U.S. Cities With the Most Mortgage Refinances

Note: This is the most recent release of our U.S. Cities With the Most Mortgage Refinances study. To see data from previous years, please visit the Full Results section below.

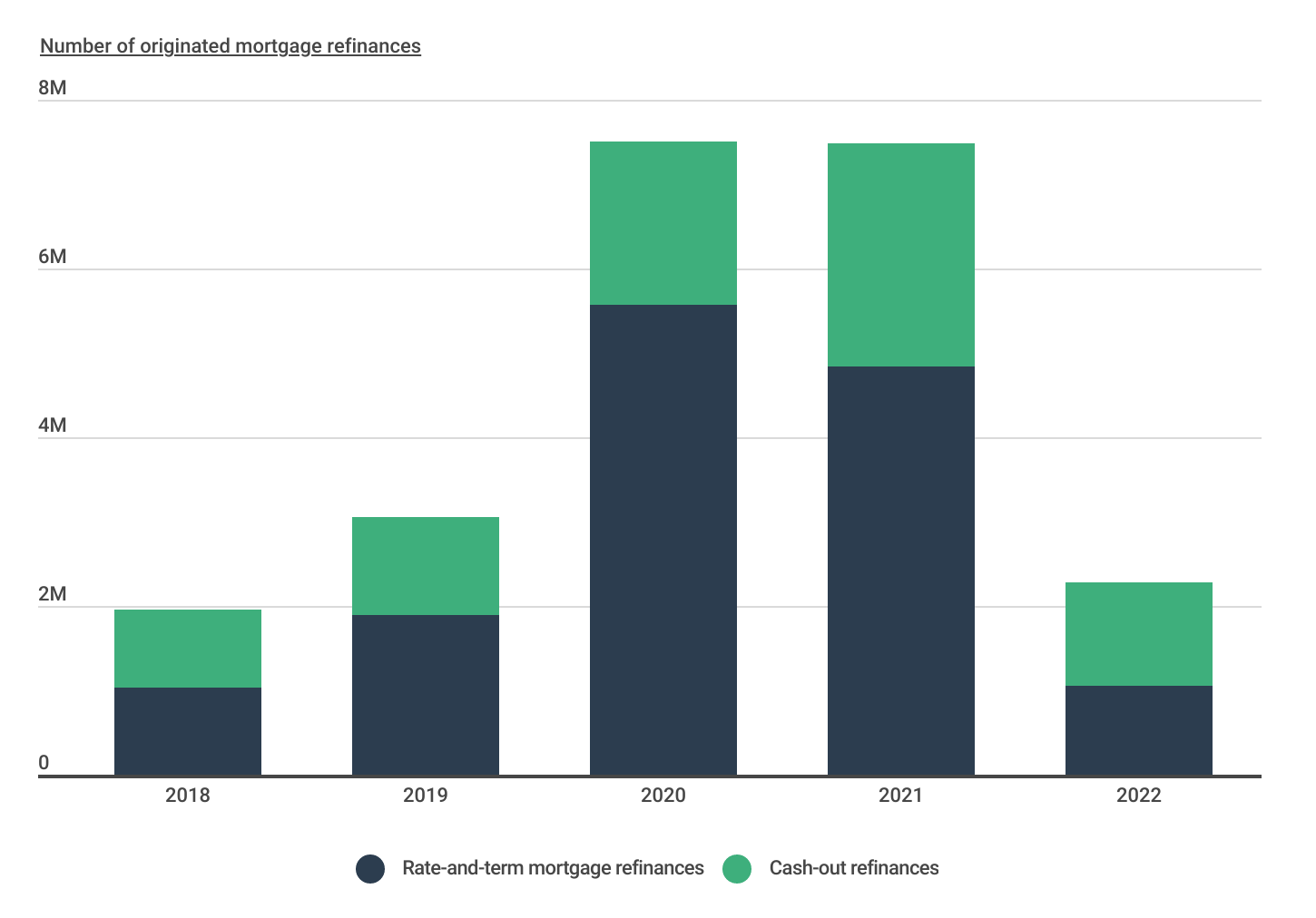

As mortgage interest rates continue to climb, mortgage refinancing applications remain in decline after refinancing exploded in 2020 and 2021 during the pandemic.

