U.S. Cities With the Highest Rent Prices

While inflation in most sectors of the economy has improved over the last year, the cost of shelter in the U.S. continues to remain high for many consumers. Inflation data released by the Bureau of Labor Statistics in October 2023 revealed that while the Consumer Price Index overall was up 3.7% year-over-year, the index for shelter had risen 7.2% over the same span. Increasing rent prices have been a major reason why.

The dynamics of the rental market in recent years largely reflect simple supply and demand. In the years following the housing crash and Great Recession, the number of new housing projects plummeted and were slow to recover over the course of the 2010s. Around the same time, the Millennial generation—America’s largest, with more than 72 million members—began to reach adulthood, introducing greater demand in the market.

Economic conditions during the COVID-19 pandemic have exacerbated issues with the rental market. As fast-rising real estate values priced more people out of homebuying, rental markets became more competitive among consumers. On the supply side, inflation in the cost of materials, rising interest rates, and tightness in the labor market have all contributed to difficulties in developing new housing stock.

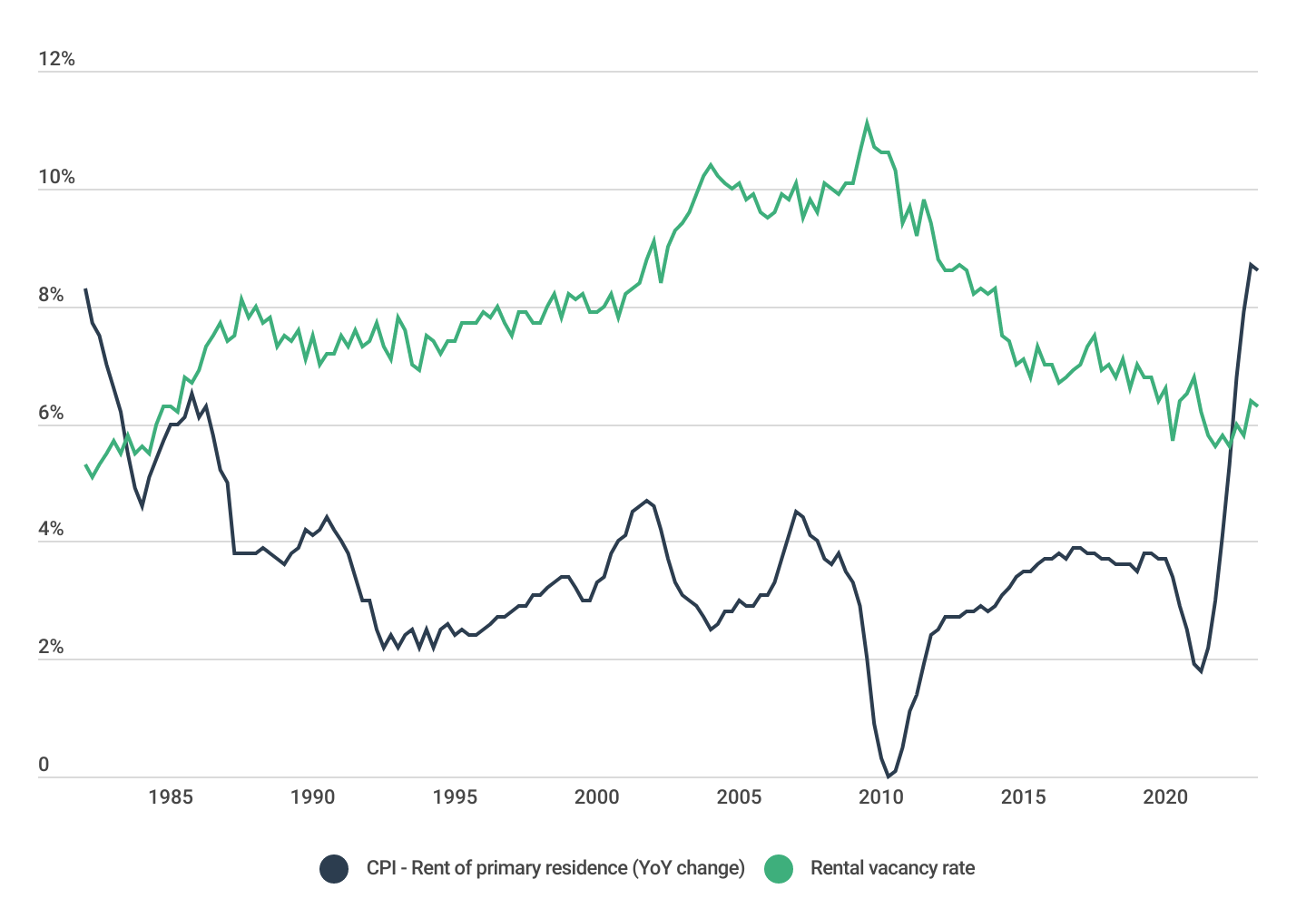

Rental Supply & Prices Over Time

A historically tight rental market drove prices up at the fastest rate since the 1980s

All of these issues have come to a head over the last couple of years. The combined crunch of limited supply and high demand have driven the national rental vacancy rate—a key metric used to track the availability of rental housing—to its lowest levels since the late 1980s. With fewer units available, prices have risen dramatically. The year-over-year change in rental prices leaped from a recent low of 1.8% in Q2 2021 to 8.6% in Q2 2023.

RELATED

Are you planning a home renovation? A standard homeowners insurance policy won’t cover your home while it’s being renovated, so you should consider builders risk insurance for homeowners—designed specifically for the home while under construction or renovation.

