The Best U.S. Cities To Find a Starter Home

Note: This is the most recent release of our Best U.S. Cities to Find a Starter Home study. To see data from prior years, please visit the Full Results section below.

The American dream of homeownership often begins with a starter home—a manageable property that allows young adults and families to establish roots, build equity, and lay the groundwork for financial security. This initial step on the property ladder fuels the housing market and strengthens the economy by creating a generation of invested homeowners. However, finding an affordable starter home has become increasingly challenging in recent times. With historically low inventory and major affordability hurdles, homeownership in the U.S. has become an uphill battle.

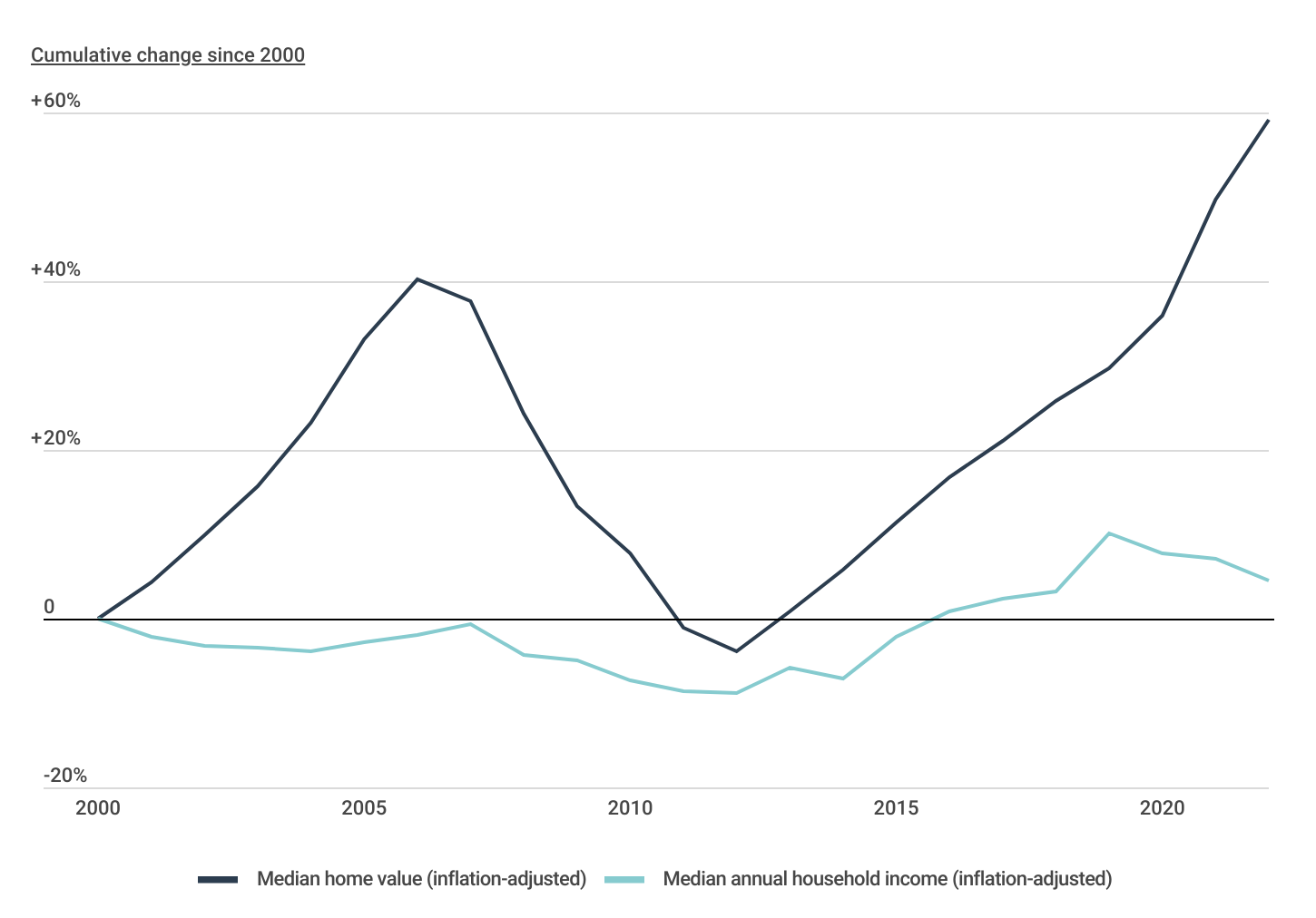

Changes in Home Values and Household Income Over Time

Changes in home prices have significantly outpaced income growth

Although recent market trends have presented significant challenges, the issue of housing affordability has persisted in the U.S. for decades. A primary contributing factor is the disparity between the rate of growth in home values and household incomes. Between 2000 and 2022, the median home value surged by 59.1% after adjusting for inflation, whereas the median household income saw a modest increase of just 4.5% during the same timeframe.

TRENDING ON CONSTRUCTION COVERAGE

The right construction software will help speed up your next job. Read our guide on the best construction project management software, as well as our estimating software and takeoff software reviews.

