U.S. Cities Where Millennials Are Buying the Most Expensive Homes [2023 Edition]

The COVID-19 pandemic transformed how Americans work, popularizing remote work by necessity. This pivot to a work-from-anywhere mentality also created a shift in where Americans live, causing more and more people to move away from dense cities like New York, Los Angeles, and the Bay Area to smaller and more affordable cities, suburbs, and rural areas across the U.S.

The relocation of tech jobs, big companies, and countless other opportunities away from coastal and mega-city hubs has played a role in escalating America’s housing affordability crisis. As Americans have infiltrated less occupied areas in search of more space, housing prices and rents have surged in once-affordable areas, culminating in home prices in the U.S. reaching record highs.

Existing home prices increased over 45% from pre-pandemic levels in December 2019 to June 2022, according to Standard & Poor’s CoreLogic Case-Shiller Home Price Index. Now that the millennial generation has finally reached peak age for homeownership, some economists believe the millennial appetite for home-buying will continue to drive housing prices higher and higher for years to come.

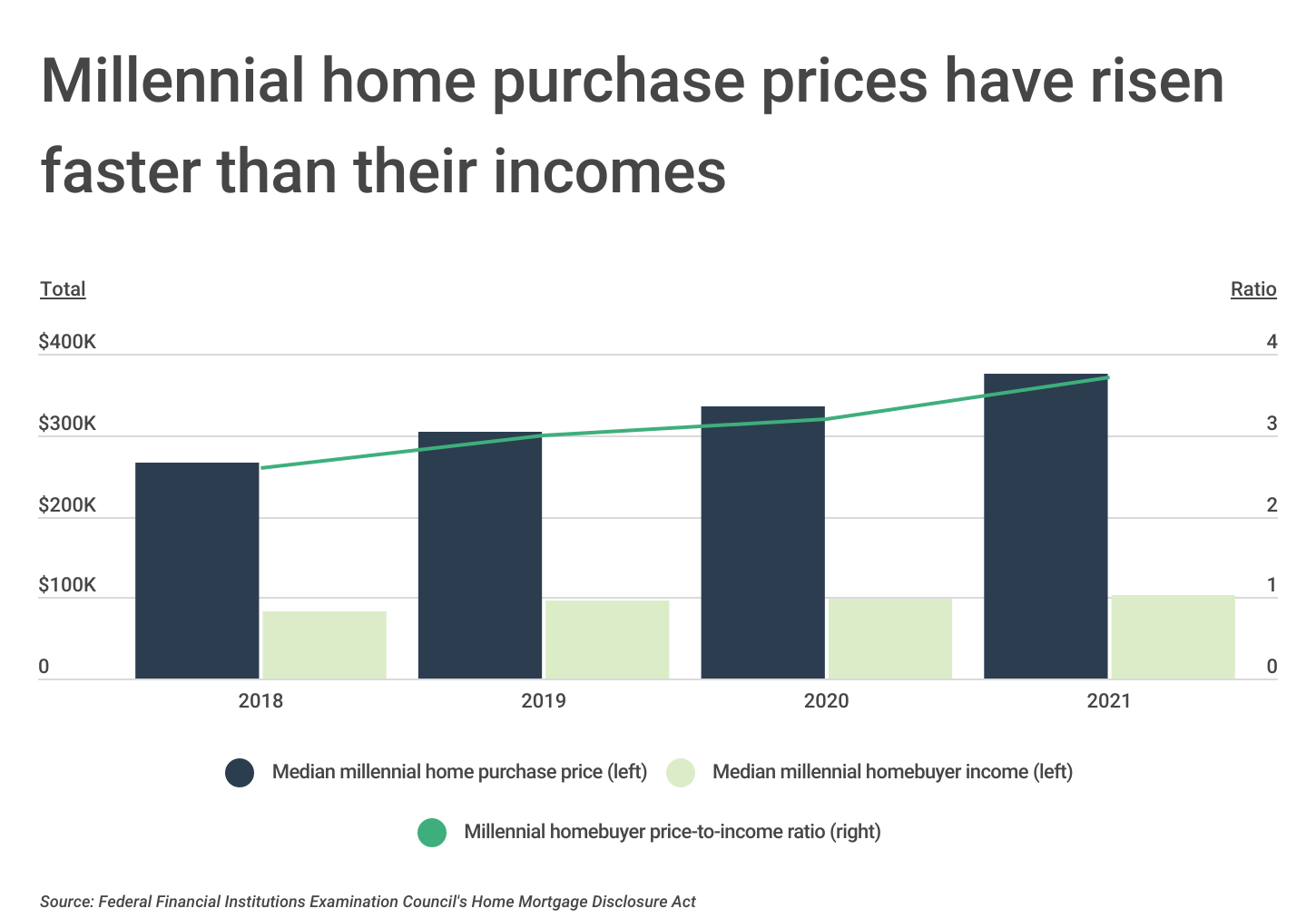

Many millennials are reaching the age where they are getting ready to settle down, form households, and have children—all of which require more space, and for many, buying property. Millennials are also deep enough into their careers to accumulate savings and pay off student loans, a significant barrier to homeownership. Yet while median millennial income has increased in the last four years, home prices have grown much faster.

The millennial homebuyer price-to-income ratio, or the ratio between what millennials are spending on homes versus what they make in a year, has increased significantly from pre-pandemic levels, deepening the divide between what millennials must pay to own and what they actually make. In 2018 and 2019, the millennial homebuyer price-to-income ratio was 2.6 and 3.0, respectively. By 2021, the millennial homebuyer price-to-income ratio increased to a striking 3.7, highlighting the mounting financial barriers for millennials when it comes to homeownership. While median millennial homebuyer income increased 24% from 2018 to 2021, it failed to keep pace with the median millennial home purchase price, which increased roughly 42% in the same time period.

FOR HOMEOWNERS

Looking to increase the value of your home with an updated kitchen or a renovated bathroom? Be sure to consider builders risk insurance for homeowners which will provide coverage for your home while it’s under renovation.