Most commonly, mortgage refinancing allows a homeowner to replace their existing loan with a new loan at a lower interest rate or different term length. Certain types of refinancing agreements can also enable the homeowner to receive cash in exchange for accrued home equity. The mortgage refinance industry is acutely sensitive to changes in the overall U.S. economy, so as economic conditions continue to change, the mortgage refinancing landscape will shift as well.

Composition of U.S. Mortgage Refinances

Mortgage refinances returned to pre-pandemic levels in 2022, but a majority of them were cash-out

FOR CONSTRUCTION PROFESSIONALS

Do you run a general contracting business? If so, choosing the right contractor accounting software can help you manage your cash flow and better understand the revenue and expenses associated with each project.

Due primarily to historically low interest rates, mortgage refinances skyrocketed in 2020, increasing a whopping 145% from 2019 and remaining at similar levels in 2021. However, in 2022, mortgage refinances regressed back to pre-pandemic levels—declining nearly 70% to a total of approximately 2.3 million refinances. Notably, the composition of mortgage refinances shifted as well. Driven by a historic runup in home sale value during COVID, nearly 54% of all mortgage refinances in 2022 were cash-out as homeowners looked to draw on their newfound home equity.

Most Common Denial Reasons for Mortgage Refinance Applications

Inadequate debt-to-income ratio is the most common reason for denied refinancing

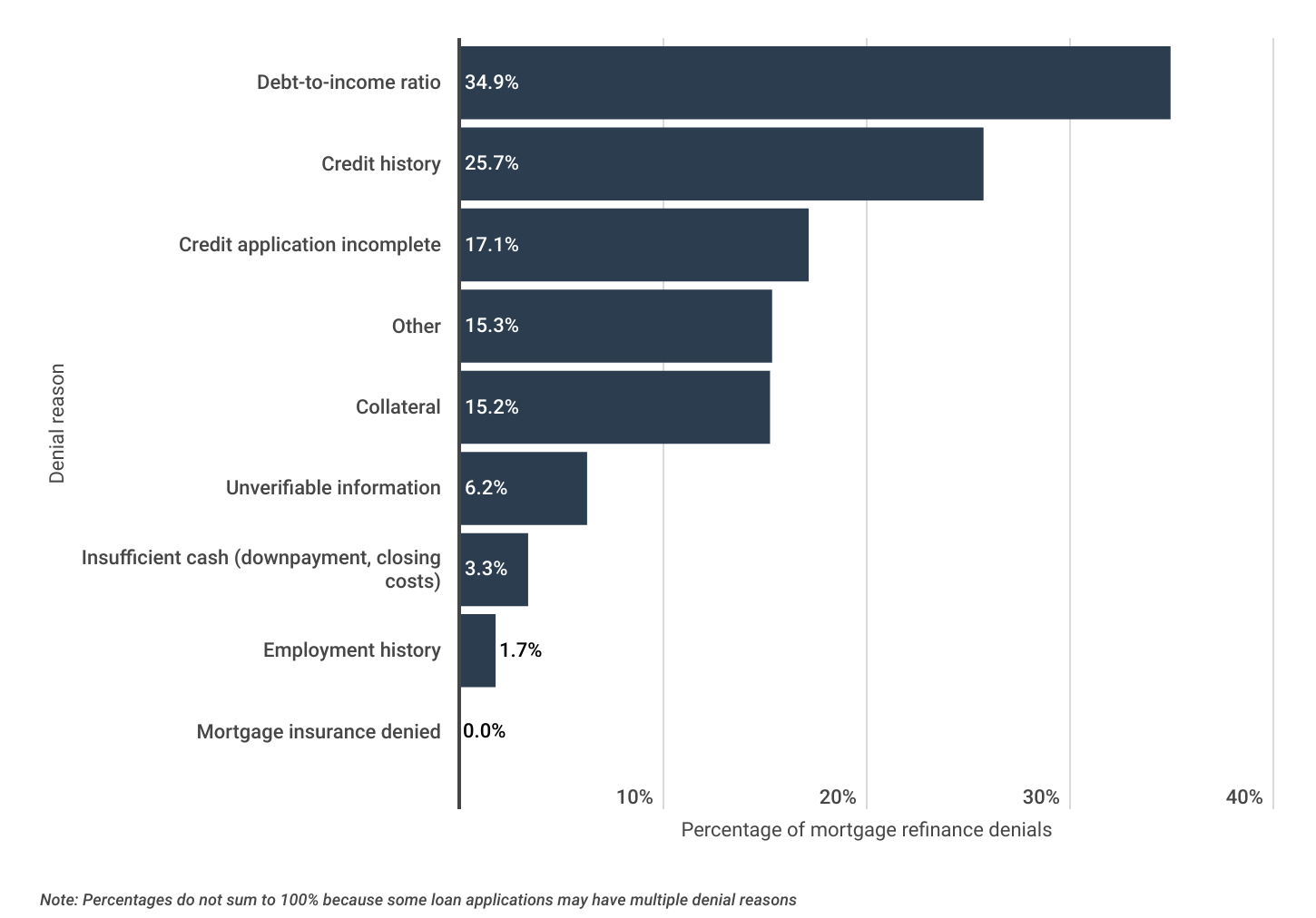

Although refinancing a mortgage can help reduce monthly payments or provide some much needed liquidity, not all refinancing applications are approved. The most common reason for refinancing denials was an inadequate debt-to-income ratio, cited in nearly 35% of all refinancing applications that were denied. Credit history was the second most common reason for refinancing denials, mentioned in over one in four denials.

TRENDING

Do you manage multiple rental properties? The best property management software will help you streamline rental and leasing, building maintenance, communication with tenants and owners, accounting, and more.

