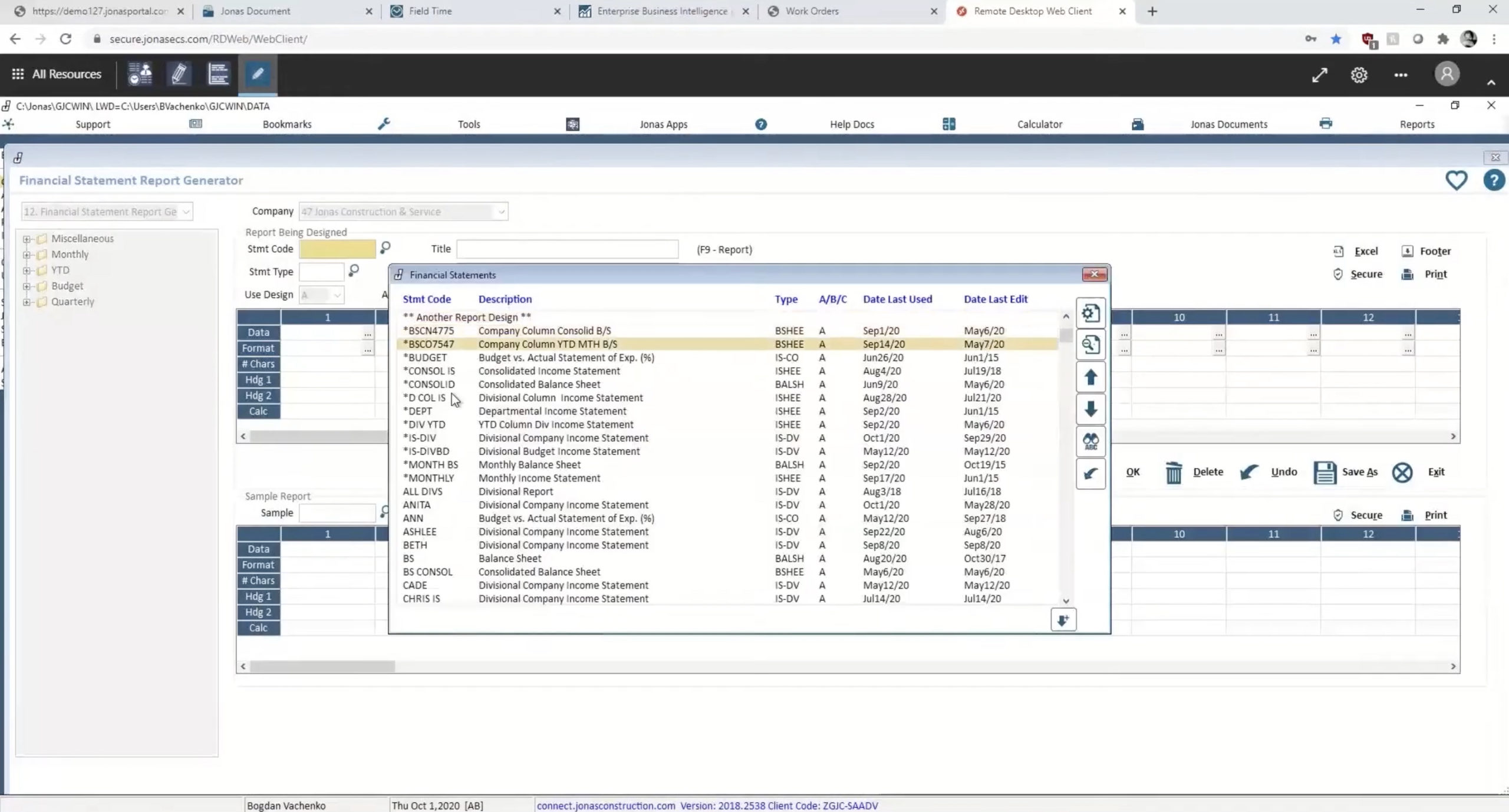

Sage 300 Construction and Real Estate (Best for Construction Accounting & Project Management)

With thousands of customers and several decades in the industry, Sage 300 CRE is one of the most prominent tools available on the market, supporting complex financial management needs for midsize and large construction firms. As a market leader, Sage 300 CRE has a strong track record that makes it one of the top choices for construction accounting software.

Pros

- Long track record in the construction and real estate industries

- Extensive reporting and business intelligence features

- Strong customer service and support offerings

Cons

- Software can be difficult to learn and the UI feels dated compared to newer competitors

- High price, especially for certain features and higher tiers of customer support

- Only available as an on-premise solution

Sage 300 CRE distinguishes itself with a full suite of features that include sophisticated accounting tools and reports for job costing, payroll and HR, and billing and invoicing. The software also includes features for estimating, document management, project management, business intelligence, and service management, which makes it a strong all-around option for businesses seeking out a comprehensive software product. Sage 300 CRE’s reporting and business intelligence features are among the highlights for many users. With more than 1,400 prebuilt report formats and extensive customization available, Sage 300 CRE allows users to access important insights about their business and individual jobs.

Sage 300 CRE (formerly known as Timberline) has been on the market for several decades. While this has made Sage 300 CRE a trusted product, some users report that certain modules feel outdated or unintuitive and that the product is not as dynamic as some newer competitors. Sage 300 CRE is also only offered as an on-premise solution, so businesses that would prefer the convenience and flexibility of a cloud-based product will have to consider other alternatives.

Additionally, the number and complexity of features make Sage 300 CRE difficult to navigate for many users, so it may take time to transition from another platform or get new team members up to speed. However, Sage has a well-regarded customer support team who can help ensure that each business makes the best use of Sage 300 CRE’s many tools and features. Sage 300 CRE also recently launched the Business Care Gold Plus Plan, which includes additional enhancements and superior customer support for additional assistance.

Sage 300 CRE’s comprehensive tools come at a fairly high price, which means that it may not be a good fit for smaller companies. While exact pricing will depend on factors specific to your business, Sage 300 CRE can easily cost thousands of dollars per year between implementation costs, ongoing subscription fees, and higher tiers of customer service. But for larger companies with complex operations who are looking for some of the most comprehensive accounting and financial management tools in the industry, Sage 300 CRE is an excellent choice and our pick as Best Software for Construction Accounting and Project Management.