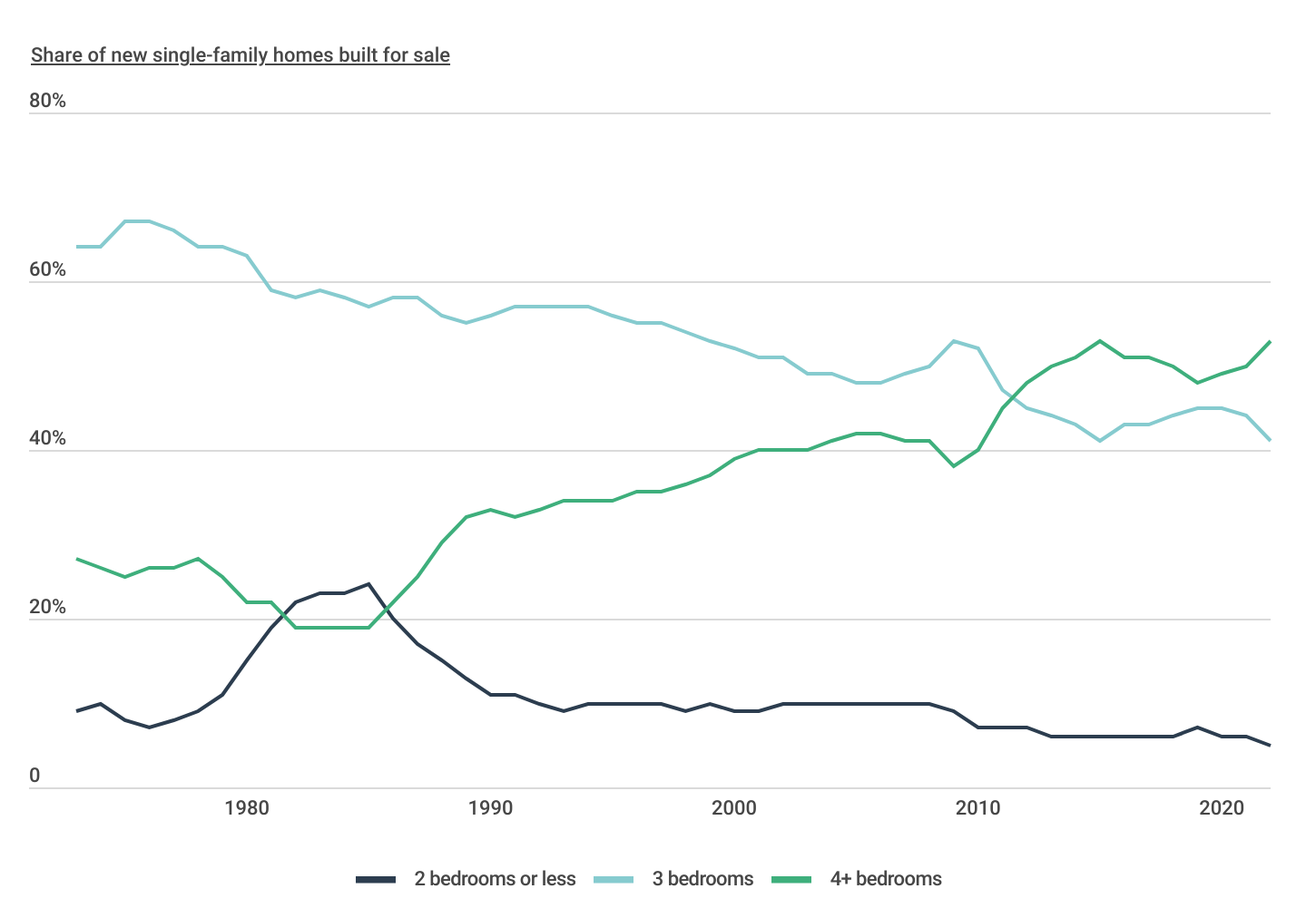

Single-Family Homes Built for Sale

Starter home construction has been on a multi-decade decline

Supply has been another constraint for first-time homebuyers. The U.S. faces a shortage of housing overall, but builders are also building fewer of the smaller, more affordable homes they used to. One- or two-bedroom homes represented 24% of single-family homes built in the mid-1980s, but just 5% in 2022. Over the same