Buyers in These U.S. Cities Get the Best Mortgage Rates [2022 Edition]

After hitting record lows in August of 2021, mortgage interest rates have been steadily rising. Recent actions by the Federal Reserve to combat inflation have caused mortgage rates to double since the start of the year. While home prices are starting to come down, the drop is not expected to offset the price jump that occurred during the pandemic. As a result, the combination of rising rates on top of an already expensive housing market have made purchasing a home even more costly.

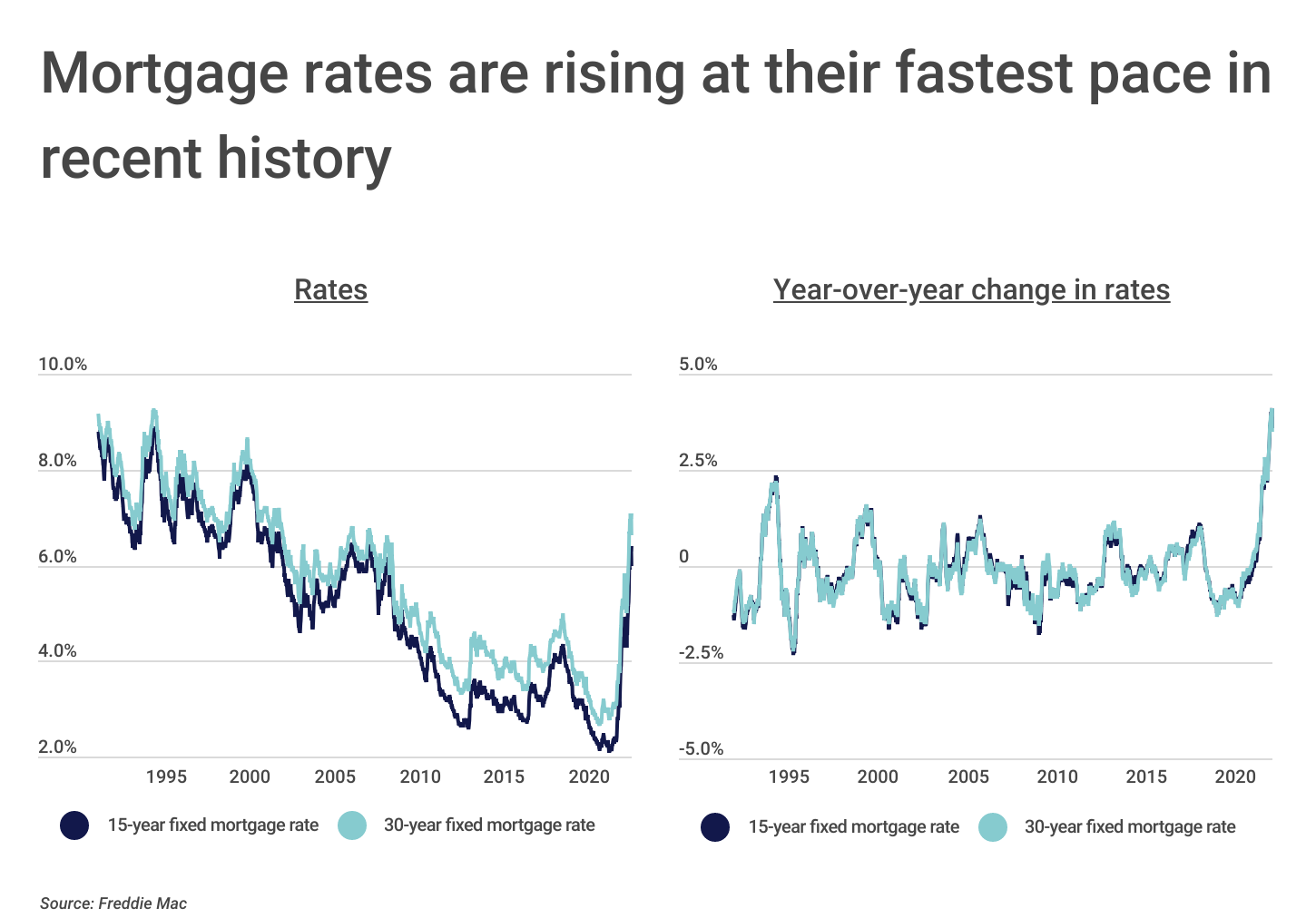

In 2021, the average interest rate for a 30-year mortgage was 2.96%, nearly half the average interest rate for a 30-year mortgage over the last 30 years—5.74%. The Federal Reserve began raising interest rates in March of this year, starting gradually and then more aggressively as inflation remained stubbornly high. As a result, mortgage rates are rising at their fastest pace in decades. Just recently, 30-year mortgage interest rates topped 7%.

Mortgage rates are now at the highest they’ve been in 20 years. And despite a decline in home prices, the monthly mortgage payment for a median-priced home in the U.S. remains about 50% higher than before the rate increases. While mortgage interest rates are largely determined by macroeconomic trends, prospective home buyers do have ways of securing a lower rate—including maintaining good credit and putting down a larger down payment on their home purchase.

