U.S. Cities Building the Most Multi-Family Housing

Note: This is the most recent release of our U.S. Cities Building the Most Multi-Family Housing study. To see data from previous years, please visit the Full Results section below.

The state of the U.S. housing market has been one of the defining economic stories of the past two and a half years. Since the beginning of the COVID-19 pandemic, housing has become more expensive for both buyers and renters. Despite recent price drops, both home prices and rental prices remain roughly 30% higher than before the pandemic.

Inadequate housing supply has been a key factor contributing to issues with housing affordability in the U.S. for years. Federal mortgage backer Freddie Mac estimates that the U.S. has a 3.8 million unit shortage of housing. But the pandemic only exacerbated the issue of supply. Housing inventory fell to record lows in 2020. The shift to working, schooling, and socializing from home increased preferences—and competition—for larger, single-family homes among both buyers and renters. In addition, ongoing supply chain challenges and labor shortages have made it difficult for builders to add new stock: building permits and housing starts rose significantly in 2021 and 2022, but completions failed to keep up. And now with higher interest rates, building permits have again declined back to 2019 levels.

Despite these challenges, one promising sign for housing supply is an uptick in planned multi-family home construction. Multi-family housing increases the density and availability of housing units in urban and suburban locations, and it is more efficient and cost-effective to develop than single-family stock. And with more people now returning to their offices, denser housing closer to work and social attractions is regaining its appeal.