span, the share of new homes with four or more bedrooms grew from 19% to 53%.

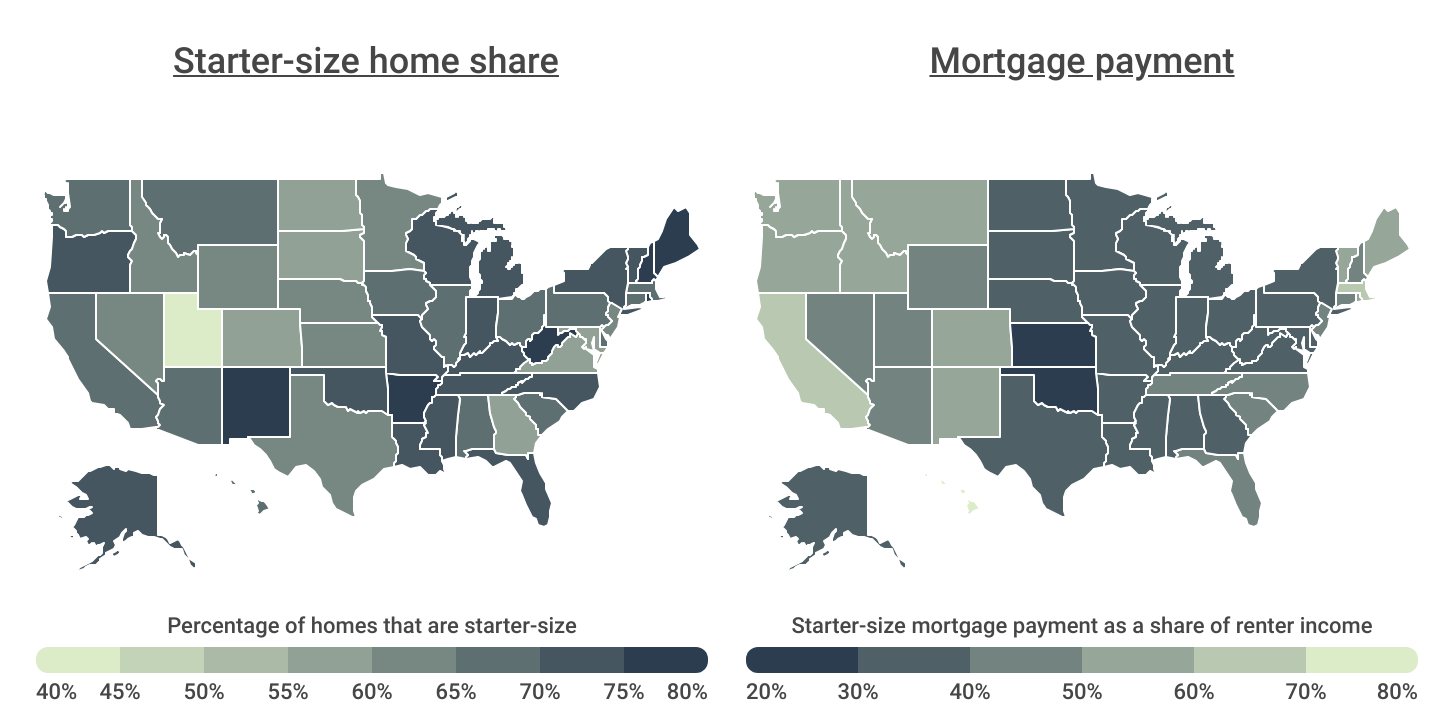

Geographical Differences in Starter Home Buying Environment

Starter-size homes in western states are significantly less affordable than average

FOR CONSTRUCTION PROFESSIONALS

Whether you are a homeowner or a general contractor, finding a reliable builders risk insurance policy for your next project could save you thousands of dollars.

