Where Are Seniors Buying Homes? [2022 Edition]

Today’s real estate market remains highly challenging for many buyers. With a limited supply of homes and a high number of buyers, prices have soared to record heights over the past two years.

One of the underlying factors contributing to the current state of the market is generational. Real estate experts have noted that with an increasing number of older Americans aging in place, fewer homes are available for younger buyers. With millennials (America’s largest generation) currently aged 26 to 41—a peak period for first- or second-time home buying—competition in the real estate market has been fierce. And as prices rise, younger buyers with lower savings or less pre-existing home equity than older buyers may have an even harder time purchasing.

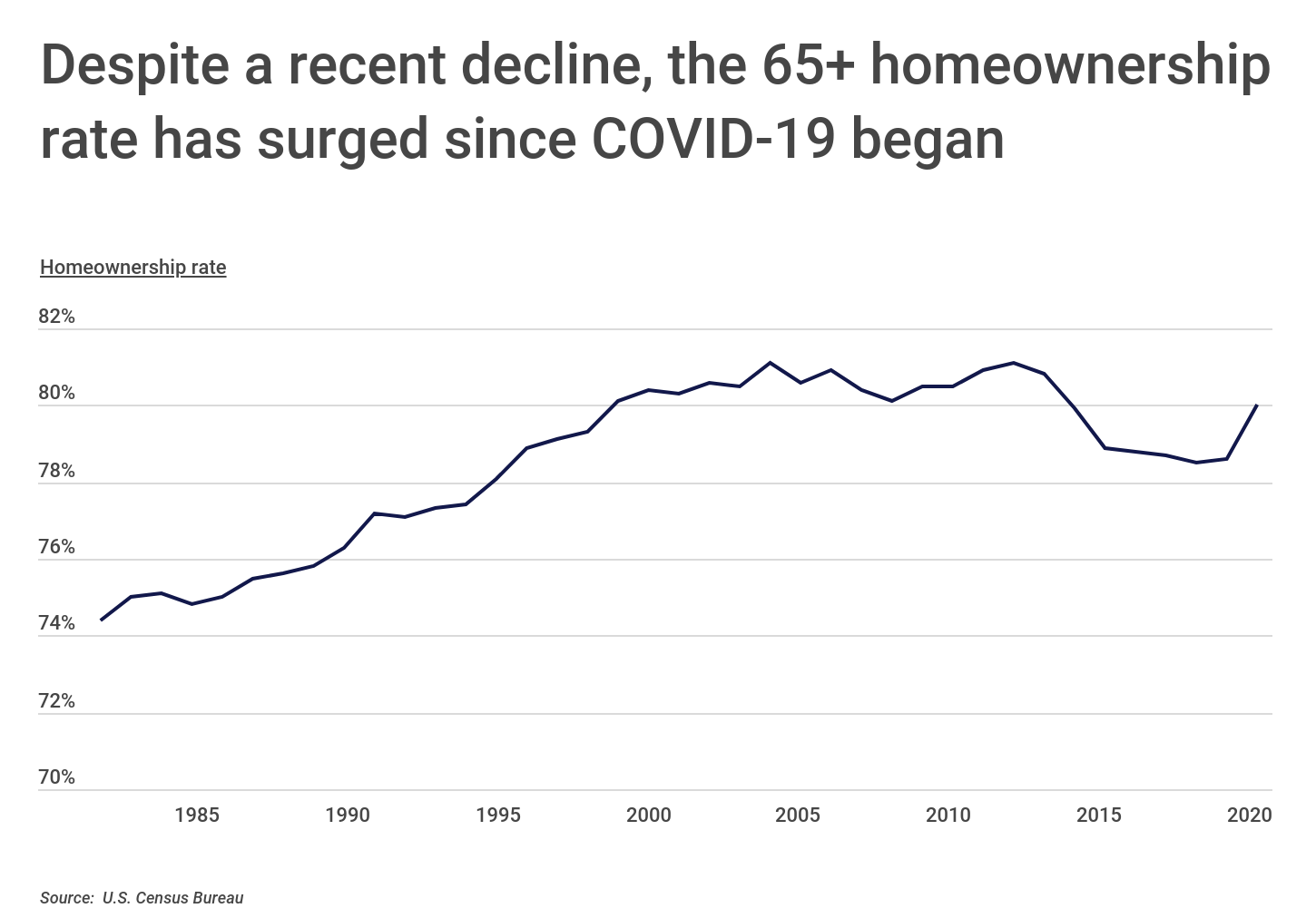

Unfortunately for younger homebuyers, homeownership among older Americans remains high. In 2012—the year after the first Baby Boomers turned 65—the homeownership rate among those aged 65 and over peaked at 81.1%. Beginning in 2013, that rate declined slightly each year until 2018, when the rate fell to 78.5%. But by 2020, that number increased to 80%—approximately 27.1 million owner-occupied households out of the 33.9 million total U.S. households of retirement age.

This trend may in part be attributable to larger numbers of wealthy Baby Boomers entering the 65-and-over age bracket. With more than 71 million Boomers controlling an estimated $70 trillion in wealth, the share of 65-and-over homeowners may continue to increase as the last of the Baby Boomer cohort reaches that age. Despite recent fluctuation in the rate of homeownership among older Americans, the raw number of retirement-age homeowners is up by more than 40% over the last decade.

But beyond simple demographic trends, many older Americans are also active buyers, looking for homes that suit their lifestyle preferences late in life. According to data from the National Association of Realtors, the most common reasons for older buyers to purchase are to be closer to friends and families or to find a smaller home. Older homeowners with these motivations are often exchanging one home for another, rather than exiting homeownership altogether. Retirement-age adults also faced many of the same pandemic-related motivations for buying in 2020, which was reflected in broad homeownership rate increases across all age cohorts.

