Baby Boomer-Dominant Housing Markets

Note: This is the most recent release of our Baby Boomer-Dominant Housing Markets study. To see data from previous years, please visit the Full Results section below.

Homeownership has long been considered part of the American dream. But first-time home buyers, especially millennials and Gen Xers, are facing an uphill battle when it comes to house hunting. This is in part because of a growing trend in which baby boomers, the generation that owns the largest share of American homes, are planning to stay put. In fact, a 2021 survey conducted by AARP found that 77% of Americans over the age of 50 would prefer to remain in their current home—rather than move in with family, to a nursing home, or to an assisted living facility—which is leading to less inventory for new buyers.

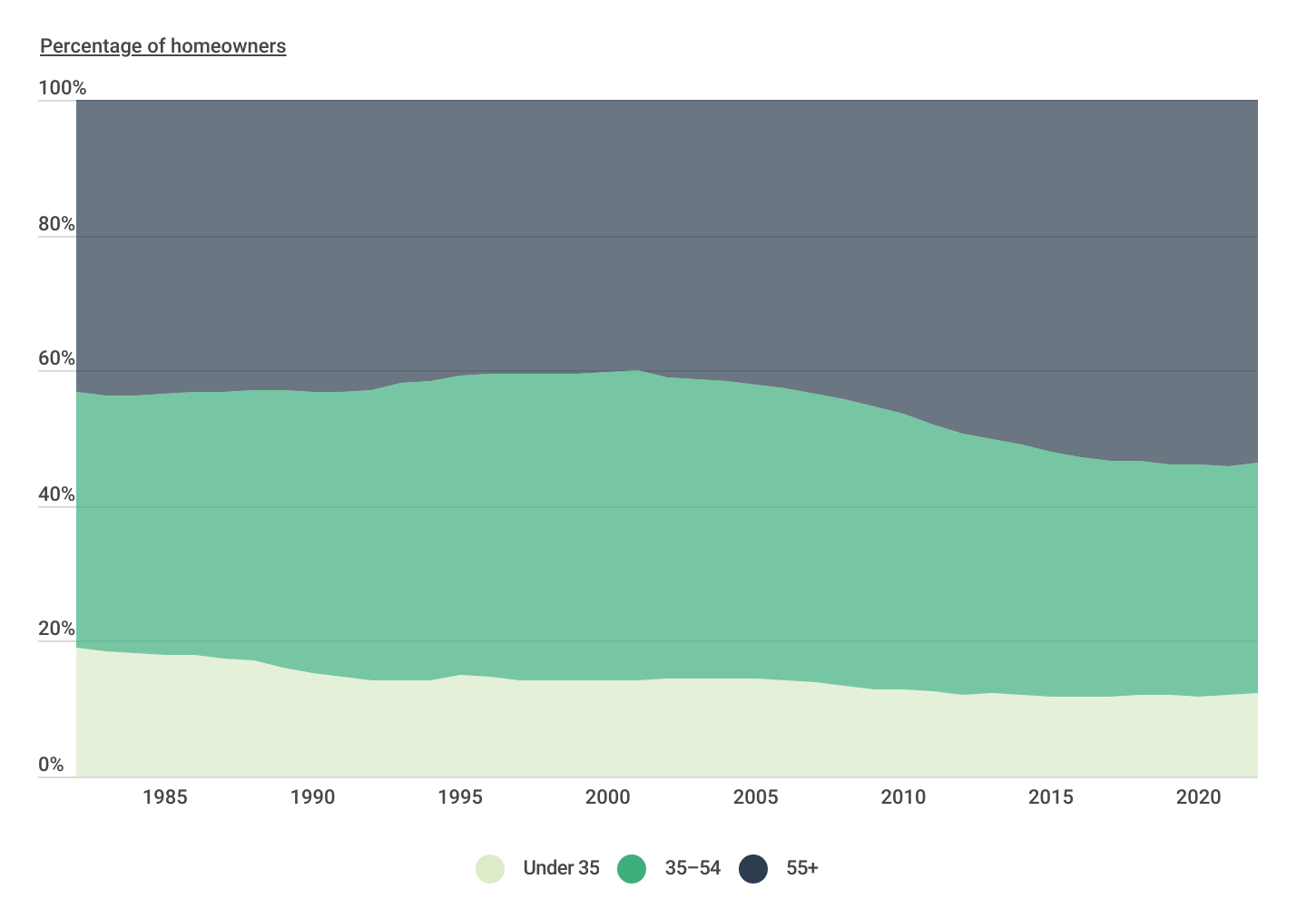

Composition of Homeownership by Age

Americans 55 years and older own the majority of U.S. homes

According to the U.S. Census Bureau, the share of homeowners over the age of 55 has been steadily increasing. In 2008, at the onset of the Great Recession, Americans over the age of 55 owned 44.3% of homes. By 2021, that percentage had increased to 54.2%. While the share of homeowners under the age of 35 remained fairly steady within the same time span, the share of homeowners between the ages of 35 and 54 decreased from 42.3% to 33.8%. However, in 2022, the 55-and-older cohort ceded a bit of homeownership share—decreasing to 53.6% while homeowners under 35 (12.2%) and 35–54 (34.2%) saw modest increases.

HOME IMPROVEMENT TIP

Planning a home renovation? Homeowners insurance policies likely won’t cover your home while it’s being renovated, so you should consider builders risk insurance for homeowners—designed specifically for the home while under construction or renovation.