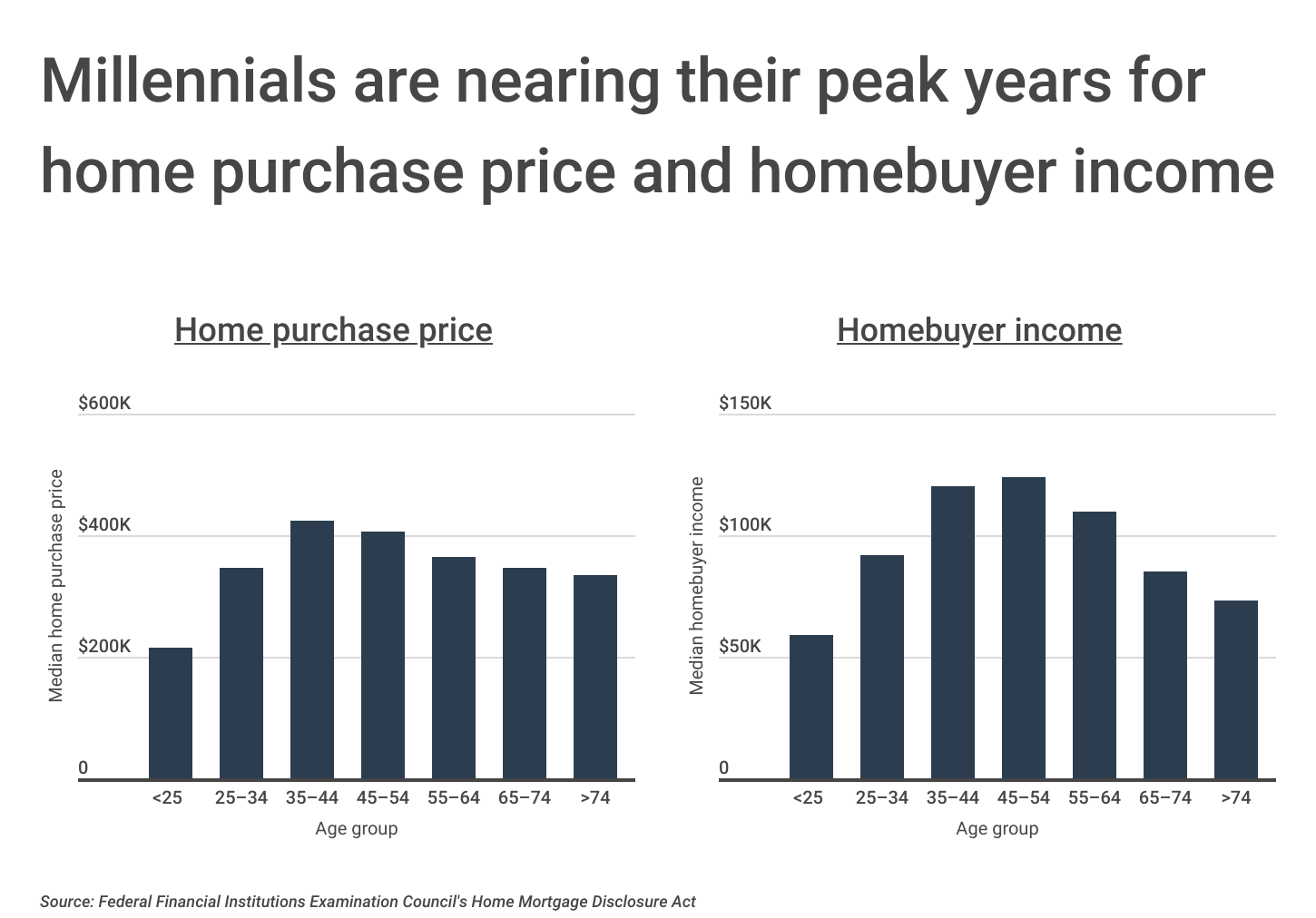

In spite of the growing gap between millennial home prices and millennial incomes, millennials are entering their prime earning years, making it a pivotal time to buy a home. The median income for homebuyers between 35 and 44 was $120,000 in 2021, which is 30% more than the median income for homebuyers between 25 and 34 ($92,000), and 103% more than that for homebuyers under 25 ($59,000). Gen X was the only age group earning more than millennials, with a median homebuyer income of $124,000—which also means that millennials can expect some remaining growth in purchasing power in the years ahead.

This additional income will likely come in handy, because despite millennials earning less than Gen X, they have been spending more on home purchases than any other generation. The median home purchase price for individuals ages 35 to 44 was $425,000. That’s 23% higher than the median home purchase price of individuals ages 25 to 34, and approximately 5% more than individuals ages 45 to 54.