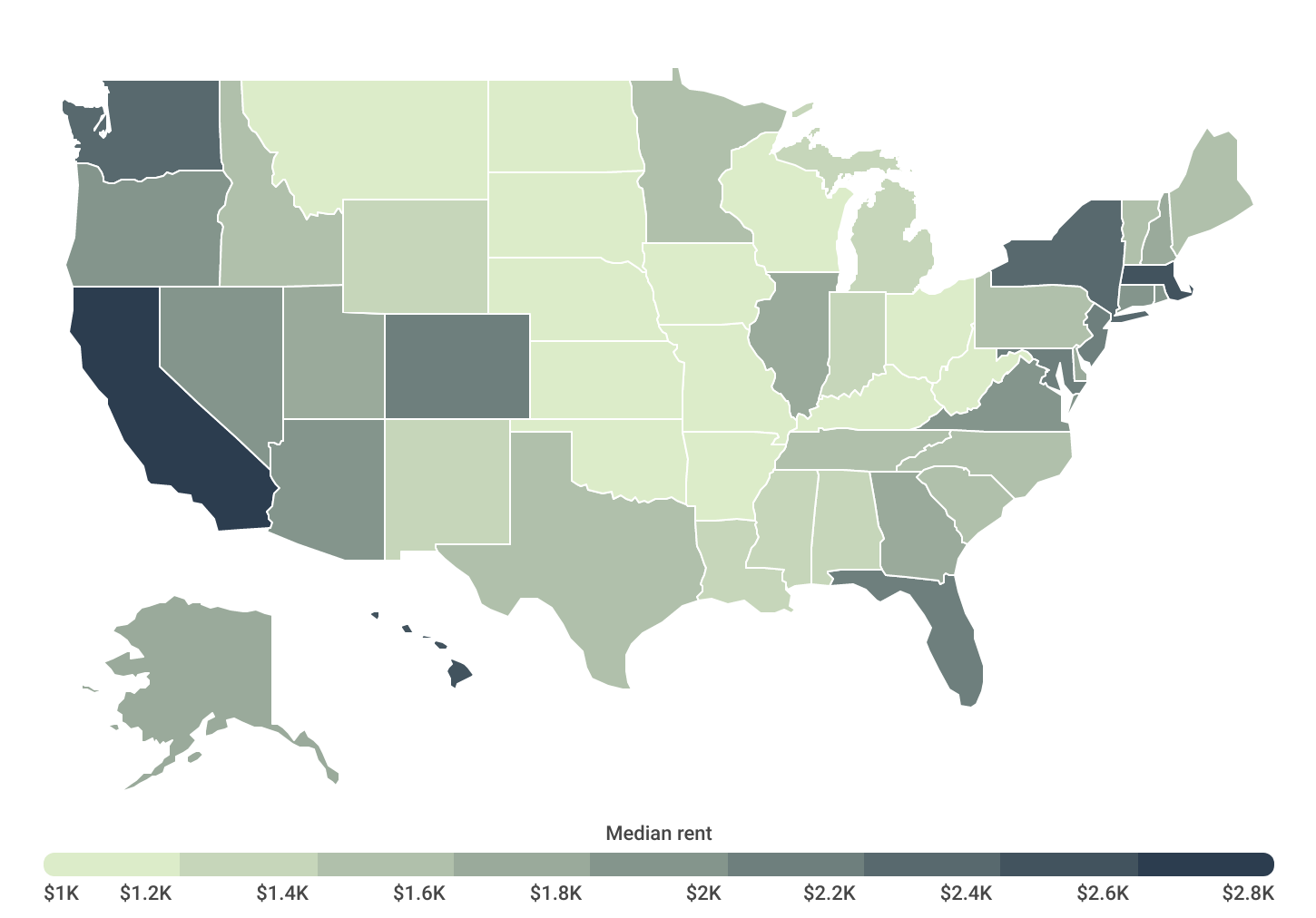

Residential Rent Prices by Location

Top coastal states are about twice as expensive as the Midwest for renters

However, the impact of rent increases has not been felt evenly across the U.S., as renters in some locations face much higher costs than in others. Recently released data from the Department of Housing and Urban Development (HUD) shows that nine states have median market rents topping $2,000 per month, led by California at $2,690. On top of national supply and demand dynamics, many of the most expensive locations face more intense demand due to strong local economies alongside more severe supply constraints resulting from laws and regulations that make it difficult to add housing.

The most expensive states are, unsurprisingly, also home to some of the nation’s most expensive metropolitan areas for renters. California is home to all of the top 10 most expensive metros overall, with San Jose ($3,451) leading the large metro cohort, Salinas ($3,353) leading the midsize cohort, and Santa Cruz ($4,134) leading the small cohort. Other major metros like Boston, Seattle, and New York are not far behind.

Below is a complete breakdown of rental prices across more than 350 metropolitan areas grouped by size and all 50 states. The analysis was conducted by researchers at Construction Coverage using data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau. For more information on how each statistic was computed, refer to the methodology section below.