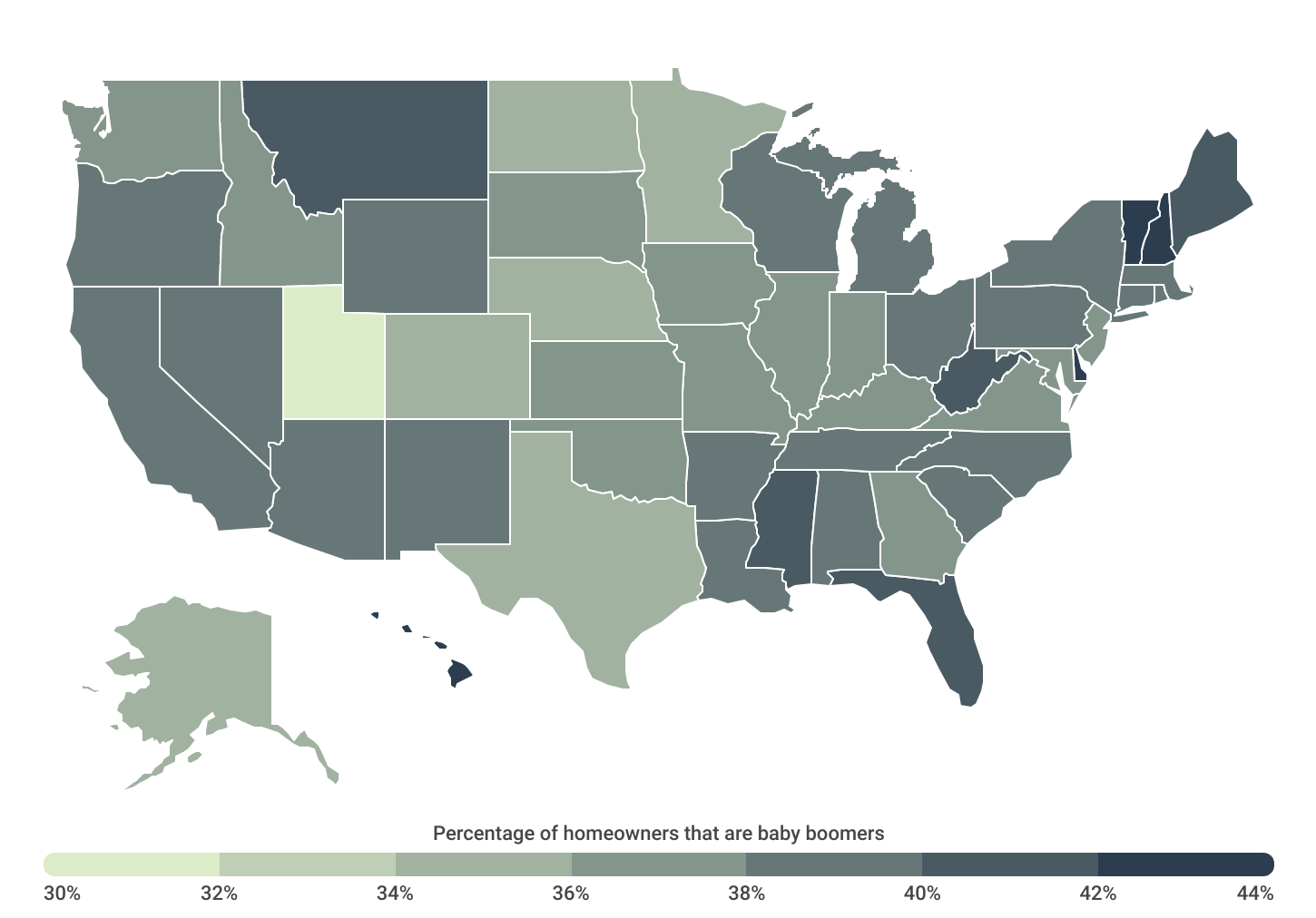

Geographic Differences in Baby Boomer Homeownership

States in the Northeast have the largest share of homes owned by baby boomers

While baby boomers—defined as Americans between the ages of 58 and 76 in 2022—comprise just over 20% of the U.S. population, they account for nearly 38% of homeowners nationwide. Notably, baby boomers dominate the housing market in many New England states, such as New Hampshire (42.5%), Vermont (42.0%), and Maine (41.7%). But Delaware leads all states with 42.7% of homeowners being a part of the baby boomer generation.

By contrast, Midwest states are more likely to have fewer baby boomer homeowners, including North Dakota (35.5%), Nebraska (35.6%), Minnesota (35.7%), and Indiana (36.0%). However, Utah stands alone with only a 30.4% baby boomer homeownership share.

At the metropolitan level, locations in the Northeast like Pittsburgh, PA (40.0%), Rochester, NY (40.0%), and Buffalo-Cheektowaga, NY (39.0%) have some of the highest concentrations of baby boomer homeowners. Similarly, major metros in warmer climates also have highly baby boomer-dominant homeownership numbers. Tucson, AZ leads the country with 41.8% of homeowners between ages 58 and 76, while Tampa-St. Petersburg-Clearwater, FL (40.0%), Los Angeles-Long Beach-Anaheim, CA (39.0%), and Miami-Fort Lauderdale-West Palm Beach, FL (38.9%) are not far behind.

Below is a complete breakdown of baby boomer homeownership percentages across more than 250 metropolitan areas and all 50 states. The analysis was conducted by researchers at Construction Coverage using data from the U.S. Census Bureau and Zillow. For more information, refer to the methodology section.