Mortgage Refinances by Location

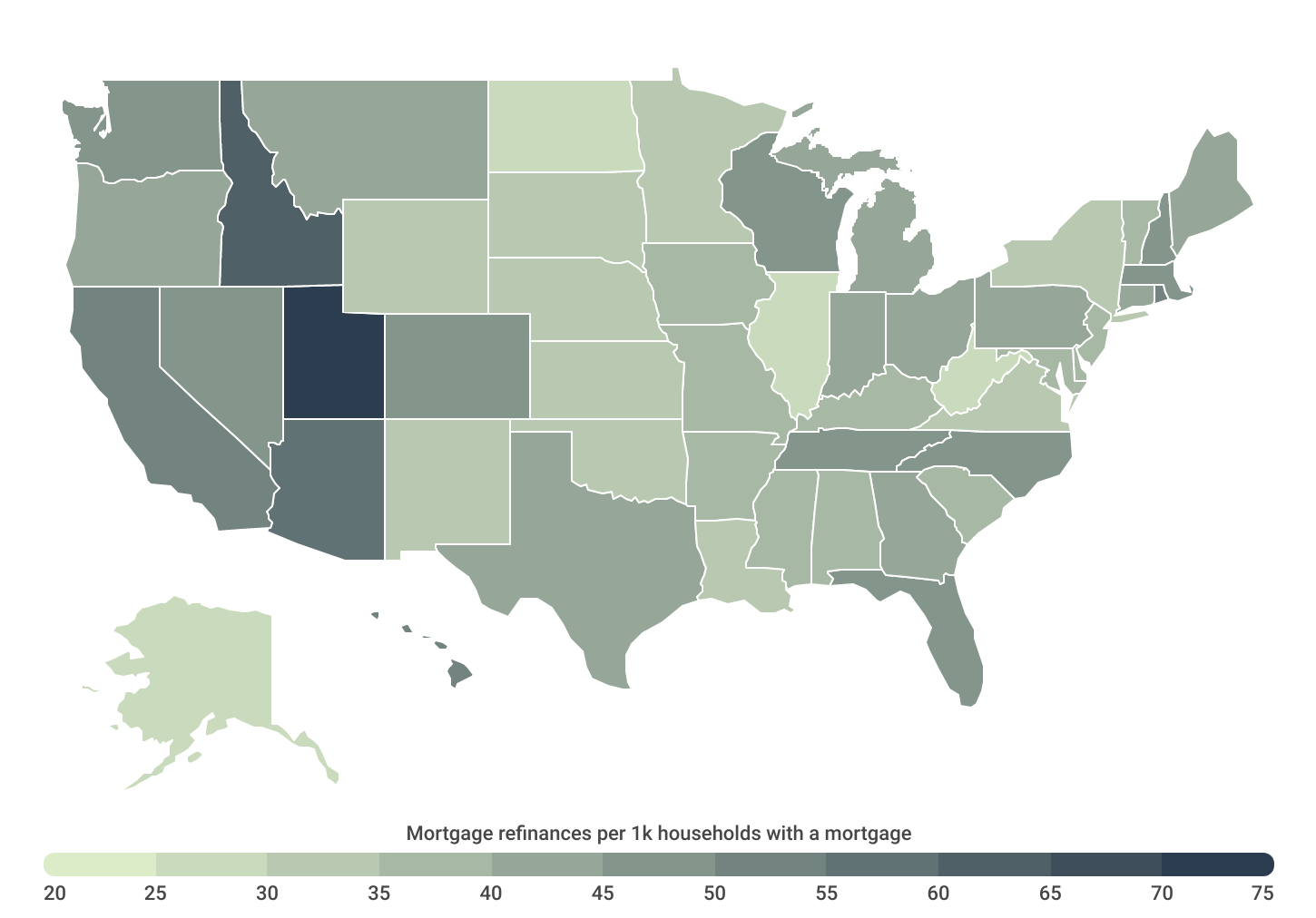

Mortgage refinancing is most popular in Utah, Idaho, and Arizona

The proportion of households that refinance their mortgage varies considerably across regions of the country. In the U.S. overall, there were 42.1 mortgage refinances approved per 1,000 households with mortgages in 2022. Refinancing is much more common in the western U.S. where home prices have appreciated rapidly over the past decade. Out of all 50 states, Utah had the most mortgage refinances at 70.3 refinances per 1,000 households with a mortgage, followed by Idaho (63.4), and Arizona (56.2). Conversely, at just 26.0 refinances per 1,000 mortgaged households, Alaska had the fewest.

At the metropolitan level, many of the same trends hold true. Utah is well represented, with the Salt Lake City metro ranking first among large metros, Provo-Orem claiming the top spot among midsize metros, and St. George, UT and Logan, UT-ID ranking second and fourth, respectively, among small metros.

Below is a complete breakdown of mortgage refinances in 2022 across more than 380 metropolitan areas, grouped by size, and all 50 states. The analysis was conducted by researchers at Construction Coverage using data from the Federal Financial Institutions Examination Council and the U.S. Census Bureau. For more information on how each statistic was computed, refer to the methodology section below.

