U.S. Cities With the Largest Rise in Down Payments During COVID

After a record-setting surge in home prices during the COVID-19 pandemic, the cooling of the real estate market seems to have fully set in.

Mortgage rates doubled over the course of 2022 as the U.S. Federal Reserve raised interest rates in efforts to combat inflation. Greater costs to borrow, coupled with elevated home prices and the effects of inflation on household finances, have priced out many would-be buyers. Today’s market is a far cry from the frenzy of competition and aggressive offers that buyers experienced in 2020 and 2021. Homes are staying on the market for longer, and sellers are more willing to accept concessions or lower their price.

RELATED

Estimating software is used by both insurers and contractors to estimate the cost of construction. The best construction cost estimating software makes it easy to created highly detailed and accurate estimates of materials, labor, and equipment.

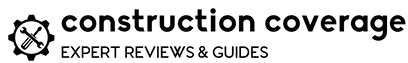

While the market today has become less competitive, many would-be buyers have stopped looking due to cost constraints. Mortgage application activity has declined substantially in recent months, returning to more typical historical levels. In the first quarter of 2020, prospective buyers submitted 1.26 million conventional conforming mortgage applications, and just over 660,000 were approved. Both of these figures approximately doubled by the peak of activity in the first quarter of 2021 before beginning to decline. The cooling of the market accelerated in 2022, and in the second quarter of last year, applications and approvals were both back below their pre-pandemic levels.