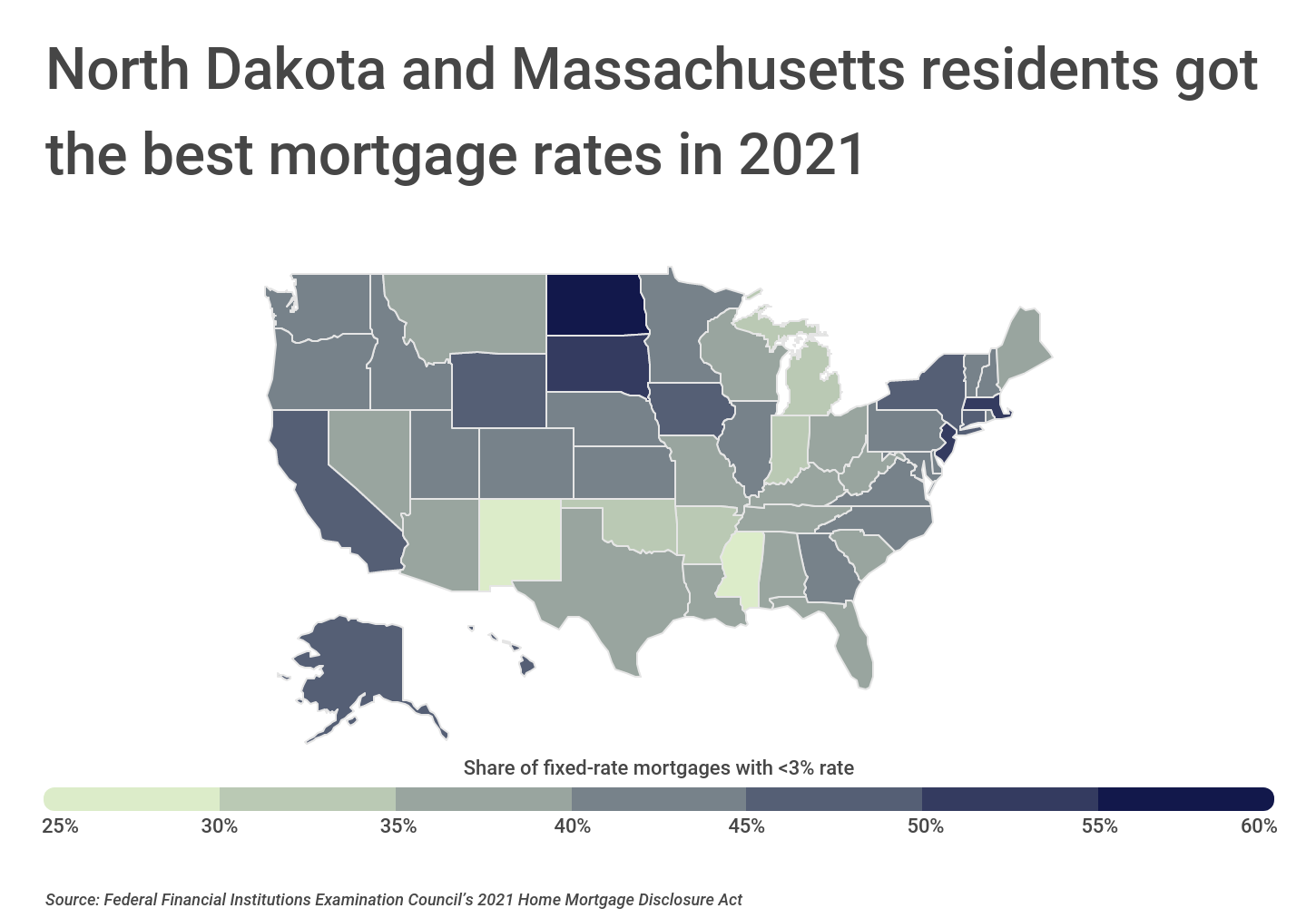

Another factor in determining mortgage interest rates is location. Interest rates vary geographically due to local market conditions, the financial health of residents, and laws governing lenders. Across the U.S., 41.6% of all approved home purchase loans had interest rates below 3.0% in 2021. However, in some parts of the country the majority of approved mortgage loans secured rates below this figure. At the state level, North Dakota and Massachusetts had the largest share of fixed-rate mortgages with rates below 3.0% in 2021, at 58.5% and 54.8% respectively. In comparison, fewer buyers in the Southeast received favorable rates. Just 27.7% of approved mortgages in Mississippi had rates of less than 3.0%—the lowest level in the country.

