Cities With the Highest Home Price-to-Income Ratios

Note: This is the most recent release of our Cities With the Highest Home Price-to-Income Ratios study. To see data from prior years, please visit the Full Results section below.

One of the major economic stories in recent years has been the lasting impact of inflation. While year-over-year wage growth in the U.S. remains above pre-pandemic levels, the benefit of rising wages for most households has been limited by increasing prices in many consumer categories. The U.S. Bureau of Labor Statistics is still reporting price increases of more than 3%—notably above the 2% target inflation rate. Recent increases in the CPI primarily came from increases in the cost of dining out, transportation, and shelter.

The latter category tends to be a major pressure on household incomes. Housing is the largest regular expenditure for most households, so the failure of wages to keep up with housing prices can make housing costs even more expensive in real dollars. And since the onset of the pandemic, housing prices have skyrocketed, with the cost of homes sold in the U.S. increasing by more than 40%.

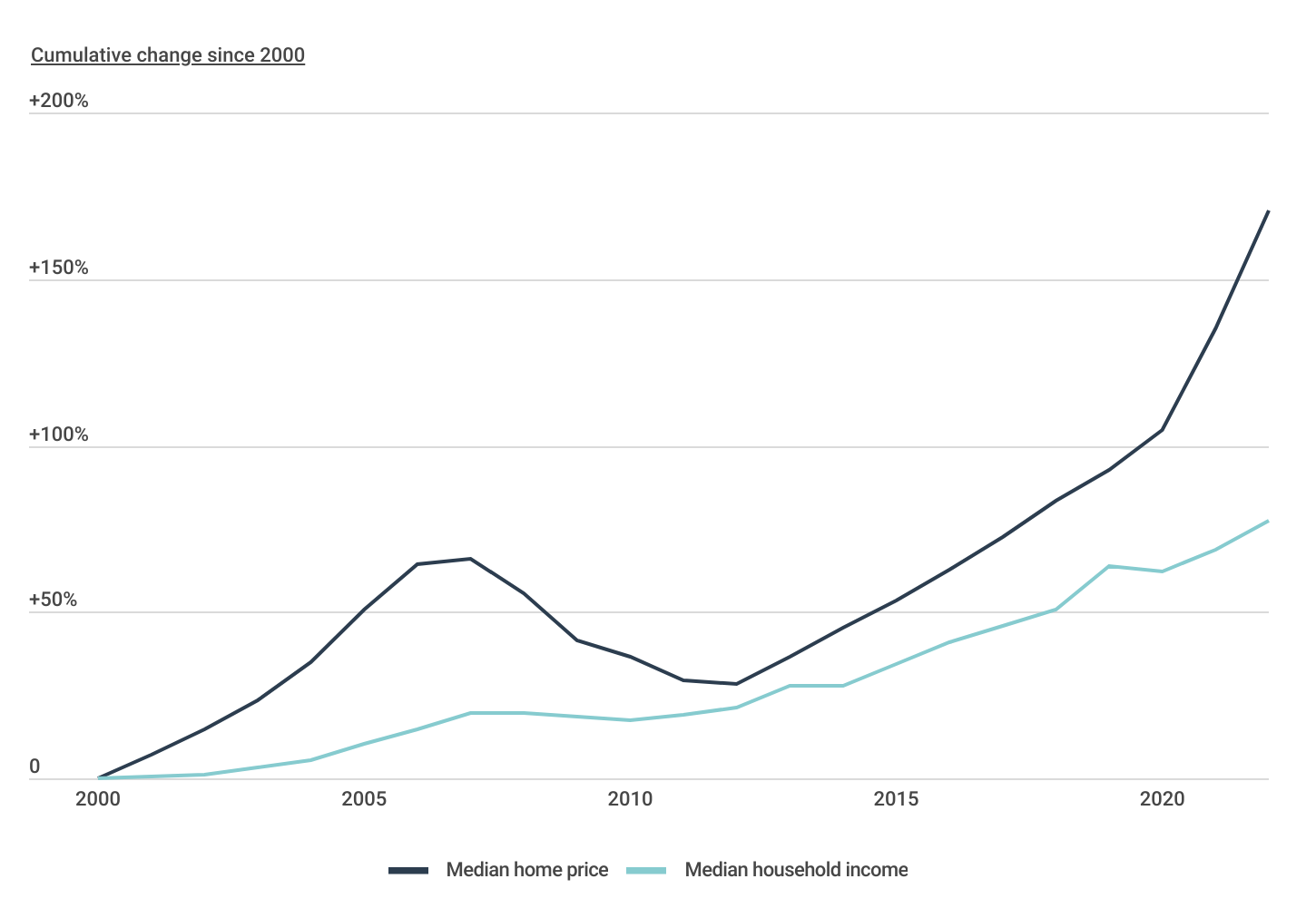

Changes in Home Prices and Household Incomes

