The Most House Poor Cities in America

June of 2019 marked 10 years of uninterrupted economic growth in the U.S., making it the longest expansion on record since 1854, according to the NBER. Unemployment rates are at historic lows and wages are inching up. So it might come as a surprise that more than a fifth of all American homeowners (almost 17 million households) are considered “house poor,” meaning they spend more than 30 percent of their total income on housing-related costs. For renter households, almost 20 million (46 percent of total) are considered house poor.

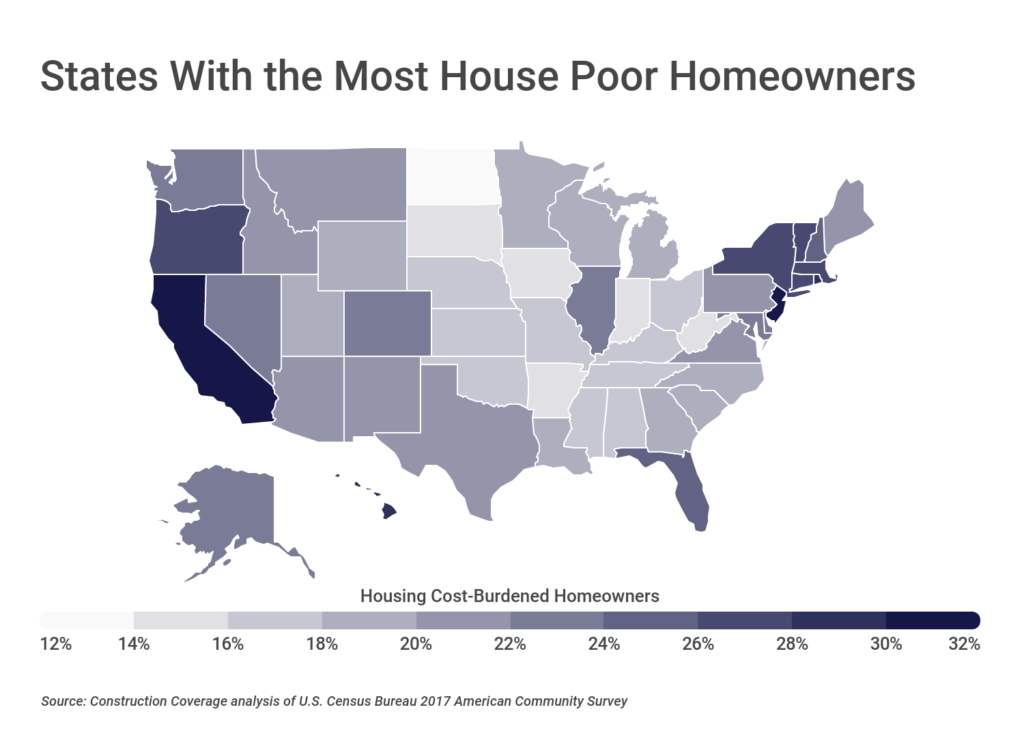

The ratio of house poor homeowners is far from uniform across the country—the highest proportions of house poor homeowners are found in Northeastern cities, closely followed by cities in the West. California ranks highest in this unfavorable statistic with 32 percent of owned households considered cost-burdened, which is significantly above the national average of 22 percent. Midwestern states, on the other hand, seem to offer a healthy balance between incomes and home prices. For example, only 15 percent of homeowners in North Dakota and South Dakota are considered cost-burdened.

