American Cities With the Most Small Businesses

Small businesses across the United States face dire circumstances following the COVID-19 outbreak. While each individual small business might seem inconsequential to the broader economy, in aggregate, these firms are critical to the country’s financial well-being.

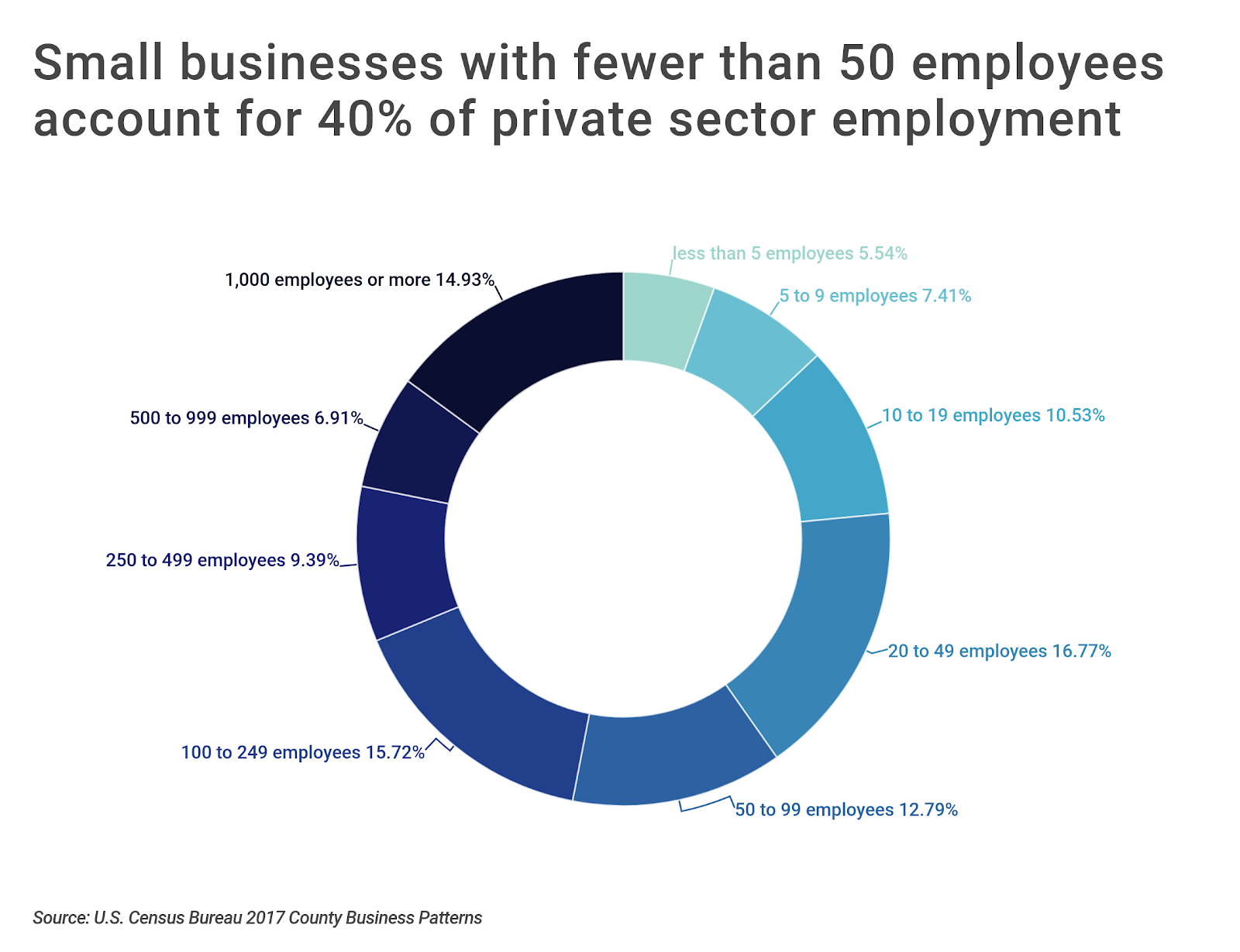

According to the most recent data from the U.S. Census Bureau, small businesses with fewer than 50 employees make up approximately 95 percent of American business establishments and employ 40 percent of private sector workers. These 7.4 million small businesses (or 2.27 per 100 residents) also account for roughly a third of total private sector payroll.