Household incomes have failed to keep up with increasing home prices

Income growth lagging behind rising housing costs, however, is not a recent development. The rate of growth of median income has trailed behind that of home prices for at least the last two decades. From 2000 to 2022, the median annual household income in the U.S. increased by 77.6%, from $41,990 to $74,580, while the median home price nearly tripled—a 170% increase—from $123,086 to $332,826, according to data from the U.S. Census Bureau and Zillow. On an inflation-adjusted basis, household incomes increased by just 4.5% since 2000, while home prices increased by 59.1%.

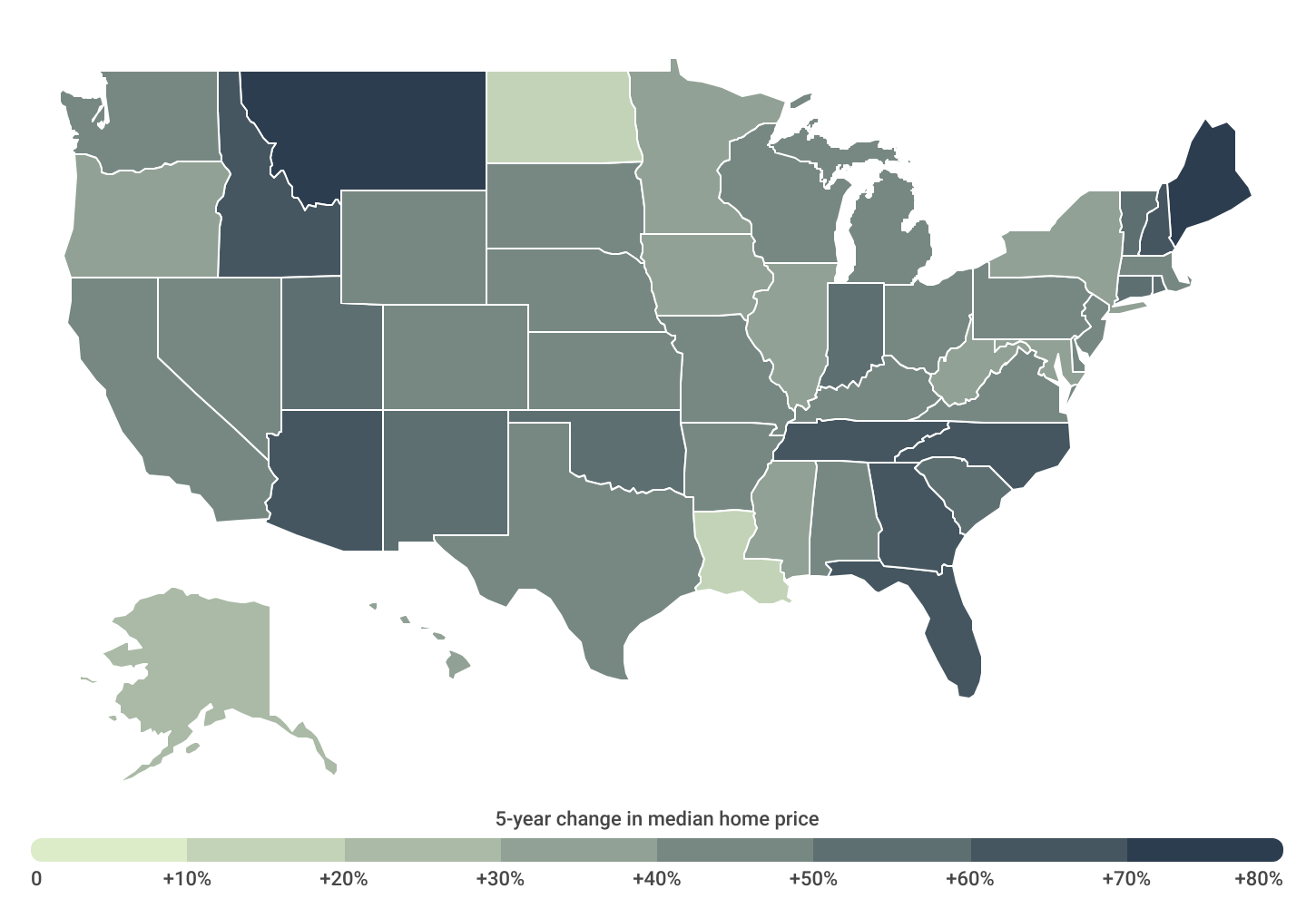

Geographical Differences in Home Price Growth

Home prices in the Mountain West, Northeast, and South Atlantic are growing the fastest

The gap between wage growth and home price growth may be most severely felt in areas where home prices are increasing the fastest. States in the Mountain West have shown the most rapid increases in housing costs in recent years, led by Montana, where the median home price is up by 71.2% just over the last five years. Other fast-growing western states like Idaho, Arizona, Utah, and New Mexico have also seen rapid home price increases over that span.

