U.S. Cities With the Biggest Increase in Housing Inventory [2023 Edition]

The COVID-19 pandemic brought dramatic changes to the U.S. housing market. At the onset of the pandemic, housing sales and new construction initially stalled due to economic uncertainty. But as the U.S. entered survival mode and the federal funds rate was lowered drastically, home buying and building resumed. The popularization and widespread acceptance of remote work not only incentivized Americans to prioritize their space (and home offices), but allowed individuals to seek housing outside of their typical boundaries, increasing demand and contributing to inflated house prices.

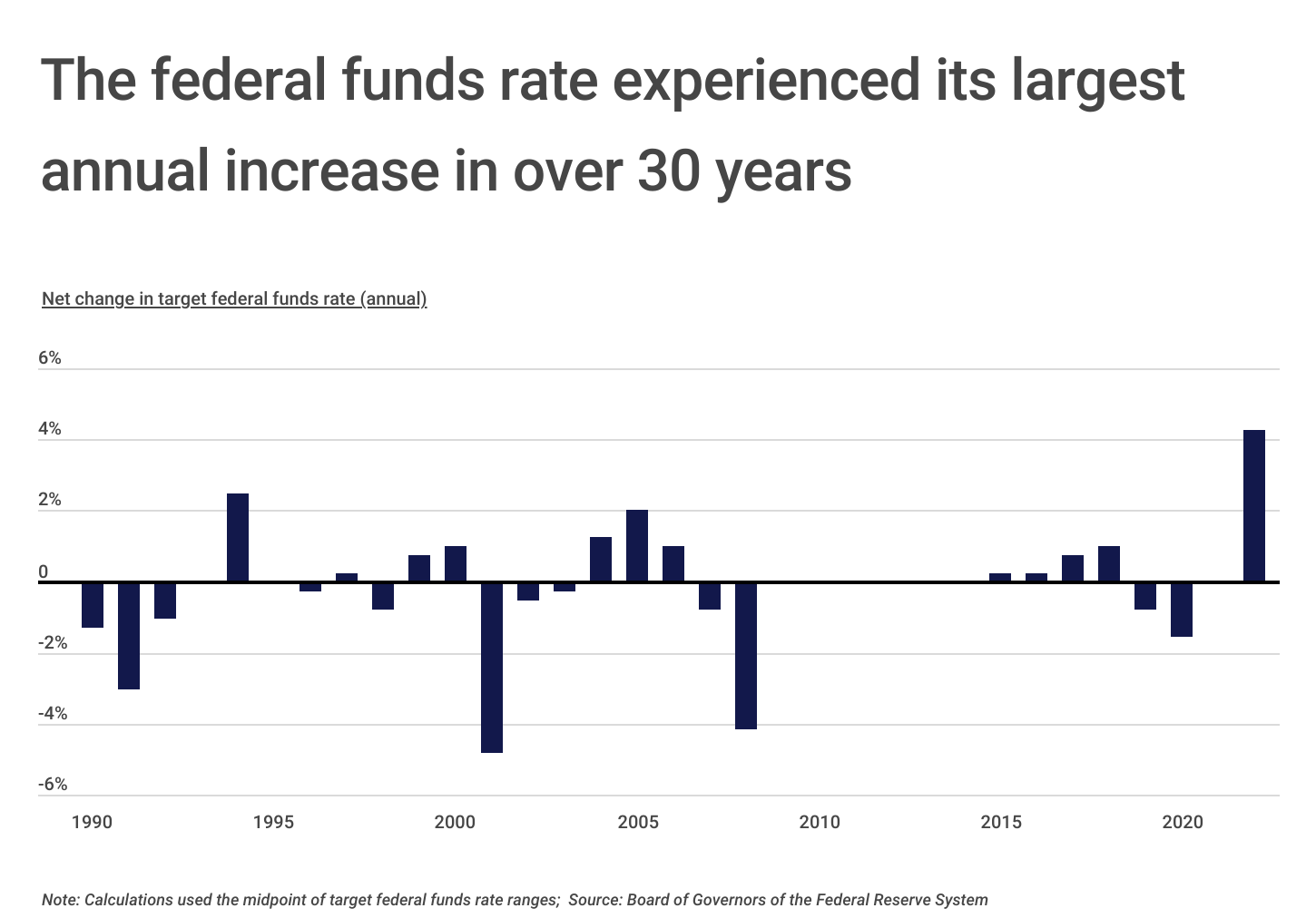

Although the federal funds rate was initially lowered in order to support spending in other areas to aid a suffering economy, this dip only lasted so long. After a 1.5% net decrease in 2020 and no rate changes in 2021, 2022 experienced its largest hike in over 30 years, with an overall net increase of 4.25%. In efforts to control raging inflation that began in 2021 and continued through 2022, the Federal Reserve initiated a series of the most aggressive rate hikes in decades. First, the Federal Reserve increased interest rates by a quarter point in March 2022, followed by a half point in May. June received a hike of three-quarters of a percentage point, which was repeated in July, September, and November, before a final half point in December.

While the federal funds rate doesn’t directly control interest rates on home loans, it influences how much it costs banks to borrow money from each other. This in turn affects mortgage rates—helping to explain their dramatic increase over the past year. By making borrowing more expensive, fewer people are able to participate, causing a ripple effect in the housing market.

While high mortgage rates are a significant barrier for potential home buyers, they do their part to increase housing inventory. The low interest rates and high demand environment of 2020 and 2021 contributed to the significant decline of housing inventory between January 2020 and December 2021, which dropped from nearly 1.3 million to just over 650,000 homes, according to data from Redfin. This aligns with a larger trend over the past two decades: from May 2012 to January 2022, U.S. housing inventory dropped from 2,194,184 available homes to 629,904—a net decrease of over 1.5 million.

However, with rising mortgage rates and an increase in home construction during COVID, U.S. housing inventory is finally showing signs of growth after years of steady decline. From January 2022 to October 2022, U.S. housing inventory increased from 629,904 to 1,173,927 available homes. While housing inventory is still below pre-pandemic levels (in March 2020, housing inventory stood at 1,365,211), this recent growth is promising for future homebuyers seeking lower asking prices.