Large Metros With the Most Mortgage Refinances

| Top Metros | Refinances* |

|---|---|

| 1. Salt Lake City, UT | 68.2 |

| 2. Phoenix-Mesa-Chandler, AZ | 59.6 |

| 3. Los Angeles-Long Beach-Anaheim, CA | 57.5 |

| 4. Nashville-Davidson–Murfreesboro–Franklin, TN | 56.6 |

| 5. Riverside-San Bernardino-Ontario, CA | 55.0 |

| 6. Grand Rapids-Kentwood, MI | 52.7 |

| 7. Charlotte-Concord-Gastonia, NC-SC | 52.5 |

| 8. Raleigh-Cary, NC | 51.8 |

| 9. San Diego-Chula Vista-Carlsbad, CA | 50.9 |

| 10. Austin-Round Rock-Georgetown, TX | 50.6 |

| 11. San Jose-Sunnyvale-Santa Clara, CA | 50.0 |

| 12. San Francisco-Oakland-Berkeley, CA | 49.8 |

| 13. Providence-Warwick, RI-MA | 49.8 |

| 14. Sacramento-Roseville-Folsom, CA | 49.6 |

| 15. Tampa-St. Petersburg-Clearwater, FL | 49.2 |

| Bottom Metros | Refinances* |

|---|---|

| 1. Virginia Beach-Norfolk-Newport News, VA-NC | 30.0 |

| 2. Tulsa, OK | 30.7 |

| 3. New Orleans-Metairie, LA | 31.2 |

| 4. Chicago-Naperville-Elgin, IL-IN-WI | 31.8 |

| 5. Oklahoma City, OK | 32.9 |

| 6. Washington-Arlington-Alexandria, DC-VA-MD-WV | 33.0 |

| 7. Buffalo-Cheektowaga, NY | 33.3 |

| 8. New York-Newark-Jersey City, NY-NJ-PA | 34.0 |

| 9. St. Louis, MO-IL | 34.5 |

| 10. Baltimore-Columbia-Towson, MD | 35.1 |

| 11. Minneapolis-St. Paul-Bloomington, MN-WI | 35.2 |

| 12. Birmingham-Hoover, AL | 36.8 |

| 13. Richmond, VA | 36.8 |

| 14. Houston-The Woodlands-Sugar Land, TX | 37.0 |

| 15. Kansas City, MO-KS | 37.5 |

Midsize Metros With the Most Mortgage Refinances

| Top Metros | Refinances* |

|---|---|

| 1. Provo-Orem, UT | 73.3 |

| 2. Ogden-Clearfield, UT | 69.6 |

| 3. Santa Maria-Santa Barbara, CA | 63.3 |

| 4. Boise City, ID | 62.1 |

| 5. Madison, WI | 58.4 |

| 6. Asheville, NC | 56.3 |

| 7. Salinas, CA | 56.3 |

| 8. Naples-Marco Island, FL | 53.6 |

| 9. Cape Coral-Fort Myers, FL | 53.2 |

| 10. Knoxville, TN | 51.7 |

| 11. Spokane-Spokane Valley, WA | 51.4 |

| 12. Springfield, MO | 51.3 |

| 13. North Port-Sarasota-Bradenton, FL | 51.0 |

| 14. Chattanooga, TN-GA | 51.0 |

| 15. Stockton, CA | 50.8 |

| Bottom Metros | Refinances* |

|---|---|

| 1. Peoria, IL | 24.4 |

| 2. Anchorage, AK | 25.5 |

| 3. Shreveport-Bossier City, LA | 26.4 |

| 4. McAllen-Edinburg-Mission, TX | 26.5 |

| 5. Fayetteville, NC | 27.2 |

| 6. Augusta-Richmond County, GA-SC | 27.8 |

| 7. Baton Rouge, LA | 29.1 |

| 8. Syracuse, NY | 29.9 |

| 9. Brownsville-Harlingen, TX | 30.3 |

| 10. Montgomery, AL | 30.4 |

| 11. Little Rock-North Little Rock-Conway, AR | 30.5 |

| 12. Savannah, GA | 31.2 |

| 13. El Paso, TX | 31.4 |

| 14. Huntington-Ashland, WV-KY-OH | 32.0 |

| 15. Mobile, AL | 32.3 |

Small Metros With the Most Mortgage Refinances

| Top Metros | Refinances* |

|---|---|

| 1. Ocean City, NJ | 74.1 |

| 2. St. George, UT | 73.6 |

| 3. Flagstaff, AZ | 73.4 |

| 4. Logan, UT-ID | 69.7 |

| 5. Barnstable Town, MA | 69.0 |

| 6. Idaho Falls, ID | 68.1 |

| 7. Pocatello, ID | 65.4 |

| 8. Coeur d’Alene, ID | 61.4 |

| 9. Janesville-Beloit, WI | 59.4 |

| 10. Twin Falls, ID | 59.1 |

| 11. Green Bay, WI | 59.0 |

| 12. Kahului-Wailuku-Lahaina, HI | 58.8 |

| 13. Appleton, WI | 57.7 |

| 14. Oshkosh-Neenah, WI | 56.5 |