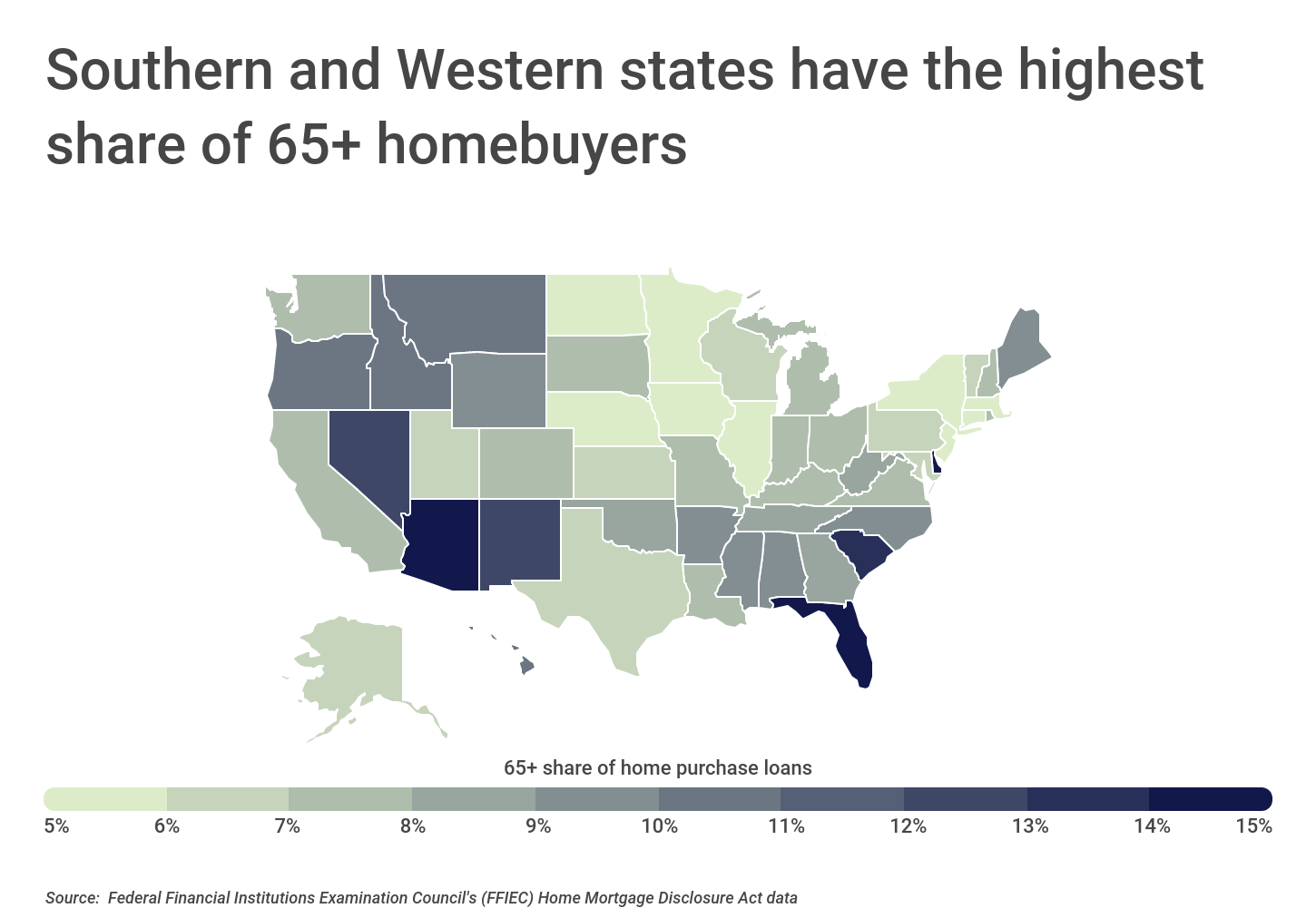

Many of the locations where older Americans are buying homes are Sun Belt locations that have been attracting retirees for years. States like Arizona, Florida, and Nevada have high numbers of seniors moving in, attracted by pleasant climates and more affordable cost of living than many northern cities. But the top state where seniors are buying homes is actually Delaware, where homebuyers aged 65 or older made up 15.1% of home purchase loans in 2020. Among Delaware’s benefits for seniors are low property taxes, tax breaks on pension and 401k income, and an absence of state sales and estate taxes, all of which help seniors keep more disposable income and allow them to transfer more of their wealth to their heirs.