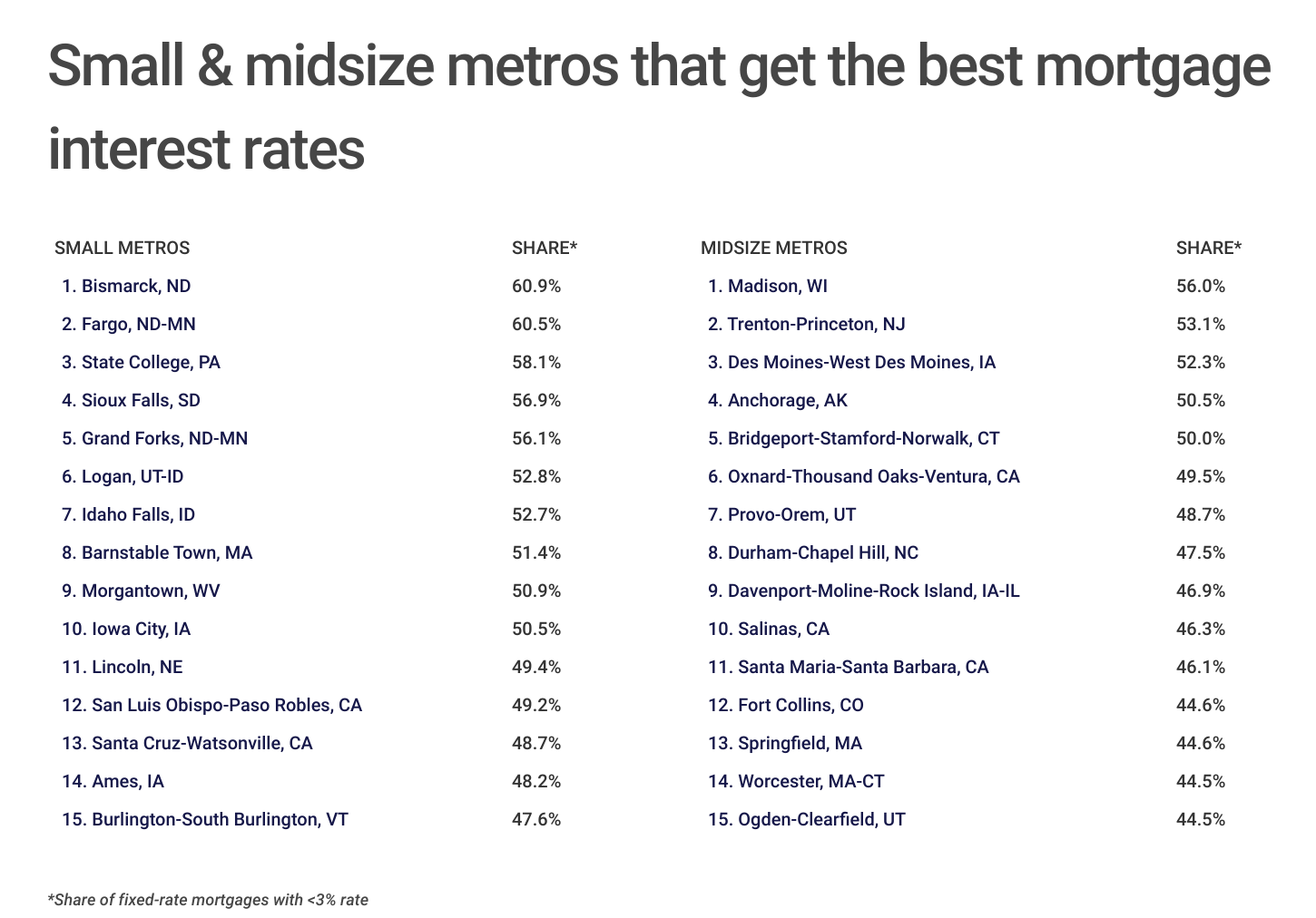

To determine the U.S. metropolitan areas that get the best mortgage interest rates, researchers at Construction Coverage analyzed the latest data from the 2021 Home Mortgage Disclosure Act. The researchers ranked metros according to the share of all fixed-rate mortgages with less than a 3.0% interest rate. Researchers also calculated the share of 30-year and 15-year mortgages with less than a 3.0% rate, and the median interest rate across all fixed-rate mortgages.

Here are the metros with the best mortgage interest rates.

Large Metros That Get the Best Mortgage Rates

Photo Credit: Sean Pavone / Shutterstock

15. Denver-Aurora-Lakewood, CO

- Share of fixed-rate mortgages with <3% rate: 43.9%

- Share of 30-year mortgages with <3% rate: 43.3%

- Share of 15-year mortgages with <3% rate: 82.5%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: Dave Riewe / Shutterstock

14. Minneapolis-St. Paul-Bloomington, MN-WI

- Share of fixed-rate mortgages with <3% rate: 44.2%

- Share of 30-year mortgages with <3% rate: 43.2%

- Share of 15-year mortgages with <3% rate: 89.6%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: photo.ua / Shutterstock

13. Salt Lake City, UT

- Share of fixed-rate mortgages with <3% rate: 44.3%

- Share of 30-year mortgages with <3% rate: 43.9%

- Share of 15-year mortgages with <3% rate: 65.6%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: Roschetzky Photography / Shutterstock

12. Austin-Round Rock-Georgetown, TX

- Share of fixed-rate mortgages with <3% rate: 44.5%

- Share of 30-year mortgages with <3% rate: 44.8%

- Share of 15-year mortgages with <3% rate: 66.0%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: Jon Bilous / Shutterstock

11. Riverside-San Bernardino-Ontario, CA

- Share of fixed-rate mortgages with <3% rate: 44.6%

- Share of 30-year mortgages with <3% rate: 44.5%

- Share of 15-year mortgages with <3% rate: 85.7%

- Median interest rate across all fixed-rate mortgages: 3.1%

Photo Credit: Sean Pavone / Shutterstock

10. Cleveland-Elyria, OH

- Share of fixed-rate mortgages with <3% rate: 45.3%

- Share of 30-year mortgages with <3% rate: 42.0%

- Share of 15-year mortgages with <3% rate: 87.9%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: Sean Pavone / Shutterstock