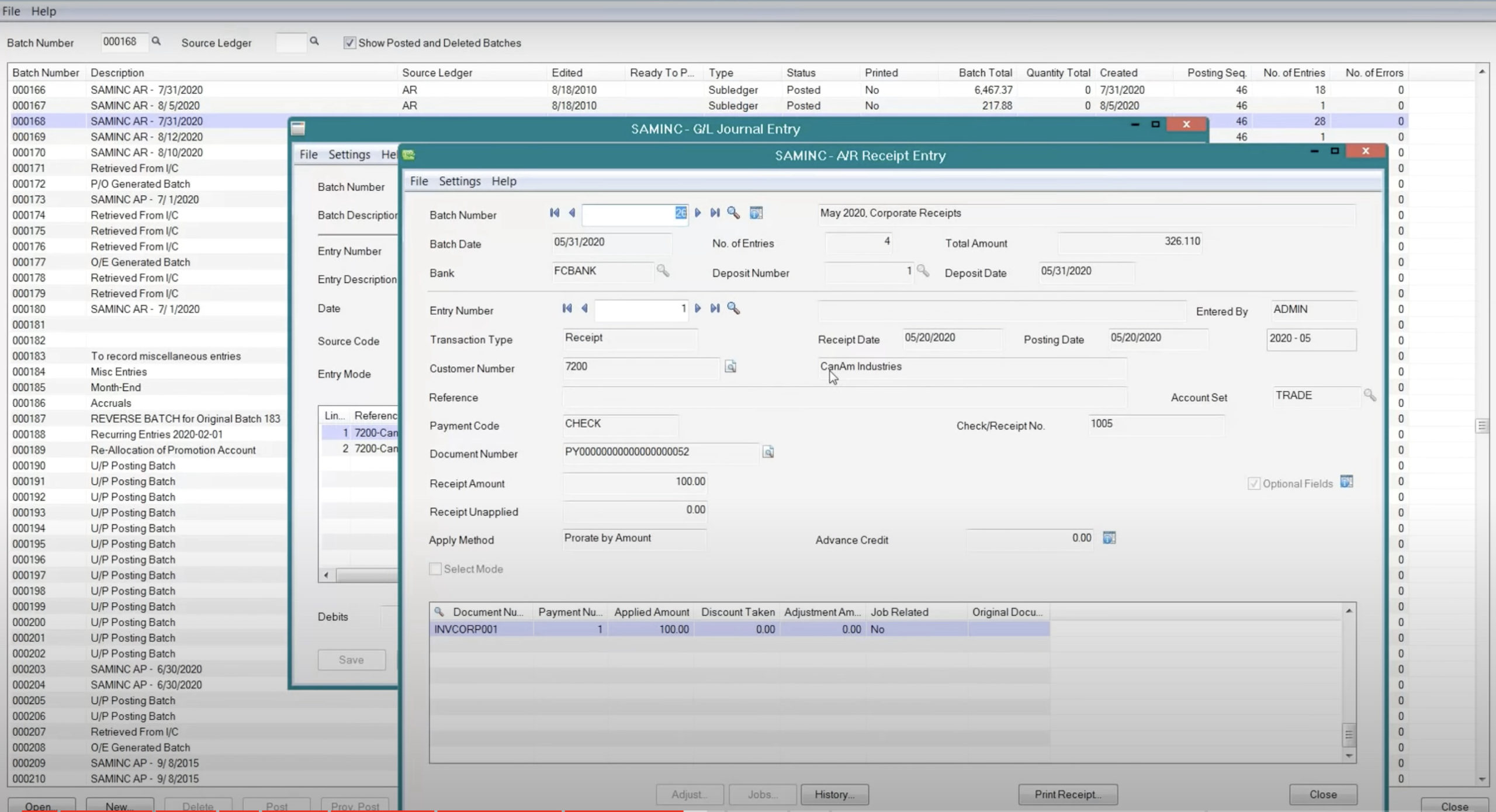

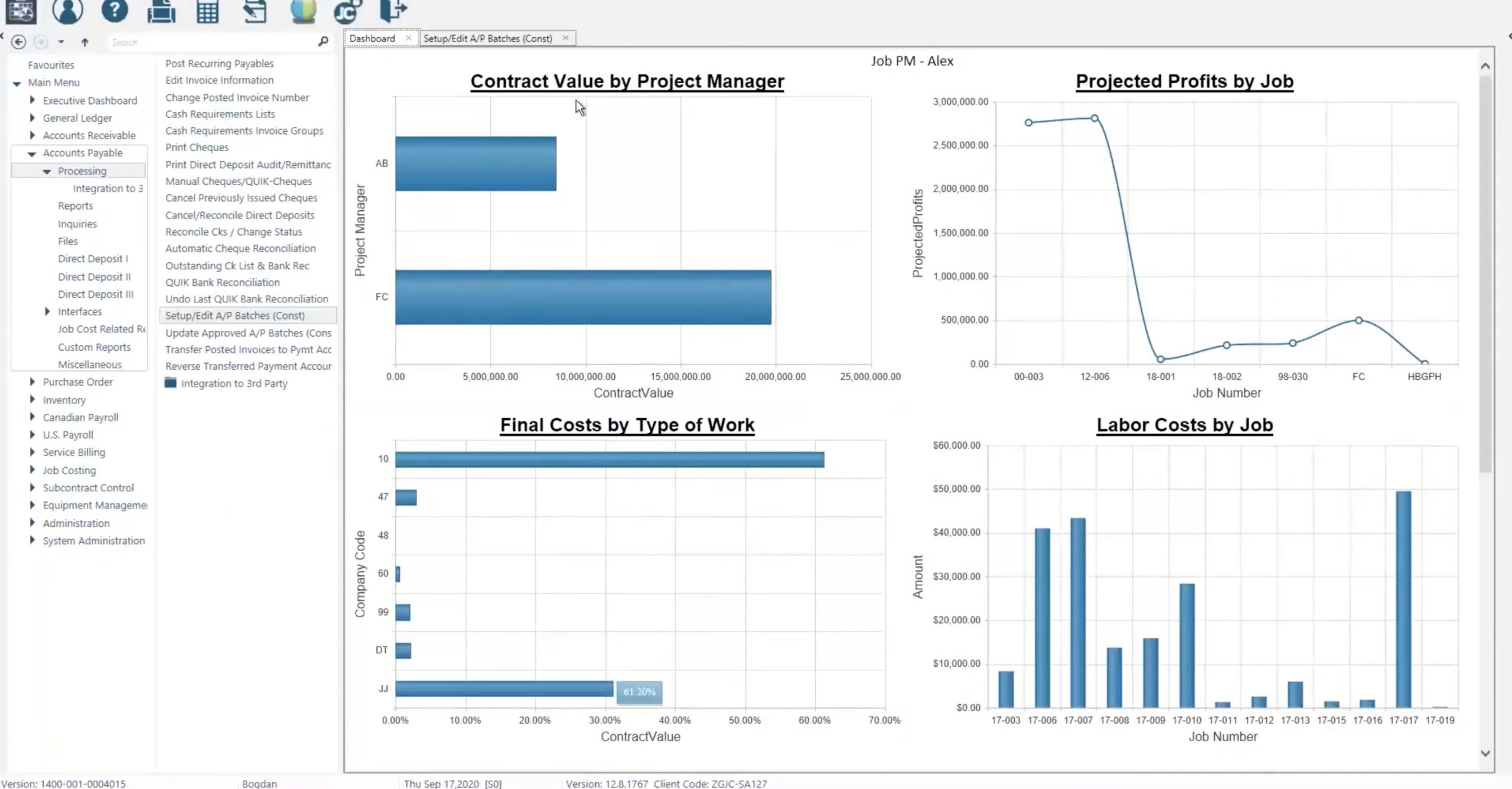

Jonas Enterprise (Best for Enterprise Customers)

For large companies looking to add construction accounting software that will meet the complex business needs of multiple simultaneous projects running in various states and localities, Jonas Enterprise is a good pick. Jonas Enterprise is tailored toward commercial construction companies. In addition to the essential job costing elements included in construction accounting software, Jonas Enterprise also has modules suited to general contracting and specialized building trades alike.

Pros

- Comprehensive functionality for accounting and other construction management

- Good for businesses operating in multiple jurisdictions

- Excellent training and customer support resources

- Option for on-premise or cloud-based installation

Cons

- Cost is high for many businesses

- Some users feel the product is clunky and not intuitive

Jonas Enterprise has strong accounting functionality, with seamless integration between the general ledger, job costing, accounts payable, and accounts receivable modules. Users report that Jonas Enterprise has particularly strong job costing features and helpful dashboards and reporting features, with the ability to drill down on particular projects. As an enterprise product, Jonas Enterprise’s functionality extends beyond construction accounting. Jonas Enterprise also includes tools for project management, service management, inventory and equipment tracking, scheduling, and payroll. The payroll module is another standout feature for businesses with complex payroll needs, as the module is capable of handling payroll across different jurisdictions (in both the U.S. and Canada), unions, pay periods, and reporting needs.

