Cities Where It’s Cheaper to Buy Than Rent

Price increases throughout the U.S. economy over the past few years have made nearly everything more expensive, but perhaps no spending category has squeezed Americans’ budgets like the cost of housing. Between high costs to buy a home and skyrocketing rents, non-homeowners are faced with impossible choices throughout the market.

Throughout 2020 and 2021, low interest rates and rising household savings and incomes positioned many Americans to buy real estate. But high competition and low supply created a boom in the residential real estate market that sent home prices in the U.S. to record highs. With home prices elevated and interest rates rising to cool the market, more would-be buyers have been priced out, increasing the competitiveness of the rental market and in turn driving rents upward.

These shifting conditions have made things difficult for households debating whether to buy or rent. Shelter is already the largest spending category for most U.S. households, but larger economic trends have raised the financial stakes on the buy-or-rent decision. For now, at least, renting has taken the edge.

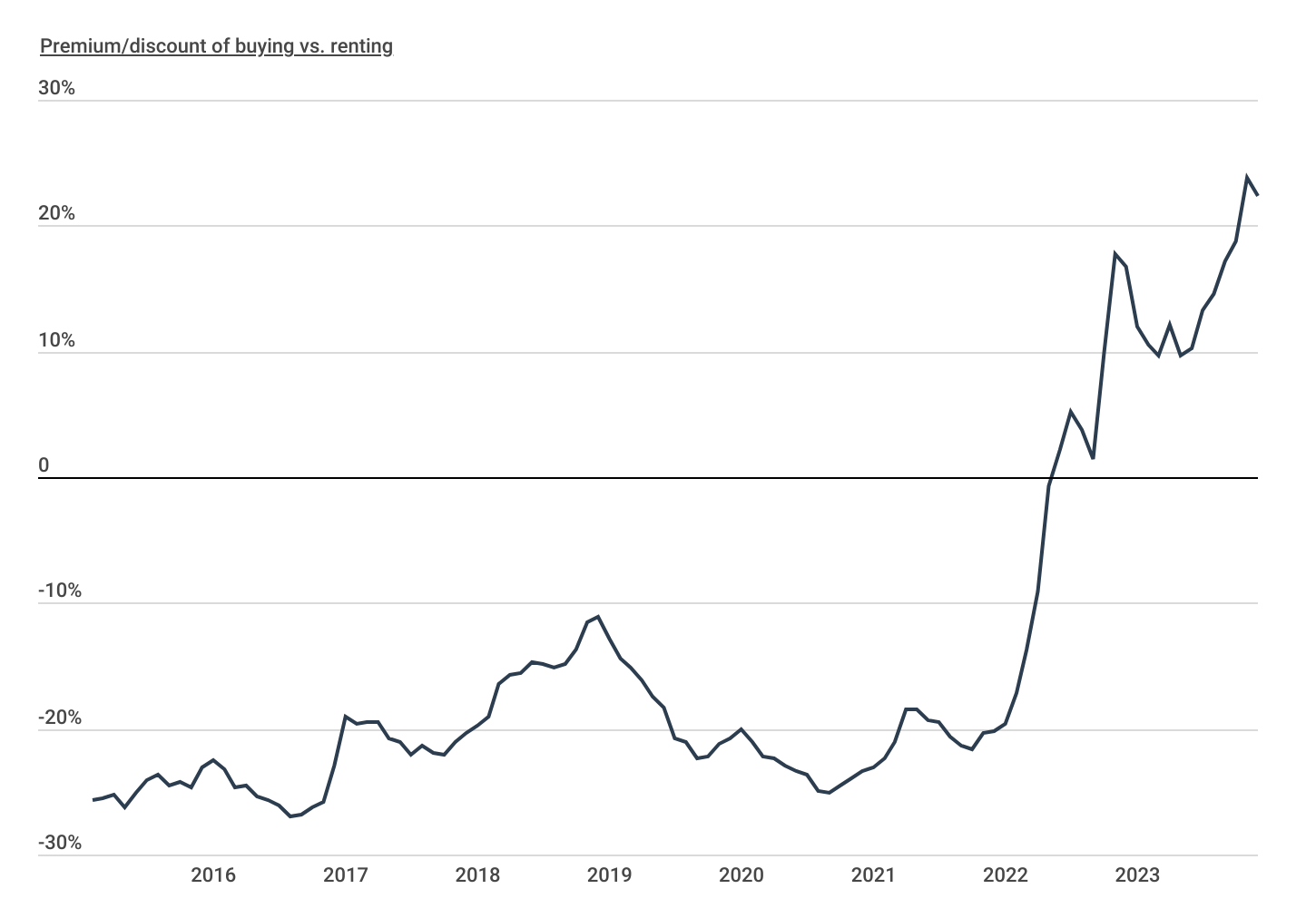

The Cost of Buying vs. Renting Over Time

Amid elevated interest rates and home prices, the buying premium has skyrocketed

In recent years, the typical monthly costs of buying a home after accounting for sales prices, mortgage rates, and property taxes had fallen well below the costs of typical rents in the U.S. Relatively low home costs following the Great Recession and a period of low interest rates kept mortgage payments affordable for much of the 2010s. Even as home prices began to increase amid the competitive market in 2020 and 2021, low interest rates still made buying more affordable.

But beginning in 2022, the combination of high home prices and high interest rates tilted the scales in favor of renting. Mortgage interest rates have more than doubled since January 2022, and while the pace of home price increases has slowed, the median home price is still up nearly 11% over the same span. As of November 2023, the typical monthly payment for a home in the U.S. is now more than 22% higher than the typical monthly rent.

FOR HOMEOWNERS

Are you increasing the value of your home with a renovated bathroom or upgraded kitchen? Be sure to consider builders risk insurance for homeowners, which will provide coverage for your home while it’s under renovation—a time when most homeowners insurance policies won’t.