9. Portland-Vancouver-Hillsboro, OR-WA

- Share of fixed-rate mortgages with <3% rate: 45.8%

- Share of 30-year mortgages with <3% rate: 45.4%

- Share of 15-year mortgages with <3% rate: 87.8%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: Jon Bilous / Shutterstock

8. Charlotte-Concord-Gastonia, NC-SC

- Share of fixed-rate mortgages with <3% rate: 47.3%

- Share of 30-year mortgages with <3% rate: 45.7%

- Share of 15-year mortgages with <3% rate: 88.8%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: Farid Sani / Shutterstock

7. Raleigh-Cary, NC

- Share of fixed-rate mortgages with <3% rate: 47.9%

- Share of 30-year mortgages with <3% rate: 45.4%

- Share of 15-year mortgages with <3% rate: 87.7%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: f11photo / Shutterstock

6. Hartford-East Hartford-Middletown, CT

- Share of fixed-rate mortgages with <3% rate: 48.1%

- Share of 30-year mortgages with <3% rate: 45.3%

- Share of 15-year mortgages with <3% rate: 86.6%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: Andriy Blokhin / Shutterstock

5. Sacramento-Roseville-Folsom, CA

- Share of fixed-rate mortgages with <3% rate: 49.2%

- Share of 30-year mortgages with <3% rate: 48.7%

- Share of 15-year mortgages with <3% rate: 92.2%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: Izabela23 / Shutterstock

4. Urban Honolulu, HI

- Share of fixed-rate mortgages with <3% rate: 50.5%

- Share of 30-year mortgages with <3% rate: 50.3%

- Share of 15-year mortgages with <3% rate: 63.4%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: Sean Pavone / Shutterstock

3. Pittsburgh, PA

- Share of fixed-rate mortgages with <3% rate: 50.6%

- Share of 30-year mortgages with <3% rate: 48.6%

- Share of 15-year mortgages with <3% rate: 82.6%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: Lucky-photographer / Shutterstock

2. San Diego-Chula Vista-Carlsbad, CA

- Share of fixed-rate mortgages with <3% rate: 52.1%

- Share of 30-year mortgages with <3% rate: 52.4%

- Share of 15-year mortgages with <3% rate: 90.7%

- Median interest rate across all fixed-rate mortgages: 3.0%

Photo Credit: Uladzik Kryhin / Shutterstock

1. San Jose-Sunnyvale-Santa Clara, CA

- Share of fixed-rate mortgages with <3% rate: 60.1%

- Share of 30-year mortgages with <3% rate: 61.6%

- Share of 15-year mortgages with <3% rate: 92.7%

- Median interest rate across all fixed-rate mortgages: 2.9%

Detailed Findings & Methodology

To determine the U.S. metropolitan areas that get the best mortgage interest rates, researchers at Construction Coverage analyzed the latest data from the Federal Financial Institutions Examination Council’s 2021 Home Mortgage Disclosure Act. The researchers ranked metros according to the share of all fixed-rate mortgages with less than a 3.0% interest rate. In the event of a tie, the metro with the larger number of mortgages with less than a 3.0% interest rate was ranked higher. Researchers also calculated the share of 30-year and 15-year mortgages with less than a 3.0% rate and the median interest rate across all fixed-rate mortgages. Only conventional home purchase loans approved in 2021 were included in the analysis.

To improve relevance, only metropolitan areas with at least 100,000 people were included in the analysis. Additionally, metro areas were grouped into the following cohorts based on population size:

- Small metros: 100,000-349,999

- Midsize metros: 350,000-999,999

- Large metros: 1,000,000 or more

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.