U.S. Counties That Have Built the Most Housing Over the Past Decade

The need for affordable housing in the United States has never been greater. After a dizzying run-up in residential real estate prices and rents in the last few years, housing costs are putting a financial squeeze on renters and homebuyers nationwide as they compete for a scarce, expensive supply of housing.

Research from federal mortgage backer Freddie Mac estimates that the U.S. is short 3.8 million housing units relative to current market needs, while the National Association of Realtors pegs the figure even higher at 5.5 million units. Regardless of the precise number, it is clear that the U.S. housing supply is insufficient, creating more competition for fewer units.

Experts cite a variety of factors that contribute to difficulties adding housing stock. In every state and locality, housing development may be subject to a host of laws and regulations regarding zoning, land use, building standards, environmental protection, historic preservation, and other issues that make it difficult to add housing. Developers and political officials may also face organized pressure from “not in my backyard” (NIMBY) interests concerned about neighborhood property values, overcrowding, or disruptions from construction work. Further, rising labor and material costs have made it more expensive to build over time, which impacts the type of units builders can afford to construct along with project timelines and costs.

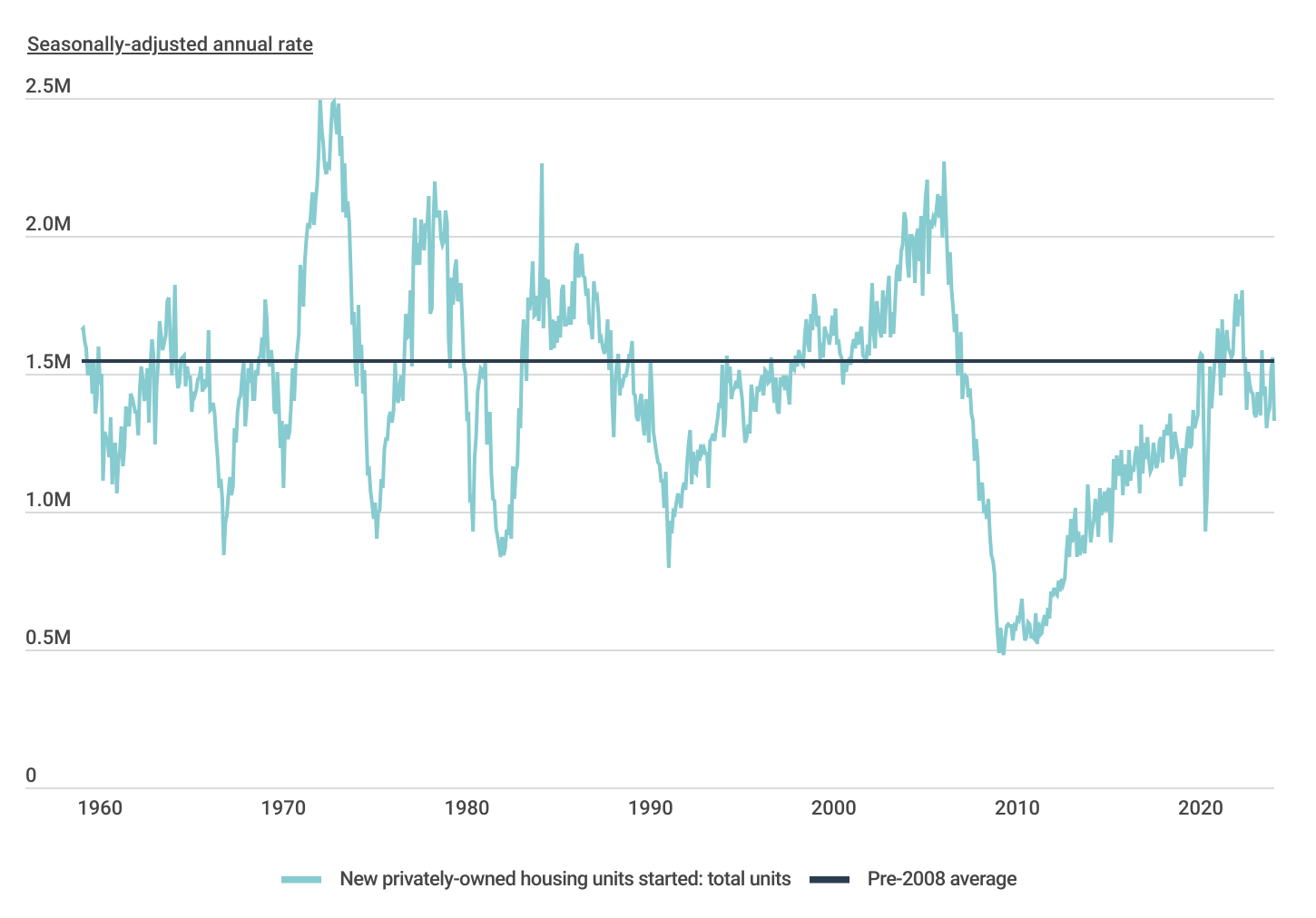

Trends in U.S. Housing Construction Over Time

Since the 2008 housing market crash, the U.S. has underinvested in new residential construction

Beyond these conditions, one of the most significant drivers for the current undersupply of housing is the long-term impact of the Great Recession. Following the collapse of the housing bubble in the mid-2000s and the ensuing economic downturn, construction companies were extremely hard-hit. The industry experienced mass layoffs, many firms shuttered or were absorbed into others, and residential construction activity slowed dramatically. The annual rate of housing starts fell from more than 2 million at the height of the housing market in 2006 to just 490,000 at the beginning of 2009. After a prolonged recovery, housing starts did not exceed pre-2008 averages again until the beginning of 2020.

FOR SPECIALTY FIELDS

If you manage a team of contractors in the field, it’s worth considering field service management software. The best field service software allows users to schedule and dispatch employees, communicate with customers, and accept payments on the go.

