Where Are Millennials Buying Homes in the U.S.?

Note: This is the most recent release of our Where Are Millennials Buying Homes in the U.S.? study. To see data from prior years, please visit the Full Results section below.

According to the National Association of Realtors, the average age of first-time homebuyers is 36 years old, which means that the millennial generation—generally regarded as individuals born between 1981 and 1996—has reached the stage in their lives where buying a home is often a top priority. Yet recently, the cost of homeownership has skyrocketed in large part due to an adverse combination of high interest rates and scarce inventory, leaving millennials with a daunting homeownership outlook.

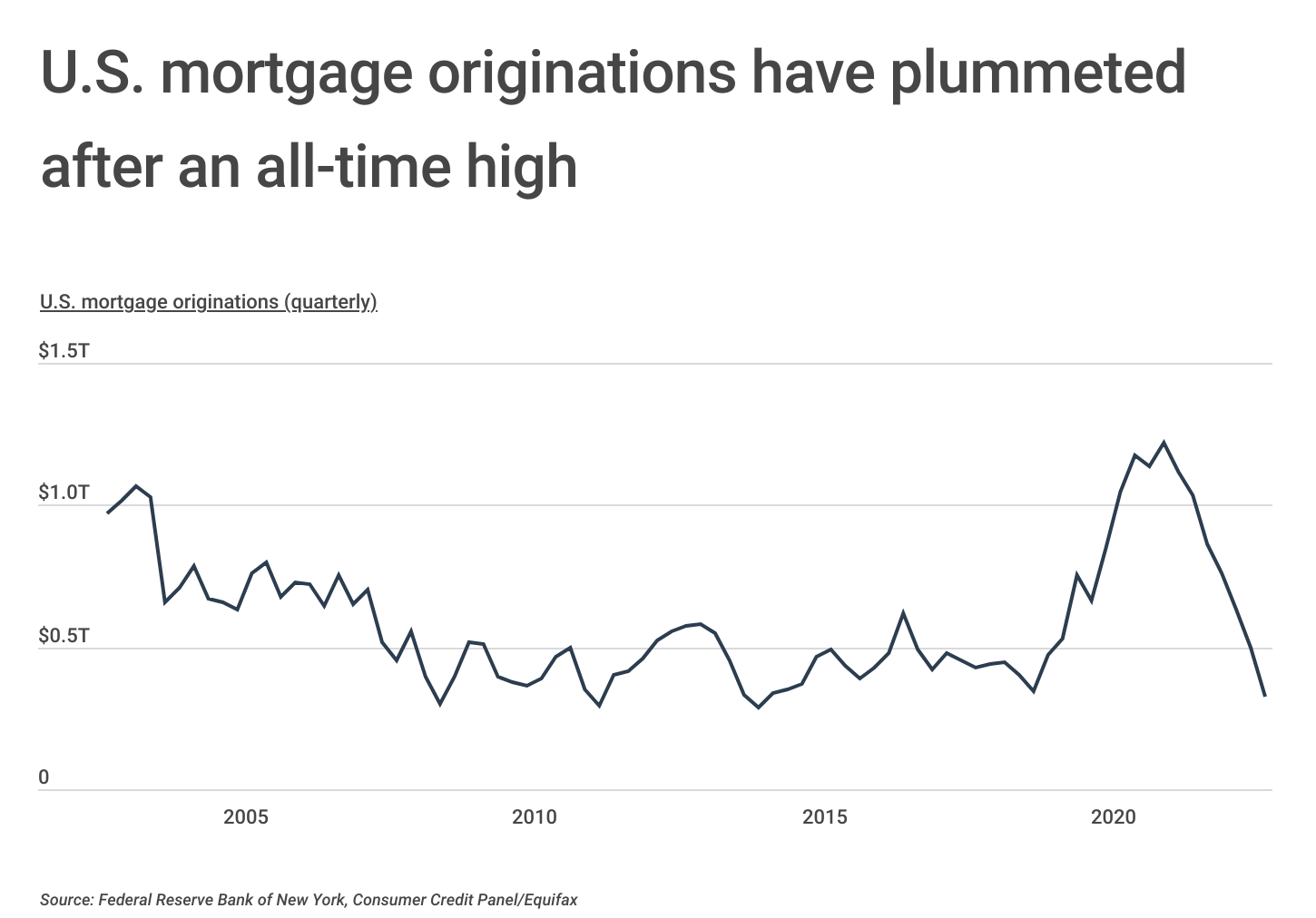

This difficult homebuying landscape has resulted in a dramatic shift in mortgage originations. Prior to the COVID-19 pandemic, U.S. mortgage originations were already on the rise—climbing from $344 billion in Q1 2019 to a 14-year high of nearly $752 billion in Q4 2019. After a brief dip due to pandemic-era stay-at-home orders and social distancing, originated mortgage volume skyrocketed to a new high of over $1.2 trillion in Q2 2021. This abrupt growth is mostly attributed to historically low interest rates, low inventory, and an increased desire for more space amid the pandemic, but these conditions were short-lived. Rapidly rising interest rates combined with other forces, such as return-to-office mandates, have brought mortgage originations down to under $324 billion in Q1 2023, the lowest it has been in nearly nine years.