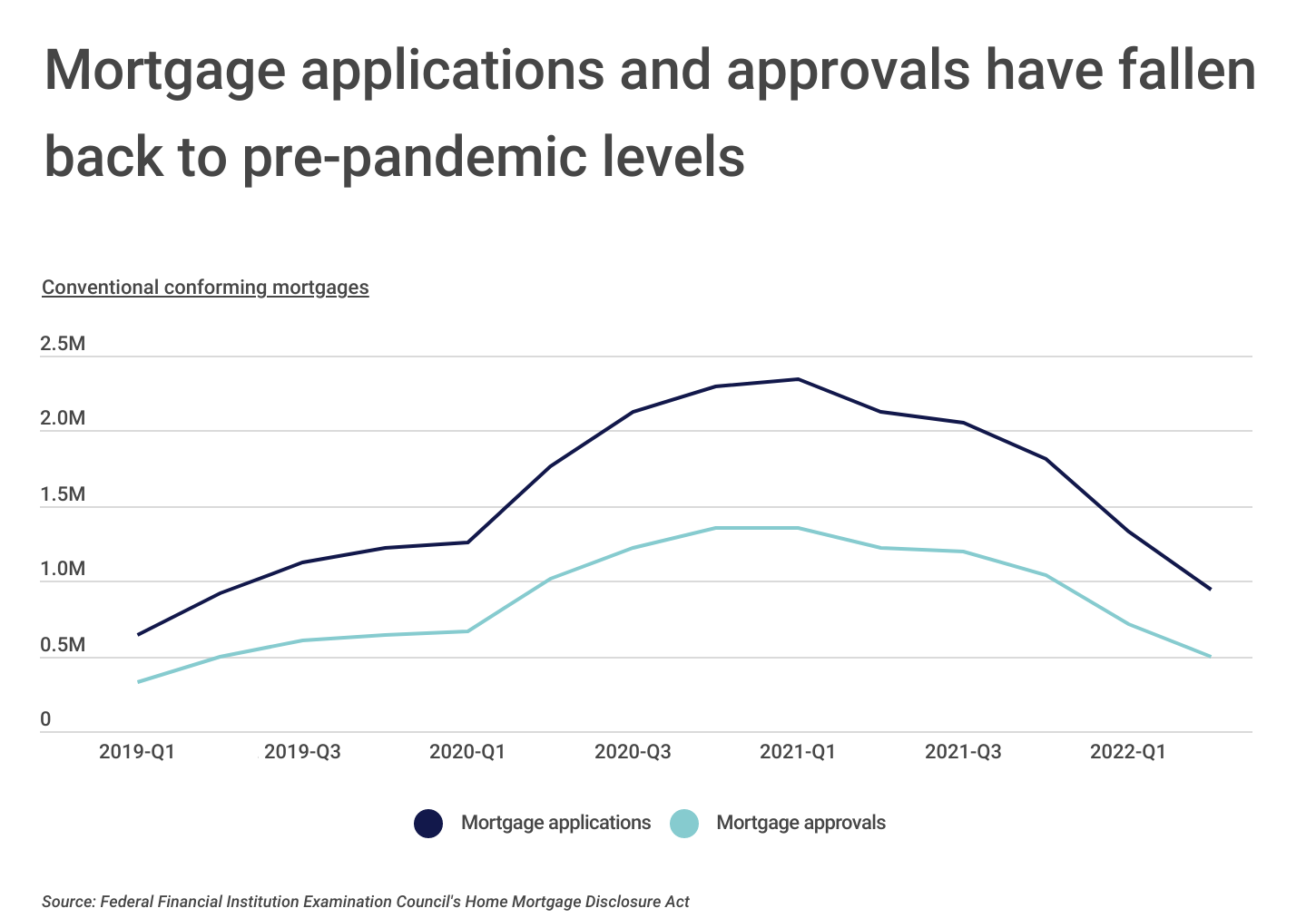

Amid this rapid rise and fall in mortgage applications and approvals, applicants’ mortgage qualifications shifted as well. Prior to the pandemic, the median combined loan-to-value ratio for U.S. mortgages was around 75%, meaning that the typical buyer put 25% down on a home. That figure fell to below 70% by the beginning of 2021 and remained there until rebounding back to 75% in the second quarter of 2022. A similar trend took place in debt-to-income ratio: after falling to a low of 34% in 2021, the median debt-to-income ratio for a mortgage applicant returned to its highest levels since 2019 after mortgage rates began increasing early last year.

These figures suggest that buyers were using more of their own cash and personal savings to finance purchases during the pandemic. Flush with cash from increased household savings and government stimulus payments, many buyers had greater resources at hand to put money down toward a home-and they often needed to put more down to compete. As these trends have reversed, buyers are needing to borrow more to finance home purchases.

RELATED

If you’re gearing up for a home renovation project in the near future, it’s crucial to keep in mind that a standard homeowners insurance policy will not provide coverage while your home is undergoing renovations. Therefore, it’s highly advisable to consider obtaining builders risk insurance, which is specifically designed to safeguard your property during construction or renovation work.