TRENDING

Workers’ comp insurance protects employees and business owners if/when work-related injuries occur. To help protect your business and staff, our researchers found the best workers’ compensation insurance companies for small businesses.

Unfortunately, research shows that small businesses and their workers are particularly vulnerable during recessions and other periods of economic hardship. A recent survey conducted by the New York Fed found that even prior to the pandemic, 64 percent of small businesses faced financial challenges in the preceding 12 months. The same survey reported that a two-month loss of revenue would cause 86 percent of firms to take a serious financial action, such as using the owner’s personal savings, taking out a loan, or cutting staff salaries.

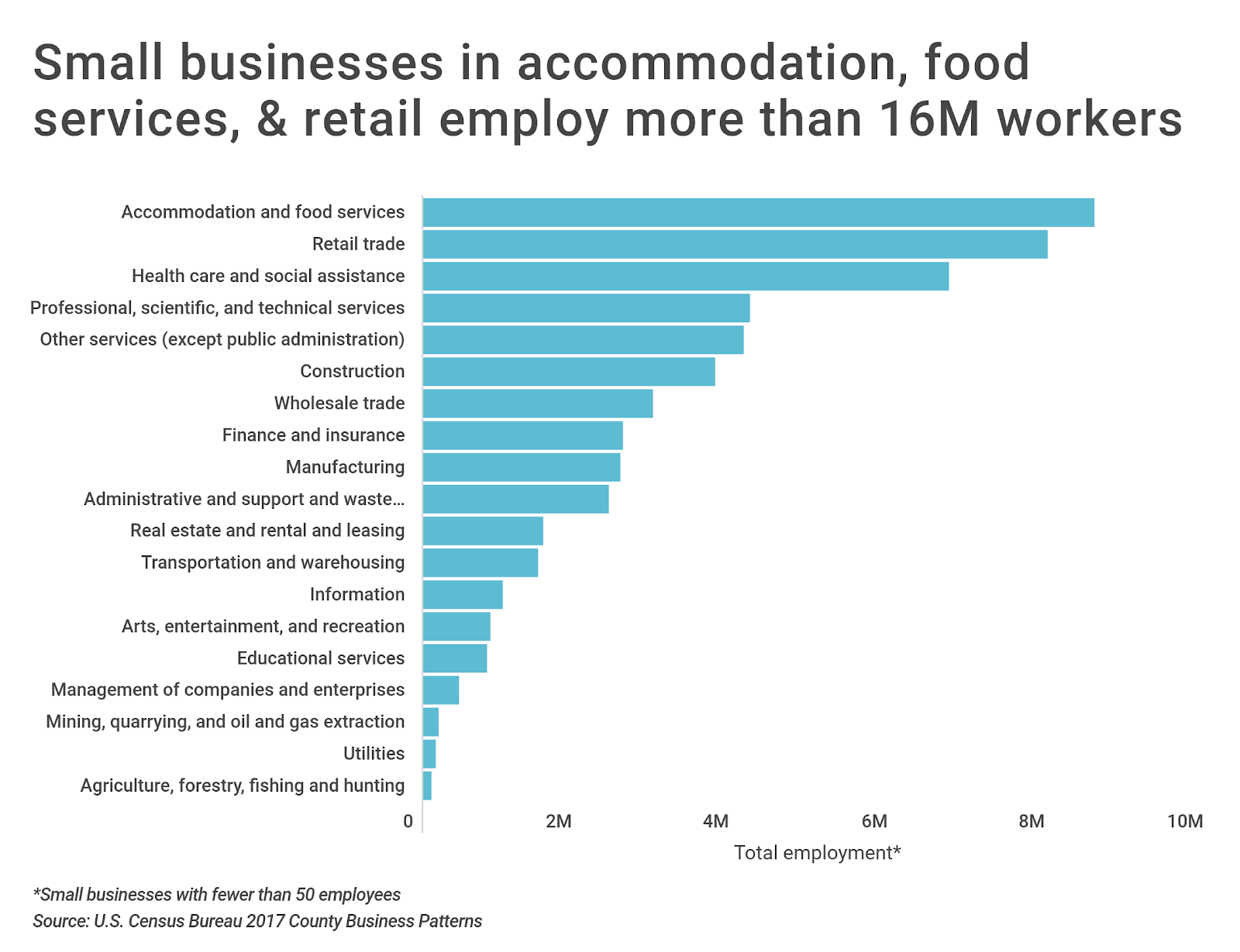

Moreover, small businesses in some industries have a larger economic impact than others. Among small businesses with fewer than 50 employees, those in accommodation, food services, and retail trade—coincidentally, the sectors hit hardest by COVID-19—employ the most workers. These industries, combined, account for more than 16 million employees and $362 billion in annual payroll.