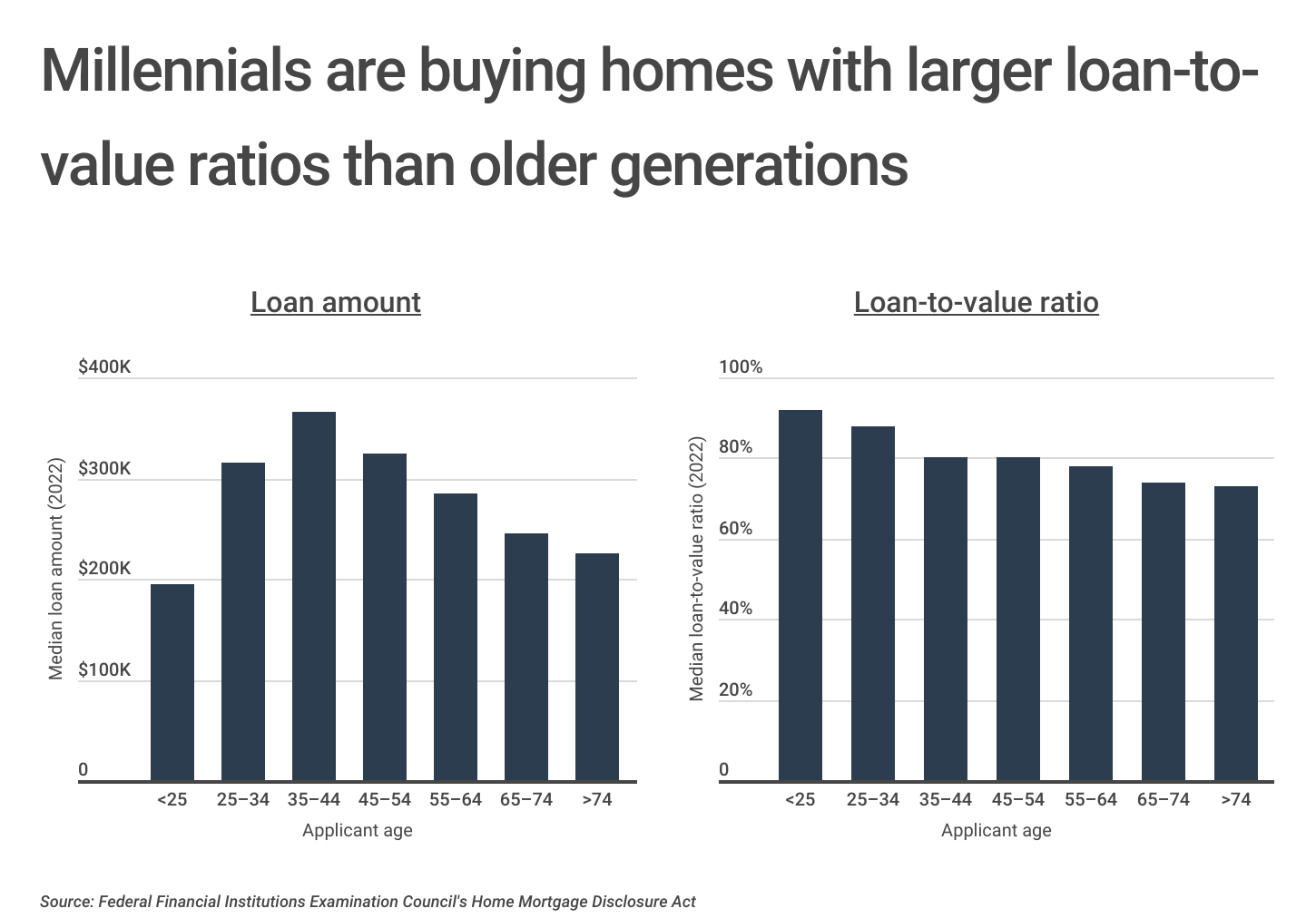

In order to cope with rising prices, millennials are taking out larger home loans. In 2022, the median loan amount for mortgages taken out by applicants age 25-34 was $315,000, and $365,000 for applicants age 35-44, higher than any other age group. Similarly, the loan-to-value ratio—or the amount of the mortgage compared to the sale price of the home—was 88% for 25- to 34-year-olds and 80% for 35- to 44-year-olds. Inherently, many millennials are first-time homebuyers and typically have less existing home equity to apply to new mortgages. Additionally, millennials are at the stage of their lives where they may be supporting a growing family and require more living space compared to older generations.

FOR HOMEOWNERS

Are you considering increasing the value of your home with a renovated bathroom or an upgraded kitchen? Be sure to consider builders risk insurance for homeowners, which will provide coverage for your home while it’s under renovation—when most homeowners insurance policies won’t have you covered.