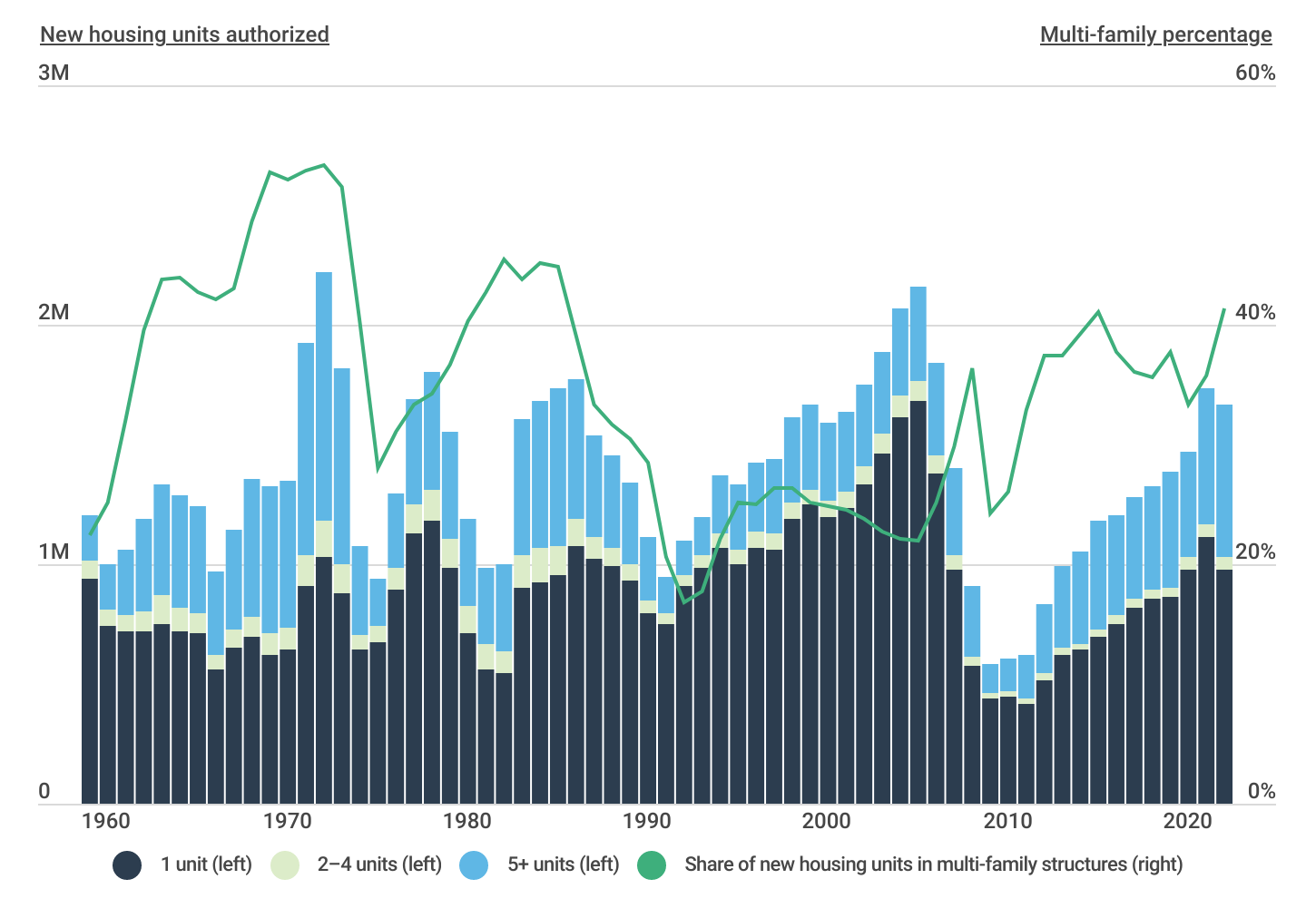

New Residential Building Permits by Size of Structure

The percentage of new housing in multi-family structures reached its highest level since 1985

For several years prior to the pandemic, the total number of new multi-family units authorized held steady, while multi-family units as a share of total new units experienced a slow decline. Both of these figures increased in 2019 but fell off again with the onset of the pandemic in 2020.

In 2021, however, the total number of multi-family units authorized jumped from 491,700 to 621,700, which brought the share of multi-family units authorized from 33.4% to 35.8%. The following year, in 2022, the authorization of multi-family units continued to climb, reaching 689,500. Simultaneously, the number of authorized single-family units experienced its first decline since 2011. This resulted in a notable shift, with multi-family buildings accounting for 41.4% of new housing, marking the highest level since 1985.

FOR LARGE CONSTRUCTION PROJECTS

Two new pieces of construction technology will make all the difference when working on large multi-family residential projects. The first is construction accounting software, which is loaded with features specific to managing the finances of a construction job. The second is construction project management software, which will help keep the job organized, safe, and completed on time.

The Popularity of Multi-Family Housing by State

The Midwest & West are investing far more in multi-family housing than in the past