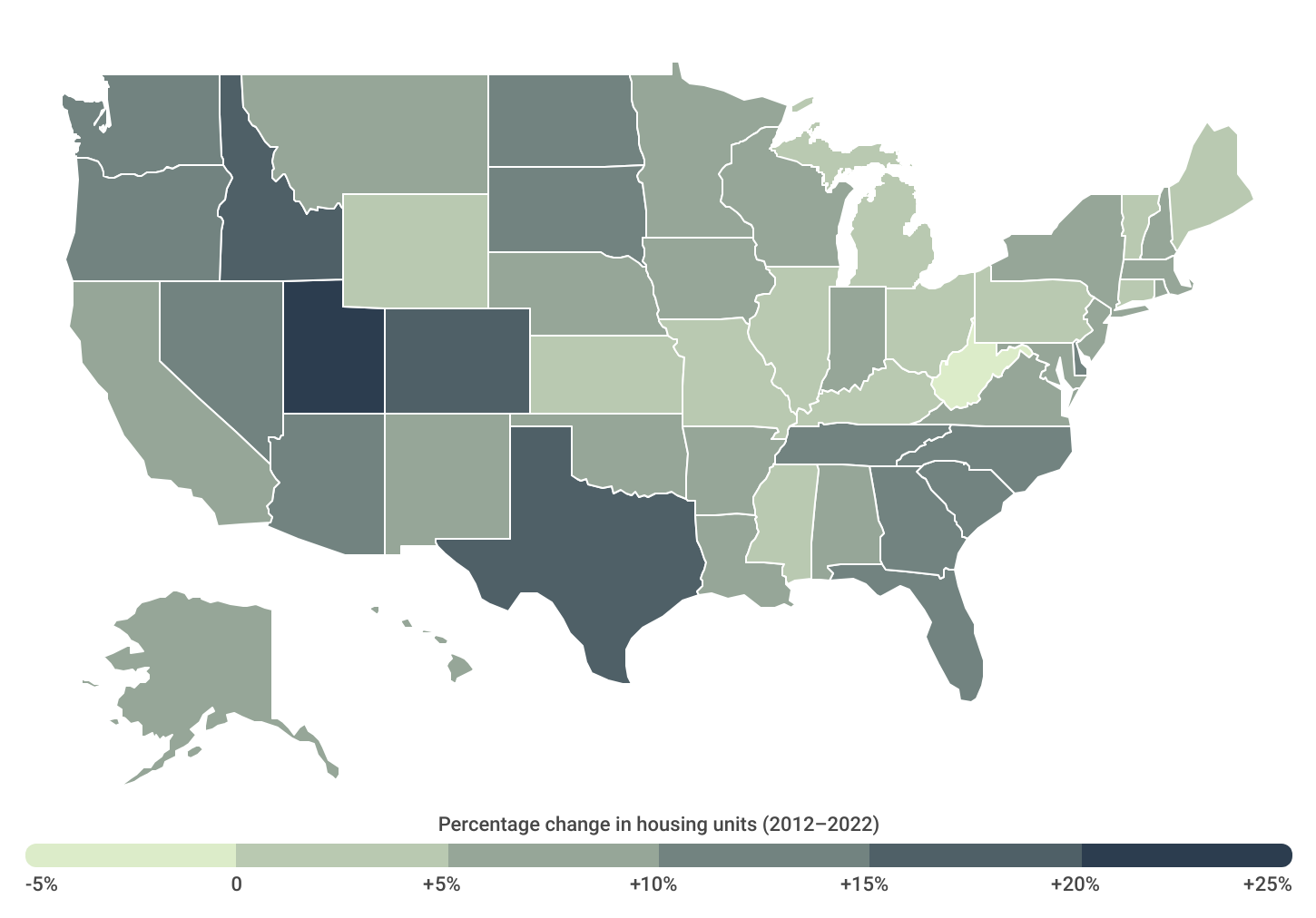

Housing Growth by State

Mountain West states & Texas have added the most housing over the past 10 years

While the national supply of housing has been lagging overall, some parts of the country have managed to add homes faster than others. States that have experienced the most housing growth in recent years are found in the Mountain West and Sun Belt, which tend to be less expensive than heavily developed coastal markets and have fewer regulations limiting construction. Utah leads the U.S. with a 23.3% increase in housing stock over the last decade, with Texas second at 19.5% and other western states like Idaho and Colorado ranking highly. In contrast, one state—West Virginia—has experienced a 2.4% decline in housing stock, and Great Lakes states like Michigan, Illinois, and Ohio have seen relatively low rates of growth amid stagnating or declining populations.

