U.S. Cities Where Buyers Get the Best Interest Rates

After an extended run of intense competition and high prices in the residential real estate market, 2022 is bringing signs that the market could begin to cool soon. With inflation on the rise and home prices still rising, more buyers are finding themselves unable to afford the cost of real estate. And with the U.S. Federal Reserve poised to raise interest rates throughout 2022, the cost of mortgages could grow even more and deter would-be buyers.

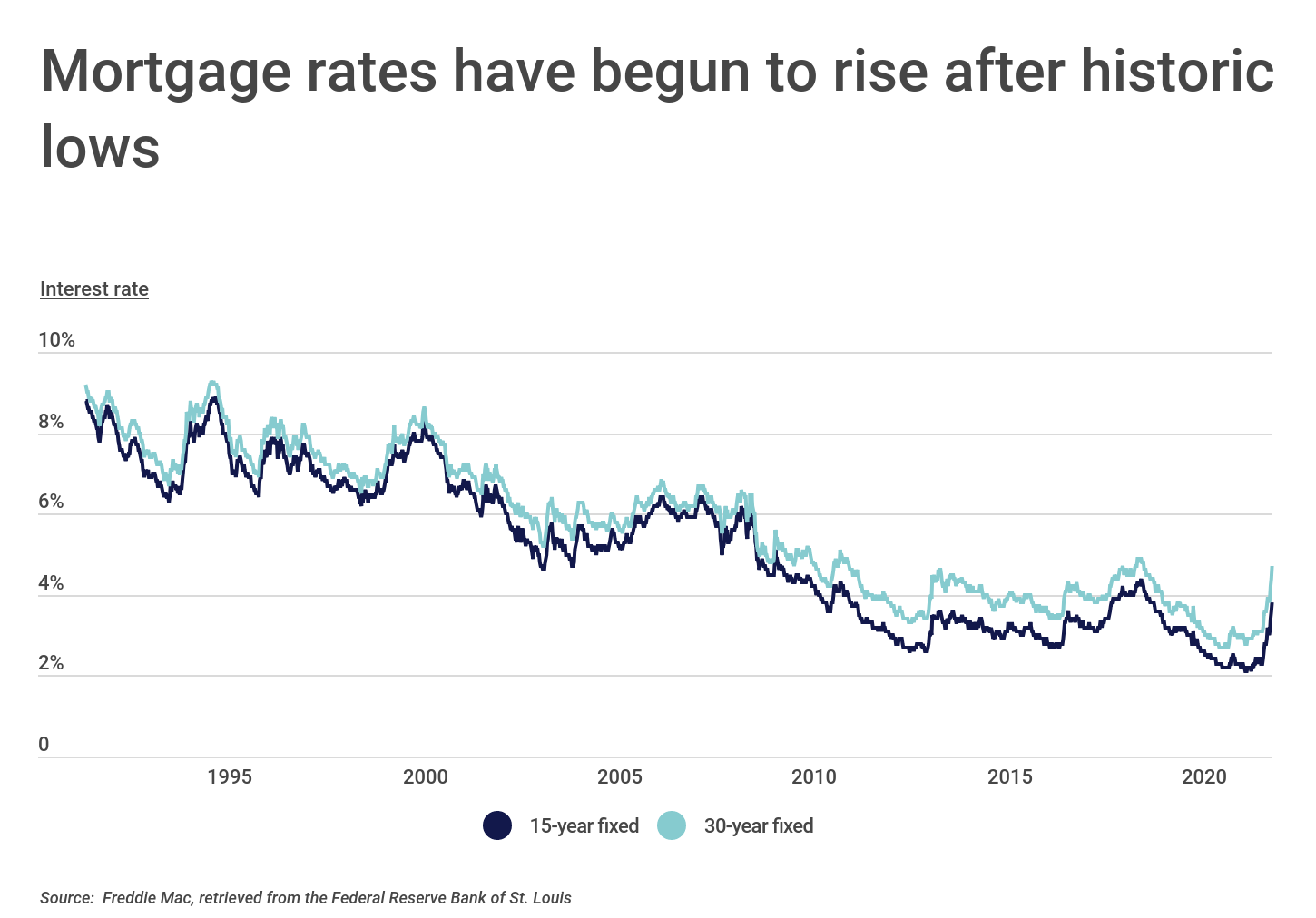

The Fed’s March 2022 decision to raise rates and signal more increases in the near future could mean the end of a long period of historically low interest rates dating back to the Great Recession. During the years following the recession, the Federal Reserve kept interest rates low to encourage economic activity. Low costs to borrow from the Fed made it less expensive for commercial banks to access credit and make loans to customers. During the COVID-19 pandemic, rates fell again as large parts of the economy experienced disruptions due to the spread of the virus. But with inflation spiking throughout 2021 and into 2022, the Fed is now looking to raise rates to stem borrowing and slow down the economy, and mortgage lenders will follow suit.