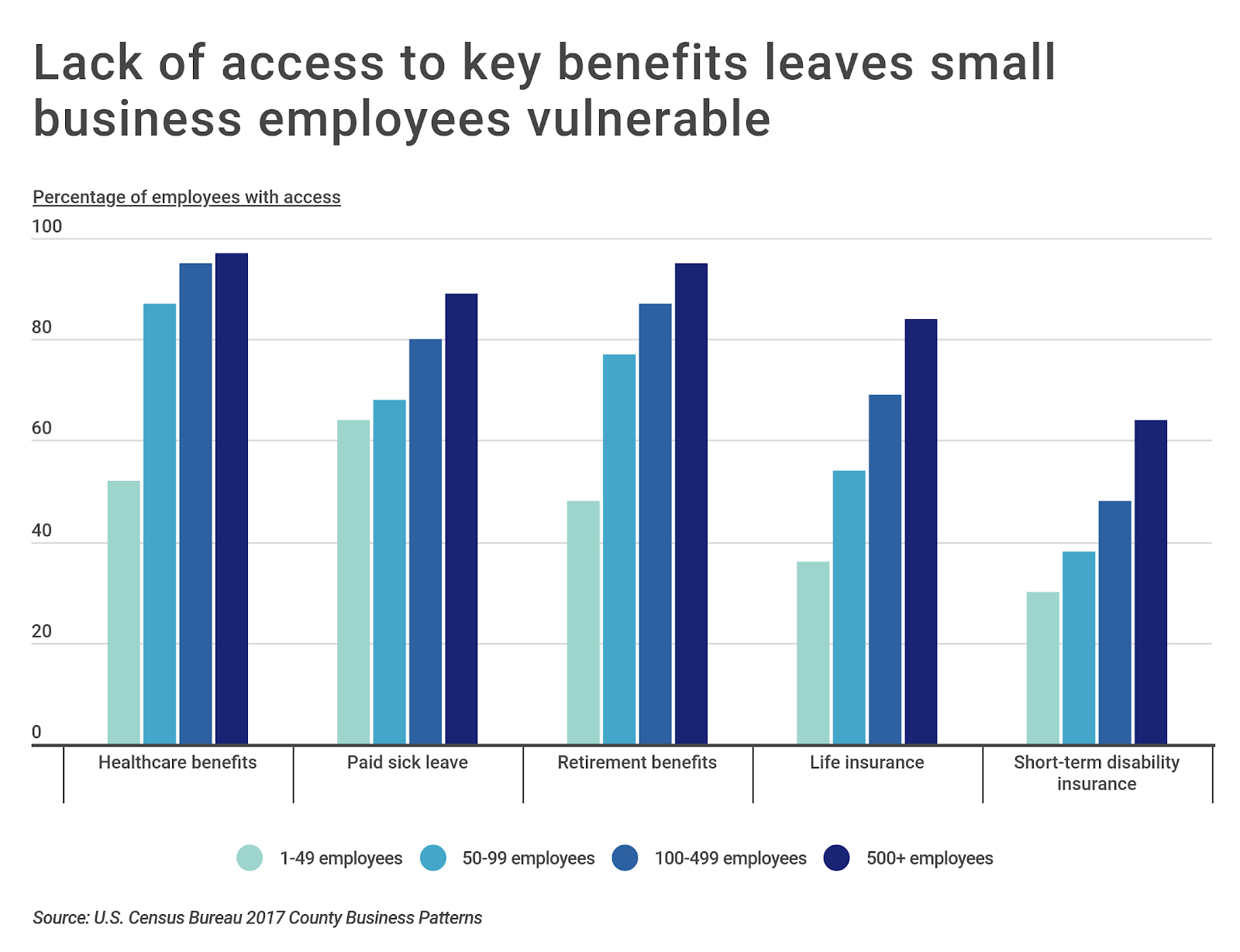

Like the businesses themselves, small business employees are also more financially vulnerable than their large-firm counterparts. Data from the Bureau of Labor Statistics shows that fewer small business employees have access to retirement benefits, healthcare benefits, paid sick leave, life insurance, or disability insurance. Troublingly, only half of employees in small businesses have health insurance through their company and only two-thirds have paid sick leave.

While small businesses are a critical component of the national economy, some parts of the country depend more on small businesses than others. To find the metropolitan areas with the most small businesses, researchers at Construction Coverage, a review website for workers’ compensation insurance companies and construction project management software, analyzed the latest data from the U.S. Census Bureau. The researchers ranked each location according to the number of small businesses per 100 residents. Researchers also included statistics on the total number of small businesses, the number of retail, accommodation, and food service businesses, and the share of workers who are self-employed. For the analysis, small businesses were defined as those employing fewer than 50 workers.

To improve relevance, only metropolitan areas with at least 100,000 people were included in the analysis. Additionally, locations were grouped into the following cohorts based on population size: large metros (1,000,000 residents or more), midsize metros (350,000-999,999 residents), and small metros (less than 350,000 residents).

Here are the metropolitan areas with the most small businesses per capita.

Large Metros With the Most Small Businesses

15. Pittsburgh, PA

- Small businesses per 100 residents: 2.40

- Number of small businesses: 55,851

- Number of retail, accommodation & food service small businesses: 12,537

- Share of workers that are self-employed: 7.3%

- Population: 2,324,743

TRENDING ON CONSTRUCTION COVERAGE