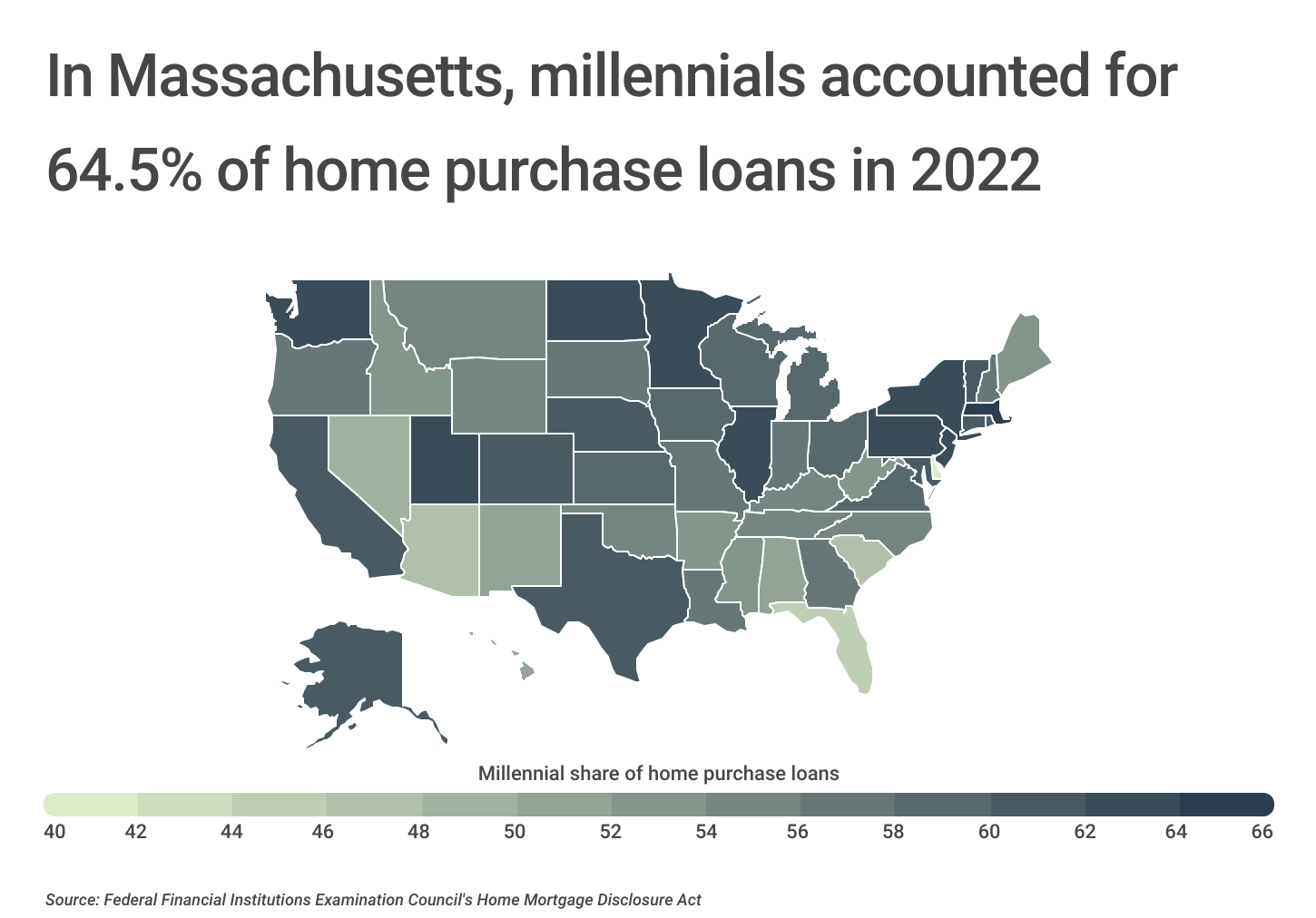

Despite the overall decline in homebuying across the country, millennials still account for the majority of home purchase loans in 2022. However, millennial home purchasing varies by location. Millennials in northeastern states account for the largest share of home purchase loans, with Massachusetts (64.5%), New York (63.8%), and New Jersey (63.0%) leading the country. Midwestern states such as Minnesota (62.9%), Illinois (62.6%), and North Dakota (62.4%) also rank among the top 10 states for millennial homebuying. On the other end of the spectrum, Delaware (41.1%), Florida (45.2%), and South Carolina (46.9%) have the lowest share of home purchase loans taken out by millennials and notably have older populations.