Most & Least Expensive Large Metros for Renters

| Top Metros | Median Rent |

|---|---|

| 1. San Jose-Sunnyvale-Santa Clara, CA | $3,451 |

| 2. San Diego-Chula Vista-Carlsbad, CA | $3,175 |

| 3. San Francisco-Oakland-Berkeley, CA | $3,141 |

| 4. Los Angeles-Long Beach-Anaheim, CA | $2,777 |

| 5. Boston-Cambridge-Newton, MA-NH | $2,740 |

| 6. Seattle-Tacoma-Bellevue, WA | $2,692 |

| 7. New York-Newark-Jersey City, NY-NJ-PA | $2,589 |

| 8. Miami-Fort Lauderdale-Pompano Beach, FL | $2,450 |

| 9. Riverside-San Bernardino-Ontario, CA | $2,441 |

| 10. Sacramento-Roseville-Folsom, CA | $2,415 |

| 11. Denver-Aurora-Lakewood, CO | $2,373 |

| 12. Portland-Vancouver-Hillsboro, OR-WA | $2,245 |

| 13. Washington-Arlington-Alexandria, DC-VA-MD-WV | $2,212 |

| 14. Phoenix-Mesa-Chandler, AZ | $2,198 |

| 15. Orlando-Kissimmee-Sanford, FL | $2,181 |

| Bottom Metros | Median Rent |

|---|---|

| 1. Cleveland-Elyria, OH | $1,203 |

| 2. Oklahoma City, OK | $1,226 |

| 3. Tulsa, OK | $1,235 |

| 4. Milwaukee-Waukesha, WI | $1,246 |

| 5. Pittsburgh, PA | $1,261 |

| 6. Cincinnati, OH-KY-IN | $1,269 |

| 7. Buffalo-Cheektowaga, NY | $1,277 |

| 8. St. Louis, MO-IL | $1,316 |

| 9. Rochester, NY | $1,365 |

| 10. Columbus, OH | $1,390 |

| 11. Louisville-Jefferson County, KY-IN | $1,406 |

| 12. Detroit-Warren-Dearborn, MI | $1,414 |

| 13. Kansas City, MO-KS | $1,422 |

| 14. Birmingham-Hoover, AL | $1,441 |

| 15. Grand Rapids-Kentwood, MI | $1,451 |

FOR LANDLORDS

Landlord insurance limits the many risks associated with renting out property by compensating landlords in the event that there is property damage or liability. To protect your assets and income, you should consider carrying landlord insurance. Here are the best landlord insurance companies of 2023.