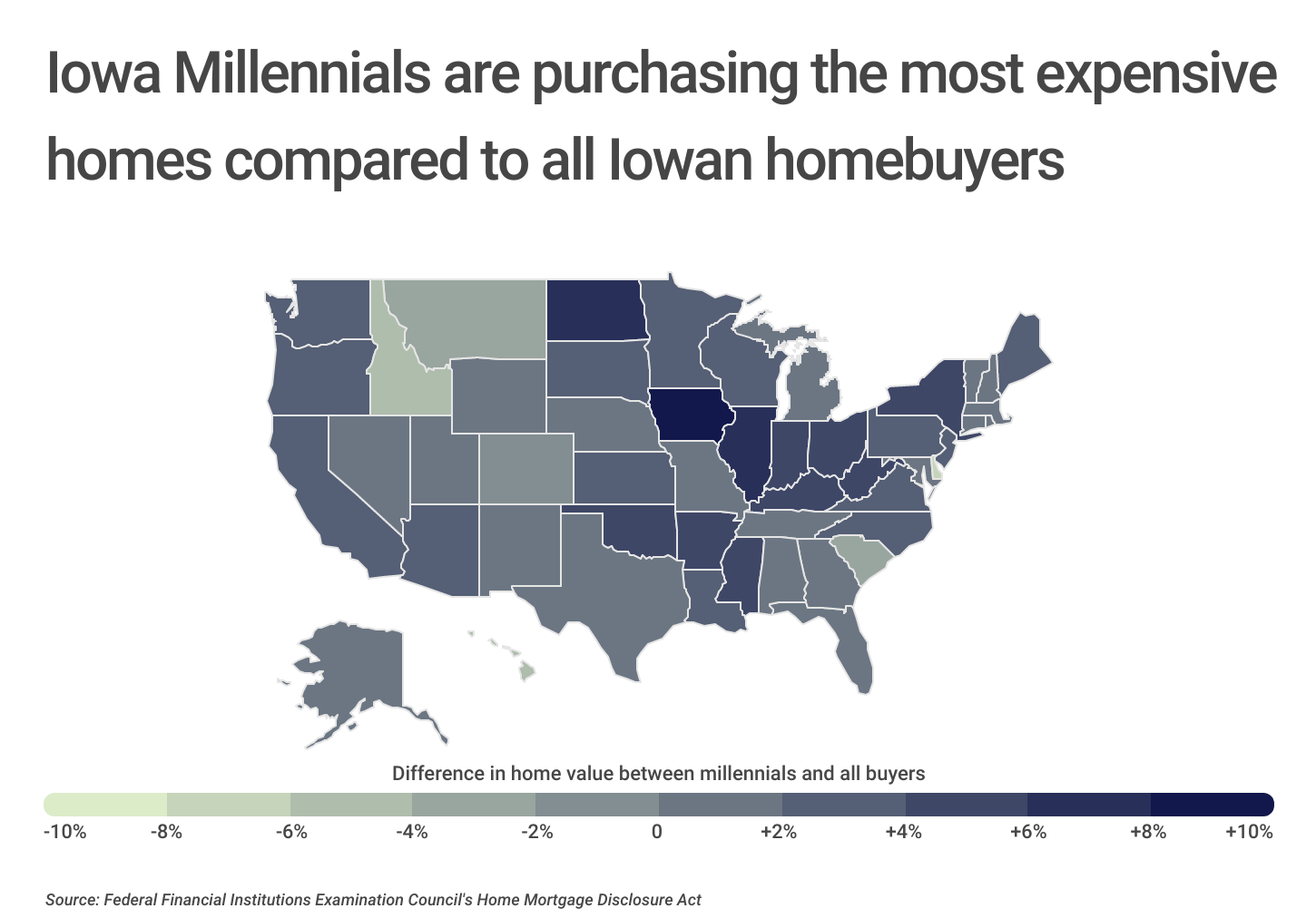

The nation’s largest generation has begun buying homes at a time where dwindling supply and soaring demand have contributed to an unprecedented rise in housing costs, so buying more expensive homes is a necessity for many. At the state level, the gap between millennial home purchase prices and the median purchase price across all buyers is greatest in the Midwest. In states like Iowa, North Dakota, and Illinois, millennials are spending at least 7% more on home purchases than what is typical across all buyers.

Of course, it’s worth noting that the median millennial purchase price in Iowa was $235,000 in 2021, and the median purchase price for all homebuyers was $215,000. So while millennial home purchases are relatively more expensive in certain Midwest states, in absolute terms, millennials are buying the most expensive homes in states like California, Hawaii, Washington, and Massachusetts.

The data used in this analysis is from the Home Mortgage Disclosure Act. To determine the locations where millennials are buying the most expensive homes, researchers at Construction Coverage compared the median purchase price in 2021 for millennial homebuyers to all homebuyers. Only home purchases with conventional mortgages issued in 2021 were included in the analysis.

