Cities with the Highest Property Taxes

With President Trump’s Tax Cuts and Jobs Act in effect, living in a high-tax state is now even more expensive than before. Prior to the new law, taxpayers in those states benefited from the ability to deduct the full amount of their state and local tax (SALT) payments on their federal returns. However, starting with the 2018 tax year, the SALT deduction is capped at $10,000. As a result, taxpayers who pay more than that amount each year will likely be faced with higher federal tax bills. The new SALT deduction limit will hit high-income households (especially property owners) in high-tax states—for example, California, New York, and New Jersey—the hardest.

There’s a wide variation in how much people in different locations pay in taxes and what those taxes go toward. A recent study by Lattice Publishing highlights the differences at the state level. While federal income taxes go toward national programs like Medicare, Social Security, interest on the national debt, and discretionary spending, state and local taxes are put toward local needs, such as public education, municipalities, construction, and maintenance.

Taxpayers in every state are subject to property taxes, which are primarily levied by cities, counties, and school districts, not the state. Property taxes are calculated based on a property’s fair market value, an assessment rate, and the local nominal tax rate, which is sometimes referred to as the “mill levy.” The assessment rate is the percentage of the property’s fair market value that is subject to taxation. This rate ranges widely by location—from a few percentage points up to 100 percent. The nominal tax rate, which also varies widely, is calculated based on what the city, county, and school districts require to fund operations. Together, the assessment rate and the nominal tax rate determine an effective tax rate that can be used to compare property tax burdens across different locations.

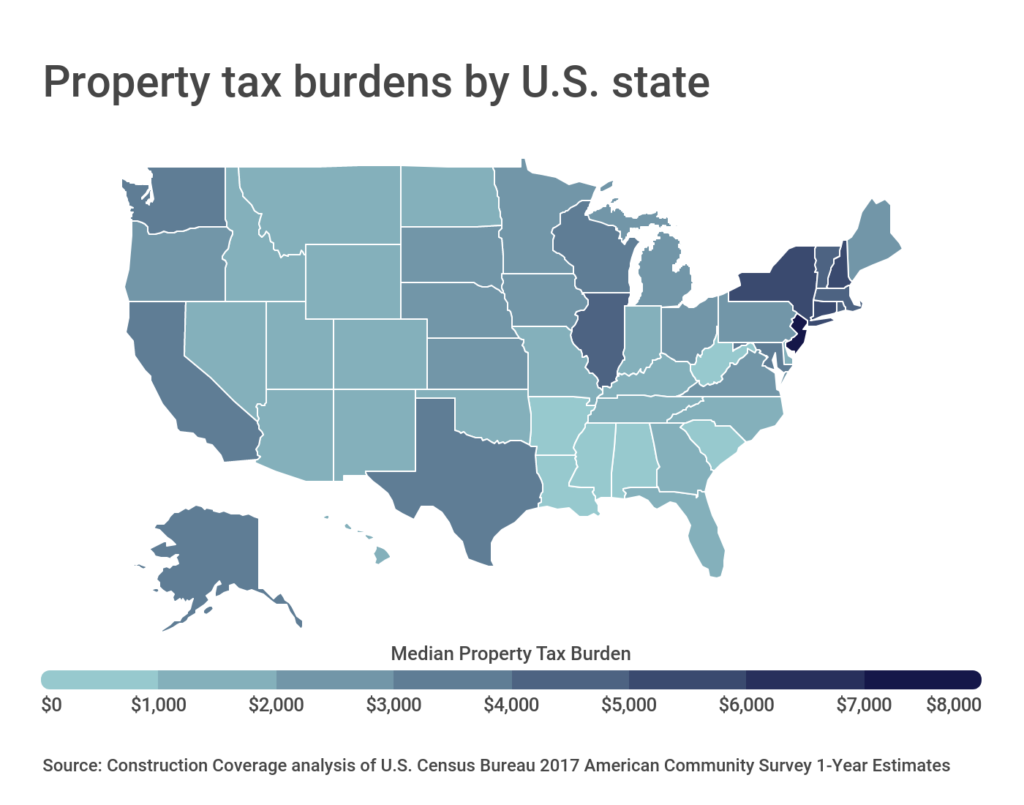

According to the U.S. Census Bureau, the median property tax bill for American households was $2,428 in 2017. But depending on the state, that amount ranges from a high of $8,124 per year in New Jersey to a low of $571 in Alabama. Nationwide, states in the Northeast and on the West Coast tend to pay the highest median property taxes, which reflects a combination of higher state/local tax rates and higher home values.