With such robust functionality, Jonas Enterprise offers good resources for training and support to help customers get the most out of the product. Training resources during the implementation phase include training videos, lectures, webinars, and documentation. They also have 24/7 customer support hotlines and email support available.

Jonas Enterprise can be installed on-premise with a Windows operating system or as a cloud-based service, depending on the company’s preference. For cloud customers, Jonas offers support in setting up the hardware needed to manage and maintain servers. While the on-premise solution is more expensive up front, Jonas states that the investment for each option comes out to around the same amount after about four or five years.

Compared to other products, Jonas Enterprise can be costly. However, as a comprehensive solution for many aspects of construction management, Jonas Enterprise is a worthwhile pick for larger companies and our choice for Best Construction Accounting Software for Enterprise Customers.

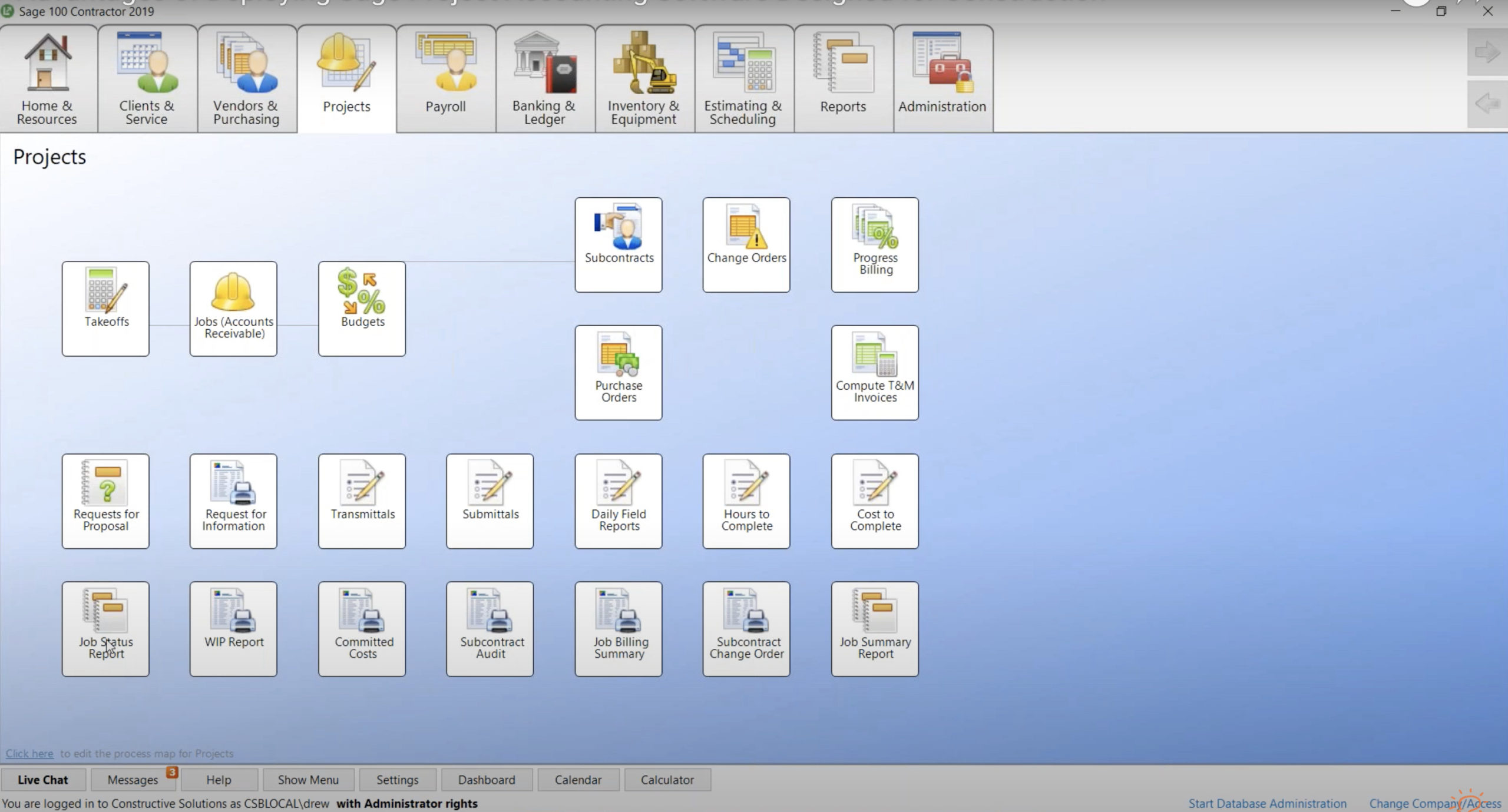

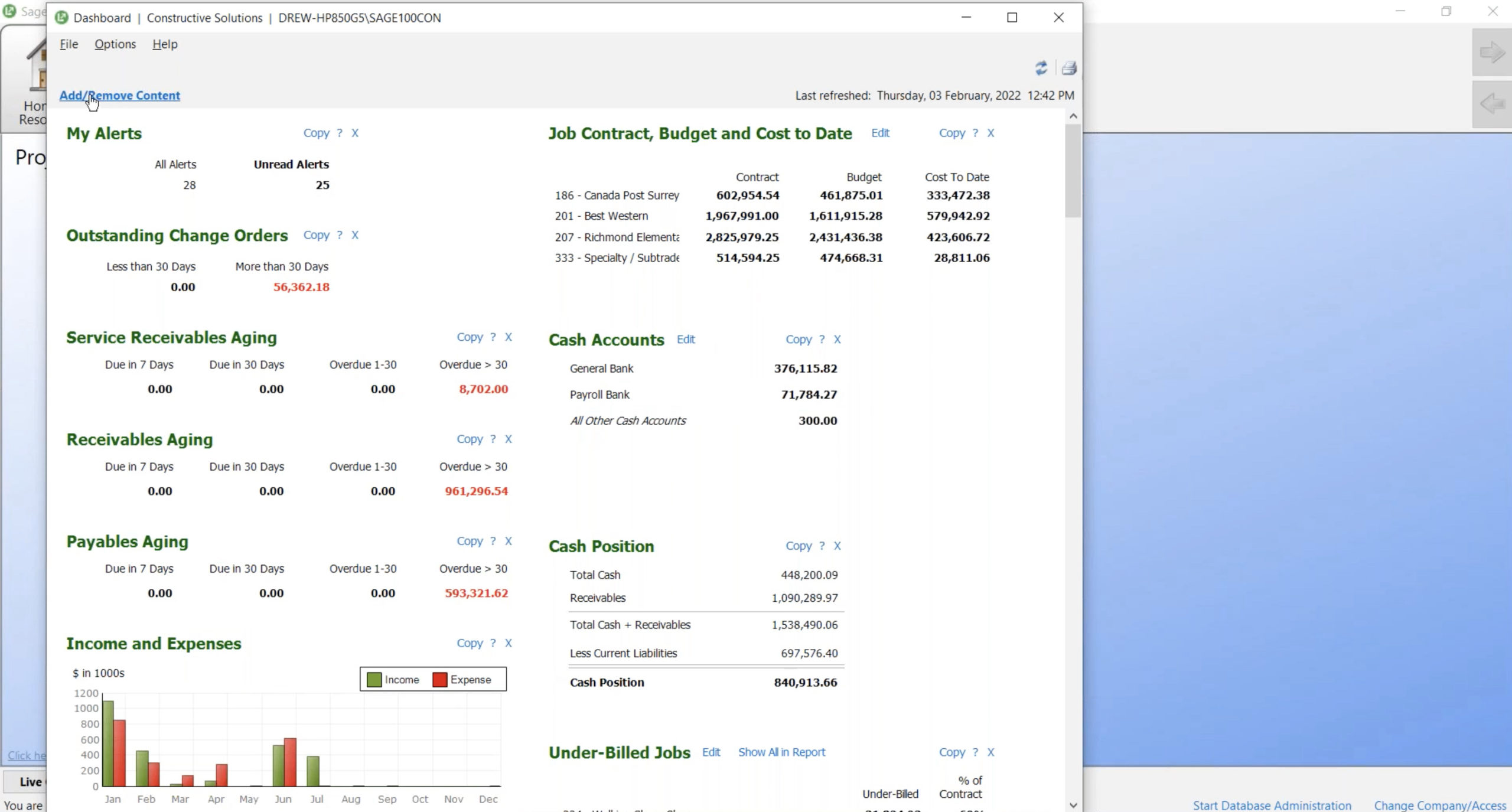

Sage 100 Contractor (Best Midsize Contractor Accounting Software)

Formerly known as Sage Master Builder, Sage 100 Contractor is a popular choice for smaller and midsize construction firms. Striking a balance between a reasonable price and a strong feature set, Sage 100 Contractor is a great choice for construction professionals who are upgrading from a more general accounting software program like QuickBooks to their first construction-specific accounting solution.

Pros

- Construction-specific features at a reasonable price

- Functionality beyond accounting including estimating and project management

- Strong customer service and training resources

Cons

- Can be challenging to learn for new users

- Its on-premise solution is more cumbersome than cloud-based alternatives

Sage 100 Contractor offers many essential features for construction accounting software, like job costing, work-in-progress reporting, certified payroll, and change order management. Sage 100 Contractor offers customizable dashboards along with a number of built-in reports that users can also use for key insights on project status, costs, and profitability.

Sage 100 Contractor also includes modules for other important functions in any construction business, like estimating and project management. This ability to manage multiple aspects of a construction business is highly convenient, and the ability to import and export budgets, subcontracts, purchase orders, and more saves users time and reduces the possibility of data entry errors.

Reviewers find that Sage 100 Contractor offers quick implementation and good customer service. However, one downside is that there is a steep learning curve. Some users report that the product can be difficult to learn, especially for those transitioning from a simpler product like QuickBooks. Additionally, the user interface is fairly dated when compared to some of the newer products on the market (see screenshots below). Sage 100 does have a variety of training resources available to help with this transition, including live and on-demand training, a peer-to-peer learning community, a library of articles and resources, and an online customer support chat.

Sage 100 Contractor is installed as an on-premise solution. With more businesses increasingly preferring cloud-based technology, accessing data and keeping up with maintenance and updates can feel cumbersome with Sage 100 Contractor compared to other cloud-based products. For businesses seeking a cloud-only accounting solution, Sage Intacct Construction may be a better option to consider.

Sage 100 Contractor’s focus on small and medium-sized businesses also means that its cost is relatively affordable compared to more comprehensive solutions on the market. While it costs more than QuickBooks and other basic solutions, Sage 100 Contractor delivers solid value with its more wide-ranging feature set. Companies should contact Sage for precise information about pricing structure.

Between Sage 100 Contractor’s strong array of essential accounting features and the ease of implementing and transitioning from a general accounting system, we recommend Sage 100 Contractor as the Best Accounting Software for Midsize Contractors.

QuickBooks for Construction (Best Small Contractor Accounting Software)

While QuickBooks isn’t specifically for construction accounting, they do offer enough capabilities for construction that small contractors can use the software. The QuickBooks for Construction product builds on the basic version of QuickBooks with construction-specific features like job costing and integrations with other construction management software. These basic features, coupled with affordable pricing and a user-friendly interface, make QuickBooks a good option for smaller construction businesses.