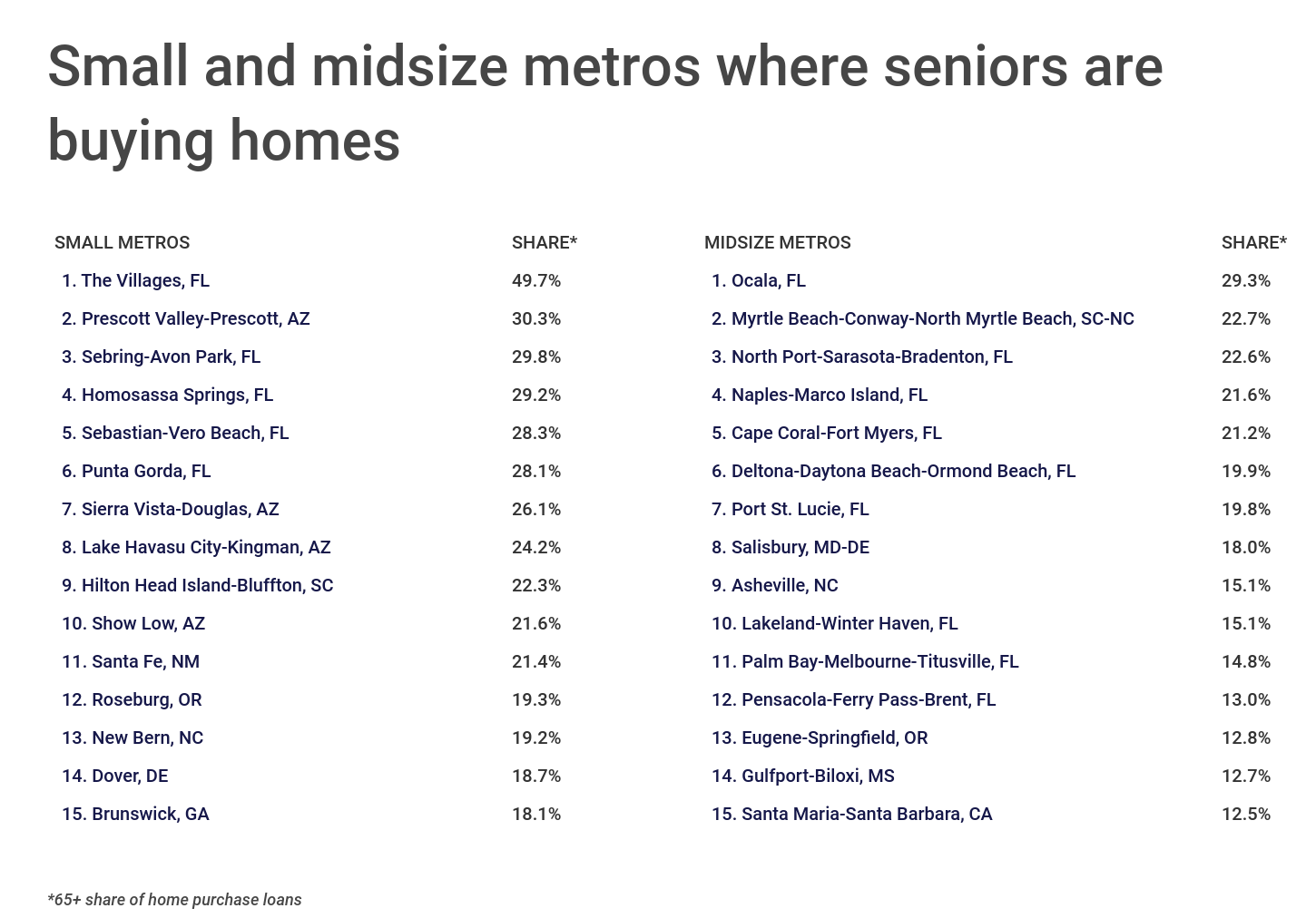

But at the metro level, the major Sun Belt retirement destinations are home to most of the top locations for older homebuyers. Among major metros, an overwhelming majority are located in Arizona, Florida, California, and the Carolinas. In some of these locations, homebuyers over 65 accounted for more than 20%—and up to nearly 50%—of all home purchase loans in 2020.

The data used in this analysis is from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act. Only conventional, home purchase loans originated in 2020 were considered. To determine the locations where the most seniors are buying homes, researchers at Construction Coverage calculated the share of home purchase loans in 2020 accounted for by homebuyers 65 years or older.

Here are the metropolitan areas where seniors are buying homes.

Large Metros Where Seniors Are Buying Homes

Photo Credit: Sean Pavone / Shutterstock

15. Richmond, VA

- 65+ share of home purchase loans: 7.4%

- Median loan amount: $225,000

- Median property value: $325,000

- Median loan-to-value ratio: 80.0%

- Median interest rate: 3.13%

CONSIDERING A MOVE?

When relocating to a new home, make sure whichever moving company you use is insured by a reputable trucking insurance company. In addition to protecting the moving company, trucking insurance protects your belongings should damage occur.