Most & Least Expensive Midsize Metros for Renters

| Top Metros | Median Rent |

|---|---|

| 1. Salinas, CA | $3,353 |

| 2. Santa Maria-Santa Barbara, CA | $3,345 |

| 3. Oxnard-Thousand Oaks-Ventura, CA | $2,879 |

| 4. Vallejo, CA | $2,845 |

| 5. Urban Honolulu, HI | $2,649 |

| 6. Santa Rosa-Petaluma, CA | $2,632 |

| 7. Bridgeport-Stamford-Norwalk, CT | $2,451 |

| 8. North Port-Sarasota-Bradenton, FL | $2,132 |

| 9. Trenton-Princeton, NJ | $2,075 |

| 10. Colorado Springs, CO | $2,048 |

| 11. Naples-Marco Island, FL | $2,044 |

| 12. Fort Collins, CO | $2,017 |

| 13. Stockton, CA | $2,012 |

| 14. Cape Coral-Fort Myers, FL | $1,967 |

| 15. Port St. Lucie, FL | $1,962 |

| Bottom Metros | Median Rent |

|---|---|

| 1. Youngstown-Warren-Boardman, OH-PA | $917 |

| 2. Canton-Massillon, OH | $988 |

| 3. Davenport-Moline-Rock Island, IA-IL | $1,014 |

| 4. Peoria, IL | $1,024 |

| 5. Springfield, MO | $1,038 |

| 6. Toledo, OH | $1,070 |

| 7. Brownsville-Harlingen, TX | $1,070 |

| 8. Wichita, KS | $1,116 |

| 9. Huntington-Ashland, WV-KY-OH | $1,118 |

| 10. Lafayette, LA | $1,118 |

| 11. Dayton-Kettering, OH | $1,130 |

| 12. McAllen-Edinburg-Mission, TX | $1,133 |

| 13. Lansing-East Lansing, MI | $1,134 |

| 14. Akron, OH | $1,142 |

| 15. Flint, MI | $1,158 |

Most & Least Expensive Small Metros for Renters

| Top Metros | Median Rent |

|---|---|

| 1. Santa Cruz-Watsonville, CA | $4,134 |

| 2. Napa, CA | $3,014 |

| 3. San Luis Obispo-Paso Robles, CA | $2,559 |

| 4. Boulder, CO | $2,519 |

| 5. Kahului-Wailuku-Lahaina, HI | $2,499 |

| 6. Bremerton-Silverdale-Port Orchard, WA | $2,271 |

| 7. Barnstable Town, MA | $2,209 |

| 8. Flagstaff, AZ | $2,153 |

| 9. California-Lexington Park, MD | $2,144 |

| 10. Olympia-Lacey-Tumwater, WA | $2,081 |

| 11. Bend, OR | $2,043 |

| 12. Charlottesville, VA | $2,002 |

| 13. Hilton Head Island-Bluffton, SC | $1,930 |

| 14. Burlington-South Burlington, VT | $1,897 |

| 15. Kingston, NY | $1,880 |

| Bottom Metros | Median Rent |

|---|---|

| 1. Fort Smith, AR-OK | $945 |

| 2. Mansfield, OH | $967 |

| 3. Cedar Rapids, IA | $986 |

| 4. Wheeling, WV-OH | $991 |

| 5. Jefferson City, MO | $995 |

| 6. Weirton-Steubenville, WV-OH | $1,003 |

| 7. Johnstown, PA | $1,003 |

| 8. Decatur, IL | $1,009 |

| 9. Terre Haute, IN | $1,016 |

| 10. Kingsport-Bristol, TN-VA | $1,026 |

| 11. Jonesboro, AR | $1,026 |

| 12. Joplin, MO | $1,026 |

| 13. Sheboygan, WI | $1,030 |

| 14. Anniston-Oxford, AL | $1,032 |

| 15. Fargo, ND-MN | $1,032 |

Most & Least Expensive States for Renters

| Top States | Median Rent |

|---|---|

| 1. California | $2,690 |

| 2. Hawaii | $2,590 |

| 3. Massachusetts | $2,431 |

| 4. New York | $2,306 |

| 5. Washington | $2,243 |

| 6. Colorado | $2,141 |

| 7. Maryland | $2,121 |

| 8. New Jersey | $2,075 |

| 9. Florida | $2,051 |

| 10. Arizona | $1,976 |

| 11. Nevada | $1,904 |