For homebuyers, this means that mortgage interest rates have already started to tick up and will likely continue to rise in the months ahead. The average interest rates for both 15-year fixed rate mortgages and 30-year fixed rate mortgages are up by more than a percentage point since the beginning of 2022. After remaining at or below 2.5% throughout 2021, the 15-year rate rose to 3.8% at the end of March 2022, while the 30-year rate hovered between 2.7% and 3.2% in 2021 before rising to 4.7%. After a period of historically low rates, continued increases could push rates to their highest levels since 2018 and eventually back to pre-recession levels.

FOR HOMEBUYERS

When moving or having work done on a house, it’s important to make sure your contractors have adequate insurance. For example, moving companies should have commercial truck insurance, general contractors should have a builders risk insurance policy, and architects should have errors and omissions coverage. These policies will protect the contractor and the homeowner should something go wrong with the work.

Economic trends and the Fed’s actions will be a major factor in determining what rates banks will offer, but prospective homebuyers can manage their interest rates and keep homeownership in reach in other ways. Excellent credit and a large down payment will usually result in lower rates, and borrowers can evaluate options like a shorter mortgage term, adjustable rate mortgages, or non-conventional loan types that may provide workable alternatives.

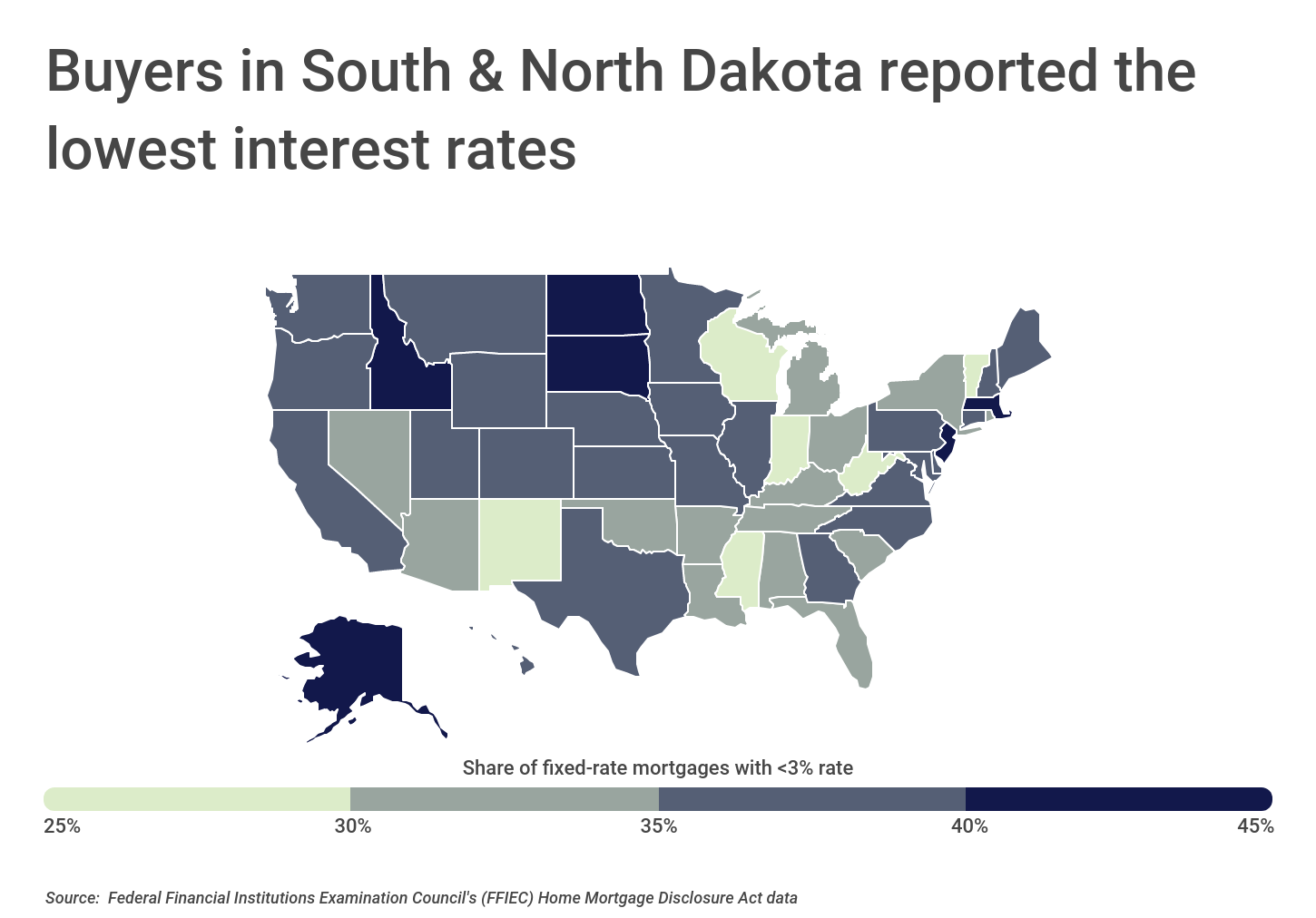

One other significant factor in mortgage interest rates is geography. Rates vary from location to location due to differences in economic characteristics, laws governing lenders, and real estate market conditions. Generally, real estate markets serviced by fewer lenders often have higher rates because there is less competition to drive rates down. Lenders in areas where more borrowers have low incomes or bad credit will also be less likely to offer low rates.