Pros

- Affordable pricing for small businesses

- Integrates with construction management software like Corecon and Buildertrend

- User-friendly interface is easy to learn

Cons

- Limited feature set compared to more construction-specific accounting software

- Caps on users make it less appropriate for midsize to large businesses

For construction businesses with a smaller number of employees and projects with predictable job costs, QuickBooks can be a great solution. Many of the more advanced capabilities of competing construction accounting software products will not be available with QuickBooks, but there are enough construction-specific features in its QuickBooks for Construction product to make it a viable solution for some businesses.

QuickBooks includes basic functionality for job costing, invoicing, and contract management. The software also offers dashboards that managers can use to monitor profit margins and costs associated with each project. This includes the ability to track labor costs and employee time, with easy syncing to the QuickBooks Payroll feature for an additional fee.

Another benefit to QuickBooks is the easy-to-learn, easy-to-use interface. Customizing reports, entering invoices, and connecting bank accounts for simplified transactions are all streamlined in QuickBooks. For people without a need for complex financial reporting, QuickBooks makes accounting simple.

As the go-to accounting software for many small businesses, one of QuickBooks’ advantages is affordable pricing. QuickBooks offers two tiers of pricing:

- Plus – $42.50 for the first three months and then $85 per month after.

- Advanced – $100 for the first three months and then $200 per month after.

Advanced offers more capabilities like batching invoices and bills, automating workflows, and on-demand training for the software. Payroll is an additional feature that can be added on for $22.50 flat plus $5 per employee per month for Core, $37.50 flat plus $8 per employee per month for Premium, and $62.50 flat plus $10 per employee per month for Elite. With Plus, a customer can have five users included in the monthly fee, although up to 25 additional users can be added as the company scales up. For small companies, that should be more than enough to cover the employees who need to access the software.

Most editions of QuickBooks are cloud-based, which means that they can be run on any device with an internet connection, updates are immediately available for installation, and upgrades from one edition of QuickBooks to another are simple. QuickBooks also integrates with many other software programs, so it is easy to use QuickBooks when you want to bring in data from other programs. Construction-specific integrations include project management products like Corecon and Buildertrend.

For all of these reasons, we have chosen QuickBooks as the Best Accounting Software for Small Contractors.

Deltek ComputerEase (Best for Financial Reporting)

Deltek acquired the construction accounting software company ComputerEase in 2019, bringing together Deltek’s leading position as a provider of software for project-based businesses and ComputerEase’s extensive industry expertise in construction.

Pros

- Reputation for user-focused product development

- Easy to use with strong training and support resources available

- Strong feature set for reporting and payroll

Cons

- Few integrations with other construction software products

- Limited pricing information is available

Deltek ComputerEase was first developed in the early 1980s, giving the product a track record that can rival nearly any other construction accounting software. With a focus on serving the construction businesses, it has been consistently updated and evolved to meet the specific challenges of the industry, with a highly user-focused product development process. This dedication to construction has paid off, as Deltek ComputerEase counts more than 6,000 contractors as loyal customers, across a variety of construction specialties.

The product is available as either a cloud-based or Windows on-premise solution. Deltek ComputerEase includes core functionality for job costing, accounts receivable, accounts payable, payroll, general ledger, and reporting. Its payroll and reporting features are especially strong. Payroll is closely integrated with job costing, which makes it easy to apply different tax and pay rates to each job. The product’s reporting functionality includes hundreds of standardized reports, including profit & loss and estimated vs. actuals, but it also offers Qtool, a customized report writer for unique reporting needs. Deltek ComputerEase can be configured to include tools for project management, field service management, and other modules like inventory, fleet, and CRM.