Do you have insurance for your business vehicles? If not, make sure to look through our commercial auto insurance guide as well as our new report on the best commercial truck insurance companies.

14. San Diego-Carlsbad, CA

- Small businesses per 100 residents: 2.41

- Number of small businesses: 80,643

- Number of retail, accommodation & food service small businesses: 15,857

- Share of workers that are self-employed: 11.9%

- Population: 3,343,364

13. Providence-Warwick, RI-MA

- Small businesses per 100 residents: 2.42

- Number of small businesses: 39,195

- Number of retail, accommodation & food service small businesses: 9,732

- Share of workers that are self-employed: 7.6%

- Population: 1,621,337

12. Oklahoma City, OK

- Small businesses per 100 residents: 2.44

- Number of small businesses: 34,137

- Number of retail, accommodation & food service small businesses: 7,019

- Share of workers that are self-employed: 10.6%

- Population: 1,396,445

11. Chicago-Naperville-Elgin, IL-IN-WI

- Small businesses per 100 residents: 2.45

- Number of small businesses: 232,666

- Number of retail, accommodation & food service small businesses: 44,827

- Share of workers that are self-employed: 8.5%

- Population: 9,497,790

10. Minneapolis-St. Paul-Bloomington, MN-WI

- Small businesses per 100 residents: 2.51

- Number of small businesses: 90,953

- Number of retail, accommodation & food service small businesses: 16,245

- Share of workers that are self-employed: 8.3%

- Population: 3,629,190

9. Boston-Cambridge-Newton, MA-NH

- Small businesses per 100 residents: 2.51

- Number of small businesses: 122,251

- Number of retail, accommodation & food service small businesses: 26,958

- Share of workers that are self-employed: 8.6%

- Population: 4,875,390

TRENDING ON CONSTRUCTION COVERAGE

If you run a construction business, there are many software solutions that can help you operate more efficiently. To learn more, review our picks for the best construction project management software.