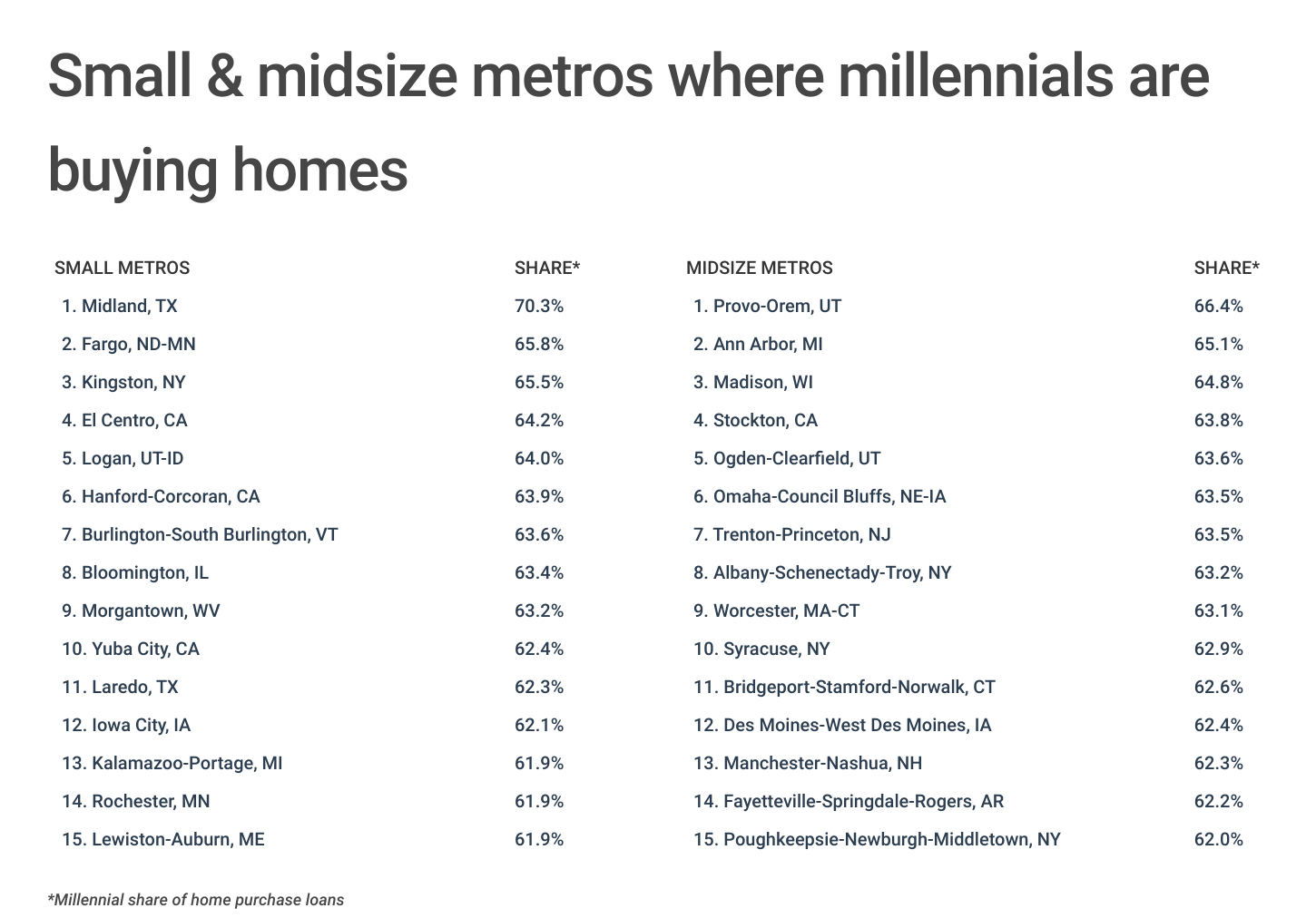

To determine the locations where millennials are buying homes, researchers at Construction Coverage analyzed the latest data from the Federal Financial Institutions Examination Council. The researchers ranked metropolitan areas according to the millennial share of conventional home purchase loans originated in 2022. For the purpose of this analysis, millennials were considered to be those age 25-44 in the year 2022. In the event of a tie, the location with the greater total number of millennial home purchase loans was ranked higher.

Here are the U.S. metropolitan areas with the most millennial homebuyers.

Large Metros Where Millennials Are Buying Homes

Photo Credit: AevanStock / Shutterstock

15. Pittsburgh, PA

- Millennial share of home purchase loans: 64.5%

- Total millennial home purchase loans: 12,258

- Median loan amount: $235,000

- Median loan-to-value ratio: 88.6%

- Median interest rate: 5.00%

FOR LANDLORDS

Some new landlords make the mistake of assuming that a typical homeowners insurance policy will cover risks related to the properties they rent out. Usually, however, rental properties need a different form of insurance to account for the different risks a landlord faces compared to a homeowner. These are the best landlord insurance companies of 2023.