One downside for many users is limited integration with other third-party software products. Some support is available for integration with construction estimating software, and Deltek has announced some additional integrations to strengthen its field management capabilities, but overall this aspect lags behind some competitors.

Users report that while Deltek ComputerEase is rich in features, the software is nonetheless fairly easy to learn. And for users who require additional support, the company offers an online portal for customers to access support, training, and other resources to maximize their use of the software. Deltek’s acquisition of ComputerEase recently allowed the company to begin offering 24/7 customer support.

Shoppers looking for pricing information will need to reach out for a quote and demo. Because Deltek ComputerEase has a variety of modules available, pricing will be dependent on the type of installation chosen and the modules each customer selects.

Deltek ComputerEase construction accounting software centers the needs of its users with expertise in the construction industry, easy-to-use features, and strong training and support. These qualities make it a great choice for many construction businesses. But with hundreds of standardized reports and the option of easily customized reporting through Qtools, Deltek ComputerEase stands out as Best for Financial Reporting.

Methodology: How We Found The Best Construction Accounting Software

To find the best construction accounting software, we evaluated the top products on the market based on several factors, including their deployment, features, product design, customer reviews, and finally, pricing.

We first looked at each product’s deployment model, assigning more points to those offering cloud-based installations. Next, we evaluated the features offered and the overall product design. For a software product to be included in our list, it needed to have sufficient construction-specific accounting features to be adequate for most small- to midsize contracting businesses. From there, we assigned more points to those products offering more robust features and integrations, as well as a more intuitive user experience.

After narrowing down our list further, we combed through user reviews of each product, focusing heavily on both product functionality and customer support. Lastly, where available, we reviewed pricing information. We gave preference to companies that provide transparent pricing data, but understand this isn’t always possible given the custom nature of the products. In the absence of reliable pricing data, we draw on customer reviews pertaining to cost and value. More information on each rating category is included below.

Deployment

Construction accounting software can be deployed either through on-premise or cloud-based installations. If the software is cloud-based, users will be able to access the software anywhere with an internet connection. If the software is on-premise, it can only be used with equipment where the software has been installed.

These days, many software providers are increasingly focused on cloud-based software, but on-premise installations are still fairly common. When evaluating your deployment options, you should consider the costs and benefits associated with each. For example, if you have employees working in many different locations, a cloud solution may be more convenient. Alternatively, if you are worried about the cost of ongoing monthly subscription fees, purchasing a license upfront for on-premise software could be preferable.

Features & Product Design

When comparing accounting software for construction, contractors should focus specifically on features that pertain to job costing, revenue recognition, retainage, and payroll. The specific features contained within these categories are what set construction accounting software apart from general accounting software solutions. The other key thing to consider is integrations. For example, does the construction accounting software integrate with your existing construction project management software or CRM software?

A particular construction accounting software program could have every feature imaginable, but if the product itself is complicated to use, it could take up valuable staff time and energy. This is why product design and user experience are crucial factors in evaluating any kind of software.

One of the best ways to evaluate the product design and user experience is to try a demo of the product. Reading about a piece of software or discussing features with a vendor cannot replace the value of hands-on experience with the tool. This will help make sure that the software not only has the features that your business needs, but also that these features are designed in a way that allows you to get the most usefulness out of them.

Customer Reviews

Knowing how existing customers review a company’s product is a significant factor in the decision to implement their software. You can learn a lot from others who have used the software before and can tell you how well the software features meet their requirements and how easy the software is to use. Always check out other websites with impartial reviews for the company’s reputation before you implement their software.

One particular quality to focus on in reviews is customer service. When a software provider has fast, friendly, knowledgeable customer service to solve problems or guide you through a solution, you will get far more value out of the software. Software issues are unavoidable, so you should be confident that your chosen vendor will also work with you to solve any problems that arise.

Pricing

As discussed elsewhere in this guide, pricing for your construction accounting solution typically depends on a variety of factors, including what features you need, the number of users, and whether the software is cloud-based or installed on-premise. Because every business has different needs when it comes to construction accounting software, prices may range from a few hundred dollars per year to tens of thousands of dollars per year in implementation fees and monthly user access fees.

Many vendors do not publicly disclose their pricing structure, instead preferring to create custom software packages for their clients. This can make it more difficult to compare prices, but the advantage is that the vendors work to fulfill your precise requirements. However, it is important to obtain quotes from multiple vendors to find a system that adds value for the company while remaining within your budget.

Understanding Construction Accounting Software

Accounting is an essential aspect of running any type of business, but it is especially important in construction. In fact, it’s been said that “construction companies are really accounting companies that just happen to build buildings.” Each individual construction project varies in size, scope, materials, and labor costs, so contractors and managers need detailed, job-specific financial data and the ability to process different costs and transactions under each project’s unique circumstances.

Construction accounting is unique from the principles of general business accounting in a variety of ways that reflect how work is done in the construction industry. As such, the tools that construction businesses use to track their finances must reflect these unique characteristics. Three of the most important factors that shape how constructing accounting works are:

- Construction is project-based. Every construction project is unique, and the requirements to complete one will vary based on client specifications, site conditions, and other unique variables. Because these variables are less predictable, construction managers must be able to account for the costs and revenues of each project to ensure that individual jobs are successful and meet targets for profitability.

- Construction is decentralized. Rather than happening in a central office or plant, construction happens out on job sites in the field. This means that the company’s resources, like equipment and labor, move around often depending on project needs. As a result, construction companies must closely track which resources are being used in which quantities at which location. This is especially important for labor, which may be subject to different wage rates and regulations in different states and localities.

- Construction relies on long-term contracts. Many businesses sell a product or service in a single transaction and have fairly steady input costs, all of which make it simpler to track money coming in or going out. In contrast, construction projects can take months or years to complete. Incoming revenue is based on certain milestones or the amount of work completed, while costs can increase or decrease depending on the phase of the project. In the wrong circumstances, this can create cash flow problems for the construction company, so it is important to stay on top of ongoing costs and revenues associated with each project over the long term.

To address these differences, the field of construction accounting relies on a few core concepts that anyone evaluating software should be aware of: job costing, revenue recognition, construction billing and retainage, and construction payroll.

- Job Costing – Whereas most businesses rely only on a general ledger, construction accounting supplements the company’s G/L with job costing. Job costing is the process by which costs and revenues associated with individual projects are tracked, and it is important because of how projects evolve. For instance, projects have mobilization costs, or start-up costs, early on that require the allocation of cash and resources upfront. Over time, if the scope of the project shifts, a firm may need to pay for additional labor, resources, or equipment, increasing expenses and cutting into the project’s margin. Job costing information is useful both to the project managers—who can make sure that the project is on track to be profitable and adjust if not—and to the company’s financial managers, who can roll up job cost information into the general ledger for a larger picture of the firm’s financial health.

- Revenue Recognition – Cash-basis accounting is rare in the industry except for the smallest construction companies, and under the accrual basis, the long-term nature of construction projects affects when companies recognize revenue. Construction accounting commonly recognizes revenue over the life of a contract based on how much of the project is completed, rather than upon execution or completion of the contract (e.g. 25% completion means one-quarter of the contract value is recognized). This means construction accountants must be able to closely track project progress and billing to recognize revenue appropriately.