The Cost of Buying vs. Renting by City

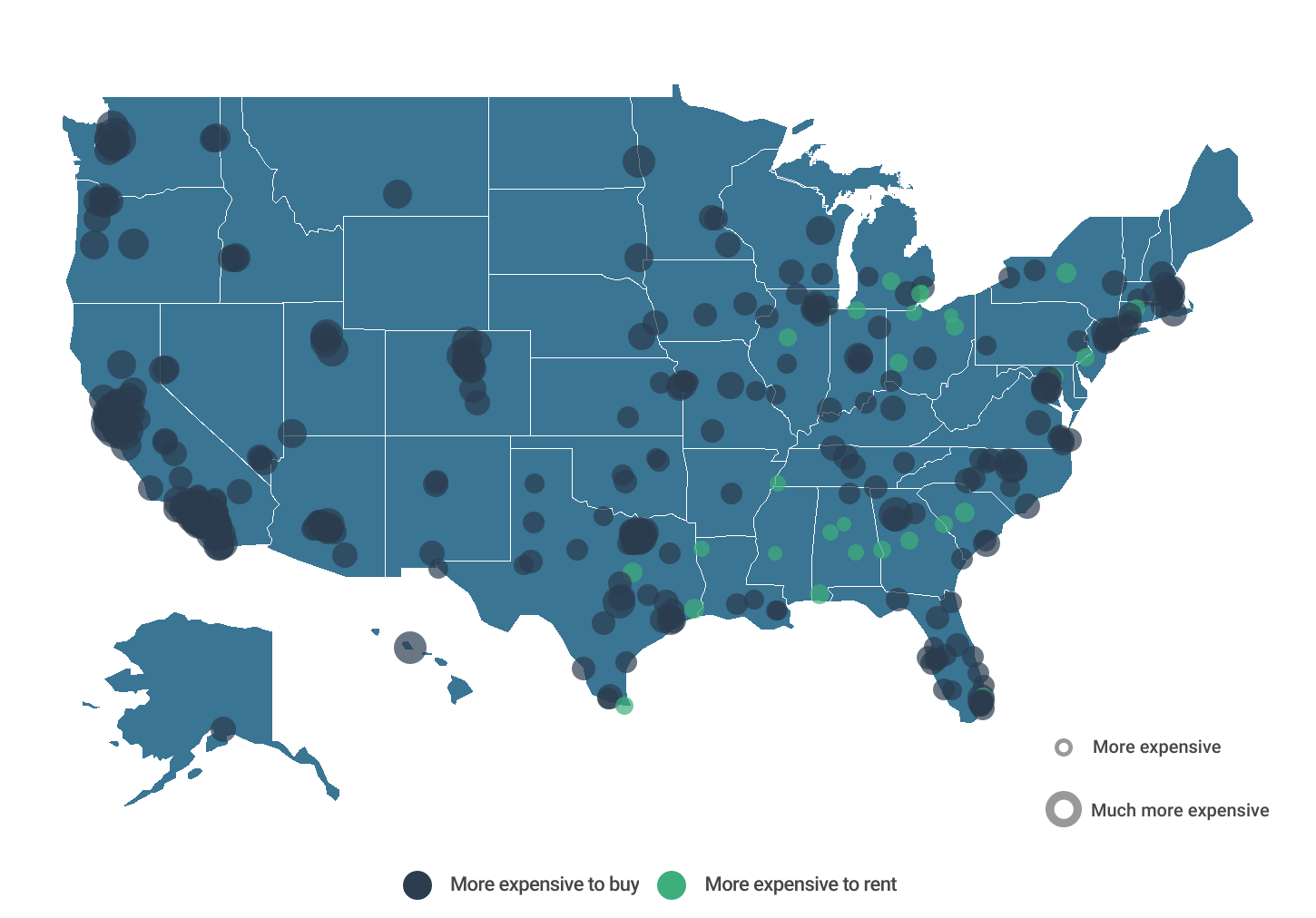

Residents in California & Washington will pay the largest premium to buy

And within some geographic markets, buying is unquestionably more difficult. Locations that face low supply, competitive markets, and high home prices—like cities throughout California and in the greater Seattle, WA region—can be two or even three times more expensive for buyers. Fast-growing cities like Frisco, TX and Scottsdale, AZ are also proving especially challenging for buyers.

Out of the 338 U.S. cities considered in this analysis, only 28 are currently more affordable for buyers than renters. Most of these locations are found in Southern states like Alabama, Mississippi, Arkansas, and Louisiana or in Rust Belt locations like Ohio and Michigan. In these locations, home costs remain relatively low, allowing buyers to save relative to the cost of renting.

Below is a complete breakdown of more than 300 U.S. cities. The analysis was conducted by Construction Coverage using data from Zillow, the U.S. Census Bureau, and Freddie Mac. For more information, refer to the methodology section.

The Cheapest Large Cities for Homebuyers