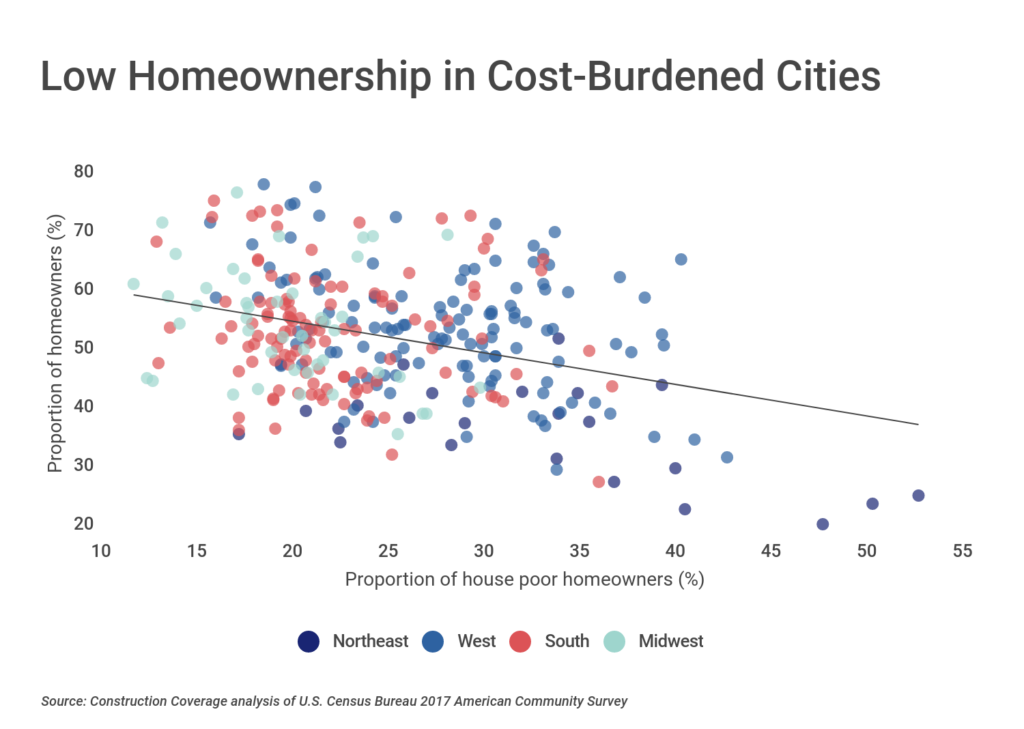

There is a strong negative relationship between the proportion of house poor homeowners and homeownership. In areas with the highest share of residents spending more than 30 percent of income on housing, far fewer people own homes. States in the Northeast exhibit low homeownership and high proportions of cost-burdened homeowners, while many midwestern and southern states demonstrate higher homeownership rates and fewer house poor homeowners.

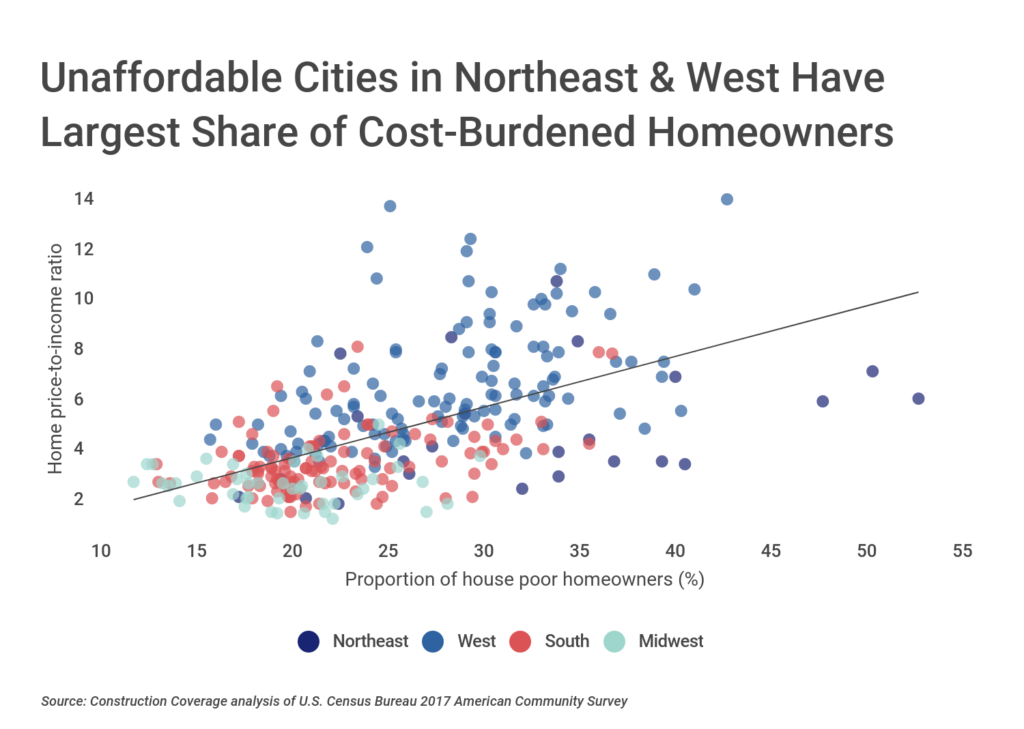

Interestingly, house poverty affects affluent and poor communities alike. Nationally, home values have grown by a whopping 36 percent in the last five years, while incomes increased only by 17 percent. The analysis finds that the strongest predictor of how many residents are housing cost-burdened in a given city is not median household income or median home price, but rather the ratio of between the two.