- Construction Billing & Retainage – Contractors use a variety of different approaches to billing that reflect job costs and progress toward project completion. For instance, time and material billing is based on hourly labor rates and supply costs used toward the project during a billing period. Alternatively, AIA progress billing is based on the percentage of work completed, and invoices include detailed reports on what work has been done and billed. In either approach, managers’ ability to closely track the costs and progress incurred on a job is essential to producing accurate invoices. Construction clients may additionally withhold some percentage of the contract payment until they are satisfied that the work is completed, a practice known as retainage. Retainage is not invoiced the same as other client billing and must be treated separately from other receivables. Accounting for retainage ensures that a company’s cash flow and ultimate profit margin from a project remain at acceptable levels.

- Construction Payroll – And adding to these complications are varying wage and labor conditions in different locations where a company might have projects, which makes payroll and tax processing a challenge as well. Challenging factors include prevailing wages (which are essentially the minimum wages and fringe benefits standard for workers of a certain type in an area), unionization (which comes with wage and fringe benefit requirements), and state and local tax rates (which produce different withholding requirements). As managers track labor on different sites, they must be able to apply these differing standards as they account for costs and manage payroll.

The unique qualities of construction accounting described above can make it hard to keep track of the financial information construction firms need to operate. Typical general accounting software lacks the built-in capabilities to handle these needs, which is why many vendors offer software solutions that are customized to the unique needs of the construction industry.

What Is Construction Accounting Software?

Construction accounting software is a type of software specifically designed for construction companies to track money coming into and out of the business. Construction accounting software expands beyond what general accounting software offers by providing the ability to track job-specific costs and revenues, manage payroll, and handle billing and procurement.

Vendors offer construction accounting software to meet the needs of companies of all sizes and scopes. Many small businesses and contractors can rely on simple accounting software, like QuickBooks, if their projects focus on a specific niche without much variation. However, general accounting software usually does not have the functionality to track job-specific costs and revenues, which creates a need for manual workarounds. As the complexities of a company’s projects grow, these workarounds become increasingly less effective and efficient for managing financial information and producing meaningful reports about the state of the business.

At the opposite end of the spectrum, accounting tools can be a key feature of enterprise resource planning (ERP) systems, which offer larger companies an all-in-one solution for many functions of a business’s operations. ERP solutions allow construction businesses to combine their accounting, asset management, contracts, CRM, payroll, and other aspects of the business into one tool. The downside of ERPs is that many of the options on the market are not tailored to the construction industry and therefore may not include construction-specific functionality. Companies looking for an ERP as their construction accounting solution should be sure to seek out a system that includes features like job costing and other construction-specific accounting modules.

Construction Accounting vs. General Accounting Software

General accounting software is a form of software that allows businesses to track the organization’s financial accounts. For general accounting software, like QuickBooks, most of the functionality is built around a general ledger, including accounts payable, accounts receivable, and tracking for the business’s assets, liabilities, capital, revenues, and expenses. These tools are vital day-to-day resources for companies to manage the money coming in and going out of the business.

In contrast, construction accounting software includes many of these same features but also adds more modules specific to the needs of construction professionals. Construction-specific features in a construction accounting software program usually include project accounting, job costing, and specialized progress billing. Whether your construction project entails residential, commercial, or industrial work, construction accounting software will help track real-time expenses such as materials and labor, stay on top of revenue, and handle employee payroll.

The question of whether you need construction accounting software or whether you can get by with general accounting software will be highly dependent on your business’s size and the scope of your operations. If you only have a small number of projects or projects that usually have similar costs, you may be able to work around the limitations of general accounting software. For larger companies, however, construction accounting software is virtually a must. Companies that have numerous projects happening concurrently, sometimes in different locales, need specialized modules to help them track project costs, understand revenues, and manage payroll across different locations.

Construction Accounting Software vs. ERP

An enterprise resource planning (ERP) system is a form of business management software that tracks data about all aspects of a company, including suppliers, subcontractors, employees, customers, assets, and finances. ERPs may be inclusive of accounting functionality, but this is likely not the focus, as they are typically designed to meet a variety of operational needs. For ERPs specific to the construction industry, other features may include tools for project management, estimating, bidding, contract management, scheduling, and other common business activities.

In contrast, construction accounting software is usually solely focused on the financial records and reports a construction company would require. Accounting software will not necessarily include the other functionality described above. For smaller construction firms, the full set of tools available in an ERP system may be more than the business requires, but larger businesses may benefit from a comprehensive tool.

Most ERPs on the market are designed to meet the needs of businesses in any industry, but construction-specific ERPs are available. If you are focused on finding the right software for financial management in your construction business, you should evaluate ERPs to ensure that construction-specific accounting modules are available in addition to other features. Otherwise, you may need to additionally procure construction accounting software to complement your ERP.

Construction Accounting vs. Project Management Software

Project management software allows construction professionals to document, visualize, and manage various project components, including the project budget, schedule, supplies, and team. Because every construction project requires extensive coordination of resources within a certain timeframe and scope, project management tools are a useful resource for staying on top of progress toward a project’s completion.

Budgeting is an important component of project management, so project management software frequently incorporates invoicing, cost tracking, budget reporting, and other finance-oriented features. Some project management software even features built-in accounting modules or allows integration with construction accounting software. However, construction accounting software will have a much wider range of tools available for finance purposes. For instance, construction accounting software is more likely to be able to integrate project costs with the business’s general ledger, generate high-level financial reports, and process and report payroll.

Construction Accounting Software Features

The core benefit of construction accounting software is that a company’s general ledger can be integrated with the costs and revenues associated with particular jobs. Job costing functionality is one of the defining attributes of the construction accounting software category, and you should expect that any solution advertising as a construction accounting program will have this feature included.

Beyond that, the features and functionality available will vary by vendor, and you will need to evaluate which are important for your company and which you can live without. Being able to do so will help make sure your business requirements are met without spending more on a product with features you don’t need. This section of the guide highlights many of the construction-specific features that a construction company might come across when evaluating software options.

Job Costing

Job costing is one of the essential parts of construction accounting and a key feature of construction accounting software. These modules allow users to track actual costs and revenues for different phases of a project, compare those figures to what was estimated and budgeted for the project, and link that information to the company’s general ledger. Construction professionals should take a close look at a software solution’s job costing module to understand all the features available within it. Common features available for job costing in construction accounting software include:

- Project Cash Flow – Accounting software can generate reports that provide insight into how much of a project has been completed and how much has been billed, which is important for monitoring cash flow and profitability as projects go on.

- Budget Management – The user can input a budget for each project with set variances based on cost predictions. As the project progresses, easily add or subtract additional costs that come up along the way.

- Compare Estimated and Actual Costs – The software will show you how well the actual costs match up to the predicted ones. These features allow comparisons across labor, materials, equipment, overhead costs, and other custom categories for any length of time during the project to ensure that project costs are on track.

- Automated Alerts – These alerts help contractors avoid exceeding the budget for both labor and overhead costs. Alerts are issued when one of the selected categories is nearing its budget cap so that the contractor can decide whether to override it or not.

- Generate Production Reports – Production reports help managers understand the unit costs for a construction project, finding how much has been produced per man hour or the cost per unit produced. This is important data for tracking progress and projecting costs both for the project at hand and for future estimates.

