Cities With the Most Homebuyers Under 25

Although some unique, pandemic-related economic factors have contributed to the current state of the real estate market, some of the largest structural factors driving the current market are generational.

Baby boomers—those born between 1946 and 1964—are increasingly choosing to age in place as they reach retirement. Simultaneously, millennials, who were born between 1981 and 1996, are now America’s largest generational cohort and at a peak age for buying a first or second home. Together, these forces mean that more buyers are competing for fewer homes. And according to Freddie Mac, the supply of homes for sale was already at a record low prior to the pandemic.

Despite the residential real estate market showing signs of cooling off after a historic runup during the COVID-19 pandemic, finding a home remains challenging for many buyers. Intense competition and rising prices have made it especially difficult for young, first-time homebuyers to make a purchase.

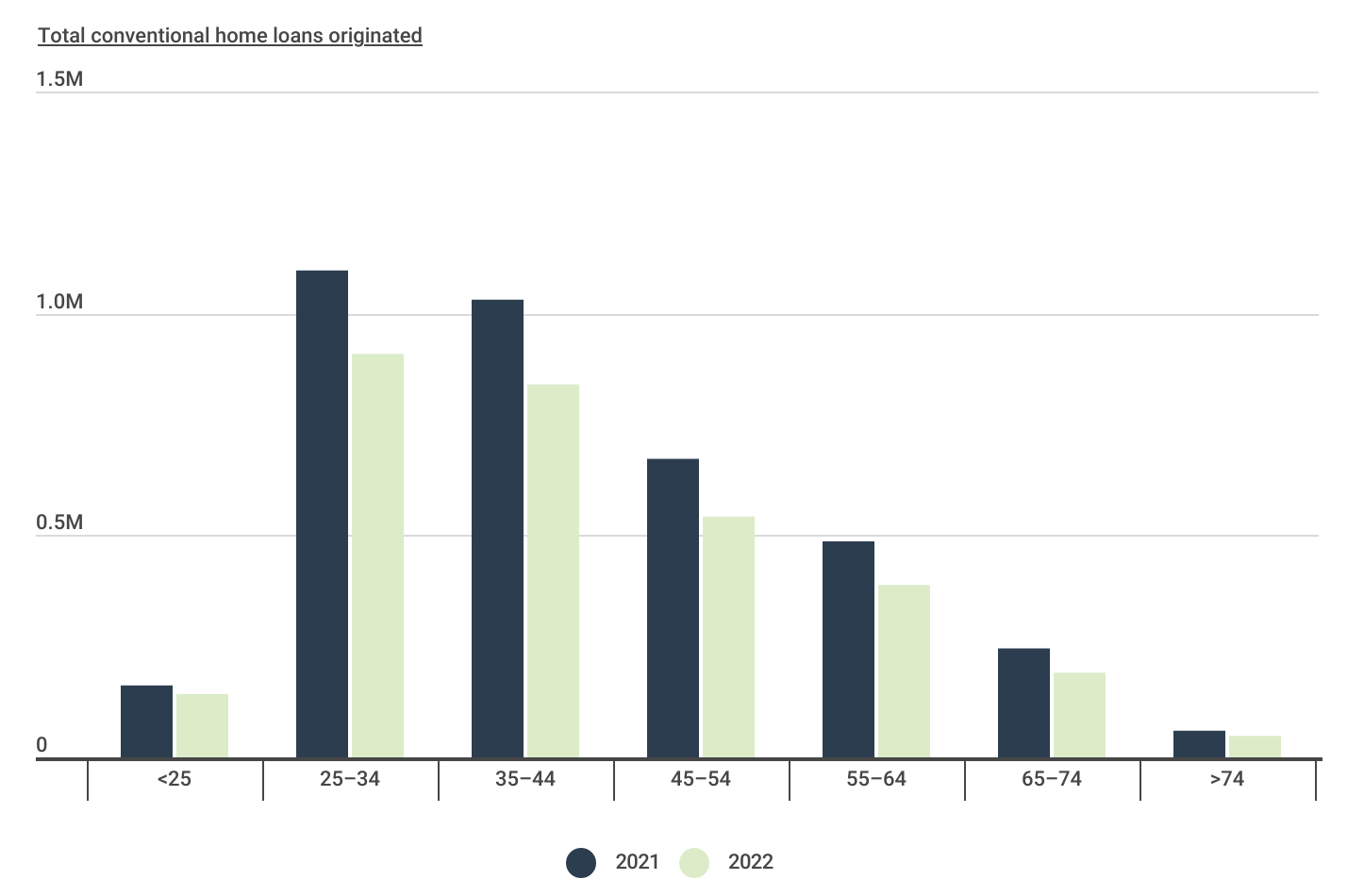

Home Purchase Loans by Age Cohort

Home purchase loans decreased across all age cohorts in 2022

The real estate cool-off is also evidenced by changing home purchase loan volume. The total number of conventional home loans originated in 2022 was down across all age groups from the year prior. Among all age cohorts, 65-74 year-olds experienced the largest percentage decline, decreasing by 22.3%. However, younger homebuyers saw smaller decreases in home purchase volume. Notably, the under-25 age group only experienced a 12.3% decline, the smallest of all cohorts and a sign of persistent housing demand from younger generations despite economic headwinds.