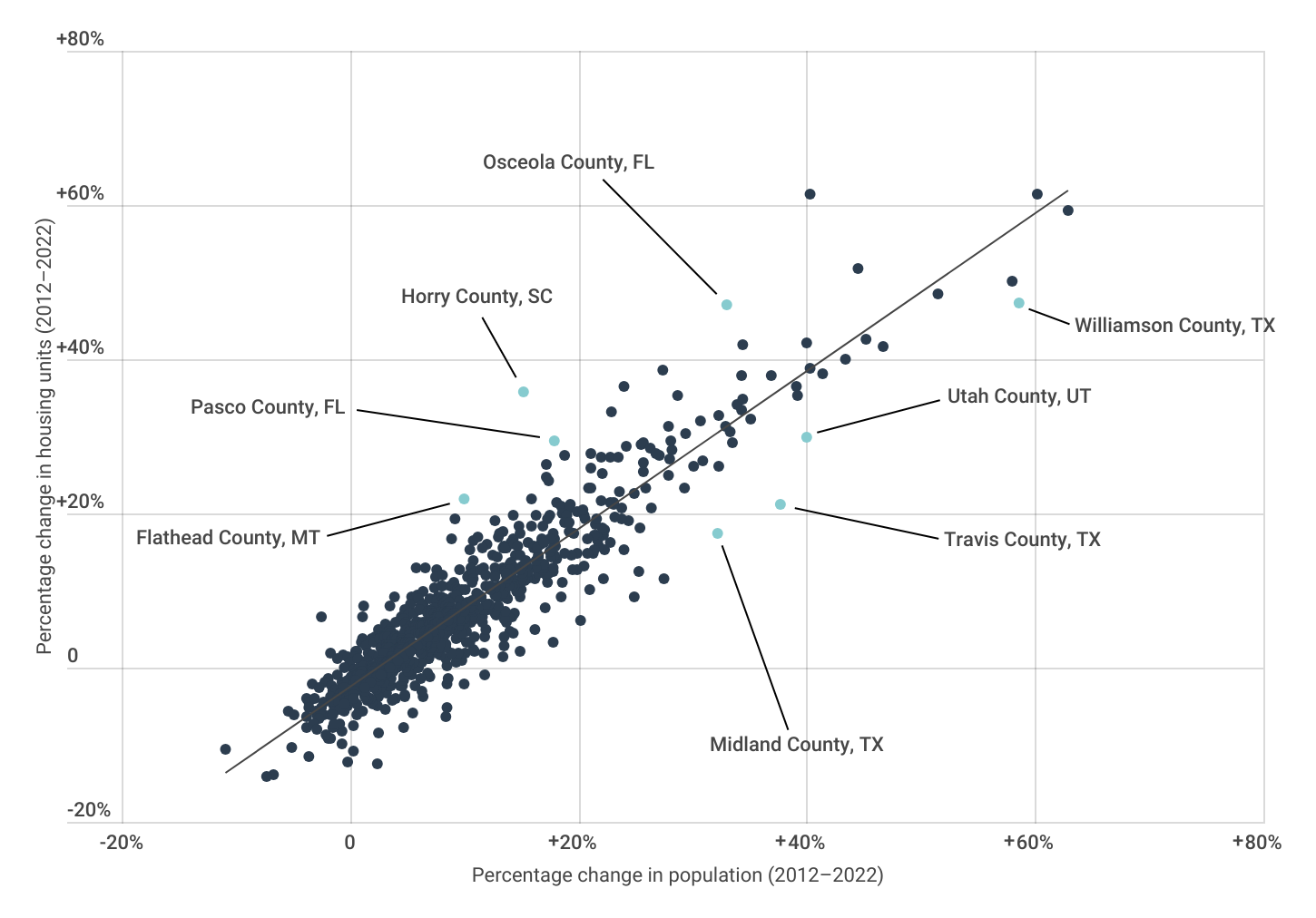

Housing Growth vs. Population Growth for U.S. Counties

Relative to population growth, locations in Texas & Utah have added housing at a faster pace than average

But rates of housing supply growth may not be sufficient to understand how well a location is meeting current and future housing needs. In some places, housing growth is exceeding the rate of population growth, which positions those markets to keep housing affordable now while also being better able to accommodate new residents in the future. Many counties in fast-growing Utah and Texas have added stock faster than they have added people. But in parts of Florida, Idaho, Montana, and other growing states, the opposite is true. These markets may experience greater competition as their populations continue to grow.

Below is a complete breakdown of housing growth across nearly 800 U.S. counties (grouped by size) and all 50 states. The analysis was conducted by Construction Coverage, using data from the Census Bureau and Zillow. For more information, see the methodology section below.