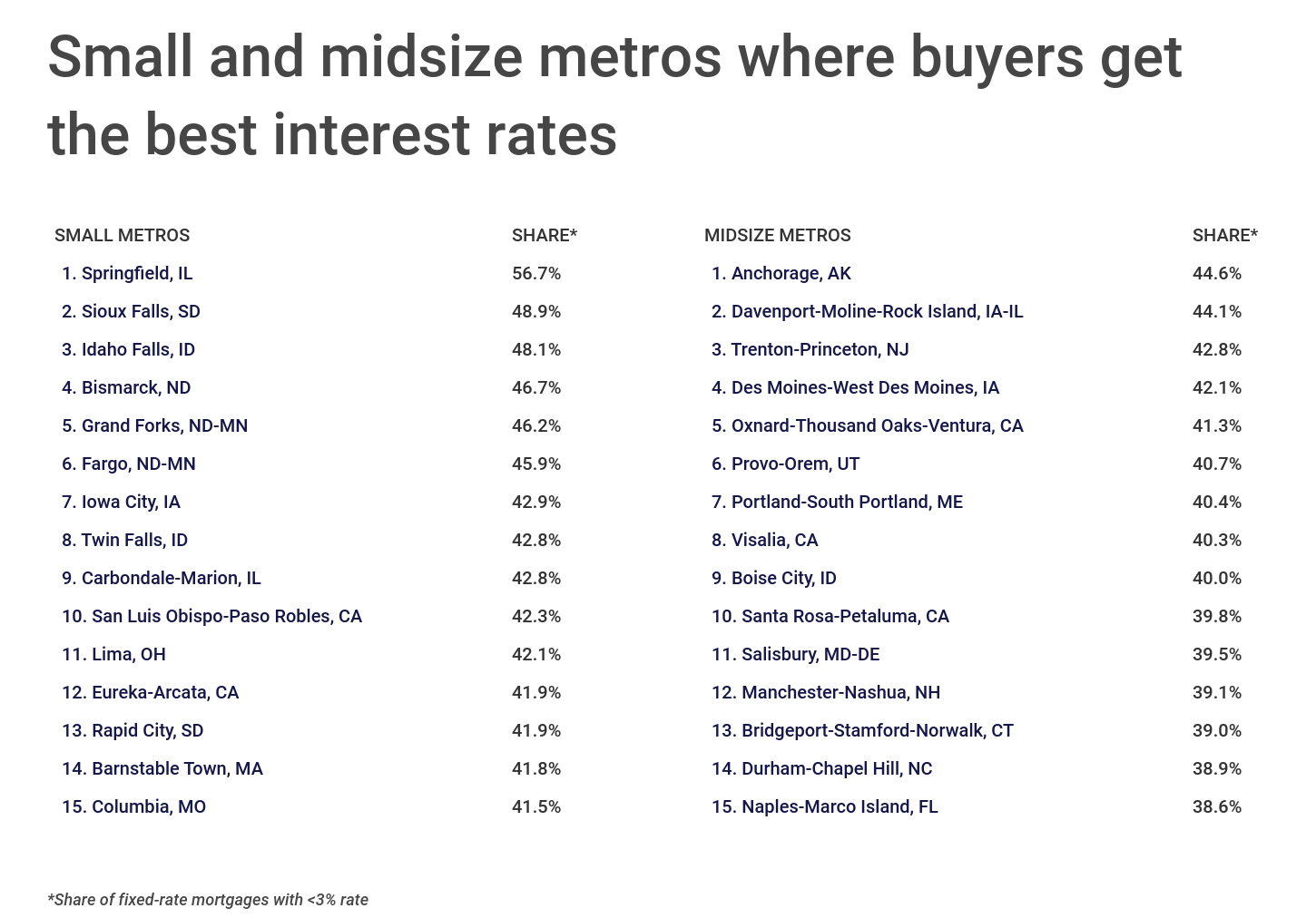

While the median interest rate across all fixed rate mortgages in 2020 was 3.15%, over a third of all buyers secured rates below 3.0%. Among states, Mississippi and New Mexico have the lowest share of mortgages with rates below the 3.0% threshold at 25.6%, while nearly half of borrowers (47.2%) secured rates below 3.0% in U.S.-leading South Dakota. At the metro level, some of America’s most expensive markets—including the Bay Area and Boston—offer low interest rates most commonly. In these locations, homebuyers tend to have higher incomes and more money to put toward a down payment, which helps keep their rates in check.

FOR CONSTRUCTION PROFESSIONALS

Did you know that personal auto insurance often won’t cover you when using your vehicle for work? If you use your personal car for work, it’s important to have a commercial policy. Our guide on the best commercial vehicle insurance explains everything you need to know.

The data used in this analysis is from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act. Only conventional home purchase loans approved in 2020 with a fixed interest rate were considered in this analysis. To determine the locations where buyers get the best interest rates, researchers at Construction Coverage calculated the share of all fixed-rate mortgages—including both 15- and 30-year—that were below a 3.0% interest rate. Researchers also included statistics on 15- and 30-year fixed-rate mortgages, as well as the median interest rate across all fixed mortgages.

Here are the U.S. metropolitan areas where buyers get the best interest rates.