8. Salt Lake City, UT

- Small businesses per 100 residents: 2.55

- Number of small businesses: 31,214

- Number of retail, accommodation & food service small businesses: 5,606

- Share of workers that are self-employed: 8.8%

- Population: 1,222,540

7. Seattle-Tacoma-Bellevue, WA

- Small businesses per 100 residents: 2.55

- Number of small businesses: 100,611

- Number of retail, accommodation & food service small businesses: 19,483

- Share of workers that are self-employed: 9.6%

- Population: 3,939,363

6. San Francisco-Oakland-Hayward, CA

- Small businesses per 100 residents: 2.59

- Number of small businesses: 122,580

- Number of retail, accommodation & food service small businesses: 25,218

- Share of workers that are self-employed: 11.8%

- Population: 4,729,484

5. Los Angeles-Long Beach-Anaheim, CA

- Small businesses per 100 residents: 2.66

- Number of small businesses: 353,637

- Number of retail, accommodation & food service small businesses: 65,704

- Share of workers that are self-employed: 13.6%

- Population: 13,291,486

4. Portland-Vancouver-Hillsboro, OR-WA

- Small businesses per 100 residents: 2.69

- Number of small businesses: 66,624

- Number of retail, accommodation & food service small businesses: 13,044

- Share of workers that are self-employed: 11.0%

- Population: 2,478,996

3. Denver-Aurora-Lakewood, CO

- Small businesses per 100 residents: 2.74

- Number of small businesses: 80,420

- Number of retail, accommodation & food service small businesses: 14,157

- Share of workers that are self-employed: 10.0%

- Population: 2,932,415

2. New York-Newark-Jersey City, NY-NJ-PA

- Small businesses per 100 residents: 2.77

- Number of small businesses: 554,124

- Number of retail, accommodation & food service small businesses: 127,338

- Share of workers that are self-employed: 9.8%

- Population: 19,979,477

1. Miami-Fort Lauderdale-West Palm Beach, FL

- Small businesses per 100 residents: 3.01

- Number of small businesses: 186,802

- Number of retail, accommodation & food service small businesses: 33,771

- Share of workers that are self-employed: 14.1%

- Population: 6,198,782

Methodology & Detailed Findings

The business data used in this analysis is from the U.S. Census Bureau’s County Business Patterns survey. The survey covers most non-farm, private industries. For this analysis, small businesses are defined as those having fewer than 50 employees. Locations were ranked based on the number of small businesses per 100 residents. In the event of a tie, the location with the greater total number of small businesses was ranked higher.

Population and self-employment data is from the U.S. Census Bureau’s 2018 American Community Survey 1-Year Estimates. For this analysis, self-employed workers include those working in incorporated or unincorporated businesses.