Large Counties With the Most Housing Growth

| Top Counties | Change* |

|---|---|

| 1. Williamson County, TX | +58.6% |

| 2. Fort Bend County, TX | +46.7% |

| 3. Montgomery County, TX | +43.4% |

| 4. Denton County, TX | +41.4% |

| 5. Collin County, TX | +40.3% |

| 6. Utah County, UT | +40.0% |

| 7. Travis County, TX | +37.7% |

| 8. Ada County, ID | +30.9% |

| 9. Wake County, NC | +29.3% |

| 10. Mecklenburg County, NC | +25.4% |

| 11. Denver County, CO | +25.3% |

| 12. Davidson County, TN | +24.9% |

| 13. Clark County, WA | +22.3% |

| 14. Bexar County, TX | +22.3% |

| 15. Salt Lake County, UT | +22.2% |

| Bottom Counties | Change* |

|---|---|

| 1. Wayne County, MI | -3.3% |

| 2. Baltimore city, MD | -0.7% |

| 3. Cuyahoga County, OH | -0.6% |

| 4. Montgomery County, OH | -0.5% |

| 5. Shelby County, TN | +0.7% |

| 6. Summit County, OH | +0.9% |

| 7. Hamilton County, OH | +1.4% |

| 8. Milwaukee County, WI | +1.5% |

| 9. St. Louis County, MO | +1.9% |

| 10. Suffolk County, NY | +2.0% |

| 11. Nassau County, NY | +2.7% |

| 12. Jefferson County, AL | +2.9% |

| 13. Allegheny County, PA | +3.0% |

| 14. Stanislaus County, CA | +3.1% |

| 15. DuPage County, IL | +3.1% |

TRENDING GUIDES ON CONSTRUCTION COVERAGE

- Best workers comp insurance for small business

- Errors and omissions insurance

- Inland marine insurance

Midsize Counties With the Most Housing Growth

| Top Counties | Change* |

|---|---|

| 1. Hays County, TX | +62.9% |

| 2. St. Johns County, FL | +44.5% |

| 3. Forsyth County, GA | +40.0% |

| 4. Williamson County, TN | +39.2% |

| 5. Osceola County, FL | +33.0% |

| 6. Rutherford County, TN | +32.9% |

| 7. Douglas County, CO | +32.3% |

| 8. Weld County, CO | +32.3% |

| 9. Hamilton County, IN | +30.1% |

| 10. Benton County, AR | +29.4% |

| 11. Lake County, FL | +28.7% |

| 12. Loudoun County, VA | +28.2% |

| 13. Canyon County, ID | +28.1% |

| 14. Cherokee County, GA | +28.0% |

| 15. Manatee County, FL | +26.3% |

| Bottom Counties | Change* |

|---|---|

| 1. Genesee County, MI | -3.8% |

| 2. St. Clair County, IL | -1.7% |

| 3. St. Louis city, MO | -0.7% |

| 4. Winnebago County, IL | -0.6% |

| 5. Lucas County, OH | -0.5% |

| 6. Westmoreland County, PA | +0.4% |

| 7. Erie County, PA | +0.6% |

| 8. Marin County, CA | +0.8% |

| 9. Madison County, IL | +1.4% |

| 10. Stark County, OH | +1.8% |

| 11. Sonoma County, CA | +1.8% |

| 12. Luzerne County, PA | +2.0% |

| 13. Cumberland County, NC | +2.2% |

| 14. Orleans Parish, LA | +2.3% |

| 15. Santa Cruz County, CA | +2.7% |

Small Counties With the Most Housing Growth

| Top Counties | Change* |

|---|---|

| 1. Comal County, TX | +60.2% |

| 2. Dallas County, IA | +58.0% |

| 3. Rockwall County, TX | +51.5% |

| 4. Sumter County, FL | +45.2% |