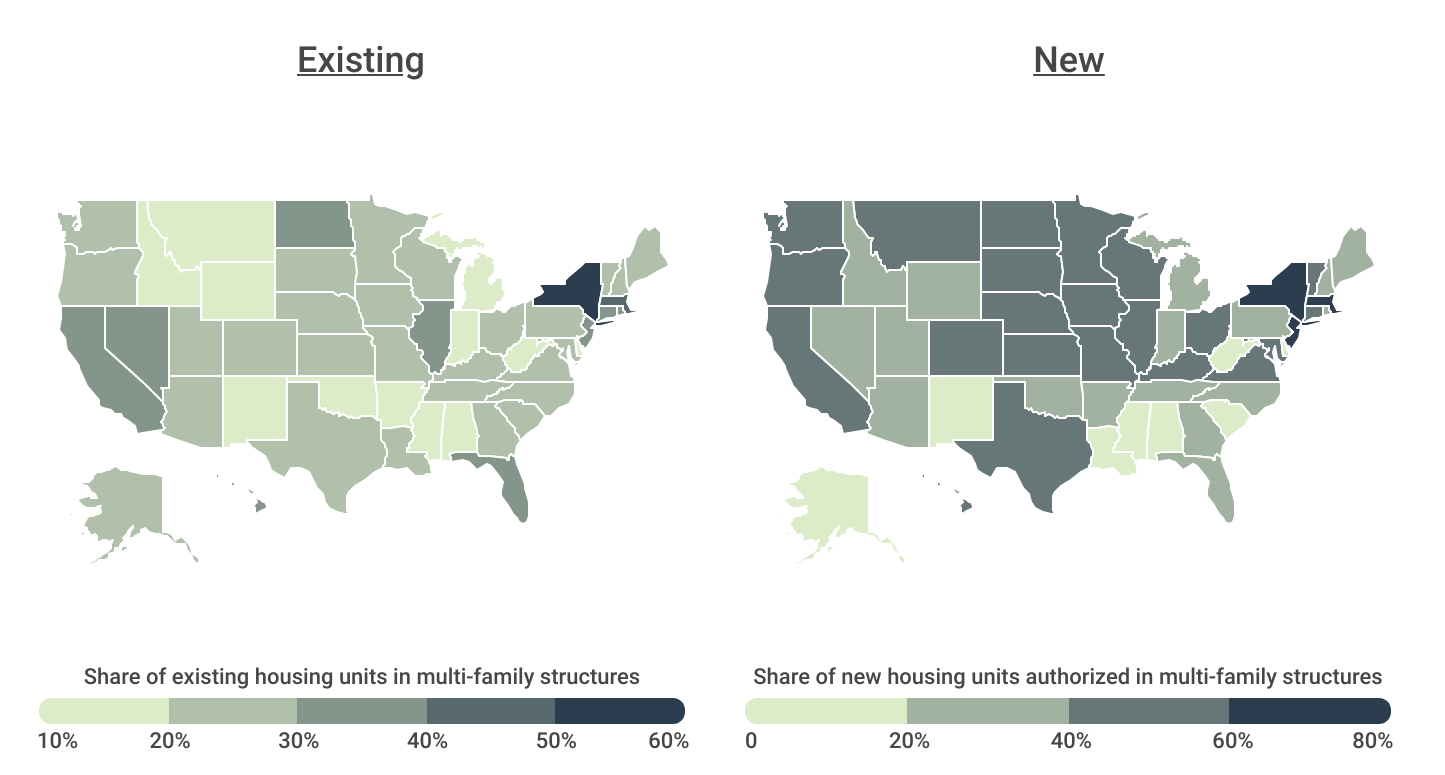

Multi-family housing plays a crucial role in bolstering housing availability in states with substantial urban populations. Nationally, approximately 28% of the current housing stock falls under the multi-family category, although this figure exhibits significant regional disparities. New York State leads the pack with the highest proportion of existing homes classified as multi-family, standing at 52.5%, followed by Massachusetts (43.1%), Rhode Island (38.6%), Hawaii (36.4%), and New Jersey (36.0%). Conversely, states in the South, Midwest, and Mountain West, which tend to be more rural, have traditionally allocated fewer resources to medium- and high-density housing. For instance, in West Virginia, Idaho, and Mississippi, less than 17% of the existing housing stock comprises multi-family units.

When considering new housing units authorized in 2022, a few notable trends emerge. To start, states with already substantial levels of multi-family housing, such as New York, Massachusetts, and New Jersey, saw a significant uptick in authorizations during this period. In these three states, the proportion of authorized multi-family units surpassed 60% of the total, with New York leading at nearly 74%. Furthermore, in all but nine states, the percentage of new housing units categorized as multi-family exceeded that of the existing housing stock.

Perhaps most interesting, there has been a compelling surge in multi-family home construction in unexpected regions. Areas in the Midwest and West, traditionally characterized by average or below-average concentrations of multi-family housing, have now ascended to the forefront in terms of the proportion of newly authorized multi-family units. This includes states like South Dakota, Washington, Minnesota, Nebraska, Colorado, and Montana, all of which now exceed the 50% mark.

Similar patterns emerge at the local level, where a blend of densely populated coastal cities and focal points in the Midwest and Western United States show the highest rates of multi-family development. There are a few exceptions in Florida, Texas, and Georgia, but generally, cities in the South report the lowest rates of new multi-family housing. This is likely attributed to lower demand and lower home prices compared to other regions of the country.

Below is a complete breakdown of new multi-family housing development across all major U.S. metropolitan areas and all 50 states. The analysis was conducted by researchers at Construction Coverage using data from the U.S. Census Bureau. Refer to the detailed methodology section for more information.