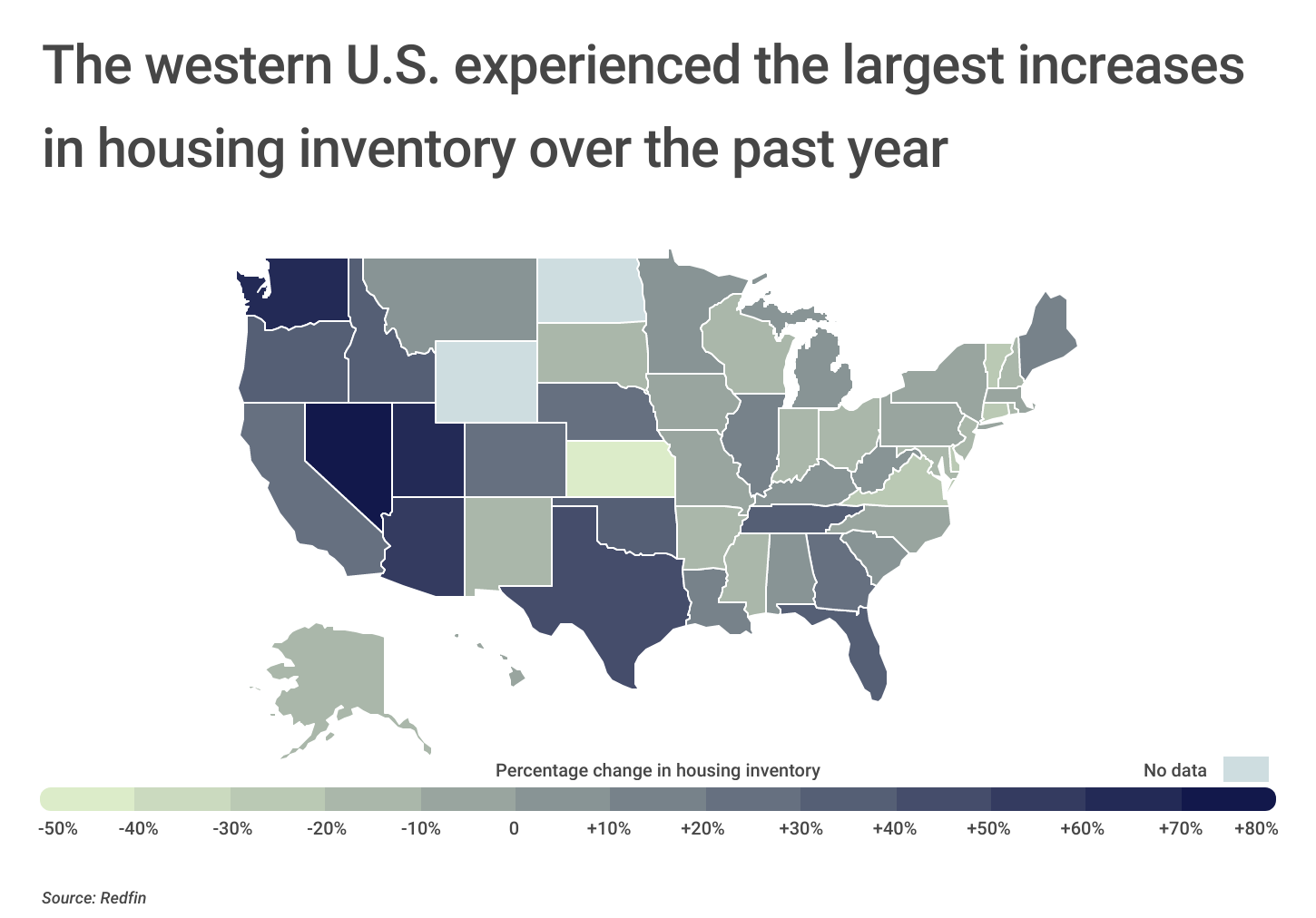

Although housing inventory is increasing throughout the U.S. overall, certain geographic regions have seen faster growth than others. The western U.S. experienced the largest increases in housing inventory from Q3 2021 to Q3 2022. Six states in the western region ranked within the top 10 of all 50 states, with Nevada (+74.7%) topping the charts. Utah and Washington weren’t far behind, experiencing positive changes of 63.0% and 60.8% respectively.

This trend of housing inventory gains in the west applies to cities of all sizes, along with certain cities in states like Florida, Michigan, and Texas, which make attractive places to buy a home due to their growing job markets and affordable costs of living.

To determine the locations with the biggest increases in housing inventory, researchers at Construction Coverage analyzed the latest data from Redfin’s Data Center. The researchers ranked cities by the year-over-year percentage increase in housing inventory. In the event of a tie, the city with the bigger total change in average monthly housing inventory was ranked higher.

Here are the U.S. cities with the biggest increase in housing inventory.

Large Cities With the Biggest Increase in Housing Inventory

Photo Credit: Lucky-photographer / Shutterstock

15. San Diego, CA

- Percentage change in housing inventory: +29.1%

- Total change in housing inventory: +418

- Months’ supply (Q3 2022): 2.0

- Months’ supply (Q3 2021): 0.9

FOR CONSTRUCTION BUSINESSES

As the construction industry experiences a slowdown, it becomes crucial to enhance the quality of your bids in order to secure a limited number of available projects. To achieve this goal, you can leverage two powerful tools: construction estimating software and takeoff software. These technologies enable you to improve bid accuracy and expedite the bidding process.