| 12. Connecticut | $1,897 |

| 13. Oregon | $1,858 |

| 14. Rhode Island | $1,834 |

| 15. Virginia | $1,815 |

| Bottom States | Median Rent |

|---|---|

| 1. Iowa | $1,061 |

| 2. North Dakota | $1,063 |

| 3. West Virginia | $1,106 |

| 4. Arkansas | $1,113 |

| 5. South Dakota | $1,125 |

| 6. Nebraska | $1,137 |

| 7. Ohio | $1,163 |

| 8. Oklahoma | $1,165 |

| 9. Kansas | $1,180 |

| 10. Wisconsin | $1,183 |

| 11. Kentucky | $1,191 |

| 12. Missouri | $1,192 |

| 13. Montana | $1,194 |

| 14. Mississippi | $1,216 |

| 15. Indiana | $1,242 |

Methodology

The data used in this study is from the U.S. Department of Housing and Urban Development’s 2024 50th Percentile Rent Estimates dataset and the U.S. Census Bureau’s 2022 American Community Survey 1-Year Estimates. To determine the locations with the highest rent prices, researchers at Construction Coverage calculated a median monthly rent estimate across all rental types in each location. This estimate was calculated as a weighted average of each location’s median monthly rent price across each rental size category (i.e. studio, one-bedroom, two-bedroom, etc.). The weights used in the calculation were the number of renter-occupied housing units belonging to each size category as reported by the Census Bureau in 2022. In the event of a tie, the location with the greater one-bedroom rent was ranked above.

Only locations with populations of 100,000 or more and data available from all sources were included. To improve relevance, metropolitan areas were grouped into size cohorts based on population: small (100,000–349,999), midsize (350,000–999,999), and large (1,000,000 or more).

References

- Bureau of Labor Statistics. (2023, October 12). Consumer Price Index News Release. https://www.bls.gov/news.release/archives/cpi_10122023.htm

- Khan, A., Weller, C., and Roberts, L. (2022, August 22). The Rental Housing Crisis Is a Supply Problem That Needs Supply Solutions. Center for American Progress. https://www.americanprogress.org/article/the-rental-housing-crisis-is-a-supply-problem-that-needs-supply-solutions/

- Marcum. (2023, August 9). Construction Industry Struggling With Inflation, Changing Economic Dynamics. Consulting-Specifying Engineer. https://www.csemag.com/articles/construction-industry-struggling-with-inflation-changing-economic-dynamics/

- Schuetz, J. (2022, February 22). Commentary: Dysfunctional policies have broken America’s housing supply chain. Brookings. https://www.brookings.edu/articles/dysfunctional-policies-have-broken-americas-housing-supply-chain/

- U.S. Department of Housing and Urban Development (HUD). (2023). 50TH PERCENTILE RENT ESTIMATES. https://www.huduser.gov/portal/datasets/50per.html

- U.S. Census Bureau. (2023). American Community Survey (ACS). https://www.census.gov/programs-surveys/acs

Full Results

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.