The declining trend in the construction of starter-size homes—defined here as homes with three or fewer bedrooms—is especially apparent in the northern areas of the Great Plains and Mountain West. Less densely populated than their Northeast or West Coast counterparts, states in these regions all have a below-average share of starter-size homes (compared to the national average of 67.7%). Notably, Utah (41.8%) stands out with the lowest proportion of homes with three or fewer bedrooms, while Rhode Island (78.7%) and West Virginia (76.5%) offer the greatest proportion of smaller homes.

Another important factor for new homebuyers is affordability. Nationally, the monthly mortgage payment for a typical starter-size home consumes 39.8% of the median income for renter households. In recent years, many of the most competitive real estate markets have been concentrated in the western states, spanning the Mountain West, Pacific Coast, and Hawaii, all of which exhibit above-average mortgage costs relative to income. Hawaii is the least affordable state for potential first-time buyers, with mortgage payments devouring 75.5% of the median income for renters. Hawaii is closely followed by California at 67.1%, making these states some of the most challenging for those seeking starter homes. At the opposite end of the spectrum, states in the Midwest and South, like Kansas (26.5%), Oklahoma (28.4%), and Iowa (30.1%), provide buying opportunities that account for a much smaller share of income.

While conditions are challenging overall for new buyers, some parts of the U.S. are more favorable than others. To determine the best places to find a starter home in the U.S., researchers at Construction Coverage calculated a composite score based on the percentage of homes with three or fewer bedrooms (40%), the monthly starter-size home mortgage payment as a percentage of median renter income (20%), median sale price of homes with three or fewer bedrooms (15%), supply of homes (15%), and the homeownership rate for under-35 householders (10%).

By these measures, West Virginia is the best state in the country to find a starter home, followed by Oklahoma and Mississippi. Starter-size homes in these states represent over 70% of all homes and are relatively affordable. Similar trends hold at the metropolitan level, with Southern and Rust Belt cities leading the way.

Below is a complete breakdown of more than 330 metros and all 50 states. For more information on data sources and calculations, see the methodology section.