Photo Credit: Chansak Joe / Shutterstock

14. Raleigh-Cary, NC

- Millennial share of home purchase loans: 64.8%

- Total millennial home purchase loans: 14,163

- Median loan amount: $395,000

- Median loan-to-value ratio: 85.2%

- Median interest rate: 4.63%

Photo Credit: Sean Pavone / Shutterstock

13. Dallas-Fort Worth-Arlington, TX

- Millennial share of home purchase loans: 64.9%

- Total millennial home purchase loans: 53,494

- Median loan amount: $365,000

- Median loan-to-value ratio: 84.9%

- Median interest rate: 4.99%

Photo Credit: Lukas Uher / Shutterstock

12. New York-Newark-Jersey City, NY-NJ-PA

- Millennial share of home purchase loans: 64.9%

- Total millennial home purchase loans: 78,046

- Median loan amount: $495,000

- Median loan-to-value ratio: 79.9%

- Median interest rate: 4.50%

Photo Credit: Andrei Medvedev / Shutterstock

11. Washington-Arlington-Alexandria, DC-VA-MD-WV

- Millennial share of home purchase loans: 65.2%

- Total millennial home purchase loans: 39,837

- Median loan amount: $485,000

- Median loan-to-value ratio: 85.0%

- Median interest rate: 4.75%

Photo Credit: AMB-MD Photography / Shutterstock

10. Minneapolis-St. Paul-Bloomington, MN-WI

- Millennial share of home purchase loans: 65.4%

- Total millennial home purchase loans: 29,552

- Median loan amount: $325,000

- Median loan-to-value ratio: 86.4%

- Median interest rate: 5.00%

Photo Credit: Gang Liu / Shutterstock

9. Philadelphia-Camden-Wilmington, PA-NJ-DE-MD

- Millennial share of home purchase loans: 65.4%

- Total millennial home purchase loans: 34,434

- Median loan amount: $325,000

- Median loan-to-value ratio: 84.7%

- Median interest rate: 4.99%

Photo Credit: Sergey Novikov / Shutterstock

8. Buffalo-Cheektowaga, NY

- Millennial share of home purchase loans: 65.5%

- Total millennial home purchase loans: 5,378

- Median loan amount: $215,000

- Median loan-to-value ratio: 86.0%

- Median interest rate: 5.00%

Photo Credit: ESB Professional / Shutterstock

7. Boston-Cambridge-Newton, MA-NH

- Millennial share of home purchase loans: 67.0%

- Total millennial home purchase loans: 27,977

- Median loan amount: $515,000

- Median loan-to-value ratio: 80.1%

- Median interest rate: 4.63%

Photo Credit: photo.ua / Shutterstock

6. Salt Lake City, UT

- Millennial share of home purchase loans: 67.1%

- Total millennial home purchase loans: 8,355

- Median loan amount: $455,000

- Median loan-to-value ratio: 80.7%