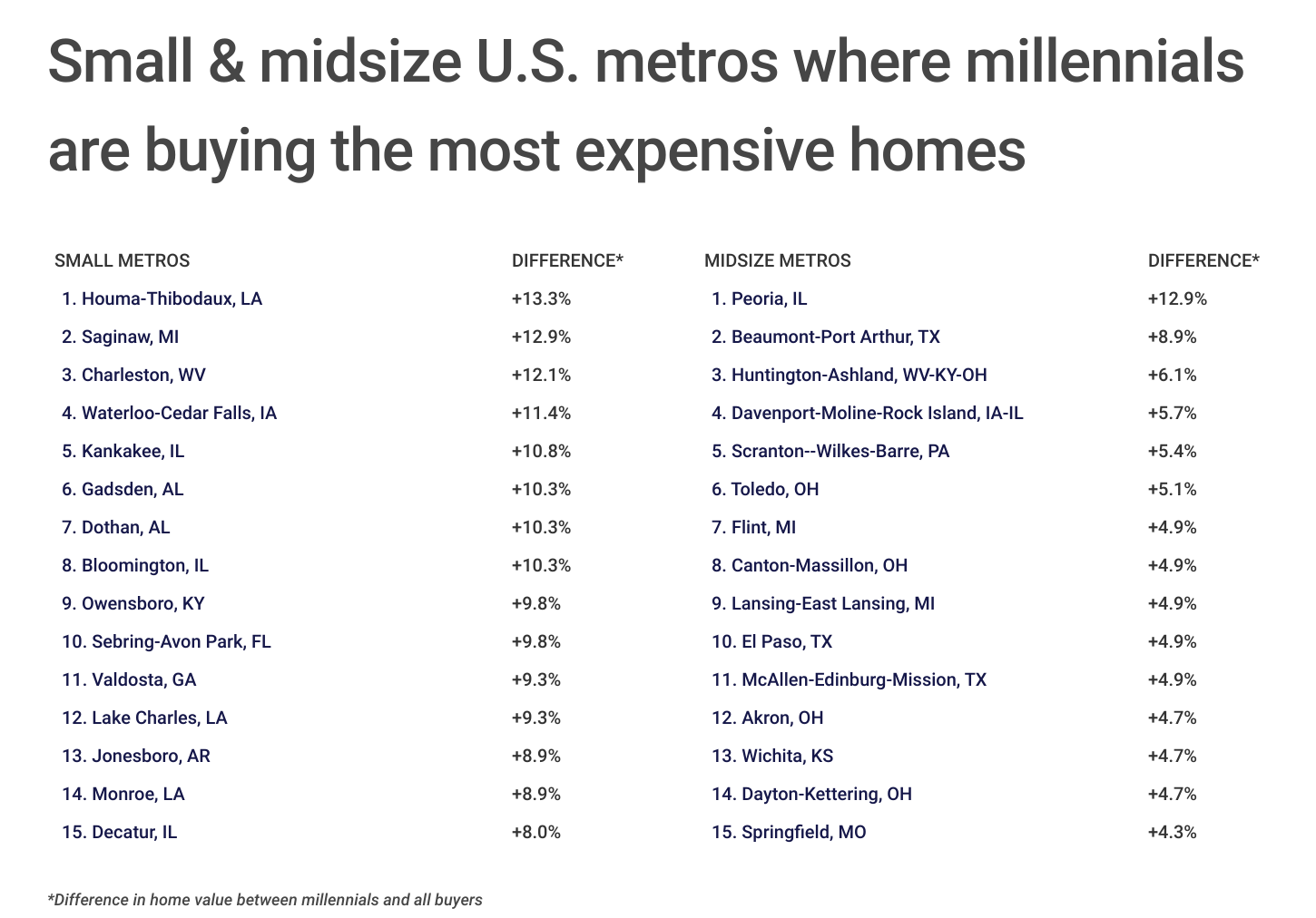

Here are the U.S. metropolitan areas where millennials are buying the most expensive homes relative to other buyers.