The Best Large Metros to Find a Starter Home

| Top Metros | Score* |

|---|---|

| 1. Pittsburgh, PA | 75.1 |

| 2. Tulsa, OK | 60.9 |

| 3. Oklahoma City, OK | 60.6 |

| 4. Detroit-Warren-Dearborn, MI | 60.2 |

| 5. New Orleans-Metairie, LA | 55.3 |

| 6. Tampa-St. Petersburg-Clearwater, FL | 55.0 |

| 7. Birmingham-Hoover, AL | 52.7 |

| 8. San Antonio-New Braunfels, TX | 52.6 |

| 9. Miami-Fort Lauderdale-Pompano Beach, FL | 52.2 |

| 10. Louisville/Jefferson County, KY-IN | 50.8 |

| 11. Rochester, NY | 50.4 |

| 12. St. Louis, MO-IL | 49.6 |

| 13. Memphis, TN-MS-AR | 49.4 |

| 14. Cleveland-Elyria, OH | 49.0 |

| 15. Chicago-Naperville-Elgin, IL-IN-WI | 47.4 |

| Bottom Metros | Score* |

|---|---|

| 1. San Jose-Sunnyvale-Santa Clara, CA | 3.2 |

| 2. San Diego-Chula Vista-Carlsbad, CA | 8.6 |

| 3. Seattle-Tacoma-Bellevue, WA | 10.7 |

| 4. San Francisco-Oakland-Berkeley, CA | 11.9 |

| 5. Denver-Aurora-Lakewood, CO | 12.5 |

| 6. Sacramento-Roseville-Folsom, CA | 15.5 |

| 7. Salt Lake City, UT | 15.6 |

| 8. Los Angeles-Long Beach-Anaheim, CA | 15.7 |

| 9. Washington-Arlington-Alexandria, DC-VA-MD-WV | 17.3 |

| 10. Riverside-San Bernardino-Ontario, CA | 21.2 |

| 11. Raleigh-Cary, NC | 21.5 |

| 12. Richmond, VA | 22.7 |

| 13. Portland-Vancouver-Hillsboro, OR-WA | 22.8 |

| 14. Las Vegas-Henderson-Paradise, NV | 23.3 |

| 15. Boston-Cambridge-Newton, MA-NH | 23.4 |

TRENDING ON CONSTRUCTION COVERAGE

Do you have auto insurance for your construction vehicles? Nationwide and Progressive have some of the best commercial vehicle insurance policies on the market.