| Cheapest Cities | Premium* |

|---|---|

| 1. Detroit, MI | -61.0% |

| 2. Cleveland, OH | -44.6% |

| 3. Memphis, TN | -18.5% |

| 4. Baltimore, MD | -17.8% |

| 5. Philadelphia, PA | -10.6% |

| 6. Chicago, IL | 5.5% |

| 7. New Orleans, LA | 5.6% |

| 8. Tulsa, OK | 8.4% |

| 9. El Paso, TX | 10.1% |

| 10. Oklahoma City, OK | 11.1% |

| 11. Indianapolis, IN | 12.3% |

| 12. Kansas City, MO | 18.8% |

| 13. Milwaukee, WI | 19.5% |

| 14. Tampa, FL | 19.7% |

| 15. Louisville, KY | 20.4% |

| Most Expensive Cities | Premium* |

|---|---|

| 1. San Jose, CA | 191.6% |

| 2. Seattle, WA | 157.0% |

| 3. San Francisco, CA | 149.4% |

| 4. Long Beach, CA | 146.8% |

| 5. Los Angeles, CA | 121.4% |

| 6. Austin, TX | 121.4% |

| 7. Oakland, CA | 114.0% |

| 8. San Diego, CA | 113.6% |

| 9. Portland, OR | 110.2% |

| 10. Denver, CO | 85.0% |

| 11. Raleigh, NC | 73.1% |

| 12. Mesa, AZ | 69.2% |

| 13. Washington, DC | 66.8% |

| 14. Aurora, CO | 61.5% |

| 15. Colorado Springs, CO | 59.4% |

FOR LANDLORDS

Landlords face different risks than a typical homeowner does, which is why there’s a special kind of insurance for rental properties. These are the best landlord insurance companies of 2023.