Large Metros Where Buyers Get the Best Interest Rates

Photo Credit: Farid Sani / Shutterstock

15. Raleigh-Cary, NC

- Share of fixed-rate mortgages with <3.0% rate: 39.2%

- Share of 30-year mortgages with <3.0% rate: 38.0%

- Share of 15-year mortgages with <3.0% rate: 67.2%

- Median interest rate across all fixed-rate mortgages: 3.13%

Photo Credit: Sean Pavone / Shutterstock

14. Los Angeles-Long Beach-Anaheim, CA

- Share of fixed-rate mortgages with <3.0% rate: 39.2%

- Share of 30-year mortgages with <3.0% rate: 39.2%

- Share of 15-year mortgages with <3.0% rate: 66.3%

- Median interest rate across all fixed-rate mortgages: 3.13%

RELATED

Photo Credit: Gang Liu / Shutterstock

13. Philadelphia-Camden-Wilmington, PA-NJ-DE-MD

- Share of fixed-rate mortgages with <3.0% rate: 39.3%

- Share of 30-year mortgages with <3.0% rate: 38.4%

- Share of 15-year mortgages with <3.0% rate: 62.5%

- Median interest rate across all fixed-rate mortgages: 3.13%

Photo Credit: Sean Pavone / Shutterstock

12. Pittsburgh, PA

- Share of fixed-rate mortgages with <3.0% rate: 39.6%

- Share of 30-year mortgages with <3.0% rate: 37.9%

- Share of 15-year mortgages with <3.0% rate: 66.3%

- Median interest rate across all fixed-rate mortgages: 3.13%

Photo Credit: Bob Pool / Shutterstock

11. Portland-Vancouver-Hillsboro, OR-WA

- Share of fixed-rate mortgages with <3.0% rate: 39.7%

- Share of 30-year mortgages with <3.0% rate: 39.3%

- Share of 15-year mortgages with <3.0% rate: 69.9%

- Median interest rate across all fixed-rate mortgages: 3.13%

Photo Credit: Jon Bilous / Shutterstock

10. Riverside-San Bernardino-Ontario, CA

- Share of fixed-rate mortgages with <3.0% rate: 39.7%

- Share of 30-year mortgages with <3.0% rate: 39.8%

- Share of 15-year mortgages with <3.0% rate: 63.2%

- Median interest rate across all fixed-rate mortgages: 3.13%

Photo Credit: Jeremy Janus / Shutterstock

9. Seattle-Tacoma-Bellevue, WA

- Share of fixed-rate mortgages with <3.0% rate: 40.4%

- Share of 30-year mortgages with <3.0% rate: 40.2%

- Share of 15-year mortgages with <3.0% rate: 71.5%

- Median interest rate across all fixed-rate mortgages: 3.13%

Photo Credit: Roschetzky Photography / Shutterstock

8. Austin-Round Rock-Georgetown, TX

- Share of fixed-rate mortgages with <3.0% rate: 40.4%

- Share of 30-year mortgages with <3.0% rate: 40.9%

- Share of 15-year mortgages with <3.0% rate: 53.7%

- Median interest rate across all fixed-rate mortgages: 3.13%

Photo Credit: Lucky-photographer / Shutterstock

7. San Diego-Chula Vista-Carlsbad, CA

- Share of fixed-rate mortgages with <3.0% rate: 41.2%

- Share of 30-year mortgages with <3.0% rate: 41.1%

- Share of 15-year mortgages with <3.0% rate: 73.1%