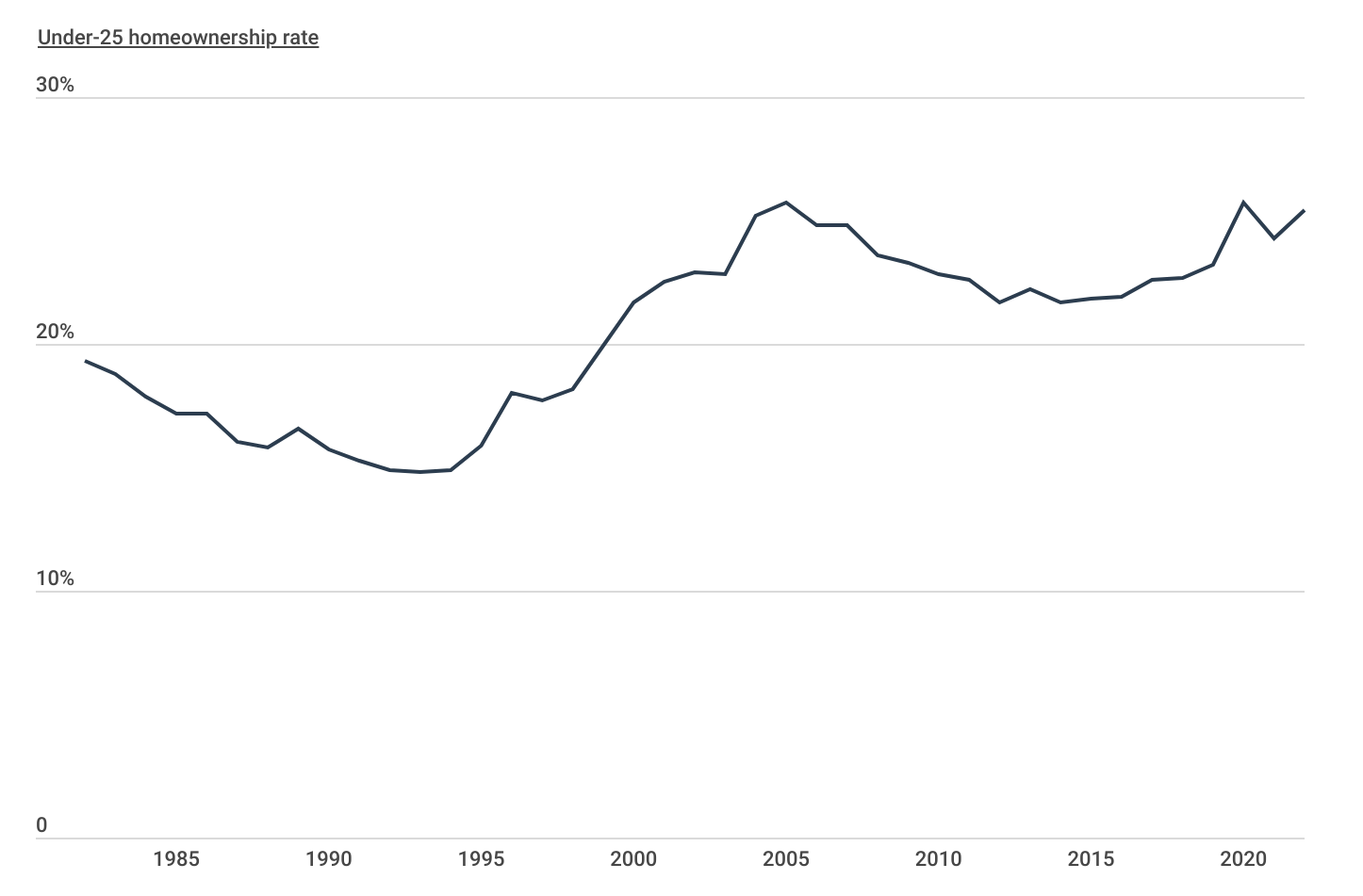

The Under-25 Homeownership Rate Over Time

The under-25 homeownership rate is approaching a new high

Even prior to 2022, homeownership interest has been increasing among young buyers in recent years. The homeownership rate for adults under 25 reached 25.7% in 2020, matching a previous peak from the height of the housing bubble in 2005. Although that figure dipped slightly in 2021, the under-25 homeownership rate sat at 25.4% in 2022, well above rates seen in the 1980s and 1990s.

FOR LANDLORDS

A landlord will face different risks than a typical homeowner, which is why there’s a special kind of insurance for rental properties. These are the best landlord insurance companies of 2023.