Large Metros With the Most and Fewest Baby Boomer Homeowners

| Top Metros | Percentage* |

|---|---|

| 1. Tucson, AZ | 41.8% |

| 2. Pittsburgh, PA | 40.0% |

| 3. Rochester, NY | 40.0% |

| 4. Tampa-St. Petersburg-Clearwater, FL | 40.0% |

| 5. Buffalo-Cheektowaga, NY | 39.0% |

| 6. Los Angeles-Long Beach-Anaheim, CA | 39.0% |

| 7. Miami-Fort Lauderdale-Pompano Beach, FL | 38.9% |

| 8. New Orleans-Metairie, LA | 38.7% |

| 9. Cleveland-Elyria, OH | 38.5% |

| 10. Providence-Warwick, RI-MA | 38.5% |

| 11. New York-Newark-Jersey City, NY-NJ-PA | 38.5% |

| 12. Memphis, TN-MS-AR | 38.5% |

| 13. Jacksonville, FL | 38.3% |

| 14. Sacramento-Roseville-Folsom, CA | 38.2% |

| 15. Boston-Cambridge-Newton, MA-NH | 38.1% |

| Bottom Metros | Percentage* |

|---|---|

| 1. Salt Lake City, UT | 29.9% |

| 2. Austin-Round Rock-Georgetown, TX | 30.4% |

| 3. Denver-Aurora-Lakewood, CO | 32.6% |

| 4. Indianapolis-Carmel-Anderson, IN | 32.9% |

| 5. Dallas-Fort Worth-Arlington, TX | 33.1% |

| 6. Houston-The Woodlands-Sugar Land, TX | 33.2% |

| 7. Raleigh-Cary, NC | 33.2% |

| 8. Grand Rapids-Kentwood, MI | 33.2% |

| 9. Seattle-Tacoma-Bellevue, WA | 33.4% |

| 10. Atlanta-Sandy Springs-Alpharetta, GA | 33.9% |

| 11. Washington-Arlington-Alexandria, DC-VA-MD-WV | 34.0% |

| 12. San Antonio-New Braunfels, TX | 34.1% |

| 13. Fresno, CA | 34.2% |

| 14. Minneapolis-St. Paul-Bloomington, MN-WI | 34.3% |

| 15. Nashville-Davidson–Murfreesboro–Franklin, TN | 34.6% |

TRENDING GUIDES ON CONSTRUCTION COVERAGE

Midsize Metros With the Most and Fewest Baby Boomer Homeowners

| Top Metros | Percentage* |

|---|---|

| 1. Myrtle Beach-Conway-North Myrtle Beach, SC-NC | 52.8% |

| 2. North Port-Sarasota-Bradenton, FL | 48.5% |

| 3. Salisbury, MD-DE | 48.4% |

| 4. Cape Coral-Fort Myers, FL | 46.9% |

| 5. Deltona-Daytona Beach-Ormond Beach, FL | 46.8% |

| 6. Santa Rosa-Petaluma, CA | 46.6% |

| 7. Santa Maria-Santa Barbara, CA | 46.0% |

| 8. Naples-Marco Island, FL | 45.3% |

| 9. Ocala, FL | 45.3% |

| 10. Palm Bay-Melbourne-Titusville, FL | 45.2% |

| 11. Port St. Lucie, FL | 45.0% |

| 12. Eugene-Springfield, OR | 44.7% |

| 13. Asheville, NC | 43.6% |

| 14. Youngstown-Warren-Boardman, OH-PA | 42.4% |

| 15. Oxnard-Thousand Oaks-Ventura, CA | 42.4% |

| Bottom Metros | Percentage* |

|---|---|

| 1. Provo-Orem, UT | 25.6% |

| 2. Ogden-Clearfield, UT | 29.1% |

| 3. Greeley, CO | 29.8% |

| 4. McAllen-Edinburg-Mission, TX | 30.1% |

| 5. El Paso, TX | 31.7% |

| 6. Des Moines-West Des Moines, IA | 31.9% |

| 7. Visalia, CA | 33.3% |

| 8. Brownsville-Harlingen, TX | 33.5% |

| 9. Omaha-Council Bluffs, NE-IA | 33.5% |

| 10. Fort Wayne, IN | 33.5% |

| 11. Fayetteville-Springdale-Rogers, AR | 33.6% |

| 12. Bakersfield, CA | 33.8% |

| 13. Charleston-North Charleston, SC | 33.8% |

| 14. Anchorage, AK | 34.3% |

| 15. Stockton, CA | 34.7% |

Small Metros With the Most and Fewest Baby Boomer Homeowners

| Top Metros | Percentage* |

|---|---|

| 1. The Villages, FL | 61.0% |

| 2. Punta Gorda, FL | 52.9% |

| 3. Lake Havasu City-Kingman, AZ | 52.6% |

| 4. Homosassa Springs, FL | 49.7% |

| 5. Barnstable Town, MA | 49.5% |

| 6. Sebastian-Vero Beach, FL | 49.5% |

| 7. Flagstaff, AZ | 47.7% |