- Median interest rate across all fixed-rate mortgages: 3.13%

Photo Credit: Lukas Uher / Shutterstock

6. New York-Newark-Jersey City, NY-NJ-PA

- Share of fixed-rate mortgages with <3.0% rate: 41.4%

- Share of 30-year mortgages with <3.0% rate: 40.6%

- Share of 15-year mortgages with <3.0% rate: 61.2%

- Median interest rate across all fixed-rate mortgages: 3.13%

Photo Credit: Sean Pavone / Shutterstock

5. Washington-Arlington-Alexandria, DC-VA-MD-WV

- Share of fixed-rate mortgages with <3.0% rate: 42.2%

- Share of 30-year mortgages with <3.0% rate: 41.2%

- Share of 15-year mortgages with <3.0% rate: 74.7%

- Median interest rate across all fixed-rate mortgages: 3.13%

Photo Credit: Feoktistoff / Shutterstock

4. Sacramento-Roseville-Folsom, CA

- Share of fixed-rate mortgages with <3.0% rate: 42.2%

- Share of 30-year mortgages with <3.0% rate: 41.8%

- Share of 15-year mortgages with <3.0% rate: 73.8%

- Median interest rate across all fixed-rate mortgages: 3.13%

Photo Credit: Uladzik Kryhin / Shutterstock

3. San Jose-Sunnyvale-Santa Clara, CA

- Share of fixed-rate mortgages with <3.0% rate: 42.2%

- Share of 30-year mortgages with <3.0% rate: 42.6%

- Share of 15-year mortgages with <3.0% rate: 75.0%

- Median interest rate across all fixed-rate mortgages: 3.00%

Photo Credit: Pete Niesen / Shutterstock

2. San Francisco-Oakland-Berkeley, CA

- Share of fixed-rate mortgages with <3.0% rate: 43.6%

- Share of 30-year mortgages with <3.0% rate: 43.5%

- Share of 15-year mortgages with <3.0% rate: 72.7%

- Median interest rate across all fixed-rate mortgages: 3.00%

Photo Credit: Travellaggio / Shutterstock

1. Boston-Cambridge-Newton, MA-NH

- Share of fixed-rate mortgages with <3.0% rate: 43.7%

- Share of 30-year mortgages with <3.0% rate: 42.4%

- Share of 15-year mortgages with <3.0% rate: 78.2%

- Median interest rate across all fixed-rate mortgages: 3.00%

Detailed Findings & Methodology

The data used in this analysis is from the Federal Financial Institutions Examination Council’s 2020 Home Mortgage Disclosure Act. Only conventional home purchase loans approved in 2020 with a fixed interest rate were considered in this analysis. To determine the locations where buyers get the best interest rates, researchers calculated the share of all fixed-rate mortgages—including both 15- and 30-year—that were below a 3.0% interest rate. In the event of a tie, locations with a higher share of 30-year mortgages below a 3.0% interest rate were ranked higher. To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts based on population size: small (100,000-349,999), midsize (350,000-999,999), and large (1,000,000 or more).

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.