Midwestern and southern states offer the most affordable real estate (i.e. the lowest median home price to income ratio), while homes in the West are the least affordable in the country—in fact, the seven least affordable cities in the U.S. are all in California. This finding suggests that increased wages will be effective in battling house poverty only if such gains outpace changes in home prices.

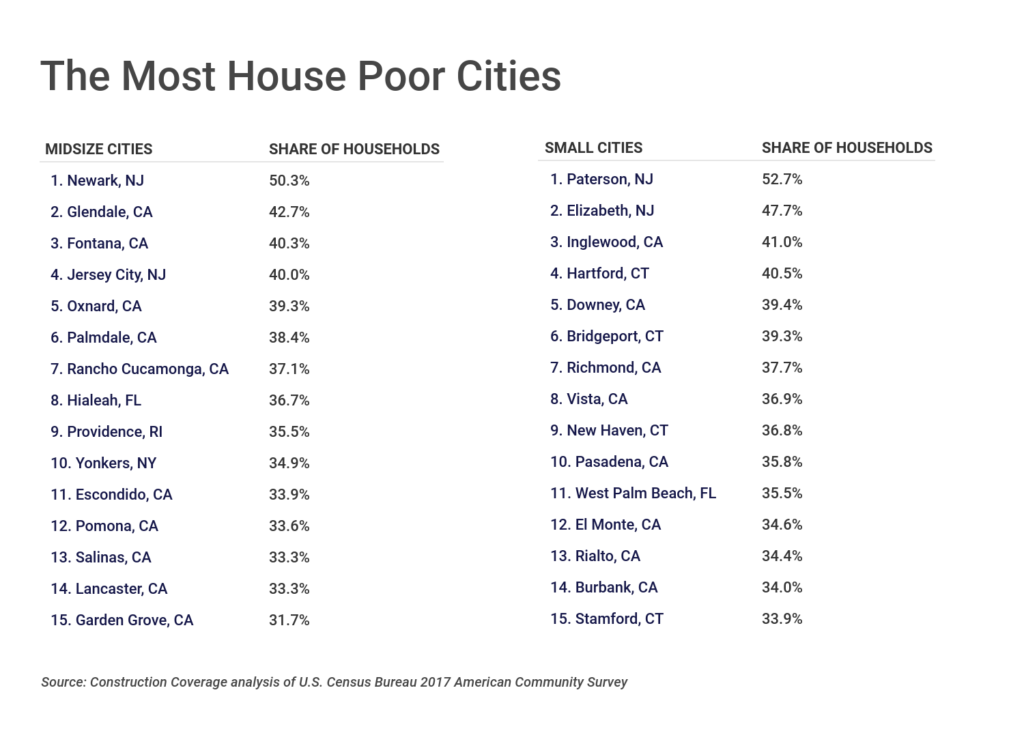

While potential homebuyers may try to avoid large cities in fear of becoming house poor, the relationship between house poverty and population size is negligible. Many large cities, such as Phoenix or San Antonio have relatively few house poor residents. On the other hand, it is not unusual for smaller cities such as Hartford, Connecticut to have a large share of house poor residents.

Researchers at Construction Coverage analyzed the most recent annual data from the U.S. Census Bureau and Zillow to uncover geographic variation in house poverty. All cities in the nation with more than 100,000 residents were considered and ranked by the proportion of homeowners who are housing cost-burdened. Here are the most house poor cities in America:

The 15 Most House Poor Big Cities in America

15. Boston, MA

- Proportion of house poor homeowners: 28.3%

- Proportion of house poor renters: 48.3%

- Median home value: $596,900

- Homeownership rate: 35.2%

- 5-year income growth: 29.3%

- 5-year home value growth: 44.5%

14. Sacramento, CA

- Proportion of house poor homeowners: 28.9%

- Proportion of house poor renters: 52.3%

- Median home value: $327,200

- Homeownership rate: 48.6%

- 5-year income growth: 17.3%

- 5-year home value growth: 54.9%

13. San Francisco, CA

- Proportion of house poor homeowners: 29.1%

- Proportion of house poor renters: 35.8%

- Median home value: $1,359,800

- Homeownership rate: 36.5%

- 5-year income growth: 51.8%

- 5-year home value growth: 46.8%

12. Chicago, IL

- Proportion of house poor homeowners: 29.8%

- Proportion of house poor renters: 46.1%

- Median home value: $228,000

- Homeownership rate: 44.9%

- 5-year income growth: 22.3%

- 5-year home value growth: 23.2%

11. San Jose, CA

- Proportion of house poor homeowners: 30.3%

- Proportion of house poor renters: 50.3%

- Median home value: $1,022,300

- Homeownership rate: 57.4%

- 5-year income growth: 30.7%

- 5-year home value growth: 49.4%

10. Honolulu, HI

- Proportion of house poor homeowners: 30.3%

- Proportion of house poor renters: 51.9%

- Median home value: $658,400

- Homeownership rate: 45.1%

- 5-year income growth: 16.4%

- 5-year home value growth: 21.7%

TRENDING ON CONSTRUCTION COVERAGE

The right construction software can help you streamline your business. Make sure to consider construction project management software, as well as estimating software and takeoff software.

9. San Diego, CA

- Proportion of house poor homeowners: 30.6%

- Proportion of house poor renters: 52.5%

- Median home value: $634,800

- Homeownership rate: 47.1%

- 5-year income growth: 22.9%

- 5-year home value growth: 33.8%

8. New Orleans, LA

- Proportion of house poor homeowners: 31.7%

- Proportion of house poor renters: 58.7%

- Median home value: $177,700

- Homeownership rate: 47.2%

- 5-year income growth: 7.7%

- 5-year home value growth: 21.9%

7. Bakersfield, CA

- Proportion of house poor homeowners: 32.2%

- Proportion of house poor renters: 49.6%

- Median home value: $242,300

- Homeownership rate: 56.1%

- 5-year income growth: 6.4%

- 5-year home value growth: 20.6%

6. Oakland, CA

- Proportion of house poor homeowners: 33.0%

- Proportion of house poor renters: 48.4%

- Median home value: $735,000

- Homeownership rate: 39.3%

- 5-year income growth: 46.4%

- 5-year home value growth: 60.9%

5. Anaheim, CA

- Proportion of house poor homeowners: 33.1%

- Proportion of house poor renters: 59.9%

- Median home value: $596,300

- Homeownership rate: 44.1%

- 5-year income growth: 26.9%

- 5-year home value growth: 30.6%

TRENDING ON CONSTRUCTION COVERAGE

People are often surprised to learn they need a commercial auto insurance policy. We recommend Geico’s commercial auto policy for Uber and Lift drivers. For commercial truck insurance, we recommend Progressive.

4. New York, NY

- Proportion of house poor homeowners: 33.8%

- Proportion of house poor renters: 50.7%

- Median home value: $676,000

- Homeownership rate: 32.7%

- 5-year income growth: 19.6%

- 5-year home value growth: 34.4%

3. Miami, FL

- Proportion of house poor homeowners: 36.0%

- Proportion of house poor renters: 61.3%

- Median home value: $335,200

- Homeownership rate: 28.9%

- 5-year income growth: 42.5%

- 5-year home value growth: 46.1%

2. Long Beach, CA

- Proportion of house poor homeowners: 36.6%

- Proportion of house poor renters: 53.5%

- Median home value: $595,400

- Homeownership rate: 40.6%

- 5-year income growth: 26.6%

- 5-year home value growth: 31.1%

1. Los Angeles, CA

- Proportion of house poor homeowners: 38.9%

- Proportion of house poor renters: 56.3%

- Median home value: $686,700

- Homeownership rate: 36.6%

- 5-year income growth: 28.6%

- 5-year home value growth: 40.7%

Methodology and Full Results

Data on the percentage of homeowners and renters spending more than 30 percent of household income on housing costs comes from the U.S. Census Bureau 2017 American Community Survey 1-Year Estimates.

Median household income, homeownership rate, and city population also come from the American Community Survey Estimates, years 2012 and 2017. Median household income growth was calculated as the percentage change between 2012 and 2017. Median home prices and growth rates were derived from the Zillow Home Price Index.

Only cities with more than 100,000 residents were included in the analysis. Cities were grouped into the following categories based on size:

- Large cities: more than 350,000 people

- Midsize cities: 150,000 – 350,000 people

- Small cities: 100,000 – 150,000 people

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.