Photo Credit: Dancestrokes / Shutterstock

14. San Diego-Chula Vista-Carlsbad, CA

- 65+ share of home purchase loans: 7.4%

- Median loan amount: $425,000

- Median property value: $685,000

- Median loan-to-value ratio: 69.4%

- Median interest rate: 3.13%

Photo Credit: Sean Pavone / Shutterstock

13. Birmingham-Hoover, AL

- 65+ share of home purchase loans: 7.8%

- Median loan amount: $175,000

- Median property value: $255,000

- Median loan-to-value ratio: 80.0%

- Median interest rate: 3.13%

Photo Credit: Sean Pavone / Shutterstock

12. Tulsa, OK

- 65+ share of home purchase loans: 7.9%

- Median loan amount: $165,000

- Median property value: $225,000

- Median loan-to-value ratio: 80.0%

- Median interest rate: 3.13%

Photo Credit: f11photo / Shutterstock

11. San Antonio-New Braunfels, TX

- 65+ share of home purchase loans: 8.2%

- Median loan amount: $195,000

- Median property value: $275,000

- Median loan-to-value ratio: 80.0%

- Median interest rate: 3.25%

Photo Credit: Andrew Zarivny / Shutterstock

10. Sacramento-Roseville-Folsom, CA

- 65+ share of home purchase loans: 8.4%

- Median loan amount: $315,000

- Median property value: $485,000

- Median loan-to-value ratio: 75.0%

- Median interest rate: 3.13%

Photo Credit: Sean Pavone / Shutterstock

9. Miami-Fort Lauderdale-Pompano Beach, FL

- 65+ share of home purchase loans: 8.5%

- Median loan amount: $225,000

- Median property value: $325,000

- Median loan-to-value ratio: 75.0%

- Median interest rate: 3.25%

Photo Credit: Jon Bilous / Shutterstock

8. Virginia Beach-Norfolk-Newport News, VA-NC

- 65+ share of home purchase loans: 8.9%

- Median loan amount: $215,000

- Median property value: $315,000

- Median loan-to-value ratio: 80.0%

- Median interest rate: 3.25%

Photo Credit: Sean Pavone / Shutterstock

7. Orlando-Kissimmee-Sanford, FL

- 65+ share of home purchase loans: 9.2%

- Median loan amount: $205,000

- Median property value: $285,000

- Median loan-to-value ratio: 80.0%

- Median interest rate: 3.25%

Photo Credit: Matt Gush / Shutterstock

6. Riverside-San Bernardino-Ontario, CA

- 65+ share of home purchase loans: 10.0%

- Median loan amount: $275,000

- Median property value: $415,000

- Median loan-to-value ratio: 75.0%

- Median interest rate: 3.13%

Photo Credit: CHARLES MORRA / Shutterstock

5. Jacksonville, FL

- 65+ share of home purchase loans: 11.4%

- Median loan amount: $205,000

- Median property value: $305,000

- Median loan-to-value ratio: 79.8%

- Median interest rate: 3.25%

Photo Credit: Sean Pavone / Shutterstock

4. Tampa-St. Petersburg-Clearwater, FL

- 65+ share of home purchase loans: 11.7%

- Median loan amount: $175,000

- Median property value: $245,000

- Median loan-to-value ratio: 80.0%

- Median interest rate: 3.37%

Photo Credit: Sean Pavone / Shutterstock

3. Phoenix-Mesa-Chandler, AZ

- 65+ share of home purchase loans: 12.1%

- Median loan amount: $235,000

- Median property value: $335,000

- Median loan-to-value ratio: 79.6%

- Median interest rate: 3.25%

Photo Credit: Sean Pavone / Shutterstock

2. Las Vegas-Henderson-Paradise, NV

- 65+ share of home purchase loans: 12.7%

- Median loan amount: $245,000

- Median property value: $335,000

- Median loan-to-value ratio: 80.0%

- Median interest rate: 3.25%

Photo Credit: Sean Pavone / Shutterstock

1. Tucson, AZ

- 65+ share of home purchase loans: 18.5%

- Median loan amount: $195,000

- Median property value: $275,000

- Median loan-to-value ratio: 80.0%

- Median interest rate: 3.25%

Detailed Findings & Methodology

The data used in this analysis is from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act. Only conventional, home purchase loans originated in 2020 were considered. To determine the locations where the most seniors are buying homes, researchers calculated the share of home purchase loans in 2020 accounted for by homebuyers 65 years or older. In the event of a tie, the location with the higher median loan amount was ranked higher. To improve relevance, only metropolitan areas with at least 100,000 residents were included. Additionally, metros were grouped into cohorts based on population size: small (100,000-349,999), midsize (350,000-999,999), and large (1,000,000 or more).

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.