- Median interest rate: 5.00%

Photo Credit: Roschetzky Photography / Shutterstock

5. Denver-Aurora-Lakewood, CO

- Millennial share of home purchase loans: 67.4%

- Total millennial home purchase loans: 27,521

- Median loan amount: $495,000

- Median loan-to-value ratio: 80.7%

- Median interest rate: 4.88%

Photo Credit: ShengYing Lin / Shutterstock

4. Austin-Round Rock-Georgetown, TX

- Millennial share of home purchase loans: 70.5%

- Total millennial home purchase loans: 24,505

- Median loan amount: $425,000

- Median loan-to-value ratio: 80.7%

- Median interest rate: 4.88%

Photo Credit: Pete Niesen / Shutterstock

3. San Francisco-Oakland-Berkeley, CA

- Millennial share of home purchase loans: 70.6%

- Total millennial home purchase loans: 24,698

- Median loan amount: $875,000

- Median loan-to-value ratio: 79.8%

- Median interest rate: 4.25%

Photo Credit: Jeremy Janus / Shutterstock

2. Seattle-Tacoma-Bellevue, WA

- Millennial share of home purchase loans: 70.6%

- Total millennial home purchase loans: 31,416

- Median loan amount: $615,000

- Median loan-to-value ratio: 80.1%

- Median interest rate: 4.75%

Photo Credit: Uladzik Kryhin / Shutterstock

1. San Jose-Sunnyvale-Santa Clara, CA

- Millennial share of home purchase loans: 74.4%

- Total millennial home purchase loans: 10,112

- Median loan amount: $1,065,000

- Median loan-to-value ratio: 79.7%

- Median interest rate: 4.10%

Detailed Findings & Methodology

The data used in this analysis is from the Federal Financial Institutions Examination Council’s 2022 Home Mortgage Disclosure Act. To determine the locations where millennials are buying homes, researchers at Construction Coverage calculated the millennial share of conventional home purchase loans originated in 2022. In the event of a tie, the location with the greater total number of millennial home purchase loans was ranked higher. Due to limitations in the dataset, the millennial generation was approximated as being age 25-44 in the year 2022—the combination of the 25-34 and 35-44 age cohorts. In a previous version of this analysis, the millennial generation was approximated using only the 25-34 age cohort in 2020 since this best represented the generation at the time.

To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts based on population size: small (100,000-349,999), midsize (350,000-999,999), and large (1,000,000 or more).

Full Results

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.