The Cheapest Midsize Cities for Homebuyers

| Cheapest Cities | Premium* |

|---|---|

| 1. Birmingham, AL | -31.6% |

| 2. Montgomery, AL | -22.7% |

| 3. Shreveport, LA | -18.9% |

| 4. Toledo, OH | -16.8% |

| 5. Akron, OH | -12.8% |

| 6. Brownsville, TX | -10.6% |

| 7. Augusta, GA | -10.3% |

| 8. Macon, GA | -7.9% |

| 9. Columbus, GA | -7.6% |

| 10. Mobile, AL | -0.5% |

| 11. Saint Louis, MO | 1.0% |

| 12. Fayetteville, NC | 4.2% |

| 13. Amarillo, TX | 5.4% |

| 14. Pittsburgh, PA | 6.0% |

| 15. Grand Rapids, MI | 7.0% |

| Most Expensive Cities | Premium* |

|---|---|

| 1. Sunnyvale, CA | 288.6% |

| 2. Bellevue, WA | 246.2% |

| 3. Fremont, CA | 214.9% |

| 4. Glendale, CA | 173.1% |

| 5. Irvine, CA | 168.7% |

| 6. Huntington Beach, CA | 166.4% |

| 7. Frisco, TX | 156.3% |

| 8. Scottsdale, AZ | 143.5% |

| 9. Cary, NC | 134.3% |

| 10. Hayward, CA | 125.1% |

| 11. Garden Grove, CA | 120.5% |

| 12. Salt Lake City, UT | 116.3% |

| 13. Honolulu, HI | 116.1% |

| 14. Arlington, VA | 112.4% |

| 15. Anaheim, CA | 111.5% |

The Cheapest Small Cities for Homebuyers

| Cheapest Cities | Premium* |

|---|---|

| 1. Jackson, MS | -63.3% |

| 2. Tuscaloosa, AL | -21.5% |

| 3. Peoria, IL | -13.2% |

| 4. South Bend, IN | -10.5% |

| 5. Dayton, OH | -9.7% |

| 6. Hartford, CT | -6.8% |

| 7. Lansing, MI | -6.8% |

| 8. Dearborn, MI | -4.8% |

| 9. Beaumont, TX | -2.2% |

| 10. Syracuse, NY | -1.7% |

| 11. Waco, TX | -1.3% |

| 12. Pompano Beach, FL | -0.7% |

| 13. Columbia, SC | -0.2% |

| 14. Lehigh Acres, FL | 0.3% |

| 15. Odessa, TX | 2.8% |

| Most Expensive Cities | Premium* |

|---|---|

| 1. Berkeley, CA | 248.8% |

| 2. Santa Clara, CA | 229.3% |

| 3. San Mateo, CA | 220.6% |

| 4. Costa Mesa, CA | 182.7% |

| 5. Carlsbad, CA | 176.5% |

| 6. Burbank, CA | 164.2% |

| 7. Torrance, CA | 162.9% |

| 8. Pasadena, CA | 154.0% |

| 9. Sandy Springs, GA | 152.4% |

| 10. Downey, CA | 146.9% |

| 11. Orange, CA | 131.1% |

| 12. El Monte, CA | 130.9% |

| 13. Fullerton, CA | 129.2% |

| 14. Fargo, ND | 128.3% |

| 15. Provo, UT | 126.4% |

*Premium/discount of buying vs. renting

Methodology

The data used in this study is from Zillow’s Home Value Index (ZHVI) and Observed Rent Index (ZORI), U.S. Census Bureau’s 2022 American Community Survey, and Freddie Mac’s Primary Mortgage Market Survey. To determine the relative cost of buying vs. renting by location, researchers calculated the percentage difference in the monthly mortgage payment and property taxes for a median price home compared to the monthly rent payment for a median price rental. The monthly mortgage payment reflects a 30-year mortgage with a 10% down payment at a 7.44% interest rate. Monthly property tax estimates were obtained using American Community Survey data by dividing aggregate annual property taxes paid in each location by the aggregate value of all homes. The resulting percentage was multiplied by the median home price and divided by 12. Only locations with available data from all sources were included in the analysis. To improve relevance, cities were divided into groups based on population size: large (350,000+), midsize (150,000–349,999), and small (100,000–149,999).

References

- Duca, J. and Murphy, A. (2021, December 28). Why House Prices Surged as the COVID-19 Pandemic Took Hold. Federal Reserve Bank of Dallas. https://www.dallasfed.org/research/economics/2021/1228

- U.S. Department of Housing and Urban Development. (2023, October 5). Median Sales Price of Houses Sold for the United States [Data set]. https://fred.stlouisfed.org/series/MSPUS

- U.S. Bureau of Labor Statistics (2023, November 14). Consumer Price Index for All Urban Consumers: Rent of Primary Residence in U.S. City Average [Data set]. https://fred.stlouisfed.org/series/CUUR0000SEHA

- Zillow. (2023, December 31). Zillow Home Value Index [Data set]. https://www.zillow.com/research/data/

- Zillow. (2023, December 31). Zillow Observed Rent Index [Data set]. https://www.zillow.com/research/data/

- U.S. Census Bureau. (2022). American Community Survey 1-Year Estimates [Data set]. https://www.census.gov/programs-surveys/acs

- Freddie Mac. (2023, December 31). Primary Mortgage Market Survey [Data set]. https://www.freddiemac.com/pmms

Full Results

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.