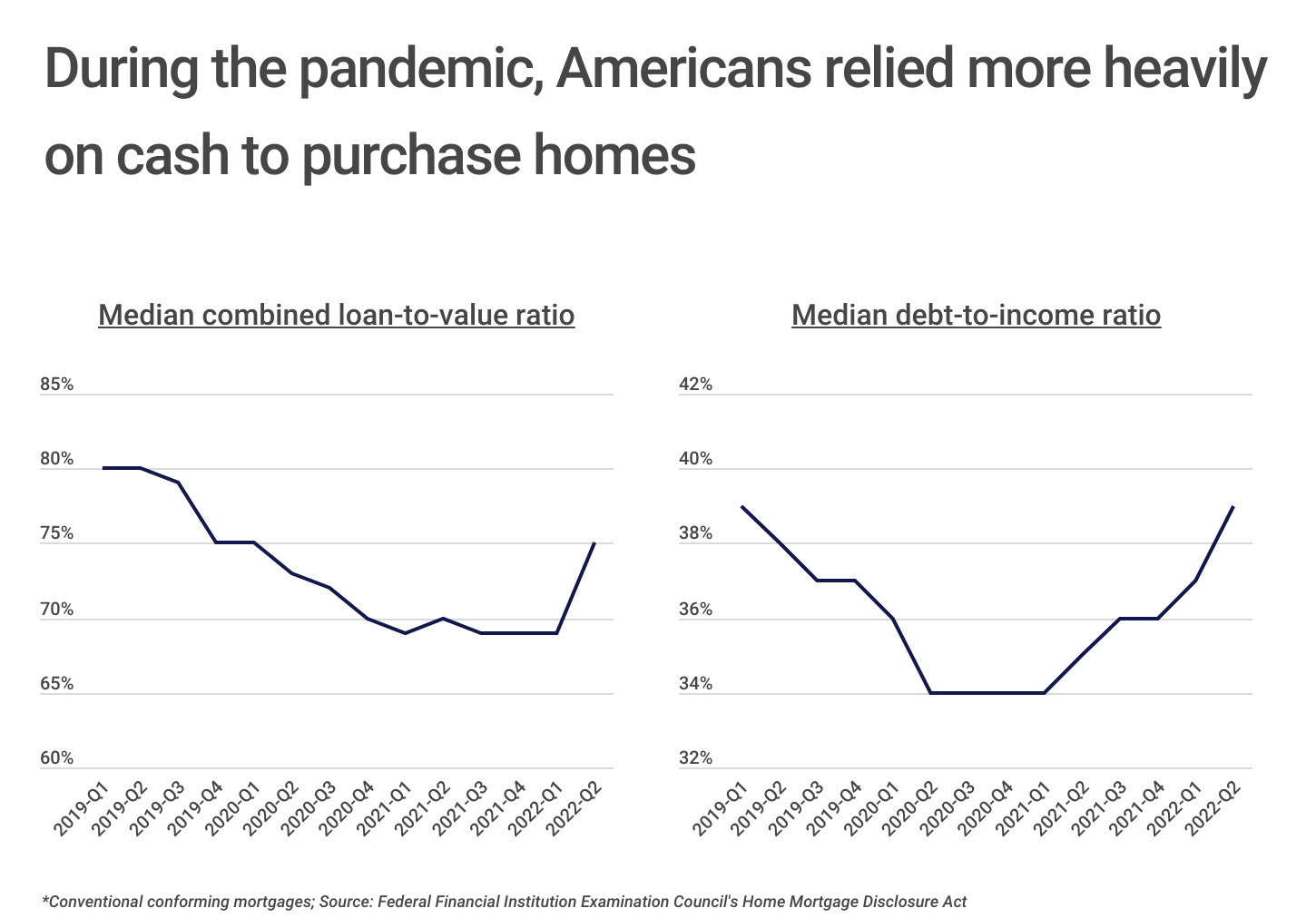

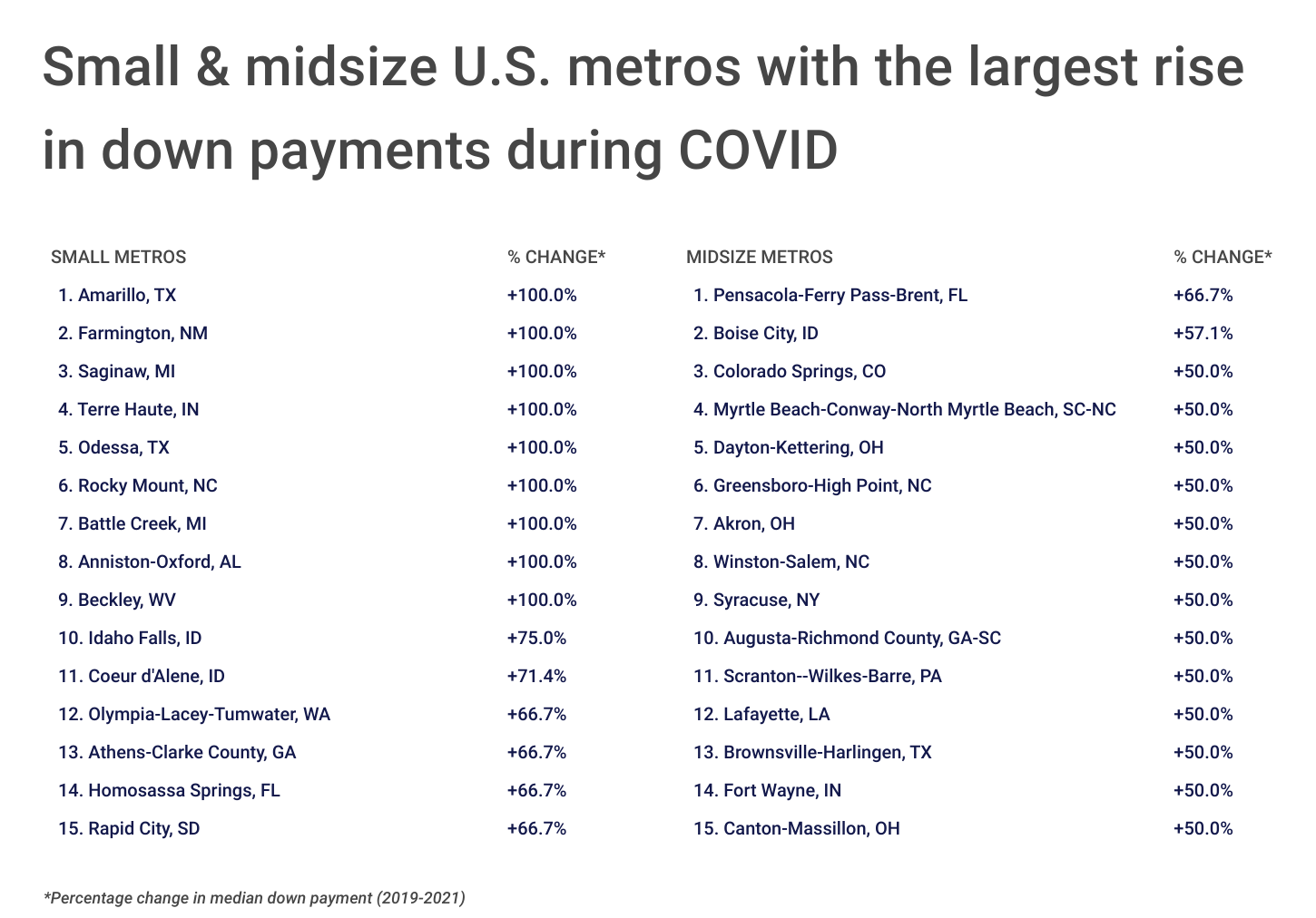

Bigger down payments became more common in some parts of the country than in others when comparing pre-pandemic numbers to those recorded in 2021. Many of the hottest markets in the U.S. during the pandemic, including Mountain West states like Idaho, Montana, and Utah, saw the largest increases in down payment size (relative to home price). These locations frequently attracted buyers from high-cost locations like Washington and California who often had more to spend.

Fast-growing Western states are also home to some of the cities that experienced the biggest percentage increases in down payments during the pandemic. Locations like Phoenix, Salt Lake City, Tucson, and Las Vegas all saw the size of the median down payment for a mortgage increase by at least 40%.

The data used in this analysis is from the Federal Financial Institutions Examination Council. To determine the locations with the largest rise in down payments during COVID, researchers at Construction Coverage calculated the percentage change in median down payment from 2019 to 2021. Only conventional home purchase loans approved in 2019 and 2021 were considered in this analysis. In the event of a tie, the location with the greater total change in median down payment was ranked higher.

Here are the U.S. metropolitan areas with the largest rise in down payments during COVID.

Large U.S. Metros With the Largest Rise in Down Payments During COVID

Photo Credit: Sean Pavone / Shutterstock

15. Memphis, TN-MS-AR

- Percentage change in median down payment (2019-2021): +33.3%

- Total change in median down payment (2019-2021): +$10,000

- Median down payment (2021): $40,000

- Median down payment (2019): $30,000

RELATED

If you are remodeling a new home, it’s highly likely that your contractor will utilize some form of construction project management software to streamline the job. As a result of advances in construction technology, many general contractors rely on software not only to manage the project effectively, but also to facilitate better communication with the homeowner.