Revenue Recognition, Construction Billing, & Retainage

One of the most significant differences between general accounting software and construction accounting software is accounting for how billing and invoicing for projects are spread out and how that affects revenue recognition. Being able to track what has been done on a project allows construction managers to bill clients accurately and ensures that revenues are recognized appropriately for tax and audit purposes. Key features for these purposes include:

- Progress-Complete Invoices – This feature simplifies billing by recording information about the contracting company and automatically filling in most fields, leaving only the unique ones. Based on bids or projections and the progress made, the software can generate the correct percentage to bill.

- AIA Billing – AIA (American Institute of Architects) billing requires forms G702 and G703 to be compliant with current construction standards. These forms give detailed information about the completion status of the project and allow for streamlined client billing. Federal jobs require AIA billing, so contracting companies with this feature can bid on a broader range of projects.

- Retainage Report – This feature shows the retainage percentage, the retainage’s monetary value based on the current project value, and how much of each invoice is retained until the client’s approval.

- Assign Specific Billing Rates – This feature allows contracting companies to input the agreed-on rates per project or customer. By automatically storing the information, future invoices can be generated faster.

- Track Cash Receipts – By maintaining a comprehensive record of cash receipts by project, and recording them against corresponding invoices, audits can be completed for individual jobs.

- View Sales and Use Tax Liabilities – All information about materials, overhead, and equipment costs are separated by actual cost, tax liabilities, and total cost with this feature. Contractors can also see the total sales or use tax liabilities per project or project phase.

- Change Orders – Change orders frequently occur whenever the current project plans need to be revised or updated. Construction accounting software usually allows you to monitor and sort incoming change orders, assess their impact on the job cost, and see if they have been approved yet.

- Create and Manage Purchase Orders – This feature allows the company to track materials and equipment expenditures through purchase orders and show the purchase status. Some software offers a more robust version of this feature that also tracks inventory and inventory location.

Payroll Management & Labor

Payroll management can be a challenge for construction companies because pay rates and labor regulations can differ by state or locality and activities performed, even for the same employee. Good accounting software will offer a robust payroll module that will allow companies to manage payroll easily despite these and other issues related to labor. Features to look for include:

- Multi-state/locality Processing – Because a single employee may work on multiple jobs in different locations during a payroll period, the ability to assign employees’ time to different sites will help automatically compute different wages, tax rates, or deductions.

- Certified Payroll Reports – With this feature, a contractor can create and send reports for federal and local agencies or create an audit trail showing how employees were paid based on project location and job activity.

- EEO Compliance Reports – Bids for government jobs require contractors to demonstrate their compliance with Equal Employment Opportunity standards. These reports can be onerous to prepare, but a good payroll solution will easily generate reports about minorities’ work on jobs with your company.

- Workers’ Compensation Tracking – Based on where the company’s office is located and where the injury happened, the amount of workers’ compensation may be different. This feature helps contractors keep records of medical benefits and insurance paid out to an employee who was hurt on the job.

- Union Reports – Construction accounting software with this feature allows companies to quickly create reports on union members’ activity and ensure that any relevant union requirements for a project are met.

- Calculate Fringe Benefits – This feature automatically adds fringe benefits like continuing education or health care as part of the employee’s compensation based on project location and local regulations. It will also factor in overtime and special rates.

Integrations

One of construction accounting software’s main benefits lies in its focus specifically on financial management for the construction industry. However, construction companies may rely on a variety of other industry-focused software tools to manage other aspects of the business, so the ability to integrate accounting software with pre-existing software can help you make the best use of your data. Here are some of the integrations to research or ask about when evaluating your construction accounting software options:

- Project Management Software – Integrations with project management software like Procore are essential for many companies. Project scope, schedule, plans, and resource allocation managed through a project management tool will have an impact on the financial information you track through your accounting software.

- Time-tracking Software – Labor is one of the most important expenses to track on construction projects. Integrations with timecard application software allow employees to automatically import labor hours into the construction accounting software to be reviewed and approved.

- Construction Estimation Software – Estimating project costs is an essential part of managing a construction company, and with specialized software, a company can keep those estimates as close to reality as possible. Integrating estimation software with your accounting system allows you to prepare more accurate estimates based on existing data from past projects.

- Field Data Software – This is typically an integration, but some construction accounting software, like Foundation, offers this feature as a module in their software package. Essentially, it allows on-site managers and employees to enter real-time information about the project such as status reports, hours worked, equipment usage, inventory receipts, and issues that prohibited progress on the project (e.g. inclement weather).

- Equipment Use Software – Integrations with equipment-use software allow contracting companies to track their fixed assets and depreciation schedules. Construction equipment is a significant aspect for most companies, and the IRS expects accurate records of new purchases and the amount of use for each piece.

- Inventory Management Software – Inventory management is another feature that some construction accounting software incorporates to track products, their use, locations, prices, and quantities. Data about how inventory is being used can also inform financial records and reports on project costs in your accounting system.

- Payment Solution – With this integration, construction companies can have checks cut or facilitate ACH payments. This feature is occasionally offered as an additional module within a construction accounting software package.

- CRM Software – CRM software allows companies to consolidate their customer information in one place. By integrating it with construction accounting software, data can be imported over and attached to specific jobs to facilitate client communication and manage leads.

Additional Features

Most of the main features of construction accounting software are listed above, but some vendors may have additional features available. These modules may be other features that come standard with the construction accounting software or extra modules paid for separately from the main software package. Some other features that you may encounter when shopping for construction accounting software include:

- Data Analytics and Business Intelligence – Software providers have developed more sophisticated uses of financial data to assess job profitability, proactively identify project challenges or risks, and produce more accurate estimates for future projects.

- Document Imaging and Management – Some construction accounting software allows images to be associated with files so that any auditor or contractor can see, at a glance, relevant information about a particular report or file.

- Permit, Inspections, and Fee Processing – Permit tracking can also be useful depending on the project and whether contractors or subcontractors need to wait for municipal permits for their work. A permit tracking module would show various permits’ statuses and alert the contracting company when a change order necessitates a license based on the project location.

Considerations for Certain Construction Businesses

Because companies in the construction business can vary so much in terms of size, scope, and specialization, different types of companies may focus on different attributes when comparing construction accounting software products. This section covers the various considerations for three subgroups of construction businesses: commercial developers, general contractors, and subcontractors.

Commercial Developers & Owners

Since commercial developers and owners tend to have larger and more complex operations, it will be important to procure a software solution that can accommodate many users and provide detailed analysis and reporting on a variety of custom projects.

For these reasons, an ERP solution may be a good choice for commercial developers. ERPs allow the business to contain extensive information about clients, employees, projects, and assets within the same database, and many ERPs include modules for construction accounting. The downside of ERP systems is that they tend to be quite costly, but they have the most comprehensive suite of features available. For commercial developers, an ERP system like that offered by Jonas Construction Software is ideal.

General Contractors

General contractors likely don’t need the comprehensive functionality of a fully-fledged ERP system, nor are their operations simple enough that they can get by with general accounting software. Instead, general contractors need software customized for the construction industry that can handle essential financial functions like job costing, invoicing, and payroll. Project management and construction scheduling tools or easy integration with other project management software are also commonly sought after for general contractors, as are tools to manage arrangements with subcontractors. A solution that can be scaled to smaller construction companies would be best for general contractors, like CMiC or Sage 100 Contractor Accounting Software.

Specialty & Subcontractors

Smaller subcontractors or specialty construction businesses operate at a small enough scale that a general accounting software program may not be a bad option. Typically, a subcontractor will be looking for software that simplifies payroll, billing, and invoicing, and general accounting software can often take care of those basic requirements. This is particularly true if your business focuses on similar, simple projects that have predictable costs, which will require fewer manual workarounds when trying to track job costs.