Photo Credit: Uladzik Kryhin / Shutterstock

14. San Jose, CA

- Percentage change in housing inventory: +31.1%

- Total change in housing inventory: +228

- Months’ supply (Q3 2022): 1.8

- Months’ supply (Q3 2021): 0.9

Photo Credit: Andrew Zarivny / Shutterstock

13. Denver, CO

- Percentage change in housing inventory: +32.3%

- Total change in housing inventory: +422

- Months’ supply (Q3 2022): 1.6

- Months’ supply (Q3 2021): 0.9

Photo Credit: Natalia Bratslavsky / Shutterstock

12. Oklahoma City, OK

- Percentage change in housing inventory: +39.6%

- Total change in housing inventory: +511

- Months’ supply (Q3 2022): 1.7

- Months’ supply (Q3 2021): 1.1

Photo Credit: Andriy Blokhin / Shutterstock

11. Sacramento, CA

- Percentage change in housing inventory: +41.8%

- Total change in housing inventory: +367

- Months’ supply (Q3 2022): 2.0

- Months’ supply (Q3 2021): 1.0

Photo Credit: Concrete Jungle Media / Shutterstock

10. Detroit, MI

- Percentage change in housing inventory: +43.0%

- Total change in housing inventory: +727

- Months’ supply (Q3 2022): 5.9

- Months’ supply (Q3 2021): 4.2

Photo Credit: Philip Lange / Shutterstock

9. Fort Worth, TX

- Percentage change in housing inventory: +47.6%

- Total change in housing inventory: +802

- Months’ supply (Q3 2022): 2.3

- Months’ supply (Q3 2021): 1.3

Photo Credit: Jacob Boomsma / Shutterstock

8. Fresno, CA

- Percentage change in housing inventory: +48.9%

- Total change in housing inventory: +258

- Months’ supply (Q3 2022): 1.9

- Months’ supply (Q3 2021): 1.0

Photo Credit: Matt Gush / Shutterstock

7. Bakersfield, CA

- Percentage change in housing inventory: +49.1%

- Total change in housing inventory: +298

- Months’ supply (Q3 2022): 2.2

- Months’ supply (Q3 2021): 1.2

Photo Credit: Roschetzky Photography / Shutterstock

6. Austin, TX

- Percentage change in housing inventory: +51.7%

- Total change in housing inventory: +1,224

- Months’ supply (Q3 2022): 3.8

- Months’ supply (Q3 2021): 1.7

Photo Credit: Kevin J King / Shutterstock

5. Tampa, FL

- Percentage change in housing inventory: +52.7%

- Total change in housing inventory: +677

- Months’ supply (Q3 2022): 2.6

- Months’ supply (Q3 2021): 1.2

Photo Credit: Gregory E. Clifford / Shutterstock

4. Phoenix, AZ

- Percentage change in housing inventory: +65.6%

- Total change in housing inventory: +2,116

- Months’ supply (Q3 2022): 3.3

- Months’ supply (Q3 2021): 1.3

Photo Credit: trekandshoot / Shutterstock

3. Las Vegas, NV

- Percentage change in housing inventory: +72.1%

- Total change in housing inventory: +2,147

- Months’ supply (Q3 2022): 4.3

- Months’ supply (Q3 2021): 1.5

Photo Credit: Jacob Boomsma / Shutterstock

2. Aurora, CO

- Percentage change in housing inventory: +85.0%

- Total change in housing inventory: +429

- Months’ supply (Q3 2022): 1.6

- Months’ supply (Q3 2021): 0.6

Photo Credit: Tim Roberts Photography / Shutterstock

1. Mesa, AZ

- Percentage change in housing inventory: +87.9%

- Total change in housing inventory: +810

- Months’ supply (Q3 2022): 3.2

- Months’ supply (Q3 2021): 1.2

Detailed Findings & Methodology

To determine the locations with the biggest increases in housing inventory, researchers at Construction Coverage analyzed the latest data from Redfin’s Data Center. The researchers ranked cities by biggest increase in average monthly housing inventory between Q3 of 2021 to that same period in 2022. In the event of a tie, the city with the bigger total change in average monthly housing inventory was ranked higher. Researchers also calculated the average months’ supply for the same periods.

To improve relevance, only cities with at least 100,000 people were included in the analysis. Additionally, cities were grouped into the following cohorts based on population size:

- Small cities: 100,000-149,999

- Midsize cities: 150,000-349,999

- Large cities: more than 350,000

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.