The Best Midsize Metros to Find a Starter Home

| Top Metros | Score* |

|---|---|

| 1. Youngstown-Warren-Boardman, OH-PA | 84.5 |

| 2. Beaumont-Port Arthur, TX | 82.1 |

| 3. Huntington-Ashland, WV-KY-OH | 81.2 |

| 4. Flint, MI | 78.0 |

| 5. Ocala, FL | 77.4 |

| 6. Shreveport-Bossier City, LA | 76.6 |

| 7. McAllen-Edinburg-Mission, TX | 75.8 |

| 8. Gulfport-Biloxi, MS | 75.5 |

| 9. Hickory-Lenoir-Morganton, NC | 72.5 |

| 10. Canton-Massillon, OH | 72.4 |

| 11. Deltona-Daytona Beach-Ormond Beach, FL | 71.3 |

| 12. Cape Coral-Fort Myers, FL | 70.4 |

| 13. Davenport-Moline-Rock Island, IA-IL | 69.8 |

| 14. Lafayette, LA | 69.5 |

| 15. Brownsville-Harlingen, TX | 69.4 |

| Bottom Metros | Score* |

|---|---|

| 1. Oxnard-Thousand Oaks-Ventura, CA | 12.5 |

| 2. Stockton, CA | 17.0 |

| 3. Provo-Orem, UT | 18.1 |

| 4. Fort Collins, CO | 18.4 |

| 5. Bridgeport-Stamford-Norwalk, CT | 20.2 |

| 6. Reno, NV | 20.4 |

| 7. Spokane-Spokane Valley, WA | 20.5 |

| 8. Vallejo, CA | 22.0 |

| 9. Modesto, CA | 22.4 |

| 10. Ogden-Clearfield, UT | 22.8 |

| 11. Greeley, CO | 23.3 |

| 12. Ann Arbor, MI | 23.4 |

| 13. Boise City, ID | 26.2 |

| 14. Urban Honolulu, HI | 26.2 |

| 15. Trenton-Princeton, NJ | 27.3 |

The Best Small Metros to Find a Starter Home

| Top Metros | Score* |

|---|---|

| 1. Weirton-Steubenville, WV-OH | 95.3 |

| 2. Enid, OK | 89.8 |

| 3. Anniston-Oxford, AL | 89.0 |

| 4. Terre Haute, IN | 87.9 |

| 5. Fort Smith, AR-OK | 86.7 |

| 6. Longview, TX | 85.5 |

| 7. Wichita Falls, TX | 84.4 |

| 8. Decatur, IL | 82.6 |

| 9. Abilene, TX | 82.5 |

| 10. Monroe, LA | 81.9 |

| 11. Lawton, OK | 81.2 |

| 12. Albany, GA | 80.7 |

| 13. Wheeling, WV-OH | 80.1 |

| 14. Amarillo, TX | 80.1 |

| 15. Bay City, MI | 79.6 |

| Bottom Metros | Score* |

|---|---|

| 1. Boulder, CO | 12.3 |

| 2. Missoula, MT | 19.7 |

| 3. California-Lexington Park, MD | 21.4 |

| 4. Charlottesville, VA | 22.3 |

| 5. Logan, UT-ID | 22.4 |

| 6. Pocatello, ID | 23.9 |

| 7. Lawrence, KS | 25.4 |

| 8. St. George, UT | 27.0 |

| 9. Corvallis, OR | 28.9 |

| 10. Idaho Falls, ID | 29.1 |

| 11. Olympia-Lacey-Tumwater, WA | 29.1 |

| 12. Lincoln, NE | 29.3 |

| 13. Gainesville, GA | 29.5 |

| 14. Ithaca, NY | 30.6 |

| 15. Merced, CA | 30.6 |

The Best States to Find a Starter Home

| Top States | Score* |

|---|---|

| 1. West Virginia | 86.1 |

| 2. Oklahoma | 82.2 |

| 3. Mississippi | 81.7 |

| 4. Louisiana | 79.7 |

| 5. Arkansas | 75.8 |

| 6. Kentucky | 74.0 |

| 7. Iowa | 67.4 |

| 8. Michigan | 66.5 |

| 9. Indiana | 66.3 |

| 10. New Mexico | 66.2 |

| 11. Ohio | 63.1 |

| 12. Maine | 62.1 |

| 13. Florida | 62.1 |

| 14. Vermont | 61.8 |

| 15. Alabama | 61.0 |

| Bottom States | Score* |

|---|---|

| 1. California | 16.9 |

| 2. Colorado | 18.9 |

| 3. Washington | 20.2 |

| 4. Massachusetts | 21.9 |

| 5. Utah | 22.6 |

| 6. Maryland | 24.5 |

| 7. New Jersey | 24.7 |

| 8. Nevada | 27.3 |

| 9. Idaho | 27.6 |

| 10. Virginia | 27.8 |

| 11. Georgia | 34.4 |

| 12. Montana | 34.4 |

| 13. Hawaii | 35.2 |

| 14. Connecticut | 36.2 |

| 15. Minnesota | 37.3 |

*Composite Score

Methodology

To determine the best locations to find a starter home in the U.S., researchers at Construction Coverage analyzed the latest data from the U.S. Census Bureau’s 2022 American Community Survey, Zillow’s Housing Data, Redfin’s Data Center, and Freddie Mac’s Primary Mortgage Market Survey. The researchers ranked locations according to a composite score comprising the following factors and weights:

- Percentage of owner-occupied homes with three or fewer bedrooms (40%)

- Monthly mortgage payment for homes with three or fewer bedrooms as a percentage of median renter income (20%)

- Median sale price of homes with three or fewer bedrooms (15%)

- Months supply (15%)

- Homeownership rate for under-35 householders (10%)

The monthly mortgage payment as a percentage of income was calculated using a 20% down payment for the median home sale price for three or fewer bedroom homes, a 6.87% interest rate, and the median monthly renter-occupied household income. Median home sales prices and months supply data were from February 2024, the latest data available.

In the event of a tie, the location with the larger percentage of homes with three or fewer bedrooms was ranked higher. To improve relevance, only metropolitan areas with complete data were included, and metros were grouped into cohorts based on population size: small (less than 350,000), midsize (350,000–999,999), and large (1,000,000 or more).

References

- U.S. Government Accountability Office. (2023, October 12). The Affordable Housing Crisis Grows While Efforts to Increase Supply Fall Short. Retrieved on March 25, 2024 from https://www.gao.gov/blog/affordable-housing-crisis-grows-while-efforts-increase-supply-fall-short.

- Jones, J. (2024, February 22). The Hottest Real Estate Markets in the U.S. Construction Coverage. Retrieved on March 25, 2024 from https://constructioncoverage.com/research/hottest-real-estate-markets-us.

- U.S. Census Bureau. (n.d.) American Community Survey (ACS). Retrieved on March 25, 2024 from https://www.census.gov/programs-surveys/acs.

- Zillow. (n.d.). Housing Data. Retrieved on March 25, 2024 from https://www.zillow.com/research/data/.

- Redfin. (n.d). Data Center. Retrieved on March 25, 2024 from https://www.redfin.com/news/data-center/.

- Freddie Mac. (2024, March 21). Mortgage Rates Increase, Nearing Seven Percent. Retrieved on March 25, 2024 from https://www.freddiemac.com/pmms.

Full Results

Each company featured in our guides has been independently selected and reviewed by our research team. If you select one of these companies and click on a link, we may earn a commission.

By clicking on these links, you may be taken to one of our insurance partners. The specific company listed here may or may not be included in our partner’s network at this time.