| 5. Kaufman County, TX | +40.3% |

| 6. Washington County, UT | +39.1% |

| 7. Ellis County, TX | +36.9% |

| 8. Lancaster County, SC | +35.1% |

| 9. Bastrop County, TX | +34.4% |

| 10. Gallatin County, MT | +34.4% |

| 11. Canadian County, OK | +34.3% |

| 12. Wilson County, TN | +34.3% |

| 13. Johnston County, NC | +33.9% |

| 14. Berkeley County, SC | +33.5% |

| 15. Guadalupe County, TX | +33.3% |

| Bottom Counties | Change* |

|---|---|

| 1. Robeson County, NC | -6.7% |

| 2. Butte County, CA | -3.8% |

| 3. Mahoning County, OH | -3.1% |

| 4. San Juan County, NM | -2.8% |

| 5. Schuylkill County, PA | -2.7% |

| 6. Kanawha County, WV | -2.1% |

| 7. Calhoun County, MI | -1.9% |

| 8. Macon County, IL | -1.5% |

| 9. Columbiana County, OH | -1.4% |

| 10. Cambria County, PA | -1.4% |

| 11. Mercer County, PA | -1.4% |

| 12. Trumbull County, OH | -1.3% |

| 13. Monroe County, PA | -1.1% |

| 14. Delaware County, IN | -1.0% |

| 15. Fayette County, PA | -0.9% |

Very Small Counties With the Most Housing Growth

| Top Counties | Change* |

|---|---|

| 1. Nassau County, FL | +27.9% |

| 2. Walker County, TX | +24.0% |

| 3. Chatham County, NC | +23.1% |

| 4. Barrow County, GA | +22.0% |

| 5. Suffolk city, VA | +21.8% |

| 6. Hancock County, IN | +21.4% |

| 7. Franklin County, WA | +20.8% |

| 8. Burleigh County, ND | +18.0% |

| 9. Lincoln County, NC | +17.8% |

| 10. Twin Falls County, ID | +17.3% |

| 11. Frederick County, VA | +16.9% |

| 12. Bulloch County, GA | +16.5% |

| 13. Bedford County, VA | +15.6% |

| 14. Coryell County, TX | +15.0% |

| 15. Polk County, OR | +14.9% |

| Bottom Counties | Change* |

|---|---|

| 1. Apache County, AZ | -10.9% |

| 2. Jefferson County, AR | -7.3% |

| 3. Crawford County, PA | -5.4% |

| 4. Vermilion County, IL | -5.1% |

| 5. Muskogee County, OK | -4.9% |

| 6. Raleigh County, WV | -3.8% |

| 7. Northumberland County, PA | -3.6% |

| 8. Wilkes County, NC | -3.6% |

| 9. Lauderdale County, MS | -3.6% |

| 10. Madison County, NY | -3.2% |

| 11. Lawrence County, PA | -3.0% |

| 12. Harrison County, WV | -2.9% |

| 13. Scioto County, OH | -2.9% |

| 14. Steuben County, NY | -2.7% |

| 15. Lake County, CA | -2.5% |

States With the Most Housing Growth

| Top States | Change* |

|---|---|

| 1. Utah | +23.3% |

| 2. Texas | +19.5% |

| 3. Idaho | +18.4% |

| 4. Colorado | +16.1% |

| 5. North Dakota | +14.7% |

| 6. Washington | +13.7% |

| 7. Florida | +13.6% |

| 8. Delaware | +13.5% |

| 9. South Carolina | +13.4% |

| 10. Nevada | +12.3% |

| 11. North Carolina | +11.8% |

| 12. Arizona | +11.0% |

| 13. Tennessee | +10.9% |

| 14. South Dakota | +10.8% |

| 15. Oregon | +10.5% |

| Bottom States | Change* |

|---|---|

| 1. West Virginia | -2.4% |

| 2. Michigan | +1.8% |

| 3. Illinois | +3.1% |