| 8. Ocean City, NJ | 45.9% |

| 9. San Luis Obispo-Paso Robles, CA | 45.7% |

| 10. Pittsfield, MA | 45.6% |

| 11. Lima, OH | 45.6% |

| 12. Napa, CA | 45.6% |

| 13. Glens Falls, NY | 44.4% |

| 14. Johnstown, PA | 44.4% |

| 15. Redding, CA | 44.2% |

| Bottom Metros | Percentage* |

|---|---|

| 1. Midland, TX | 28.4% |

| 2. Clarksville, TN-KY | 29.2% |

| 3. Hanford-Corcoran, CA | 30.1% |

| 4. Merced, CA | 30.9% |

| 5. Jonesboro, AR | 31.0% |

| 6. Laredo, TX | 31.3% |

| 7. Mankato, MN | 31.5% |

| 8. Manhattan, KS | 31.8% |

| 9. Odessa, TX | 31.8% |

| 10. California-Lexington Park, MD | 32.0% |

| 11. Lebanon, PA | 32.0% |

| 12. Yuba City, CA | 32.4% |

| 13. El Centro, CA | 32.7% |

| 14. Muncie, IN | 32.8% |

| 15. Janesville-Beloit, WI | 32.8% |

States With the Most and Fewest Baby Boomer Homeowners

| Top States | Percentage* |

|---|---|

| 1. Delaware | 42.7% |

| 2. New Hampshire | 42.5% |

| 3. Hawaii | 42.1% |

| 4. Vermont | 42.0% |

| 5. Maine | 41.7% |

| 6. Montana | 41.7% |

| 7. Florida | 41.3% |

| 8. West Virginia | 40.5% |

| 9. Mississippi | 40.1% |

| 10. Oregon | 39.8% |

| 11. Wyoming | 39.5% |

| 12. Pennsylvania | 39.4% |

| 13. New York | 39.4% |

| 14. South Carolina | 39.3% |

| 15. Arizona | 39.2% |

| Bottom States | Percentage* |

|---|---|

| 1. Utah | 30.4% |

| 2. Texas | 34.0% |

| 3. Colorado | 35.5% |

| 4. North Dakota | 35.5% |

| 5. Alaska | 35.6% |

| 6. Nebraska | 35.6% |

| 7. Minnesota | 35.7% |

| 8. Indiana | 36.0% |

| 9. Illinois | 36.2% |

| 10. Georgia | 36.3% |

| 11. Iowa | 36.4% |

| 12. Kansas | 36.7% |

| 13. Maryland | 36.9% |

| 14. Washington | 37.0% |

| 15. South Dakota | 37.1% |

*Percentage of homeowners that are baby boomers

Methodology

The data used in this study is from the U.S. Census Bureau’s American Community Survey 2022 1-Year Estimates and Zillow’s Zillow Home Value Index (ZHVI). To determine the locations with the most baby boomer-dominant housing markets, researchers at Construction Coverage ranked locations on the percentage of owner-occupied households that are headed by baby boomers. In the event of a tie, the location with the larger baby boomer population share was ranked higher. Baby boomers were considered those ages 58–76 and median home prices were calculated using Zillow data from October 2023.

To improve relevance, only metropolitan areas with complete data were included. Additionally, metros were grouped into cohorts based on population: small (under 350,000), midsize (350,000–999,999), and large (1,000,000 or more).

References

- AARP. (2022, September). 2021 Home and Community Preferences Survey: A National Survey of Adults. https://www.aarp.org/content/dam/aarp/research/surveys_statistics/liv-com/2021/2021-home-community-preferences-chartbook.doi.10.26419-2Fres.00479.001.pdf. Retrieved November 18, 2023.

- U.S. Census Bureau. (2022). American Community Survey 1-Year Estimates [Data set]. https://www.census.gov/programs-surveys/acs. Retrieved November 18, 2023.

- Zillow. (2023). Zillow Home Value Index [Data set]. https://www.zillow.com/research/data/. Retrieved November 18, 2023.

Full Results

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.