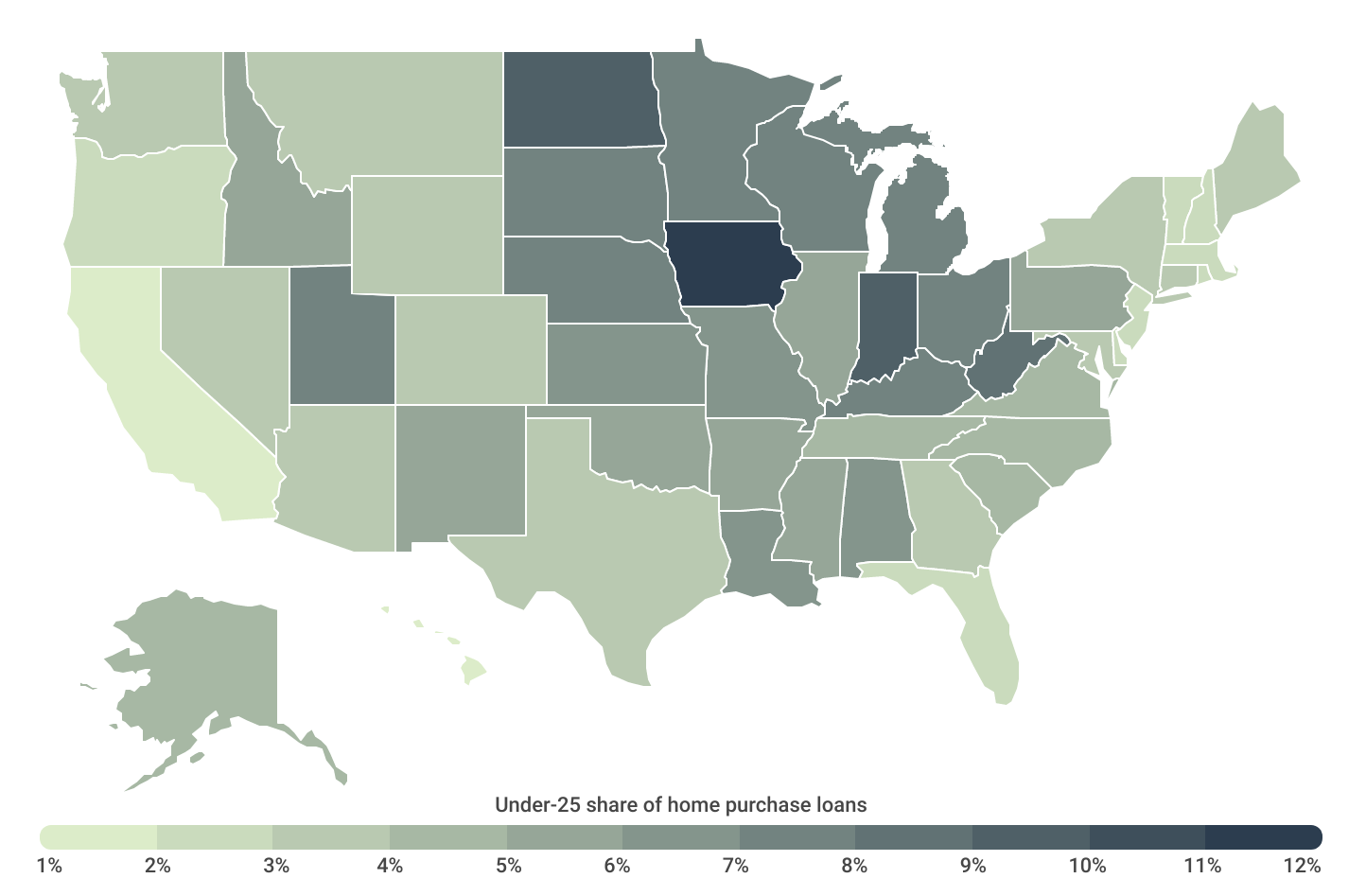

The Under-25 Homeownership Rate Varies by Location

The Midwest is home to the most homebuyers under 25 years old

For young adults interested in homeownership, some geographic locations prove more favorable than others. Many of the states with the highest shares of home purchase loans from adults under age 25 are found in the Midwest, led by Iowa at 11.5%. The Midwest tends to have lower home prices, which makes home purchases more attainable for younger homebuyers who often have less home equity built up than their older counterparts. The same trend holds at the local level, with many of the top metropolitan areas for young homeowners also found in the affordable Midwest.

In contrast, high-cost coastal states including Hawaii (1.6%) and California (1.9%) have much lower shares of home purchase loans from young adults. In these areas, would-be young homebuyers face more expensive homes and higher living costs, creating a higher barrier to entry in these real estate markets.

Below is a complete breakdown of the under-25 share of home purchase loans across more than 350 metropolitan areas (grouped by size) and all 50 states. The analysis was conducted by researchers at Construction Coverage using data from the Federal Financial Institutions Examination Council. For more information, refer to the methodology section.