Photo Credit: Sean Pavone / Shutterstock

14. Oklahoma City, OK

- Percentage change in median down payment (2019-2021): +33.3%

- Total change in median down payment (2019-2021): +$10,000

- Median down payment (2021): $40,000

- Median down payment (2019): $30,000

Photo Credit: Sean Pavone / Shutterstock

13. Milwaukee-Waukesha, WI

- Percentage change in median down payment (2019-2021): +33.3%

- Total change in median down payment (2019-2021): +$10,000

- Median down payment (2021): $40,000

- Median down payment (2019): $30,000

Photo Credit: Sean Pavone / Shutterstock

12. Indianapolis-Carmel-Anderson, IN

- Percentage change in median down payment (2019-2021): +33.3%

- Total change in median down payment (2019-2021): +$10,000

- Median down payment (2021): $40,000

- Median down payment (2019): $30,000

Photo Credit: Sean Pavone / Shutterstock

11. Columbus, OH

- Percentage change in median down payment (2019-2021): +33.3%

- Total change in median down payment (2019-2021): +$10,000

- Median down payment (2021): $40,000

- Median down payment (2019): $30,000

Photo Credit: Sean Pavone / Shutterstock

10. Kansas City, MO-KS

- Percentage change in median down payment (2019-2021): +33.3%

- Total change in median down payment (2019-2021): +$10,000

- Median down payment (2021): $40,000

- Median down payment (2019): $30,000

Photo Credit: Sean Pavone / Shutterstock

9. Cincinnati, OH-KY-IN

- Percentage change in median down payment (2019-2021): +33.3%

- Total change in median down payment (2019-2021): +$10,000

- Median down payment (2021): $40,000

- Median down payment (2019): $30,000

Photo Credit: Sean Pavone / Shutterstock

8. Providence-Warwick, RI-MA

- Percentage change in median down payment (2019-2021): +33.3%

- Total change in median down payment (2019-2021): +$20,000

- Median down payment (2021): $80,000

- Median down payment (2019): $60,000

Photo Credit: Sean Pavone / Shutterstock

7. Las Vegas-Henderson-Paradise, NV

- Percentage change in median down payment (2019-2021): +40.0%

- Total change in median down payment (2019-2021): +$20,000

- Median down payment (2021): $70,000

- Median down payment (2019): $50,000

Photo Credit: Sean Pavone / Shutterstock

6. Tulsa, OK

- Percentage change in median down payment (2019-2021): +50.0%

- Total change in median down payment (2019-2021): +$10,000

- Median down payment (2021): $30,000

- Median down payment (2019): $20,000

Photo Credit: Jacob Withey / Shutterstock

5. Rochester, NY

- Percentage change in median down payment (2019-2021): +50.0%

- Total change in median down payment (2019-2021): +$10,000

- Median down payment (2021): $30,000

- Median down payment (2019): $20,000

Photo Credit: Open.Tours LLC / Shutterstock

4. Buffalo-Cheektowaga, NY

- Percentage change in median down payment (2019-2021): +50.0%

- Total change in median down payment (2019-2021): +$10,000

- Median down payment (2021): $30,000

- Median down payment (2019): $20,000

Photo Credit: Sean Pavone / Shutterstock

3. Tucson, AZ

- Percentage change in median down payment (2019-2021): +50.0%

- Total change in median down payment (2019-2021): +$20,000

- Median down payment (2021): $60,000

- Median down payment (2019): $40,000

Photo Credit: Sean Pavone / Shutterstock

2. Salt Lake City, UT

- Percentage change in median down payment (2019-2021): +50.0%

- Total change in median down payment (2019-2021): +$30,000

- Median down payment (2021): $90,000

- Median down payment (2019): $60,000

Photo Credit: Sean Pavone / Shutterstock

1. Phoenix-Mesa-Chandler, AZ

- Percentage change in median down payment (2019-2021): +60.0%

- Total change in median down payment (2019-2021): +$30,000

- Median down payment (2021): $80,000

- Median down payment (2019): $50,000

Detailed Findings & Methodology

The data used in this analysis is from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act. To determine the locations with the largest rise in down payments during COVID, researchers at Construction Coverage calculated the percentage change in median down payment from 2019 to 2021. Only conventional home purchase loans approved in 2019 and 2021 were considered in this analysis. In the event of a tie, the location with the greater total change in median down payment was ranked higher. To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts based on population size: small (100,000-349,999), midsize (350,000-999,999), and large (1,000,000 or more).

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.