Choosing a general accounting software program or a more basic but good construction accounting software also has the advantage of being less expensive to purchase. A subcontractor or specialist may not need the same level of administrative support and financial management expertise required by a larger company, so having affordable software for accounting is one way to keep overhead costs lower while still simplifying the business’s financial and administrative functions. For these basic needs, a general accounting program like QuickBooks or a simple contractor accounting software like Sage 100 Contractor would be a good fit.

Construction Accounting Software Pricing

Construction accounting software costs are challenging to estimate because the majority of software vendors customize their prices depending on various factors, which are addressed in the following section. Some products have transparent pricing systems, but the vast majority require a consultation to determine the implementation cost and the subsequent monthly or annual fee per user. The best way to know what a package will really cost you is to speak directly with the software provider to learn more about the offerings they have available.

How Much Does Construction Accounting Software Cost?

It can be difficult to find accurate information about construction accounting software without talking to representatives of the software companies directly, but some vendors list basic pricing information online, which can give you a sense of the range of options available.

For the smallest businesses, general accounting software with some modifications for construction accounting purposes can cost less than $1,000 per year. A simple solution like QuickBooks Online Plus starts as low as $42.50 per month, with optional payroll modules that can be included with additional monthly base and per-employee charges. QuickBooks Online Advanced tier starts at $100 per month, with additional features like business analytics, automated workflows, and on-demand online training.

For companies that want construction-specific accounting software but do not need the full functionality of an enterprise solution, most options will cost between about $100 and $300 per user per month, depending on the exact features you purchase.

Finally, enterprise-level software with construction accounting functionality can cost tens of thousands of dollars per year. For example, Jonas Premier lists its prices at $30,000 for an initial implementation plus monthly charges of $199 per user. While these figures may sound exorbitant to a smaller business, if your firm has a large number of projects, does millions of dollars of business each year, and works in multiple states, these costs may be a worthwhile value for managing your complex financial operation.

We advise receiving quotes from multiple vendors to find a solution that will meet your company’s needs at a price within your software budget. To get accurate pricing information, you will likely need to speak with vendors and share information about your company’s size, goals, and software needs.

Factors That Affect The Price

Estimating the price for construction accounting software can be a challenge because vendors typically do not list a flat price for their products. Instead, you will need to speak with representatives of your potential software vendor(s) to understand the options available for your needs and budget. However, the pricing structure typically depends on a few common factors in every implementation. These include your chosen features, the number of users, software maintenance costs, and company size or revenue.

Features Included

As described elsewhere in this guide, the particular modules and features for a software package will vary substantially based on what vendors have available and what your business determines as its software requirements. As you work with a vendor to identify the modules that best suit your needs, the costs of your chosen package will vary accordingly. A bare-bones implementation with some simple job costing, payroll, billing, and invoicing tools will cost much less than a more comprehensive solution. Because of this flexibility, you will need to connect with a representative from potential vendors to receive the most accurate pricing information.

Number Of Users

Costs for construction accounting software programs are typically tied to the number of users who will be using the software. The reason is that a larger number of users is likely to require more from the software vendor in terms of training, change management, and ongoing support. Software vendors address this by charging based on the number of registered users or the number of people who are allowed to use the software concurrently. If you have a larger team using your accounting software, you should expect to pay more.

Software Maintenance

Software maintenance is a cost that is usually incorporated into monthly or annual fees for cloud-based software. However, there may be an additional cost for on-premise solutions to ensure that the vendor will routinely update or patch the system when needed. This support will help ensure that your systems remain compliant with changing requirements and regulations, allow you to access new and updated features, and ensure that your systems continue to work as intended.

Company Revenue

Software vendors have developed different software packages or tiers based on different segments of the market. For the smallest companies that are doing less than $1 million in business each year, with a small number of projects in a limited geographic area, the solutions available will be much less expensive. In contrast, a company doing tens or hundreds of millions of dollars of business will need a much more comprehensive solution and will pay a premium for the ability to manage a large-scale operation.

Free Construction Accounting Software

Most construction accounting software offers a robust suite of features specifically tailored for the construction industry. To handle the more complicated aspects of managing a construction business’s finances, customers typically have to pay a price—and for very small businesses, the costs of accounting software can quickly add to their overhead costs.

Fortunately, some software vendors offer a free trial or packages that begin at no cost for the most basic functionality. ZipBooks is one example, offering basic tools for time tracking, invoices, income statements, and other financial reports. These features are not as comprehensive as what a construction-specific vendor might offer, and the free edition does not include payroll or tax preparation with the free plan. However, for smaller businesses that do not need as extensive a collection of construction-specific features and do not want to spend on accounting software, ZipBooks may be a good entry-level accounting software option.

Frequently Asked Questions

When comparing accounting software for construction, contractors should focus specifically on features that pertain to job costing, revenue recognition, retainage, and payroll. The specific features contained within these categories are what set construction accounting software apart from general accounting software solutions. The other key thing to consider is integrations. For example, does the construction accounting software integrate with your existing construction project management software or CRM software? Lastly, you’ll want to consider whether or not the product is cloud-based. Cloud-based products are generally preferable as they are easier to set up and can be accessed in the field from any device.

For smaller construction businesses with simpler operations, QuickBooks is a solid option for construction accounting software. QuickBooks is a common choice for many small businesses of all types who appreciate its ease of use and affordable pricing. Though it was not originally designed for the construction industry, there is a QuickBooks for Construction that offers many of the essential features a construction company needs, including job costing and estimating tools and strong cash flow reporting features. Other common needs, like tracking retainage, do not have built-in features in QuickBooks, but some workarounds are available. Larger companies may prefer a more comprehensive, industry-specific solution, but for smaller-scale construction firms, QuickBooks will meet most needs. And with reasonable prices, QuickBooks can save you money compared to other software providers.

Small contractors and other small construction businesses should avoid software solutions that are designed for enterprise customers. These products will include unnecessary features and will likely be prohibitively expensive. With that said, three of the best accounting software products for small contractors include FOUNDATION, Sage 100, and QuickBooks for Construction. Each of these products offer sufficient features to run a small construction business at a reasonable price.

Most contractor accounting software products are now cloud-based, which means they can be accessed through web browsers or even mobile apps. Any cloud-based software solution is a feasible option for Mac or iOS users, even for vendors whose on-premise editions are not compatible with Mac. Cloud-based software is also frequently available on mobile devices that run iOS, so iPad users can utilize these tools as well. Some of the most popular construction accounting software for Mac users include CMiC, FOUNDATION, and Jonas.

Most construction accounting software companies have transitioned to offering cloud-based solutions (either exclusively or as an alternative to on-premise installations) and is rapidly becoming the industry standard. Between accessibility for any registered user with an internet connection and the ability to update software without downtime or waiting for a technical expert to come to the office, cloud-based tools are preferable for most companies. Fortunately, many of the top vendors offer cloud-based versions of their construction accounting software, including CMiC, Jonas, Sage, FOUNDATION, and QuickBooks.

References

- https://www.foundationsoft.com/

- https://quickbooks.intuit.com/industry/construction/

- https://cmicglobal.com/

- https://www.sage.com/en-us/

- https://www.jonasconstruction.com/

- https://jonaspremier.com/

- https://zipbooks.com/free-construction-accounting-software/

- https://www.cfma.org/content.cfm?ItemNumber=2982

- https://constructionblog.autodesk.com/cloud-based-construction-management/

- https://www.deltek.com/en/products/project-erp/computerease

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.