TRENDING ON CONSTRUCTION COVERAGE

If you are breaking ground on a new construction project, consider using construction project management software to coordinate your efforts. Our guide explains what to look for and how to choose the right construction software for your business.

With so much geographic variation in property taxes, picking the right location to buy or build a new home can go a long way in lowering the ultimate tax burden. To help homeowners and builders, researchers at Construction Coverage analyzed the property tax rates for the largest city in each state and determined how much property taxes a typical resident would pay in those cities. The city-level tax data is from a 2017 study conducted by the Government of the District of Columbia and median home values are from Zillow. Here’s what Construction Coverage found:

Property Taxes for the Largest City in Every State

Birmingham, AL

- Effective property tax rate: 0.725%

- Nominal property tax rate: 7.250%

- Assessment rate: 10.0%

- Median home value: $144,600

- Tax burden for median-value home: $1,048 per year

Anchorage, AK

- Effective property tax rate: 1.566%

- Nominal property tax rate: 1.566%

- Assessment rate: 100.0%

- Median home value: $333,500

- Tax burden for median-value home: $5,223 per year

Phoenix, AZ

- Effective property tax rate: 1.336%

- Nominal property tax rate: 13.360%

- Assessment rate: 10.0%

- Median home value: $241,500

- Tax burden for median-value home: $3,226 per year

Little Rock, AR

- Effective property tax rate: 1.400%

- Nominal property tax rate: 7.000%

- Assessment rate: 20.0%

- Median home value: $140,500

- Tax burden for median-value home: $1,967 per year

Los Angeles, CA

- Effective property tax rate: 1.140%

- Nominal property tax rate: 1.140%

- Assessment rate: 100.0%

- Median home value: $689,500

- Tax burden for median-value home: $7,860 per year

Denver, CO

- Effective property tax rate: 0.578%

- Nominal property tax rate: 8.033%

- Assessment rate: 7.2%

- Median home value: $427,200

- Tax burden for median-value home: $2,471 per year

Bridgeport, CT

- Effective property tax rate: 3.425%

- Nominal property tax rate: 5.437%

- Assessment rate: 63.0%

- Median home value: $174,700

- Tax burden for median-value home: $5,984 per year

Wilmington, DE

- Effective property tax rate: 1.603%

- Nominal property tax rate: 5.319%

- Assessment rate: 30.1%

- Median home value: $232,700

- Tax burden for median-value home: $3,729 per year

Washington, DC

- Effective property tax rate: 0.850%

- Nominal property tax rate: 0.850%

- Assessment rate: 100.0%

- Median home value: $581,200

- Tax burden for median-value home: $4,940 per year

Jacksonville, FL

- Effective property tax rate: 1.823%

- Nominal property tax rate: 1.823%

- Assessment rate: 100.0%

- Median home value: $175,600

- Tax burden for median-value home: $3,201 per year

Atlanta, GA

- Effective property tax rate: 1.728%

- Nominal property tax rate: 4.319%

- Assessment rate: 40.0%

- Median home value: $259,200

- Tax burden for median-value home: $4,478 per year

Honolulu, HI

- Effective property tax rate: 0.350%

- Nominal property tax rate: 0.350%

- Assessment rate: 100.0%

- Median home value: $677,300

- Tax burden for median-value home: $2,371 per year

Boise, ID

- Effective property tax rate: 1.534%

- Nominal property tax rate: 1.611%

- Assessment rate: 95.2%

- Median home value: $291,400

- Tax burden for median-value home: $4,470 per year

DID YOU KNOW?