FOR BUILDERS

As a result of ongoing labor shortages, increased material costs, and supply chain disruptions, it’s more important than ever to make sure your business is running efficiently. Choosing the right software can make all the difference. That’s why we’ve handpicked the best construction accounting software and construction management software based on user reviews, features, price, and more.

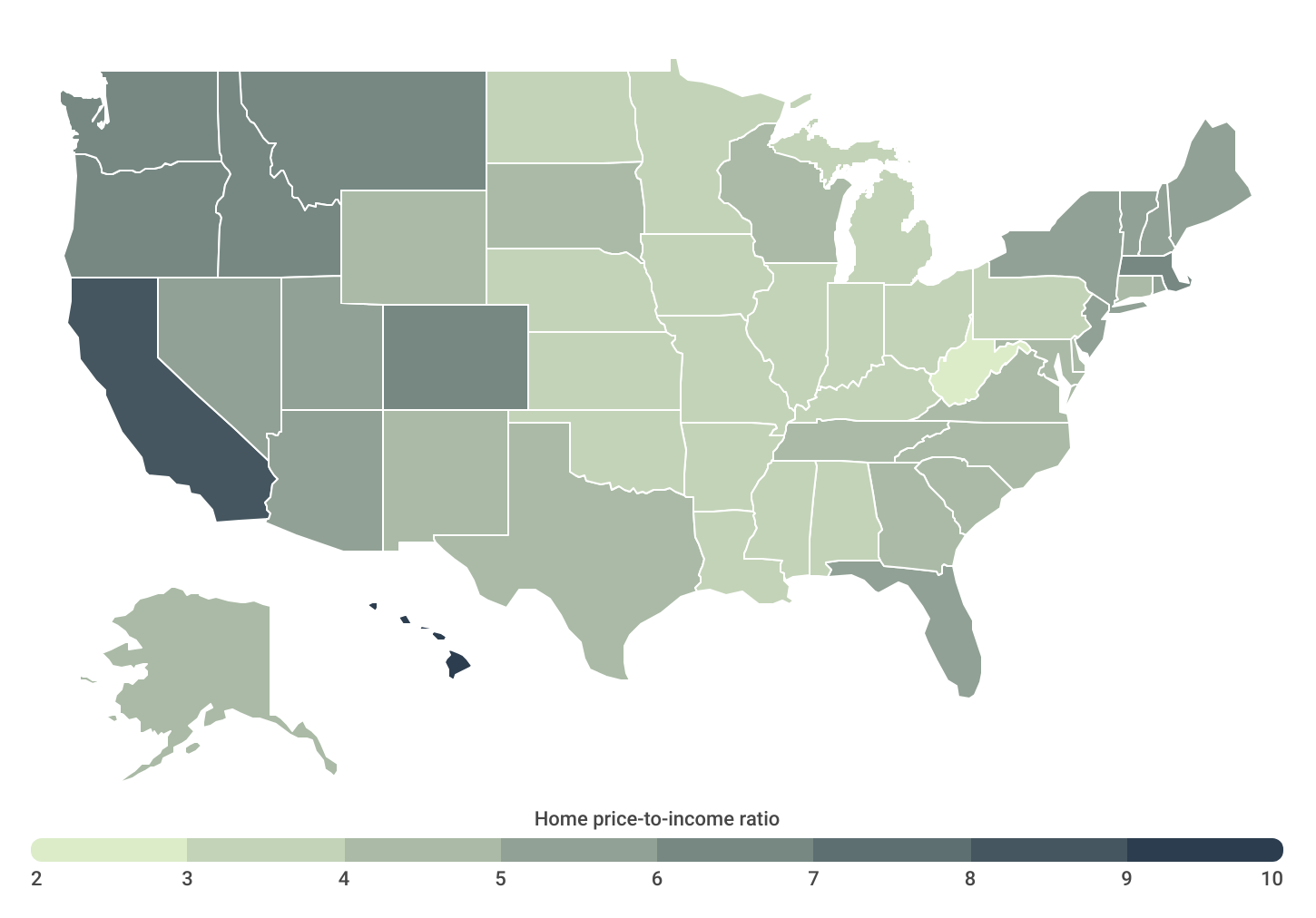

Price-to-Income Ratio by State

Western states & Hawaii have the most unaffordable homes

Many of the Mountain West states that saw home prices soar in recent years are now among the national leaders in home price-to-income ratio. The ratio of median home price to median income is one indicator for housing affordability. Nationally, that ratio is 4.7, but the top 10 states—nine of which are found in the West—currently have ratios of 5.7 or greater. The top states are Hawaii (9.1) and California (8.4), two of the states with the highest home prices and long-running issues with affordable housing. And at the local level, some California cities exhibit even starker ratios, with four of the top five most expensive large cities in the U.S. all being located in the Golden State.

Below is a breakdown of price-to-income ratios for over 380 cities and all 50 states conducted by Construction Coverage, using data from Zillow and the U.S. Census Bureau. For more detailed information, refer to the methodology section.