Large Metros With the Most and Fewest Homebuyers Under 25

| Top Metros | Share* |

|---|---|

| 1. Louisville/Jefferson County, KY-IN | 7.9% |

| 2. Grand Rapids-Kentwood, MI | 7.9% |

| 3. Cincinnati, OH-KY-IN | 7.2% |

| 4. Detroit-Warren-Dearborn, MI | 6.7% |

| 5. St. Louis, MO-IL | 6.3% |

| 6. Birmingham-Hoover, AL | 6.3% |

| 7. Indianapolis-Carmel-Anderson, IN | 6.2% |

| 8. Cleveland-Elyria, OH | 6.0% |

| 9. Buffalo-Cheektowaga, NY | 6.0% |

| 10. Pittsburgh, PA | 5.9% |

| 11. Salt Lake City, UT | 5.9% |

| 12. Minneapolis-St. Paul-Bloomington, MN-WI | 5.8% |

| 13. Kansas City, MO-KS | 5.7% |

| 14. Rochester, NY | 5.6% |

| 15. Milwaukee-Waukesha, WI | 5.5% |

| Bottom Metros | Share* |

|---|---|

| 1. San Francisco-Oakland-Berkeley, CA | 1.1% |

| 2. San Jose-Sunnyvale-Santa Clara, CA | 1.4% |

| 3. Los Angeles-Long Beach-Anaheim, CA | 1.5% |

| 4. San Diego-Chula Vista-Carlsbad, CA | 1.5% |

| 5. Miami-Fort Lauderdale-Pompano Beach, FL | 2.0% |

| 6. Boston-Cambridge-Newton, MA-NH | 2.0% |

| 7. Riverside-San Bernardino-Ontario, CA | 2.0% |

| 8. Sacramento-Roseville-Folsom, CA | 2.2% |

| 9. New York-Newark-Jersey City, NY-NJ-PA | 2.4% |

| 10. Washington-Arlington-Alexandria, DC-VA-MD-WV | 2.7% |

| 11. Providence-Warwick, RI-MA | 2.7% |

| 12. Seattle-Tacoma-Bellevue, WA | 2.8% |

| 13. Austin-Round Rock-Georgetown, TX | 2.8% |

| 14. Orlando-Kissimmee-Sanford, FL | 2.8% |

| 15. Portland-Vancouver-Hillsboro, OR-WA | 2.8% |

*Under-25 share of home purchase loans

FOR HOMEOWNERS

Is now the right time to increase the value of your home with a renovated bathroom or an upgraded kitchen? Be sure to consider builders risk insurance for homeowners, which will provide coverage for your home while it’s under renovation—a time when most homeowners insurance policies won’t have you covered.