Software has changed how many construction professionals do business. Read our latest software guides to learn more:

Chicago, IL

- Effective property tax rate: 2.153%

- Nominal property tax rate: 7.266%

- Assessment rate: 29.6%

- Median home value: $228,500

- Tax burden for median-value home: $4,919 per year

Indianapolis, IN

- Effective property tax rate: 2.754%

- Nominal property tax rate: 2.754%

- Assessment rate: 100.0%

- Median home value: $141,000

- Tax burden for median-value home: $3,883 per year

Des Moines, IA

- Effective property tax rate: 2.642%

- Nominal property tax rate: 4.750%

- Assessment rate: 55.6%

- Median home value: $140,300

- Tax burden for median-value home: $3,707 per year

Wichita, KS

- Effective property tax rate: 1.349%

- Nominal property tax rate: 11.730%

- Assessment rate: 11.5%

- Median home value: $127,300

- Tax burden for median-value home: $1,717 per year

Louisville, KY

- Effective property tax rate: 1.251%

- Nominal property tax rate: 1.251%

- Assessment rate: 100.0%

- Median home value: $158,600

- Tax burden for median-value home: $1,985 per year

New Orleans, LA

- Effective property tax rate: 1.650%

- Nominal property tax rate: 16.500%

- Assessment rate: 10.0%

- Median home value: $180,800

- Tax burden for median-value home: $2,983 per year

Portland, ME

- Effective property tax rate: 2.035%

- Nominal property tax rate: 2.165%

- Assessment rate: 94.0%

- Median home value: $312,400

- Tax burden for median-value home: $6,358 per year

Baltimore, MD

- Effective property tax rate: 2.360%

- Nominal property tax rate: 2.360%

- Assessment rate: 100.0%

- Median home value: $120,100

- Tax burden for median-value home: $2,834 per year

Boston, MA

- Effective property tax rate: 1.048%

- Nominal property tax rate: 1.048%

- Assessment rate: 100.0%

- Median home value: $599,400

- Tax burden for median-value home: $6,282 per year

DID YOU KNOW?

Many construction professionals are underinsured. To help general contractors and project managers better understand what insurance they need, we put together the following guides:

- Our construction insurance overview is a good place to start

- Commercial auto insurance for insuring your company vehicles

- Builders risk insurance for buildings/ structures while they are under construction