Large Cities With the Highest Price-to-Income Ratios

| Top Cities | Ratio* |

|---|---|

| 1. Los Angeles, CA | 12.5 |

| 2. San Jose, CA | 10.5 |

| 3. Long Beach, CA | 10.3 |

| 4. San Diego, CA | 9.9 |

| 5. New York, NY | 9.8 |

| 6. Miami, FL | 9.2 |

| 7. San Francisco, CA | 9.0 |

| 8. Oakland, CA | 8.4 |

| 9. Boston, MA | 8.3 |

| 10. Seattle, WA | 7.3 |

| 11. Portland, OR | 6.5 |

| 12. Denver, CO | 6.4 |

| 13. Tucson, AZ | 6.4 |

| 14. Washington, DC | 6.0 |

| 15. Austin, TX | 6.0 |

| Bottom Cities | Ratio* |

|---|---|

| 1. Detroit, MI | 1.9 |

| 2. Cleveland, OH | 2.7 |

| 3. Memphis, TN | 2.9 |

| 4. Wichita, KS | 3.1 |

| 5. Oklahoma City, OK | 3.1 |

| 6. Baltimore, MD | 3.2 |

| 7. Tulsa, OK | 3.6 |

| 8. Indianapolis, IN | 3.6 |

| 9. Kansas City, MO | 3.7 |

| 10. Louisville, KY | 3.7 |

| 11. Philadelphia, PA | 3.8 |

| 12. Milwaukee, WI | 3.9 |

| 13. Columbus, OH | 3.9 |

| 14. Omaha, NE | 4.0 |

| 15. Chicago, IL | 4.0 |

Midsize Cities With the Highest Price-to-Income Ratios

| Top Cities | Ratio* |

|---|---|

| 1. Glendale, CA | 15.2 |

| 2. Sunnyvale, CA | 11.8 |

| 3. Irvine, CA | 11.6 |

| 4. Huntington Beach, CA | 11.3 |

| 5. Garden Grove, CA | 10.6 |

| 6. Anaheim, CA | 10.4 |

| 7. Oceanside, CA | 10.2 |

| 8. Santa Ana, CA | 9.9 |

| 9. Honolulu, HI | 9.6 |

| 10. Paterson, NJ | 9.4 |

| 11. Fremont, CA | 9.1 |

| 12. Bellevue, WA | 8.9 |

| 13. Newark, NJ | 8.8 |

| 14. Oxnard, CA | 8.6 |

| 15. Chula Vista, CA | 8.3 |

| Bottom Cities | Ratio* |

|---|---|

| 1. Toledo, OH | 2.4 |

| 2. Montgomery, AL | 2.5 |

| 3. Akron, OH | 2.7 |

| 4. Columbus, GA | 2.9 |

| 5. Shreveport, LA | 3.0 |

| 6. Kansas City, KS | 3.1 |

| 7. Amarillo, TX | 3.1 |

| 8. Birmingham, AL | 3.2 |

| 9. St. Louis, MO | 3.2 |

| 10. Des Moines, IA | 3.3 |

| 11. Aurora, IL | 3.3 |

| 12. Laredo, TX | 3.4 |

| 13. Corpus Christi, TX | 3.5 |

| 14. Pittsburgh, PA | 3.5 |

| 15. Lubbock, TX | 3.6 |

Small Cities With the Highest Price-to-Income Ratios

| Top Cities | Ratio* |

|---|---|

| 1. Newport Beach, CA | 25.4 |

| 2. Palo Alto, CA | 19.0 |

| 3. El Monte, CA | 12.3 |

| 4. Costa Mesa, CA | 12.2 |

| 5. El Cajon, CA | 12.1 |

| 6. Inglewood, CA | 12.1 |

| 7. Hawthorne, CA | 11.9 |

| 8. Torrance, CA | 10.9 |

| 9. East Los Angeles, CA | 10.3 |

| 10. Carlsbad, CA | 10.2 |

| 11. Tustin, CA | 10.2 |

| 12. Flagstaff, AZ | 10.2 |

| 13. Fullerton, CA | 10.0 |

| 14. Downey, CA | 10.0 |

| 15. Orange, CA | 9.9 |

| Bottom Cities | Ratio* |

|---|---|

| 1. Jackson, MS | 1.4 |

| 2. Flint, MI | 1.7 |

| 3. Decatur, IL | 1.7 |

| 4. Lawton, OK | 2.4 |

| 5. Springfield, IL | 2.4 |

| 6. Waterloo, IA | 2.5 |

| 7. Joliet, IL | 2.6 |

| 8. Rockford, IL | 2.7 |

| 9. St. Joseph, MO | 2.8 |

| 10. Parma, OH | 2.8 |

| 11. Lansing, MI | 2.9 |