Large U.S. Metros Where Millennials Are Buying the Most Expensive Homes

Photo Credit: Sean Pavone / Shutterstock

15. Austin-Round Rock-Georgetown, TX

- Difference in home value between millennials and all buyers: +2.2%

- Median home value (millennial buyers): $455,000

- Median home value (all buyers): $445,000

- Median income (millennial buyers): $137,000

- Median income (all buyers): $140,000

Photo Credit: Don Donelson / Shutterstock

14. Miami-Fort Lauderdale-Pompano Beach, FL

- Difference in home value between millennials and all buyers: +2.4%

- Median home value (millennial buyers): $425,000

- Median home value (all buyers): $415,000

- Median income (millennial buyers): $114,000

- Median income (all buyers): $116,000

Photo Credit: ESB Professional / Shutterstock

13. Raleigh-Cary, NC

- Difference in home value between millennials and all buyers: +2.6%

- Median home value (millennial buyers): $395,000

- Median home value (all buyers): $385,000

- Median income (millennial buyers): $110,000

- Median income (all buyers): $111,000

Photo Credit: Jon Bilous / Shutterstock

12. Charlotte-Concord-Gastonia, NC-SC

- Difference in home value between millennials and all buyers: +2.7%

- Median home value (millennial buyers): $375,000

- Median home value (all buyers): $365,000

- Median income (millennial buyers): $104,000

- Median income (all buyers): $102,000

Photo Credit: ESB Professional / Shutterstock

11. Atlanta-Sandy Springs-Alpharetta, GA

- Difference in home value between millennials and all buyers: +2.7%

- Median home value (millennial buyers): $385,000

- Median home value (all buyers): $375,000

- Median income (millennial buyers): $105,000

- Median income (all buyers): $104,000

Photo Credit: Checubus / Shutterstock

10. Seattle-Tacoma-Bellevue, WA

- Difference in home value between millennials and all buyers: +2.9%

- Median home value (millennial buyers): $705,000

- Median home value (all buyers): $685,000

- Median income (millennial buyers): $145,000

- Median income (all buyers): $143,000

Photo Credit: Bonnie Fink / Shutterstock

9. Tampa-St. Petersburg-Clearwater, FL

- Difference in home value between millennials and all buyers: +3.0%

- Median home value (millennial buyers): $345,000

- Median home value (all buyers): $335,000

- Median income (millennial buyers): $99,000

- Median income (all buyers): $99,000

Photo Credit: Rudy Balasko / Shutterstock

8. Chicago-Naperville-Elgin, IL-IN-WI

- Difference in home value between millennials and all buyers: +3.1%

- Median home value (millennial buyers): $335,000

- Median home value (all buyers): $325,000

- Median income (millennial buyers): $101,000

- Median income (all buyers): $99,000

Photo Credit: f11photo / Shutterstock

7. Hartford-East Hartford-Middletown, CT

- Difference in home value between millennials and all buyers: +3.4%

- Median home value (millennial buyers): $305,000

- Median home value (all buyers): $295,000

- Median income (millennial buyers): $96,000

- Median income (all buyers): $95,000

Photo Credit: Sean Pavone / Shutterstock

6. Memphis, TN-MS-AR

- Difference in home value between millennials and all buyers: +3.5%

- Median home value (millennial buyers): $295,000

- Median home value (all buyers): $285,000

- Median income (millennial buyers): $93,000

- Median income (all buyers): $92,000

Photo Credit: Sean Pavone / Shutterstock

5. Indianapolis-Carmel-Anderson, IN

- Difference in home value between millennials and all buyers: +3.5%

- Median home value (millennial buyers): $295,000

- Median home value (all buyers): $285,000

- Median income (millennial buyers): $86,000

- Median income (all buyers): $84,000

Photo Credit: aceshot1 / Shutterstock

4. Cincinnati, OH-KY-IN

- Difference in home value between millennials and all buyers: +3.6%

- Median home value (millennial buyers): $285,000

- Median home value (all buyers): $275,000

- Median income (millennial buyers): $90,000

- Median income (all buyers): $87,000

Photo Credit: Henryk Sadura / Shutterstock

3. Grand Rapids-Kentwood, MI

- Difference in home value between millennials and all buyers: +3.6%

- Median home value (millennial buyers): $285,000

- Median home value (all buyers): $275,000

- Median income (millennial buyers): $81,000

- Median income (all buyers): $79,000

Photo Credit: Harold Stiver / Shutterstock

2. Louisville/Jefferson County, KY-IN

- Difference in home value between millennials and all buyers: +3.9%

- Median home value (millennial buyers): $265,000

- Median home value (all buyers): $255,000

- Median income (millennial buyers): $75,000

- Median income (all buyers): $73,000

Photo Credit: f11photo / Shutterstock

1. Cleveland-Elyria, OH

- Difference in home value between millennials and all buyers: +4.3%

- Median home value (millennial buyers): $245,000

- Median home value (all buyers): $235,000

- Median income (millennial buyers): $85,000

- Median income (all buyers): $84,000

Detailed Findings & Methodology

The data used in this analysis is from the Federal Financial Institutions Examination Council’s 2021 Home Mortgage Disclosure Act. To determine the locations where millennials are buying the most expensive homes, researchers at Construction Coverage compared the median price for conventional residential homes with an originated mortgage for millennials and all buyers. For the purposes of this analysis, the millennials generation was approximated using ages 25 to 44 in the year 2021. In the event of a tie, the location with the greater median millennial home value was ranked higher. To improve relevance, only metropolitan areas with at least 100,000 residents were included, and metros were grouped into cohorts based on population size: small (100,000-349,999), midsize (350,000-999,999), and large (1,000,000 or more).

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.