Midsize Metros With the Most and Fewest Homebuyers Under 25

| Top Metros | Share* |

|---|---|

| 1. Davenport-Moline-Rock Island, IA-IL | 11.9% |

| 2. Peoria, IL | 10.9% |

| 3. Fort Wayne, IN | 10.6% |

| 4. Provo-Orem, UT | 9.8% |

| 5. Canton-Massillon, OH | 9.6% |

| 6. Des Moines-West Des Moines, IA | 9.3% |

| 7. Lansing-East Lansing, MI | 9.1% |

| 8. Youngstown-Warren-Boardman, OH-PA | 9.0% |

| 9. Toledo, OH | 8.9% |

| 10. Flint, MI | 8.8% |

| 11. Wichita, KS | 8.6% |

| 12. Huntington-Ashland, WV-KY-OH | 8.5% |

| 13. Ogden-Clearfield, UT | 8.4% |

| 14. Hickory-Lenoir-Morganton, NC | 8.2% |

| 15. Dayton-Kettering, OH | 8.0% |

| Bottom Metros | Share* |

|---|---|

| 1. Naples-Marco Island, FL | 1.2% |

| 2. Oxnard-Thousand Oaks-Ventura, CA | 1.5% |

| 3. Bridgeport-Stamford-Norwalk, CT | 1.6% |

| 4. Santa Maria-Santa Barbara, CA | 1.6% |

| 5. North Port-Sarasota-Bradenton, FL | 1.7% |

| 6. Myrtle Beach-Conway-North Myrtle Beach, SC-NC | 1.8% |

| 7. Santa Rosa-Petaluma, CA | 1.8% |

| 8. Urban Honolulu, HI | 1.9% |

| 9. Salisbury, MD-DE | 2.0% |

| 10. Cape Coral-Fort Myers, FL | 2.1% |

| 11. Port St. Lucie, FL | 2.1% |

| 12. Salinas, CA | 2.1% |

| 13. Stockton, CA | 2.3% |

| 14. Vallejo, CA | 2.3% |

| 15. Deltona-Daytona Beach-Ormond Beach, FL | 2.4% |

*Under-25 share of home purchase loans

Small Metros With the Most and Fewest Homebuyers Under 25

| Top Metros | Share* |

|---|---|

| 1. Lima, OH | 17.5% |

| 2. Waterloo-Cedar Falls, IA | 16.4% |

| 3. Elkhart-Goshen, IN | 15.5% |

| 4. St. Cloud, MN | 13.0% |

| 5. Ames, IA | 13.0% |

| 6. Fond du Lac, WI | 12.8% |

| 7. Cedar Rapids, IA | 12.0% |

| 8. Mansfield, OH | 11.9% |

| 9. Battle Creek, MI | 11.4% |

| 10. St. Joseph, MO-KS | 11.4% |

| 11. Wheeling, WV-OH | 11.4% |

| 12. Muskegon, MI | 11.3% |

| 13. Bay City, MI | 11.3% |

| 14. Terre Haute, IN | 11.2% |

| 15. Sioux City, IA-NE-SD | 11.1% |

| Bottom Metros | Share* |

|---|---|

| 1. The Villages, FL | 0.5% |

| 2. Santa Cruz-Watsonville, CA | 0.7% |

| 3. Barnstable Town, MA | 1.0% |

| 4. Kahului-Wailuku-Lahaina, HI | 1.0% |

| 5. Hilton Head Island-Bluffton, SC | 1.3% |

| 6. Napa, CA | 1.4% |

| 7. Bend, OR | 1.5% |

| 8. San Luis Obispo-Paso Robles, CA | 1.5% |

| 9. Punta Gorda, FL | 1.7% |

| 10. Sebastian-Vero Beach, FL | 1.7% |

| 11. Crestview-Fort Walton Beach-Destin, FL | 1.8% |

| 12. Homosassa Springs, FL | 1.8% |

| 13. Prescott Valley-Prescott, AZ | 1.9% |

| 14. Lake Havasu City-Kingman, AZ | 2.0% |