Top & Bottom Large Metros for Multi-Family Housing

| Top Metros | *Share |

|---|---|

| 1. New York-Newark-Jersey City, NY-NJ-PA | 79.3% |

| 2. Seattle-Tacoma-Bellevue, WA | 73.6% |

| 3. Boston-Cambridge-Newton, MA-NH | 72.4% |

| 4. San Francisco-Oakland-Berkeley, CA | 69.9% |

| 5. Hartford-East Hartford-Middletown, CT | 66.9% |

| 6. Los Angeles-Long Beach-Anaheim, CA | 65.6% |

| 7. Miami-Fort Lauderdale-Pompano Beach, FL | 65.2% |

| 8. Washington-Arlington-Alexandria, DC-VA-MD-WV | 64.0% |

| 9. San Diego-Chula Vista-Carlsbad, CA | 62.4% |

| 10. Minneapolis-St. Paul-Bloomington, MN-WI | 61.6% |

| 11. Salt Lake City, UT | 60.5% |

| 12. San Antonio-New Braunfels, TX | 58.0% |

| 13. Baltimore-Columbia-Towson, MD | 57.0% |

| 14. Denver-Aurora-Lakewood, CO | 56.9% |

| 15. Richmond, VA | 56.8% |

| Bottom Metros | *Share |

|---|---|

| 1. Oklahoma City, OK | 13.6% |

| 2. Memphis, TN-MS-AR | 19.0% |

| 3. Fresno, CA | 19.6% |

| 4. Cleveland-Elyria, OH | 22.0% |

| 5. Buffalo-Cheektowaga, NY | 23.7% |

| 6. Sacramento-Roseville-Folsom, CA | 24.4% |

| 7. Tulsa, OK | 25.0% |

| 8. Riverside-San Bernardino-Ontario, CA | 25.6% |

| 9. New Orleans-Metairie, LA | 25.6% |

| 10. Providence-Warwick, RI-MA | 26.5% |

| 11. Birmingham-Hoover, AL | 26.6% |

| 12. Las Vegas-Henderson-Paradise, NV | 29.6% |

| 13. Charlotte-Concord-Gastonia, NC-SC | 30.1% |

| 14. Cincinnati, OH-KY-IN | 33.6% |

| 15. Tucson, AZ | 34.6% |

*Share of new housing units authorized in multi-family structures

FOR COMMERCIAL PROPERTY OWNERS

While commercial building insurance will usually cover your property in the event of damage, builders risk insurance will cover it only when the building is under construction.