- OCIP vs. CCIP explains the difference between the two

Detroit, MI

- Effective property tax rate: 3.405%

- Nominal property tax rate: 6.810%

- Assessment rate: 50.0%

- Median home value: $160,000

- Tax burden for median-value home: $5,448 per year

Minneapolis, MN

- Effective property tax rate: 1.281%

- Nominal property tax rate: 1.360%

- Assessment rate: 94.2%

- Median home value: $264,700

- Tax burden for median-value home: $3,391 per year

Jackson, MS

- Effective property tax rate: 1.894%

- Nominal property tax rate: 18.940%

- Assessment rate: 10.0%

- Median home value: $143,900

- Tax burden for median-value home: $2,725 per year

Kansas City, MO

- Effective property tax rate: 1.469%

- Nominal property tax rate: 7.730%

- Assessment rate: 19.0%

- Median home value: $148,400

- Tax burden for median-value home: $2,180 per year

Billings, MT

- Effective property tax rate: 0.952%

- Nominal property tax rate: 70.550%

- Assessment rate: 1.4%

- Median home value: $236,600

- Tax burden for median-value home: $2,253 per year

Omaha, NE

- Effective property tax rate: 2.091%

- Nominal property tax rate: 2.249%

- Assessment rate: 93.0%

- Median home value: $173,400

- Tax burden for median-value home: $3,626 per year

Las Vegas, NV

- Effective property tax rate: 1.147%

- Nominal property tax rate: 3.278%

- Assessment rate: 35.0%

- Median home value: $273,500

- Tax burden for median-value home: $3,138 per year

Manchester, NH

- Effective property tax rate: 2.102%

- Nominal property tax rate: 2.330%

- Assessment rate: 90.2%

- Median home value: $239,500

- Tax burden for median-value home: $5,033 per year

Newark, NJ

- Effective property tax rate: 3.031%

- Nominal property tax rate: 3.560%

- Assessment rate: 85.1%

- Median home value: $249,900

- Tax burden for median-value home: $7,574 per year

Albuquerque, NM

- Effective property tax rate: 1.622%

- Nominal property tax rate: 4.872%

- Assessment rate: 33.3%

- Median home value: $200,700

- Tax burden for median-value home: $3,256 per year

New York, NY

- Effective property tax rate: 0.817%

- Nominal property tax rate: 19.920%

- Assessment rate: 4.1%

- Median home value: $680,000

- Tax burden for median-value home: $5,554 per year

Charlotte, NC

- Effective property tax rate: 1.036%

- Nominal property tax rate: 1.294%

- Assessment rate: 80.0%

- Median home value: $224,200

- Tax burden for median-value home: $2,322 per year

Fargo, ND

- Effective property tax rate: 1.119%

- Nominal property tax rate: 28.550%

- Assessment rate: 3.9%

- Median home value: $221,700

- Tax burden for median-value home: $2,481 per year

Columbus, OH

- Effective property tax rate: 2.050%

- Nominal property tax rate: 6.833%

- Assessment rate: 30.0%

- Median home value: $152,300

- Tax burden for median-value home: $3,122 per year

Oklahoma City, OK

- Effective property tax rate: 1.247%

- Nominal property tax rate: 11.335%

- Assessment rate: 11.0%

- Median home value: $129,900

- Tax burden for median-value home: $1,620 per year

Portland, OR

- Effective property tax rate: 1.258%

- Nominal property tax rate: 2.320%

- Assessment rate: 54.2%

- Median home value: $426,300

- Tax burden for median-value home: $5,364 per year

Philadelphia, PA

- Effective property tax rate: 1.400%

- Nominal property tax rate: 1.400%

- Assessment rate: 100.0%

- Median home value: $160,200

- Tax burden for median-value home: $2,242 per year

Providence, RI

- Effective property tax rate: 1.692%

- Nominal property tax rate: 1.880%

- Assessment rate: 90.0%

- Median home value: $211,300

- Tax burden for median-value home: $3,575 per year

Charleston, SC

- Effective property tax rate: 1.154%

- Nominal property tax rate: 28.860%

- Assessment rate: 4.0%

- Median home value: $322,300

- Tax burden for median-value home: $3,721 per year

Sioux Falls, SD

- Effective property tax rate: 1.514%

- Nominal property tax rate: 1.781%

- Assessment rate: 85.0%

- Median home value: $189,100

- Tax burden for median-value home: $2,863 per year

Nashville, TN

- Effective property tax rate: 0.818%

- Nominal property tax rate: 3.270%

- Assessment rate: 25.0%

- Median home value: $264,100

- Tax burden for median-value home: $2,159 per year

Houston, TX

- Effective property tax rate: 2.530%

- Nominal property tax rate: 2.530%

- Assessment rate: 100.0%

- Median home value: $185,600

- Tax burden for median-value home: $4,696 per year

Salt Lake City, UT

- Effective property tax rate: 0.783%

- Nominal property tax rate: 1.425%

- Assessment rate: 55.0%

- Median home value: $398,900

- Tax burden for median-value home: $3,125 per year

Burlington, VT

- Effective property tax rate: 2.044%

- Nominal property tax rate: 2.587%

- Assessment rate: 79.0%

- Median home value: $319,200

- Tax burden for median-value home: $6,525 per year

Virginia Beach, VA

- Effective property tax rate: 0.891%

- Nominal property tax rate: 0.990%

- Assessment rate: 90.0%

- Median home value: $266,000

- Tax burden for median-value home: $2,370 per year

Seattle, WA

- Effective property tax rate: 0.882%

- Nominal property tax rate: 0.950%

- Assessment rate: 92.8%

- Median home value: $730,000

- Tax burden for median-value home: $6,436 per year

Charleston, WV

- Effective property tax rate: 0.854%

- Nominal property tax rate: 1.424%

- Assessment rate: 60.0%

- Median home value: $107,900

- Tax burden for median-value home: $922 per year

Milwaukee, WI

- Effective property tax rate: 2.732%

- Nominal property tax rate: 2.732%

- Assessment rate: 100.0%

- Median home value: $120,000

- Tax burden for median-value home: $3,278 per year

Cheyenne, WY

- Effective property tax rate: 0.952%

- Nominal property tax rate: 10.017%

- Assessment rate: 9.5%

- Median home value: $255,000

- Tax burden for median-value home: $2,427

Methodology & Full Results

The tax data used in this analysis is from Tax Rates and Tax Burdens In the District of Columbia – A Nationwide Comparison, issued March 2019. The median home value for each city is the most recent Zillow Home Value Index, accessed on March 7, 2019. This statistic includes all single-family, condominium, and co-operative homes with a county record.

In each city, the tax burden for a median-value home was calculated by multiplying the median home value by the effective property tax rate.

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.