| 15. Florence-Muscle Shoals, AL | 56.5 |

| Bottom Metros | Refinances* |

|---|---|

| 1. Decatur, IL | 15.8 |

| 2. Laredo, TX | 19.4 |

| 3. Odessa, TX | 19.5 |

| 4. Lawton, OK | 19.8 |

| 5. Enid, OK | 20.5 |

| 6. Jacksonville, NC | 20.8 |

| 7. Pine Bluff, AR | 21.2 |

| 8. Carbondale-Marion, IL | 22.4 |

| 9. Parkersburg-Vienna, WV | 23.1 |

| 10. Binghamton, NY | 23.5 |

| 11. Casper, WY | 23.6 |

| 12. Midland, TX | 23.9 |

| 13. Sumter, SC | 24.1 |

| 14. Columbus, GA-AL | 24.4 |

| 15. Vineland-Bridgeton, NJ | 24.5 |

States With the Most Mortgage Refinances

| Top States | Refinances* |

|---|---|

| 1. Utah | 70.3 |

| 2. Idaho | 63.4 |

| 3. Arizona | 56.2 |

| 4. California | 52.6 |

| 5. Rhode Island | 52.1 |

| 6. Hawaii | 51.4 |

| 7. Wisconsin | 49.9 |

| 8. Tennessee | 49.4 |

| 9. Nevada | 47.7 |

| 10. Colorado | 47.5 |

| 11. North Carolina | 46.2 |

| 12. New Hampshire | 46.1 |

| 13. Washington | 45.4 |

| 14. Massachusetts | 45.4 |

| 15. Florida | 45.3 |

| Bottom States | Refinances* |

|---|---|

| 1. Alaska | 26.0 |

| 2. North Dakota | 28.4 |

| 3. Illinois | 29.3 |

| 4. West Virginia | 29.9 |

| 5. Oklahoma | 30.9 |

| 6. Kansas | 31.5 |

| 7. Louisiana | 32.0 |

| 8. New Mexico | 32.3 |

| 9. New York | 32.7 |

| 10. Virginia | 33.5 |

| 11. Nebraska | 34.2 |

| 12. Minnesota | 34.5 |

| 13. South Dakota | 34.8 |

| 14. Wyoming | 34.9 |

| 15. Maryland | 35.2 |

*Mortgage refinances per 1k households with a mortgage

Methodology

To find the locations with the most mortgage refinances, researchers at Construction Coverage analyzed the latest data from the Federal Financial Institutions Examination Council’s 2022 Home Mortgage Disclosure Act and the U.S. Census Bureau’s 2022 American Community Survey. The researchers ranked metros according to the number of mortgage refinances originated in 2022 per 1,000 households with a mortgage. Only conventional refinances for single family dwellings were considered for this analysis. In the event of a tie, the metro with the larger total number of mortgage refinances was ranked higher.

To improve relevance, metropolitan areas were grouped in to the following cohorts based on population size:

- Small metros: less than 350,000

- Midsize metros: 350,000–999,999

- Large metros: 1,000,000 or more

References

- Freddie Mac, retrieved from FRED (2023, November 10) 30-Year Fixed Rate Mortgage Average in the United States

https://fred.stlouisfed.org/series/MORTGAGE30US - Mortgage Bankers Association (2023, November 1) Mortgage Applications Decrease in Latest MBA Weekly Survey

https://www.mba.org/news-and-research/newsroom/news/2023/11/01/mortgage-applications-decrease-in-latest-mba-weekly-survey - U.S. Census Bureau and U.S. Department of Housing and Urban Development, retrieved from FRED (2023, November 10) Median Sales Price of Houses Sold for the United States

https://fred.stlouisfed.org/series/MSPUS - Consumer Financial Protection Bureau. (2023). Mortgage data (HMDA). https://www.consumerfinance.gov/data-research/hmda/

- U.S. Census Bureau. (2023). American Community Survey [Data set]. https://www.census.gov/programs-surveys/acs

Full Results

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.