Top & Bottom Midsize Metros for Multi-Family Housing

| Top Metros | *Share |

|---|---|

| 1. Urban Honolulu, HI | 74.5% |

| 2. Trenton-Princeton, NJ | 74.3% |

| 3. Akron, OH | 73.9% |

| 4. Madison, WI | 72.6% |

| 5. Salem, OR | 69.0% |

| 6. Santa Maria-Santa Barbara, CA | 65.7% |

| 7. Oxnard-Thousand Oaks-Ventura, CA | 65.4% |

| 8. Bridgeport-Stamford-Norwalk, CT | 63.8% |

| 9. Reno, NV | 62.4% |

| 10. New Haven-Milford, CT | 61.0% |

| 11. Colorado Springs, CO | 58.8% |

| 12. Santa Rosa-Petaluma, CA | 57.9% |

| 13. Gainesville, FL | 57.1% |

| 14. Omaha-Council Bluffs, NE-IA | 56.7% |

| 15. Tallahassee, FL | 54.4% |

| Bottom Metros | *Share |

|---|---|

| 1. Shreveport-Bossier City, LA | 0.0% |

| 2. Corpus Christi, TX | 0.3% |

| 3. Montgomery, AL | 0.5% |

| 4. Lafayette, LA | 1.0% |

| 5. Jackson, MS | 1.1% |

| 6. Mobile, AL | 1.6% |

| 7. Winston-Salem, NC | 1.7% |

| 8. Beaumont-Port Arthur, TX | 2.2% |

| 9. Reading, PA | 3.6% |

| 10. Myrtle Beach-Conway-North Myrtle Beach, SC-NC | 3.8% |

| 11. Youngstown-Warren-Boardman, OH-PA | 4.7% |

| 12. Pensacola-Ferry Pass-Brent, FL | 5.0% |

| 13. Huntington-Ashland, WV-KY-OH | 5.5% |

| 14. Modesto, CA | 5.6% |

| 15. Gulfport-Biloxi, MS | 7.2% |

*Share of new housing units authorized in multi-family structures

Top & Bottom Small Metros for Multi-Family Housing

| Top Metros | *Share |

|---|---|

| 1. Napa, CA | 80.0% |

| 2. Mankato, MN | 70.9% |

| 3. Sioux Falls, SD | 70.7% |

| 4. Santa Fe, NM | 70.0% |

| 5. Missoula, MT | 67.8% |

| 6. Cheyenne, WY | 67.8% |

| 7. Athens-Clarke County, GA | 67.1% |

| 8. Lafayette-West Lafayette, IN | 66.8% |

| 9. Binghamton, NY | 66.4% |

| 10. Lincoln, NE | 66.2% |

| 11. Champaign-Urbana, IL | 66.0% |

| 12. Iowa City, IA | 65.6% |

| 13. Clarksville, TN-KY | 63.3% |

| 14. Rochester, MN | 62.8% |

| 15. Rapid City, SD | 62.3% |

| Bottom Metros | *Share |

|---|---|

| 1. Grand Forks, ND-MN | 0.0% |

| 2. Midland, TX | 0.0% |

| 3. Morgantown, WV | 0.0% |

| 4. Fond du Lac, WI | 0.0% |

| 5. Odessa, TX | 0.0% |

| 6. Macon-Bibb County, GA | 0.0% |

| 7. Muncie, IN | 0.0% |

| 8. San Angelo, TX | 0.0% |

| 9. Lawton, OK | 0.0% |

| 10. Redding, CA | 0.0% |

| 11. Jackson, MI | 0.0% |

| 12. Bay City, MI | 0.0% |

| 13. Spartanburg, SC | 0.0% |

| 14. Rocky Mount, NC | 0.0% |

| 15. Johnstown, PA | 0.0% |

*Share of new housing units authorized in multi-family structures

Top & Bottom States for Multi-Family Housing

| Top States | *Share |

|---|---|

| 1. New York | 73.7% |

| 2. Massachusetts | 65.0% |

| 3. New Jersey | 64.3% |

| 4. South Dakota | 58.4% |

| 5. Washington | 58.4% |

| 6. Connecticut | 56.8% |

| 7. Minnesota | 56.7% |

| 8. Nebraska | 54.4% |

| 9. Hawaii | 53.3% |

| 10. Illinois | 52.5% |

| 11. Colorado | 51.4% |

| 12. Montana | 50.6% |

| 13. Maryland | 49.6% |

| 14. Oregon | 49.3% |

| 15. Virginia | 46.8% |

| Bottom States | *Share |

|---|---|

| 1. Mississippi | 7.5% |

| 2. Delaware | 8.8% |

| 3. West Virginia | 13.5% |

| 4. Louisiana | 15.6% |

| 5. South Carolina | 17.4% |

| 6. New Mexico | 17.9% |

| 7. Alabama | 18.1% |

| 8. Alaska | 18.5% |

| 9. Oklahoma | 20.3% |

| 10. North Carolina | 29.0% |

| 11. Rhode Island | 30.1% |

| 12. Maine | 30.8% |

| 13. Michigan | 31.7% |

| 14. Indiana | 33.9% |

| 15. Arkansas | 34.1% |

*Share of new housing units authorized in multi-family structures

Methodology

The data used in this analysis is from the U.S. Census Bureau’s 2022 Building Permit Survey and 2022 American Community Survey. To determine the locations building the most multi-family housing, researchers at Construction Coverage calculated the share of new privately-owned housing units authorized by building permits in multi-family structures (two or more units) in 2022. In the event of a tie, the location with the greater share of existing housing units in multi-family structures was ranked higher. The proportion of existing housing units in multi-family structures was calculated using American Community Survey data and excludes mobile homes, boats, RVs, and other similar types of housing. To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts by population: small (100,000-349,999), midsize (350,000-999,999), and large (1,000,000+).

References

- U.S. Census Bureau and U.S. Department of Housing and Urban Development. (2023, July 26). Median Sales Price of Houses Sold for the United States [Data set]. https://fred.stlouisfed.org/series/MSPUS

- Leckie, J. (2023, September 15). The Rent Report September 2023. RentGroup Inc. https://www.rent.com/research/average-rent-price-report/

- Freddie Mac. (2021, May 7). Housing Supply: A Growing Deficit. https://www.freddiemac.com/research/insight/20210507-housing-supply

- Van Green, T. (2023, August 2). Majority of Americans prefer a community with big houses, even if local amenities are farther away. Pew Research Center. https://www.pewresearch.org/short-reads/2023/08/02/majority-of-americans-prefer-a-community-with-big-houses-even-if-local-amenities-are-farther-away/

- U.S. Census Bureau. (2023, September 19). Monthly New Residential Construction, August 2023. https://www.census.gov/construction/nrc/pdf/newresconst.pdf

- National Multifamily Housing Council. (2019, April). The Housing Affordability Toolkit. https://housingtoolkit.nmhc.org/

- U.S. Census Bureau. (2022). Building Permits Survey [Data set]. https://www.census.gov/construction/bps/index.html

- U.S. Census Bureau. (2022). American Community Survey [Data set]. https://www.census.gov/programs-surveys/acs

Full Results

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.