| 12. Racine, WI | 2.9 |

| 13. Cedar Rapids, IA | 2.9 |

| 14. Hammond, IN | 3.0 |

| 15. Davenport, IA | 3.0 |

States With the Highest Price-to-Income Ratios

| Top States | Ratio* |

|---|---|

| 1. Hawaii | 9.1 |

| 2. California | 8.4 |

| 3. Montana | 6.6 |

| 4. Oregon | 6.4 |

| 5. Massachusetts | 6.3 |

| 6. Washington | 6.3 |

| 7. Idaho | 6.1 |

| 8. Colorado | 6.0 |

| 9. Nevada | 5.9 |

| 10. Utah | 5.7 |

| 11. New York | 5.7 |

| 12. Arizona | 5.7 |

| 13. Florida | 5.7 |

| 14. Maine | 5.5 |

| 15. Rhode Island | 5.4 |

| Bottom States | Ratio* |

|---|---|

| 1. West Virginia | 2.9 |

| 2. Iowa | 3.0 |

| 3. Kansas | 3.2 |

| 4. Mississippi | 3.3 |

| 5. Kentucky | 3.3 |

| 6. Oklahoma | 3.3 |

| 7. Ohio | 3.3 |

| 8. Illinois | 3.3 |

| 9. North Dakota | 3.4 |

| 10. Louisiana | 3.5 |

| 11. Indiana | 3.5 |

| 12. Michigan | 3.5 |

| 13. Arkansas | 3.6 |

| 14. Nebraska | 3.6 |

| 15. Pennsylvania | 3.6 |

*Home price-to-income ratio

Methodology

The data used in this analysis is from Zillow’s Zillow Home Value Index (ZHVI) and the U.S. Census Bureau’s 2022 American Community Survey. To find the locations with the highest price-to-income ratios, researchers from Construction Coverage ranked locations by the median home price divided by the median annual household income. In the event of a tie, the location with the larger median home price was ranked higher. To improve relevance, only cities with sufficient data were included in the analysis, and they were grouped into cohorts based on population size: small (less than 350,000), midsize (350,000–1,000,000), and large (more than 1,000,000).

References

- Economic Policy Institute. (n.d.). Nominal Wage Tracker. Retrieved on April 1, 2024 from https://www.epi.org/nominal-wage-tracker/.

- Board of Governors of the Federal Reserve System. (2020, August 27). Why does the Federal Reserve aim for inflation of 2 percent over the longer run?. Retrieved on April 1, 2024 from https://www.federalreserve.gov/faqs/economy_14400.htm.

- U.S. Bureau of Labor Statistics. (2024, March 12). Consumer Price Index News Release. Retrieved on April 1, 2024 from https://www.bls.gov/news.release/archives/cpi_03122024.htm.

- Olsen, S. (2024, March 11). Influx of Sellers Arrives Just in Time for Spring Shopping Season (February 2024 Market Report). Zillow. Retrieved on April 1, 2024 from https://www.zillow.com/research/february-2024-market-report-33777/.

- Zillow. (n.d.). Housing Data, Zillow Home Value Index (ZHVI) [Data set]. Retrieved on April 1, 2024 from https://www.zillow.com/research/data/.

- U.S. Census Bureau. (n.d.) American Community Survey (ACS). Retrieved on April 1, 2024 from https://www.census.gov/programs-surveys/acs.

Full Results

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.