| 4. Ohio | +3.2% |

| 5. Connecticut | +3.5% |

| 6. Maine | +3.8% |

| 7. Missouri | +3.9% |

| 8. Kansas | +4.3% |

| 9. Pennsylvania | +4.4% |

| 10. Kentucky | +4.5% |

| 11. Wyoming | +4.5% |

| 12. Mississippi | +4.6% |

| 13. Vermont | +4.6% |

| 14. Rhode Island | +5.1% |

| 15. Arkansas | +5.1% |

*Percentage change in housing units (2012–2022)

Methodology

Population and housing unit estimates are from the U.S. Census Bureau’s American Community Survey 1-Year Estimates (2012 and 2022). Median home prices are from Zillow’s Housing Data Series. All changes were calculated between 2012 and 2022. Only locations with data available from the Census Bureau were included in the analysis. Additionally, counties were grouped into cohorts based on population: large (500,000 or more); midsize (250,000–499,999), small (100,000–249,999); and very small (less than 100,000).

References

- U.S. Census Bureau and U.S. Department of Housing and Urban Development. (2024, January 25). Median Sales Price of Houses Sold for the United States [MSPUS] [Data set]. Retrieved on March 24, 2024 from https://fred.stlouisfed.org/series/MSPUS.

- U.S. Bureau of Labor Statistics. (2024, March 12). Consumer Price Index for All Urban Consumers: Rent of Primary Residence in U.S. City Average [Data set]. Retrieved on March 24, 2024 from https://fred.stlouisfed.org/series/CUUR0000SEHA.

- FreddieMac. (2021, May 7). Housing Supply: A Growing Deficit. Retrieved on March 24, 2024 from https://www.freddiemac.com/research/insight/20210507-housing-supply.

- Rosen Consulting Group. (2021, June). Housing is Critical Infrastructure: Social and Economic Benefits of Building More Housing. Retrieved on March 24, 2024 from https://cdn.nar.realtor//sites/default/files/documents/Housing-is-Critical-Infrastructure-Social-and-Economic-Benefits-of-Building-More-Housing-6-15-2021.pdf.

- Schuetz, Jenny. The Brookings Institute. (2022, February 22). Dysfunctional policies have broken America’s housing supply chain. Retrieved on March 24, 2024 from https://www.brookings.edu/articles/dysfunctional-policies-have-broken-americas-housing-supply-chain/.

- Lawrence, Peter. Novogradac. (2022, February 23). Rising Construction, Labor Costs Increase Rents, Contributing to the Affordable Housing Crisis. Retrieved on March 24, 2024 from https://www.novoco.com/notes-from-novogradac/rising-construction-labor-costs-increase-rents-contributing-affordable-housing-crisis.

- U.S. Census Bureau. (2024). American Community Survey [Data set]. Retrieved on March 24, 2024 from https://www.census.gov/programs-surveys/acs.

- Zillow. (2024). Housing Data [Data set]. Retrieved on March 24, 2024 from https://www.zillow.com/research/data/.

Full Results

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.