| 15. East Stroudsburg, PA | 2.0% |

*Under-25 share of home purchase loans

States With the Most and Fewest Homebuyers Under 25

| Top States | Share* |

|---|---|

| 1. Iowa | 11.5% |

| 2. Indiana | 9.1% |

| 3. North Dakota | 9.1% |

| 4. West Virginia | 8.5% |

| 5. Kentucky | 7.8% |

| 6. Nebraska | 7.8% |

| 7. Ohio | 7.7% |

| 8. South Dakota | 7.6% |

| 9. Michigan | 7.4% |

| 10. Wisconsin | 7.3% |

| 11. Utah | 7.3% |

| 12. Minnesota | 7.1% |

| 13. Alabama | 6.7% |

| 14. Missouri | 6.6% |

| 15. Kansas | 6.6% |

| Bottom States | Share* |

|---|---|

| 1. Hawaii | 1.6% |

| 2. California | 1.9% |

| 3. Rhode Island | 2.4% |

| 4. Florida | 2.5% |

| 5. New Jersey | 2.5% |

| 6. Massachusetts | 2.5% |

| 7. New Hampshire | 2.7% |

| 8. Delaware | 2.7% |

| 9. Oregon | 2.9% |

| 10. Vermont | 2.9% |

| 11. Washington | 3.3% |

| 12. Connecticut | 3.4% |

| 13. Nevada | 3.4% |

| 14. Colorado | 3.5% |

| 15. Maryland | 3.5% |

*Under-25 share of home purchase loans

Methodology

The data used in this analysis is from the Federal Financial Institutions Examination Council’s 2022 Home Mortgage Disclosure Act. To determine the locations with the most homebuyers under 25, researchers at Construction Coverage calculated the share of all home purchase loans taken out by applicants under 25 years old. Only conventional home purchase loans originated in 2022 were considered for this analysis. In the event of a tie, the location with the greater total number of home purchase loans by applicants under 25 was ranked higher. To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts based on population size: small (100,000-349,999), midsize (350,000-999,999), and large (1,000,000 or more).

References

- National Association of Realtors. (2021). 2021 Home Buyers and Sellers Generational Trends Report. https://www.nar.realtor/sites/default/files/documents/2021-home-buyers-and-sellers-generational-trends-03-16-2021.pdf

- Freddie Mac. (2022, June 9). What Drove Home Price Growth and Can it Continue? https://www.freddiemac.com/research/insight/20220609-what-drove-home-price-growth-and-can-it-continue

- U.S. Census Bureau and U.S. Department of Housing and Urban Development. (2023, July 26). Median Sales Price of Houses Sold for the United States [Data set]. https://fred.stlouisfed.org/series/MSPUS

- Federal Financial Institutions Examination Council. (2022). Home Mortgage Disclosure Act [Data set]. https://ffiec.cfpb.gov/

Full Results

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.