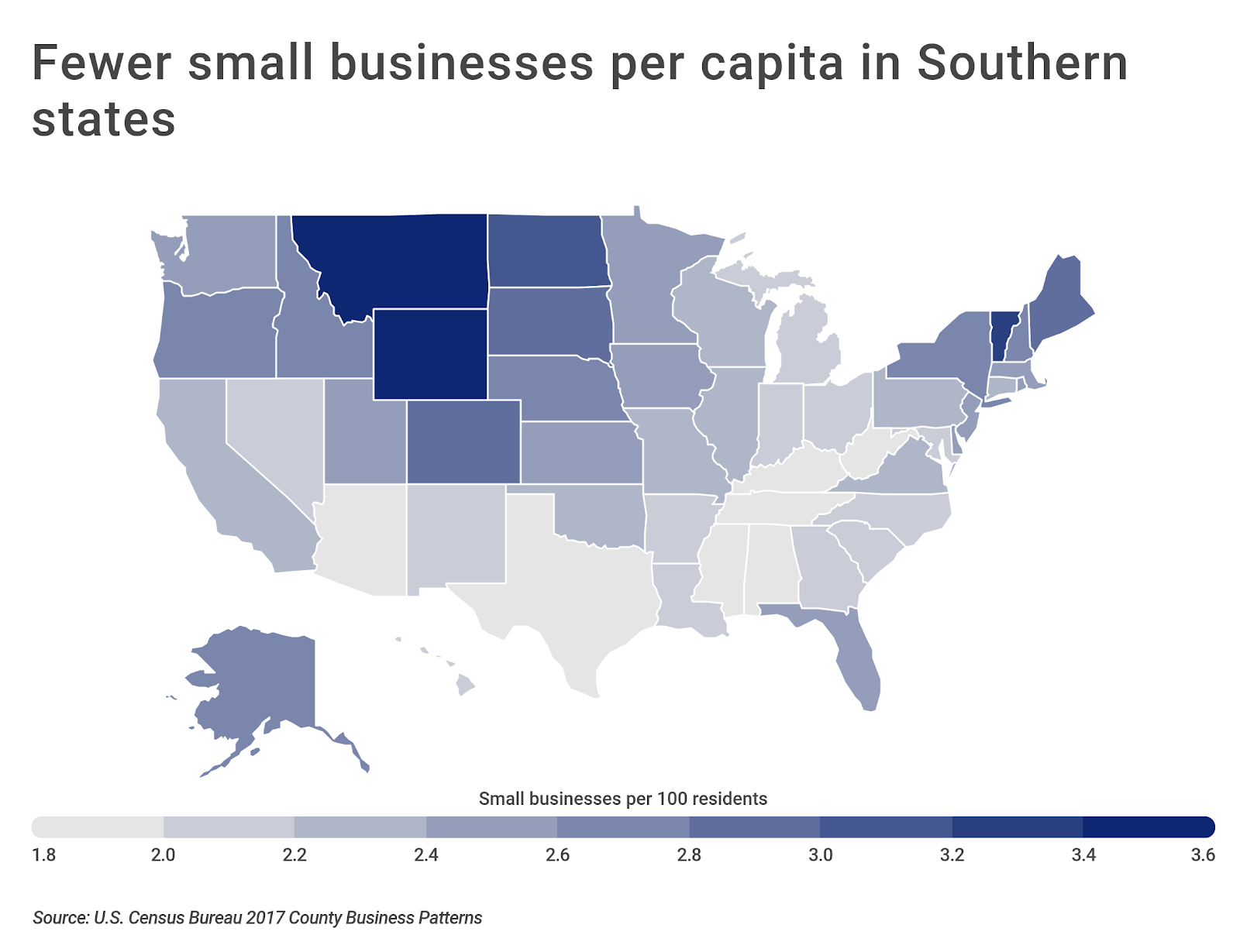

The cities with the most small businesses are geographically diverse, with representation on the coasts, Southwest, and Midwest. At the state level, however, there tend to be more small businesses per capita in sparsely populated states. For example, Wyoming, Montana, Vermont, and North Dakota all have above-average numbers of small businesses per capita. States in the South tend to have fewer small businesses per capita than the national average, with the exception of Florida.

Certain states are beginning to reopen their economies following weeks of coronavirus-related lockdowns. As these states do so, an important question is whether or not businesses will be held responsible for employees who contract COVID-19 while on the job. Sick or injured employees typically seek damages through workers’ compensation insurance; however, in order to do so, the employee must prove that the illness of injury occurred at work. Due to the high prevalence of COVID-19 in the general population, proving contraction occurred at work will be fraught with challenges. Nevertheless, the risk of litigation presents a new hurdle for businesses already struggling.

Despite the challenges ahead, small businesses remain a cornerstone of the American economy. The federal government has launched stimulus packages and loan programs to help small businesses stay afloat during the coronavirus outbreak. As the country inches back toward normalcy in the aftermath of COVID-19, small businesses will be among the most important pieces of the economy to revive.

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.